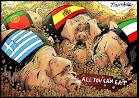

With Spain now getting a bail out all to pump up their insolvent banks, one might wonder how did we get here in the first place?

With Spain now getting a bail out all to pump up their insolvent banks, one might wonder how did we get here in the first place?

We actually are on the precipice, with a key critical Geek vote on whether or not they will default on their international bail out. Sitting on the edge of a cliff, a review of the European sovereign debt crisis and how we got here is at hand.

What the hell happened is complicated. Greece is not the same as Ireland, nor is Spain the same as Greece. Ireland's sovereign debt crisis was the direct result of their financial crisis. Greece, on the other hand, had long standing structural problems with their economy. Nor are their economies the same although treating them as such originally was part of the problem.

The St. Louis Federal Reserve Research Director Christopher Waller gave a presentation on the the European Debt Crisis. The entire May 8th, 2012 lecture is below. The focus is on debt to GDP ratios, the European Union and interest rates for sovereign bonds. We learn about the European Union's major financial structural problems versus how exactly the debt happened. There are plenty of specifics and this lecture is concise, accurate in it's scope. If you don't understand European Sovereign Debt fundamentals, watch this lecture in full and you will.

Recent comments