Why A Powerful Silver Bull Market May Be Ahead

By Jesse Colombo of BullionStar

Since early-March, precious metals have launched one of their sharpest rallies in decades. Gold surged by 16% and silver by 26%, which are significant moves for safe-haven assets — especially considering that it played out over such a short time period. During this rally, gold has received the lion’s share of the attention because it has been hitting all-time highs, while silver has yet to exceed its 2021 high of $30.13 — let alone its all-time high of $49.81 that was reached all the way back in 2011. Though silver has been languishing for the past several years, there are numerous reasons why it may be on the verge of one of its most powerful bull markets in history.

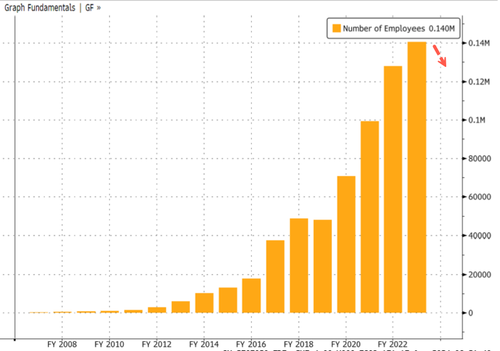

Silver Demand is Growing Rapidly

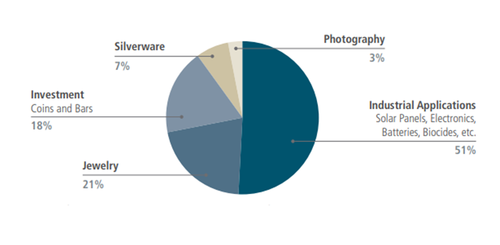

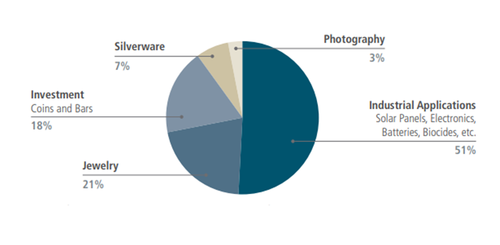

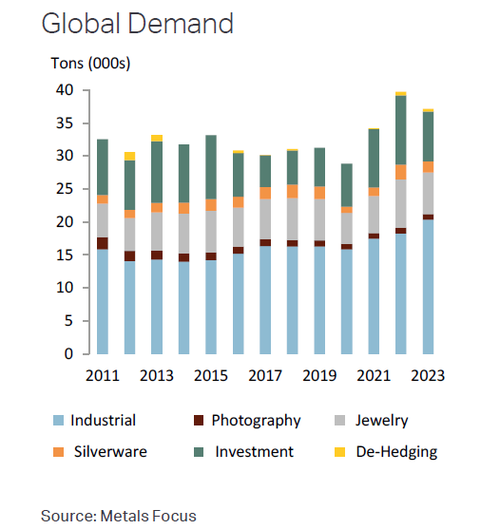

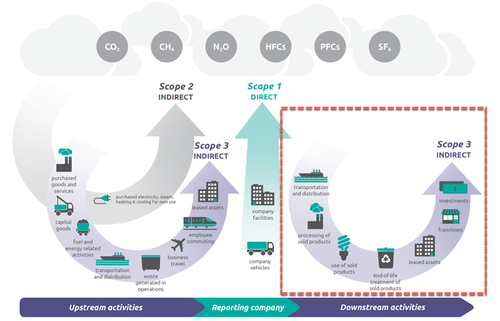

Though silver is most known for its use in jewelry, silverware, coinage, and bullion products, the largest source of silver demand is actually industrial in nature. Thanks to its unique physical, chemical, and electrical properties, silver is used in electronics, solar panels, automobiles, photography, medicine, the chemical industry, and much more.

Sources of silver demand. Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

Sources of silver demand. Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

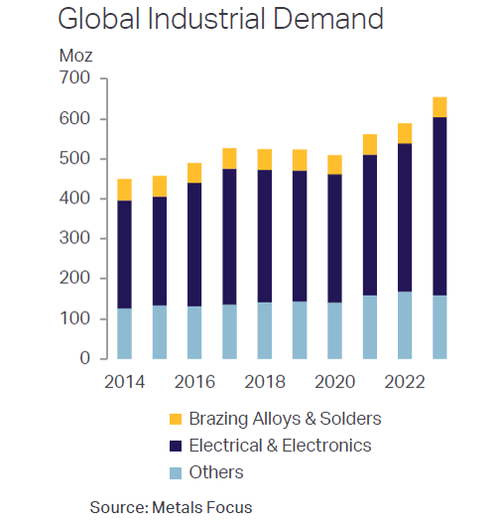

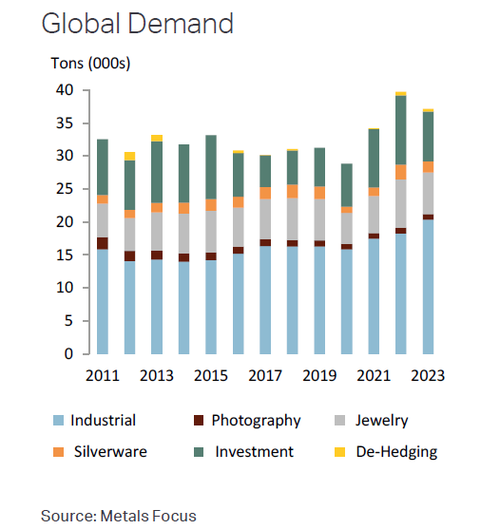

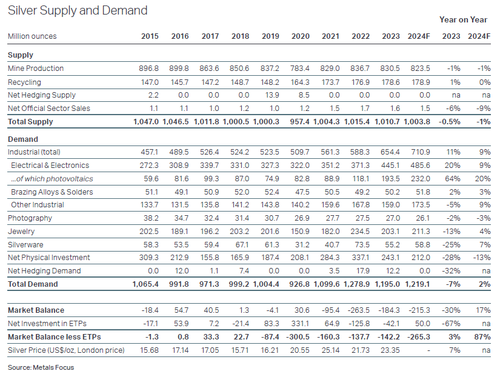

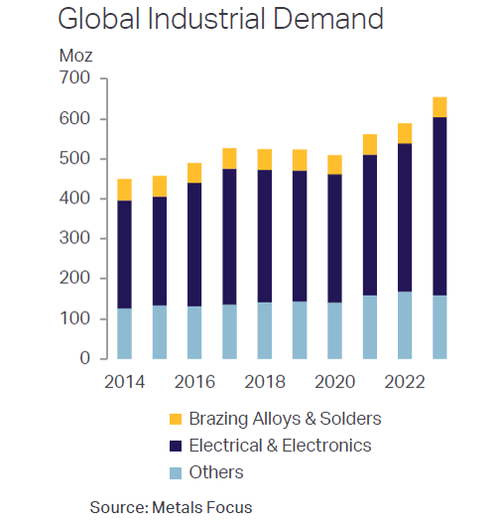

The growing number of uses for silver combined with ongoing global economic growth is causing a substantial increase in industrial demand for silver. According to the latest report from the Silver Institute, industrial demand for silver grew by a solid 11% to a record of 654.4 million ounces in 2023, which came on the heels of a record year in 2022. Silver used for photovoltaic (PV) applications skyrocketed by 64%, which caused electrical & electronics demand to increase by 20% in turn. As the push for so-called “green" energy continues, photovoltaic silver demand should keep growing at a rapid rate. The Silver Institute predicts a 9% increase in industrial demand for silver in 2024.

The steady increase of industrial demand over the past decade is driving overall silver demand higher:

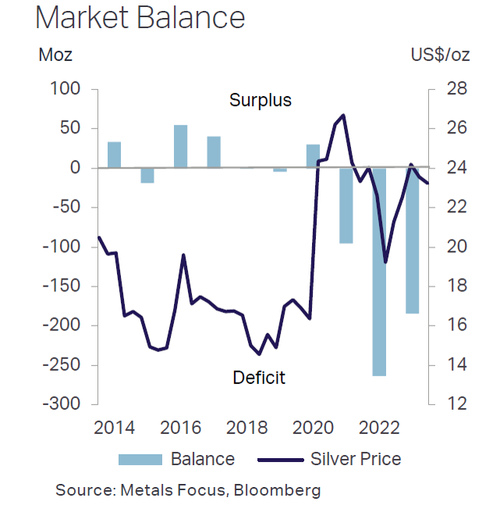

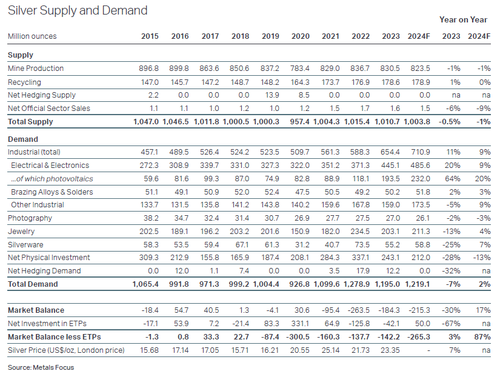

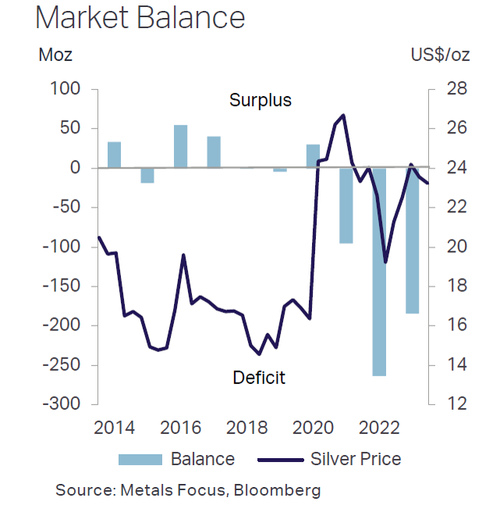

There is a Structural Silver Deficit

Since 2021, there has been a deficit of silver due to demand exceeding supply — a condition that has helped to boost prices and should continue to do so for the foreseeable future. Strong demand combined with tepid supply increases led to a deficit of 184.3 million ounces in 2023 and are expected to lead to an even worse deficit of 215.3 million troy ounces in 2024.

The chart below shows how the silver deficit has grown significantly over the past few years:

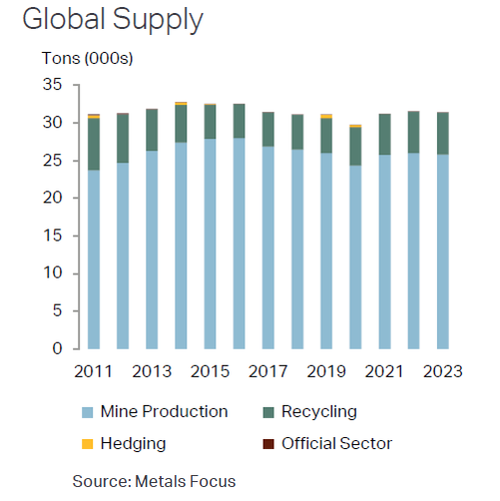

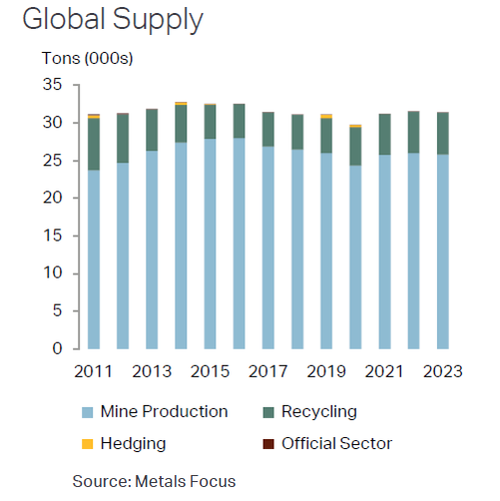

While silver demand has grown at a healthy clip over the past four years, the overall supply of silver has been flat for more than a decade:

Global mine production of silver has actually been declining for the past decade:

(Read our recent report about the structural silver deficit and why it is likely to persist and even intensify.)

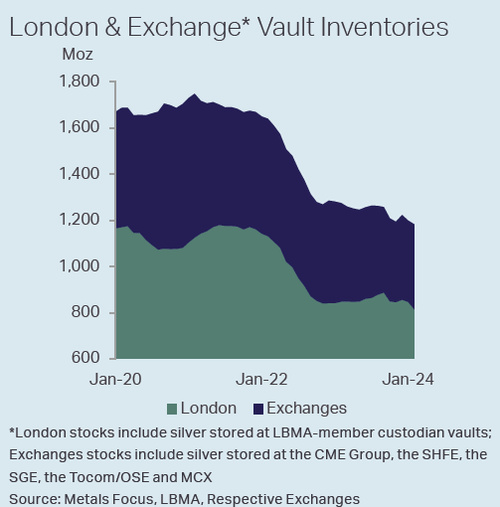

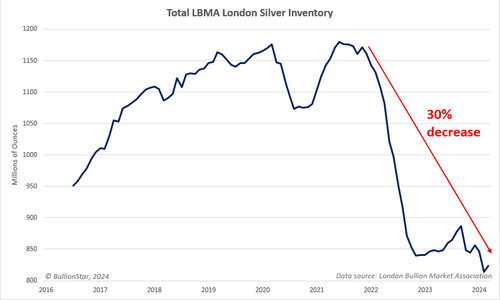

Above-Ground Supplies Are Dwindling

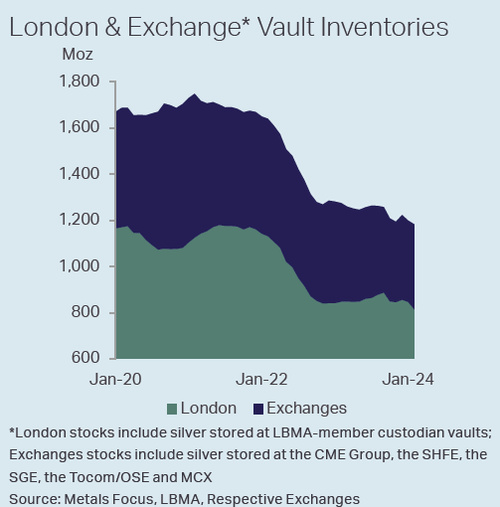

The silver deficit of the past few years is causing the above-ground supply of silver to dwindle at a rapid rate:

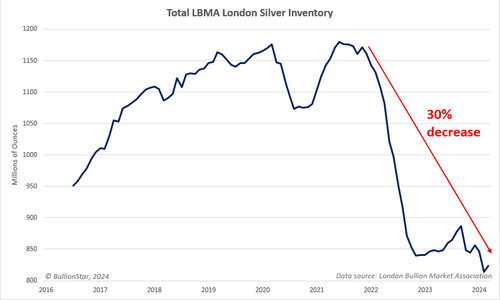

The total London Bullion Market Association (LBMA) silver inventory decreased by 30% from its peak in 2021:

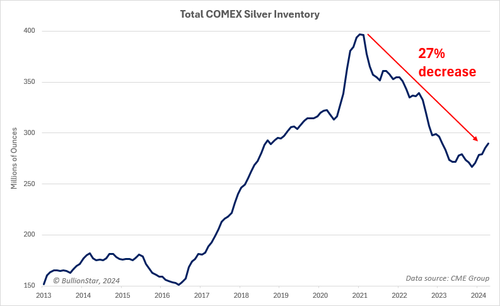

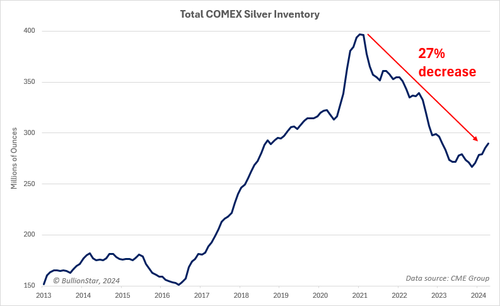

The total COMEX silver inventory (a measure of U.S. silver inventories) fell by 27% since 2021:

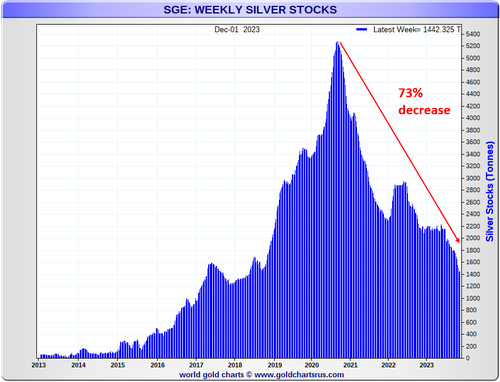

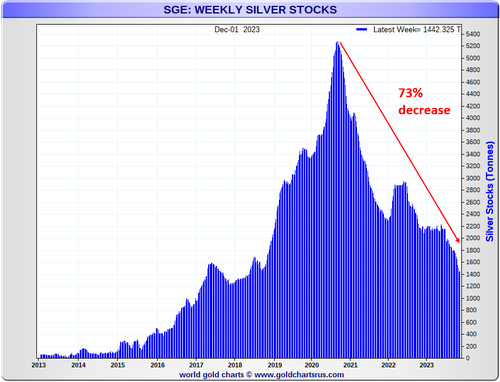

The total silver inventory on China’s Shanghai Gold Exchange fell by an incredible 73%:

The total silver inventory on China’s other main silver trading venue, the Shanghai Futures Exchange (SHFE), also fell precipitously:

The Technical Picture

For the past year, silver had been chopping up and down aimlessly until its sudden surge that came practically out of nowhere:

A look at the five-year chart shows that there is a major resistance zone overhead from $28 to $30, which is what silver struggled to surpass during the last bull run in 2020 and 2021. If silver can close above that zone in a convincing manner with heavy volume, that would signal that another bull run is likely imminent.

The long-term silver chart going back to the year 2000 shows something very interesting: a triangle pattern has been forming for over a decade as uptrend lines and downtrend lines converge together. Patterns like this often result in very powerful moves when the asset finally breaks out from it. Amazingly, silver has recently broken out from its long-term triangle, which means that a powerful bull market is likely ahead that could take silver to its prior 2011 highs of approximately $50 and even higher after that!

Silver has been rising in sympathy with gold after it broke above its critical $2,000 to $2,100 resistance zone that acted as a price ceiling from 2020 until recently. Gold’s breakout signifies that a new bull market has begun, which should help bring silver along for the ride. (There are many parallels between gold’s resistance zone and silver’s current $28 to $30 resistance zone, and silver should really shine once it finally breaks through.)

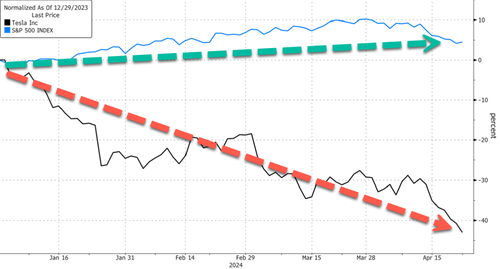

Mainstream Investors & Journalists Missed Silver’s Rally

What is also worth noting is how gold and silver’s surprising recent rally has received very little mainstream attention by a press that is much more enamored with hot AI stocks as well as Bitcoin and other cryptocurrencies that have recently benefited from the U.S. government’s approval of a number of Bitcoin exchange-traded funds (ETFs), which has resulted in tremendous inflows from institutional investors and retail investors alike.

As the chart below shows, investors have pulled a significant amount of funds from silver ETFs in order to re-invest in Bitcoin ETFs, which is ironic considering its timing shortly before silver’s liftoff (and is confirmation of contrarian investing principles). The continuation of silver’s bull market will likely lead to funds flowing back into silver ETFs, providing additional fuel for the rally.

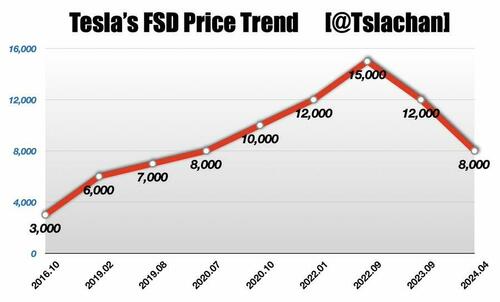

Silver is Inexpensive by Historical Standards

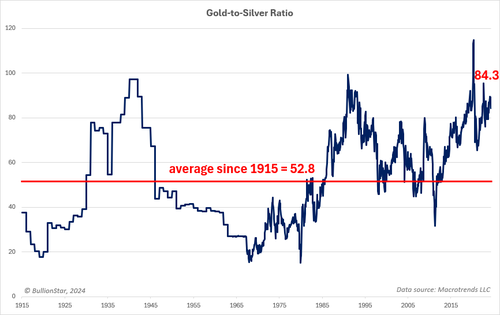

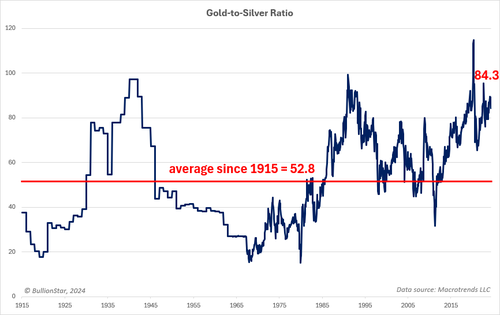

Precious metals analysts keep an eye on the gold-to-silver price ratio to get a sense of whether silver is undervalued or overvalued relative to gold. Silver is approximately 17.5 times more common than gold in earth’s crust, which is one of the reasons why silver has been cheaper than gold throughout history. During the Roman empire, the gold-to-silver price ratio was set at 12 to 1 by government decree. In much of Europe throughout the Middle Ages and the Renaissance, the gold-to-silver price ratio was set at similar levels. In 1792, the newly formed U.S. government set the ratio at 15:1.

When the gold-to-silver ratio differs greatly from its long-term historical average, there are reasons to believe that something is amiss and that the ratio will eventually revert back to its historical average. In recent decades, the gold-to-silver price ratio has ranged from approximately 50 to 100, which is much higher than its historical average.

The current gold-to-silver ratio is a lofty 84.3, which means that silver is extremely undervalued relative to gold based on historical standards. If the ratio were to revert to its average since 1915 of 52.8 (without any price increase in gold), that would result in silver being priced at a respectable $45 an ounce. If the ratio were to revert to 15:1, as it was in the U.S. in 1792, that would result in silver trading at $158.87 an ounce — an incredible 464% increase from the current price! For this reason, many investors expect silver to perform even better than gold during the coming precious metals bull market and revaluation that they expect to occur when our unsustainable global paper money system collapses (as I discussed in a recent piece). Any price increases in gold would amplify price increases in silver, if the gold-to-silver ratio reverts.

Adjusting silver’s price for inflation also shows that the precious metal is quite cheap by historical standards. At the peak of the Hunt brothers-induced silver spike in 1980, silver hit an inflation-adjusted price of $143.54. At the peak of the quantitative easing-driven bull market in 2011, silver hit an inflation-adjusted price of $67.50. At the time of writing, silver is trading at a mere $28.30, which means that it has much further to run if it is going to catch up with prior inflation-adjusted prices.

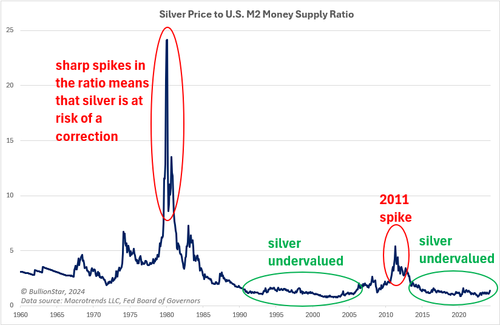

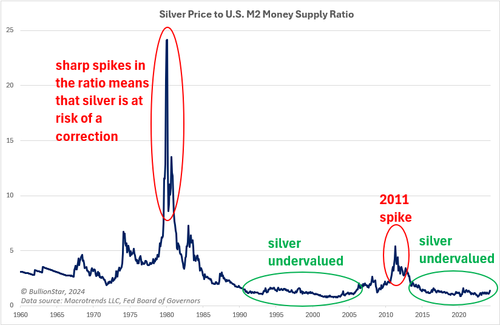

Another way to determine whether silver is undervalued or overvalued is to compare it to various money supply measures. The chart below shows the ratio of silver’s price to the United States M2 money supply, which is helpful for seeing if silver is keeping up with money supply growth, outpacing it, or lagging it. The M2 money supply is a measure of all notes and coins that are in circulation, checking accounts, travelers’ checks, savings deposits, time deposits under $100,000, and shares in retail money market mutual funds.

If silver’s price greatly outpaces money supply growth, there is a heightened chance of a strong correction. If silver’s price lags money supply growth, however, there is a good chance that silver will soon experience of period of strength. Since the mid-2010s, silver has slightly lagged M2 money supply growth, which could set it up for a period of strength due to the other factors discussed in this piece.

Silver is Rising Despite the Strong Dollar & Interest Rates

What is particularly impressive about the recent rally in silver and gold is the fact that it occurred even while the U.S. dollar was strengthening against other major currencies. Precious metals and the U.S. dollar have a long-established inverse relationship, which means that strength in the dollar typically causes weakness in precious metals, while dollar weakness typically causes precious metals prices to rise.

The chart below compares silver (the top chart) to the U.S. Dollar Index (the bottom chart) and shows how action in the dollar often causes an opposite trend in silver. Silver’s surge in the face of the strengthening dollar is a sign of strength and staying power. (I need to clarify, however, that the U.S. dollar’s exchange rate is strengthening against other fiat currencies; this does not mean that the dollar is getting stronger in terms of purchasing power or against sound money like gold and silver. All fiat currencies are being debased as a function

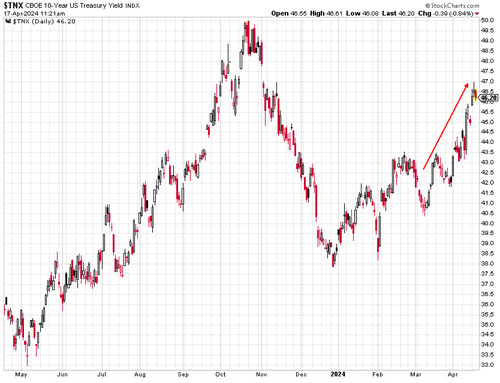

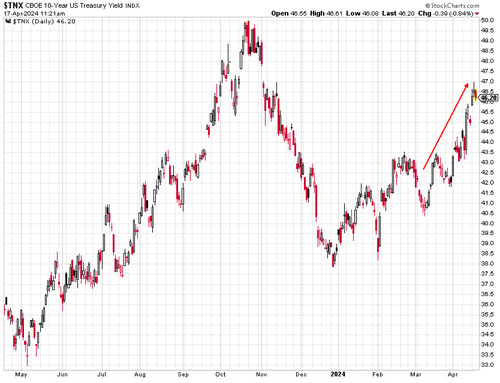

On a similar note, silver and gold are also rallying even though global interest rates have been rising at the same time due to inflation proving to be stubborn, and even at risk of increasing again. Rising interest rates are typically bearish for precious metals because they don’t pay any yield, but silver and gold appear to be unfazed this time, which is an additional sign of strength and staying power. of time but they still fluctuate against each other in the global foreign exchange market.)

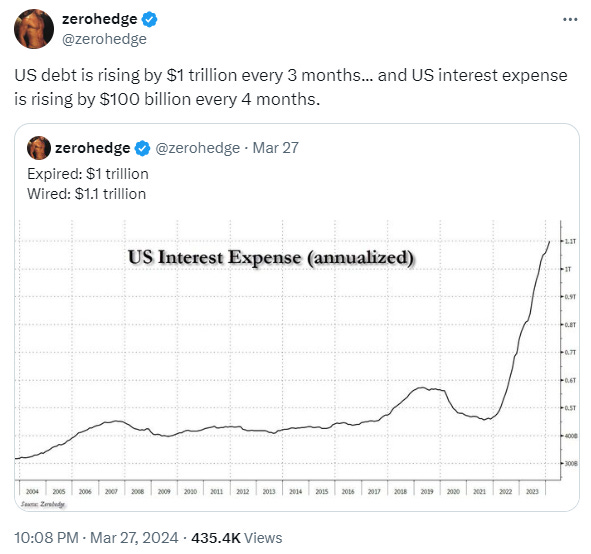

How Inflation is Contributing to Silver’s Recent Rise

Another important factor driving the recent precious metals rally is stubbornly high inflation that is not easing as quickly as economists and investors had expected and may actually be worsening instead. Gold and silver are inflation hedges and are very sensitive to changing inflation expectations. U.S. year-over-year inflation — as measured by Consumer Price Index (CPI) — increased at a 3.5% rate in March, which immediately caused traders to scale back their expectations for Federal Funds Rate cuts this year. March’s inflation rate represents an acceleration from February’s 3.2% increase.

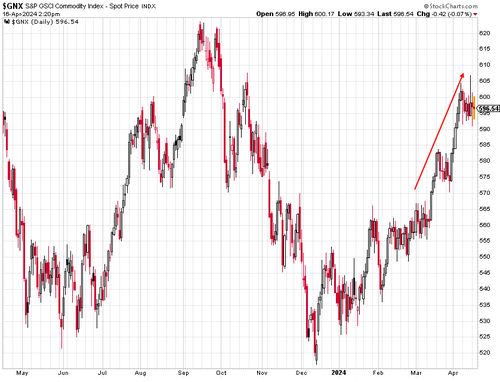

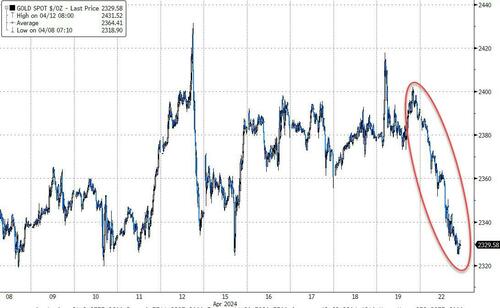

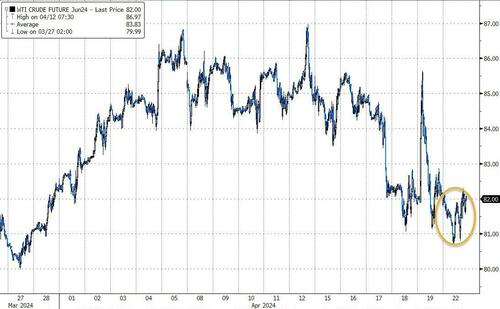

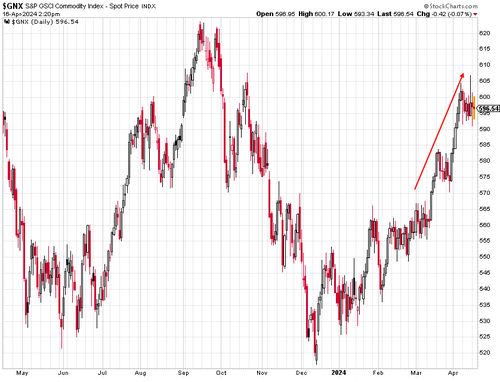

The sharp increase in commodities prices over the past few months is further confirmation that inflation may be accelerating:

Crude oil has rallied over the past few weeks:

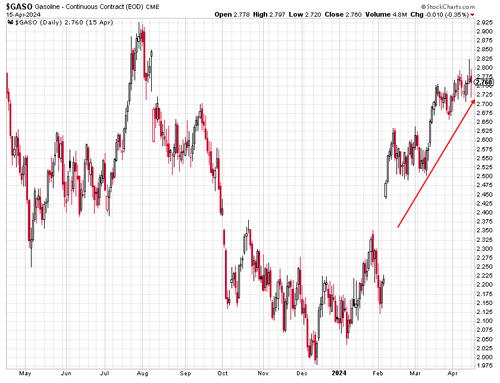

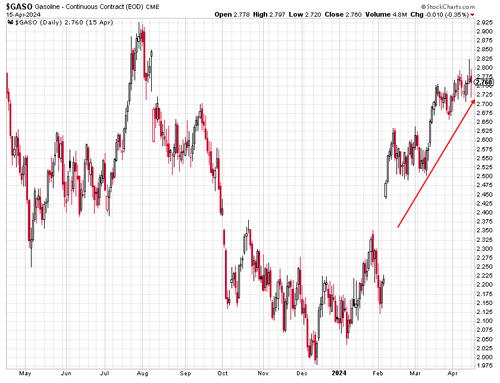

U.S. wholesale gasoline prices have increased by an alarming 30% in the past two months and are one of the most psychologically important and visible indicators of inflation in the minds of consumers:

China’s Economic Crisis is Helping Precious Metals

Though most non-Chinese are unaware, China is experiencing a serious economic crisis as well as a property and stock market crash after at least two decades of almost non-stop boom times. Unfortunately, that economic boom was actually an unsustainable bubble that was enabled by

and reckless speculation, and the chickens are now coming home to roost. China’s imploding property and stock market bubbles have resulted in at least hundreds of billions of dollars worth of losses — including

alone from the country’s property tycoons.

As Chinese investors lost faith in the property and stock market, they have shifted their attention to gold, which has earned a stellar reputation in China over thousands of years. When modern financial markets and investments sour, Chinese people seek refuge in gold bullion, which is tried-and-true. Chinese investors have clamored into the gold market with such intensity that they have pushed the price of locally-traded gold to a premium against the international price of gold.

In addition, Chinese investors recently piled into a domestic gold stock fund causing its premium to surge 30% until trading was halted to calm the frenzy and protect investors. Around the same time, the Shanghai Gold Exchange raised silver margin requirement from 10% to 12% after silver futures spiked. Though everyday Chinese investors tend to focus more on gold rather than silver, their heavy buying has helped to buoy the price of gold, which has boosted silver in turn. China’s massive economic bubble formed over decades and its collapse is only in the early stages — a fact that should propel precious metals prices higher for years to come.

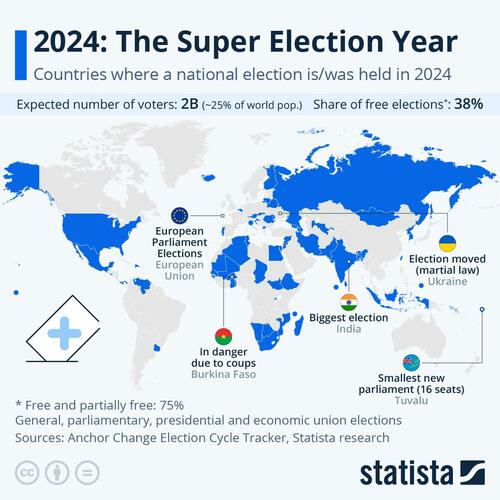

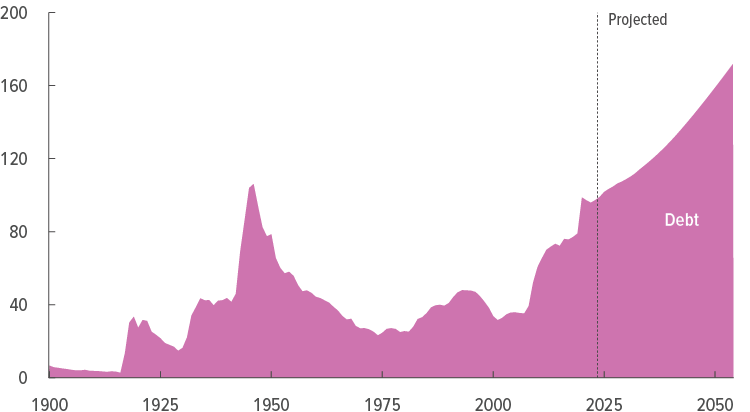

Precious Metals Are Benefiting From Political Uncertainty

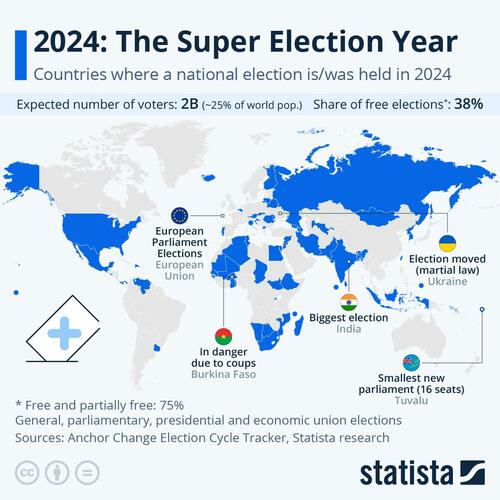

On top of their roles as inflation hedges, gold and silver are also hedges against economic and political uncertainty, and there is a great amount of political uncertainty this year as more than 60 countries — including the United States, Mexico, India and Indonesia — are set to hold national elections. In the United States, President Joe Biden and former President Donald Trump are expected to go head-to-head again as they did in 2020.

Economic issues, including inflation, have soared to the top of the list of concerns for Americans who are growing increasingly frustrated with so-called “Bidenomics" as the cost of living continues to rise at an uncomfortable pace while middle class life becomes further out of reach for a large portion of the population. The Biden administration’s heavy spending and willingness to rack up the national debt have exacerbated the country’s inflation problem, which is why it is catching flak from Americans on both sides of the aisle. In theory, a Biden win should prove beneficial for precious metals prices.

Geopolitical Risks Are Helping Gold & Silver

In addition to the other factors mentioned so far, precious metals are also benefiting from mounting geopolitical risks related to the Israel-Hamas war and the Russia-Ukraine war. The Israel-Hamas war has now been going on for six months and is heating up, unfortunately. On April 13th 2024, Iran fired hundreds of drones, cruise missiles, and ballistic missiles at Israel, which is Iran’s first direct attack on Israel since the conflict started and the first ever attack on Israel directly from Iranian soil (in the past, Iranian proxies were used to attack Israel). Though 99% of Iran’s drones and missiles were intercepted by Israel’s sophisticated Iron Dome air defense system, the attack sent a powerful message and represents a new phase of the war that is playing out across the Middle East.

The April 13th attack was retaliation after Israel struck numerous Iran-backed targets in Syria. Israel now vows to retaliate against Iran for its April 13th attack, which would further perpetuate the tit for tat cycle. As geopolitical analyst Max Abrahms said, “Iran and Israel are now at war. A real, direct war." Economist and best-selling author James Rickards is now warning about the rising risk of a nuclear war and saying that gold’s rally “is just getting started" due to that risk.

2024 Iranian strikes in Israel. Mehr News Agency.

2024 Iranian strikes in Israel. Mehr News Agency.

The Russia-Ukraine war has also taken a turn for the worse recently after Russia shot down 53 Ukrainian drones and the Kremlin warned that Russia and NATO are now in “direct confrontation.” Ukraine took credit for destroying at least six Russian fighter jets, damaging eight more, and killing or injuring 20 service personnel. The BBC has estimated that over 50,000 Russian military personnel have been killed so far in the war against Ukraine, while Ukrainian President Volodymyr Zelensky claimed that 31,000 Ukrainian military personnel have been killed — a figure that is likely understated.

The Potential For a #SilverSqueeze

In early-2021, investors and traders affiliated with the r/WallStreetBets (WSB) subreddit began promoting a theory, movement, and hashtag called #SilverSqueeze with the intention of piling into physical silver en masse in order to create a short squeeze that forces big banks and other institutions to buy back their short positions (i.e., bets against the price of silver) that are used to suppress the price of silver. If successfully pulled off, the theory went, the price of silver would skyrocket to all-time highs, which would simultaneously generate significant profits for #SilverSqueeze participants while punishing the institutions that were suppressing the price of silver.

In 2021, BullionStar agreed with and supported the #SilverSqueeze movement and still does — even though it may have been ahead of its time. We still believe that a #SilverSqueeze is likely to occur in the not-too-distant future when the manipulating institutions finally lose control of the physical silver market. We have also written extensively (here, here and here) about the manipulation and suppression of the physical gold and silver markets.

The proliferation of “paper" silver products (ETFs, futures, and other derivatives) dwarfs the supply of actual physical silver by a multiple of at least 100 to 1. The sheer volume of outstanding paper silver has had the effect of absorbing demand that would normally have flowed into and benefited the physical silver market. Furthermore, the glut of ersatz silver has suppressed the price of physical silver and has prevented true and fair price discovery.

In the coming #SilverSqueeze, we believe that investors will be forced to reckon with the fact that there is just a fraction of the physical silver in existence that they believed, which will lead to a scramble for physical silver while paper silver products sink in value. Silver’s recent breakout, if it can be sustained, has a strong potential of evolving into a #SilverSqueeze as the bull market gains momentum.

Tyler Durden

Mon, 04/22/2024 - 13:00

Turkish Presidency via Anadolu

Turkish Presidency via Anadolu

Sources of silver demand. Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

Sources of silver demand. Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

2024 Iranian strikes in Israel. Mehr News Agency.

2024 Iranian strikes in Israel. Mehr News Agency.

Source:

Source:

Maj. Gen. Aharon Haliva, chief of IDF Military Intelligence Directorate

Maj. Gen. Aharon Haliva, chief of IDF Military Intelligence Directorate

Joint Multinational Training Group-Ukraine, just prior to the Feb. 2022 Russian invasion.

Joint Multinational Training Group-Ukraine, just prior to the Feb. 2022 Russian invasion.

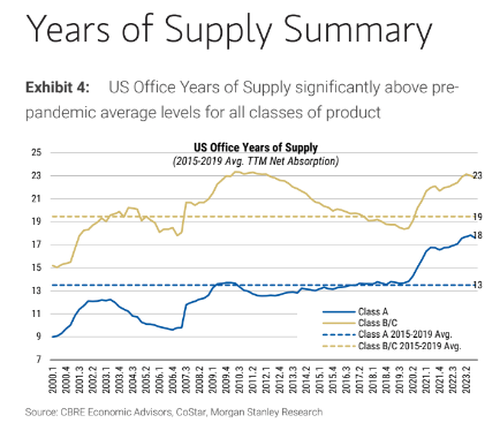

Source: Morgan Stanley

Source: Morgan Stanley

Recent comments