Part 1: Current State of the Housing Market; Overview for mid-May 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-May 2024

A brief excerpt:

A brief excerpt:

This 2-part overview for mid-May provides a snapshot of the current housing market.There is much more in the article.

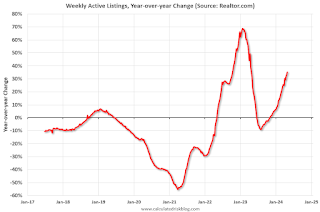

I always like to start with inventory, since inventory usually tells the tale!

...

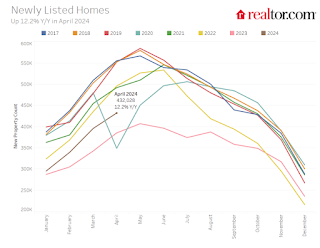

Here is a graph of new listing from Realtor.com’s April 2024 Monthly Housing Market Trends Report showing new listings were 12.2% year-over-year in April. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, which has been a drag on sales the past couple of years, sellers turned out in higher numbers this April as newly listed homes were 12.2% above last year’s levels, matching last month’s growth rate. This marked the sixth month of increasing listing activity after a 17-month streak of declines.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

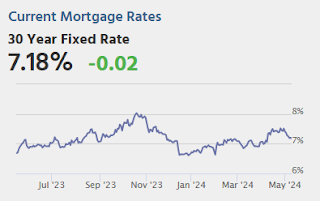

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Recent comments