Michael Collins

Gretchen Morgenson of the New York Times just published one of the few feel good stories in months following the 2008 financial crisis. She describes a possible day of reckoning for the perpetrators of the 2008 crisis and much of the pain that has followed.

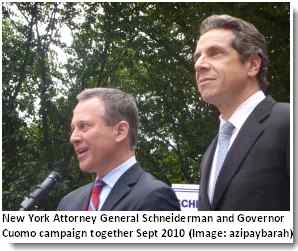

The newly elected New York attorney general, Eric Schneiderman (D), wants information from Goldman Sachs, Bank of America, and Morgan Stanley. Among other things, the information concerns mortgage pooling and bundling. This may well include information on collateralized debt obligations (CDO's) and mortgage backed securities (MBS). New York state officials told Morgenson:

"The New York attorney general has requested information and documents in recent weeks from three major Wall Street banks about their mortgage securities operations during the credit boom, indicating the existence of a new investigation into practices that contributed to billions in mortgage losses." New York Investigates Banks’ Role in Financial Crisis New York Times, May 16

Recent comments