This is a joint article I wrote with Bonddad

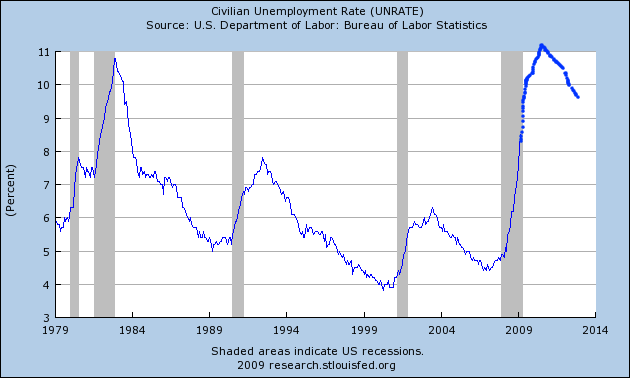

Regardless of when this recession ends, the malaise of working and middle class America will not be relieved until wages increase, and employment rates return to a robust level. Since unemployment is a lagging indicator, the news on that score is grim. Almost every analyst believes that there will be another "jobless recovery" such as those that followed the 1990 and 2001 recessions. Even after GDP bottomed and those recessions technically ended, there was an average 17 month increase in unemployment of .9% (or a 15% percent increase in the rate) followed by a 13.5 month decrease back to the rate at the "bottom" of the recession. If that pattern holds true again, then even if this recession bottoms shortly, unemployment will be 10.1% by July, rise to 11.3% by December 2010, and take until at least early 2012 to decrease back under 10%, looking like this graph:

Note this is U3 unemployment, so U6 unemployment will be correspondingly worse.

Recent comments