The Federal Reserve released their monthly consumer credit report for September 2010.

Consumer credit declined 1-1/2 percent at an annual rate in the third quarter. Revolving credit declined 8-3/4 percent at an annual rate, and nonrevolving credit increased 2-1/2 percent. In September, consumer credit increased 1 percent at an annual rate.

What is strange is for just September 2010, revolving consumer credit dropped at a 12.1% annual rate. The graph is below, first in billions and next in annualized percentage change for the month of September.

Overall, one can see a dramatic drop in revolving credit, i.e. credit cards, for consumers. Meanwhile the New York Federal Reserve released their Q3 2010 Report on Consumer Debt & Credit, which shows while debt is declining, it's not just defaults.

Excluding the effects of defaults and charge-offs, available data show that non-mortgage debt fell for the first time since at least 2000. Also, net mortgage debt paydowns, which began in 2008, reached nearly $140 billion by year end 2009. These unique findings suggest that consumers have been actively reducing their debts, and not just by defaulting.

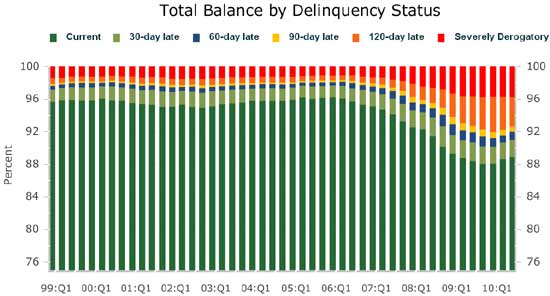

The New York Fed out did themselves with economic and statistical eye candy. There are a slew of graphs on debt, consumer debt on their website (way to go New York Fed!). Below is just one graph on current delinquencies:

For the first time since early 2006, total household delinquency rates declined in 2010Q2. As of June 30, 11.4% of outstanding debt was in some stage of delinquency, compared to 11.9% on March 31. and 11.2% a year ago. Currently about $1.3 trillion of consumer debt is delinquent and $986 billion is seriously delinquent (at least 90 days late or "severely derogatory"). Delinquent balances are now down 2.9% from a year ago, but serious delinquencies are up 3.1%.

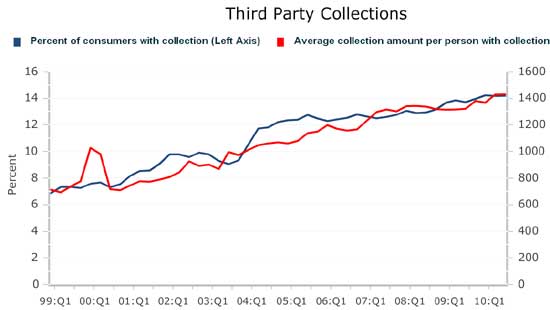

Here's a nice graph, the percentage of people being hounded by debt collectors:

So, the question is are lenders loosening? Is this consumer debt reduction really voluntary or is it people simply cannot obtain increased credit?

Reduction in Revolving Credit

Looking at the y-axis carefully, one can see that the consumer revolving credit has declined from a peak which approached US$980 Billion in 2008, down to the September 2010 figure of under US$820 Billion. The chart is truncated, so as to be quite misleading, creating a tidy bell-shaped curve. In this chart which could have served as an example in the classic text, "How to Lie with Statistics," the apparent zero point is actually US$800 Billion. So consumer credit is down, but it is still frightenly above zero for an economy with 9.6 per cent unemployment and a fragile safety net.

lying with statistics

I'm not lying with statistics here. Revolving credit is down and while it appears lending has relaxed a tad, can't say the same thing with credit cards and revolving credit will drop with the people's ability to pay (or should).

Go here and make your own graph:

http://research.stlouisfed.org/fred2/graph/?id=REVOLSL#

you can see it really does have almost a bell curve shape, not manipulating anything and that graph is from the St. Louis Federal Reserve, the statistics are from the Federal Reserve main.

oh no!

Oh no! The amount of people defaulting is falling?! Looks like banks/creditors will be collecting less overdraft fees as more and more people are working toward credit repair and paying off their debts entirely! The sad thing is, you're going to start seeing more and more other fees popping up to replace their lost revenue! You can quote me on that! Chase is already implementing checking account fees, which is why I recently switched banks! What a difference three years can make in a bank... WaMu was such an awesome bank and I never had ANY problems with them, but as soon as Chase takes over, they start lying, stealing and cheating their way into huge profits. Banks, by nature, are criminal.

Hi, I'm Ed. Nice to meatchew.