You think the United States government produces imaginary numbers for economic reports? Try China. Consider the heat on the U.S. trade deficit, jobs, currency manipulation and China. Now we have a trade report from China claiming their surplus was cut almost in half in a month.

China’s trade surplus was 40% smaller than expected in December, as export growth softened while imports expanded faster than expected, potentially easing some of the trade tensions between China and the U.S. ahead of a state visit by Chinese President Hu Jintao’s later this month.

Figures released by the General Administration of Customs on Monday showed a surplus for the month of $13.08 billion, down from $22.9 billion in November.

How misleading! The keyword is expected. The reality is China's trade surplus dropped 7% for all of 2010. Below are the numbers to pay attention to. Can you imagine the word slow used in the same breath if these were United States trade deficit monthly percentage changes?

December’s exports were up 17.9% from the year-earlier month, easing from a 34.9% rise in November, whereas imports climbed 25.6%, also slowing from November’s 37.7% increase.

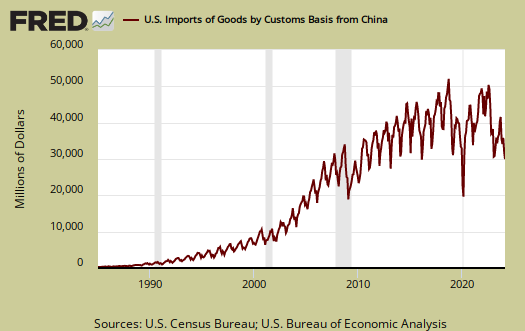

Yet look at the graph above, the dip in the China surplus is not as large as is implied the by headlines and their recent monthly trade reports. Even more telling, over all China's imports rose 39% while exports increased 31% for all of 2010.

Monday’s figures round out the data portrait for 2010, showing China’s trade surplus for the year amounted to $183.1 billion, down from $196.06 billion in 2009.

Below are China's imports into the United States, customs basis, up to October 2010. Regardless if China spent more in commodities, or even imports, it does not negate the fact China is the majority of the United States trade deficit.

The reason the China export surplus narrowed is imports rose. Remember, these reported numbers are adjusted for prices. China imports a lot of commodities, oil, copper, etc. many of which are at an all time high. Overall it is reported China import prices rose 41%. That's not exactly the great consumer society. In other words, increasing imports to China does not translate in exports from America.

There is good reason to be suspicious of these numbers. The Chinese President, Hu Jintao, is coming to D.C. next week. China has refused to re-value their currency and the pressure is increasing to confront China on their currency manipulation, due to the massive loss of U.S. jobs, offshore outsourced to China.

The graphs were created by Econgrapher and this links to their China trade article.

China foreign exchange reserves, record $2.85 trillion

EconompicData graphed it up. This is China buying up U.S. Treasuries and other deposits abroad, mainly to artificially keep the Yuan, their currency undervalued.

The New York Times gives details on how this all works to enact currency manipulation.

China to make Yuan Global Currency

This is a big deal and again shows China's agenda to be the globe's dominant economy.

WSJ: