Retail Sales Increased 0.7% in March

On a monthly basis, retail sales were up 0.7% from February to March (seasonally adjusted), and sales were up 4.0 percent from March 2023.

From the Census Bureau report:

Click on graph for larger image.

Click on graph for larger image.

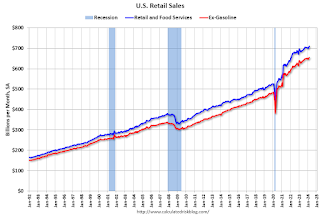

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in March.

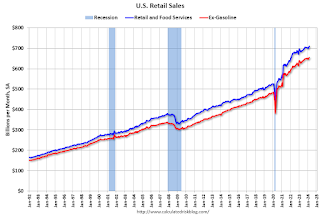

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent from the previous month, and up 4.0 percent above March 2023. ... The January 2024 to February 2024 percent change was revised from up 0.6 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

Recent comments