The Producer Price Index, or wholesale inflation, increased 0.1% in June 2012 for finished goods. Energy alone decreased -0.9% with gas actually increasing 1.9%. Core PPI, which is finished goods minus food and energy, increased 0.2% and is the 4th month in a row for an increase. Food alone increased 0.5%. While this is wholesale, retail shoppers beware, price increases are usually passed onto consumers. PPI is a Federal Reserve watch number for signs of future inflation. Intermediate goods prices decreased -0.5% and crude or raw materials prices declined a whopping -3.6%.

PPI is reported by stages of processing of materials, finished, intermediate and crude. Finished are commodities ready for final sale, intermediate are partially finished, such as lumber and cotton and crude are products entering the market for the first time, such as raw grain and crude oil.

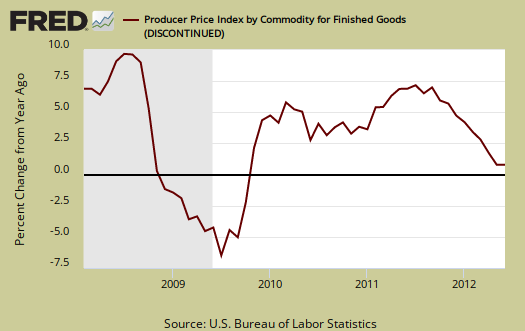

Unadjusted, finished goods have increased 0.7% for the last 12 months, the 2nd month in a row. This is the lowest year over year change since October 2009. Below is the wholesale finished goods PPI percent change for the year.

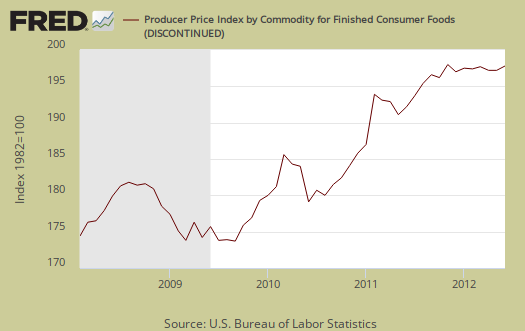

The increase in food prices was the highest since November 2011 and the 0.5% foods increase is 90% due to meats, which had a 3.1% increase overall. Fruits increased 3.1% and fresh veggies increased 2.1%. This increase is from May to June, as well as finished goods, so don't expect the incredible heat dome ruining crops to show up yet.

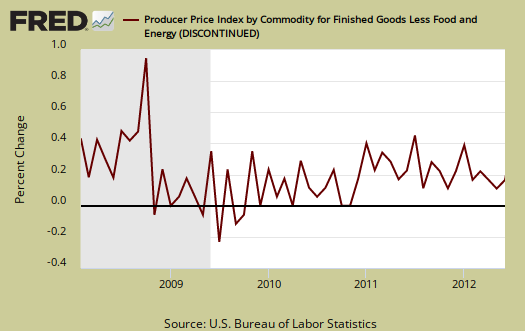

Below are Core PPI or finished goods minus food and energy, which increased 0.2% for June 2012. The reason finished core increased are light trucks.

Accounting for seventy percent of the June increase, the index for light motor trucks moved up 1.4 percent.

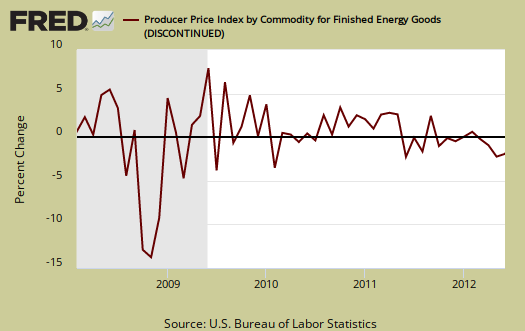

Below is the monthly percentage change of finished energy only, to show the decline in prices. Residential gas increased 3.5%, home heating oil plunged -8.3%, electricity, -2.1% and gasoline, 1.9%.

Crude PPI plunged -3.6% for the last three months is down an astounding -10.8%. Crude energy decreased -5.1%, causing half of June's core PPI decline, while foods decreased -1.6%. Crude core or crude stuff minus food and energy, decreased -4.0%. From the report:

Over eighty percent of the monthly decrease in June can be traced to a 12.8-percent drop in the index for carbon steel scrap. Lower prices for raw cotton also contributed to the decline in crude core prices.

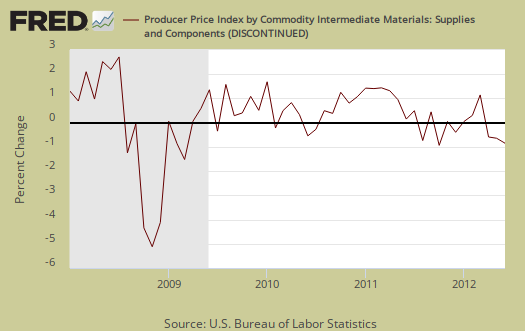

For intermediate wholesale goods we had a -0.5% decrease, the third month in a row with energy decreasing -0.2%, a result of an -8.8% drop in diesel fuel.

Intermediate foods increased 1.0% with over half of this increase due to a 2.2% increase in prepared animal feeds. Corn is heavily used in animal feeds.

Intermediate core declined -0.7% and is hasn't had this large of a monthly decline since February 2009. Industrial Chemicals was 60% of the reason, which declined -3.6%.

alt="" />

alt="" />

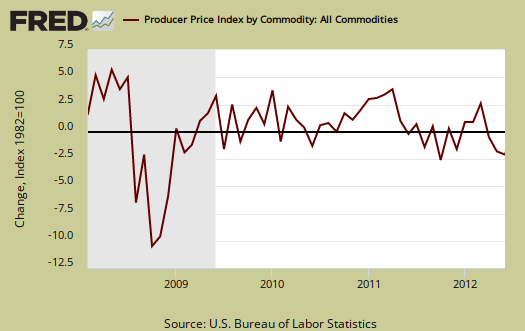

Below is the indexed price change for all commodities. Commodities are not limited to what comes from inside the United States.

PPI also has special indexes which measure services and their margins. From the report:

Trade industries: The Producer Price Index for the net output of total trade industries was unchanged in June following five consecutive increases. (Trade indexes measure changes in margins received by wholesalers and retailers.) In June, higher margins received by warehouse clubs and supercenters and by electronic shopping and mail-order houses were offset by lower margins received by family clothing stores and gasoline stations with convenience stores.

Transportation and warehousing industries: The Producer Price Index for the net output of transportation and warehousing industries moved down 0.2 percent in June, the first decrease since a 0.5-percent drop in September 2011. Accounting for a majority of the June decline, prices received by the truck transportation sector fell 1.1 percent. Lower prices received by the industry groups for air transportation support activities and nonscheduled air transportation also contributed to the decrease in the transportation and warehousing industries index.

Traditional service industries: The Producer Price Index for the net output of total traditional service industries edged up 0.1 percent in June after declining 0.2 percent in May. Leading the June increase, the index for the commercial banking industry rose1.3 percent. Higher prices received by lessors of nonresidential buildings and by the accommodation sector also were factors in the advance in the total traditional service industries index.

There are some implications in this month's PPI report. First, we might be seeing a return to deflation, although the heat wave and corresponding shortages in crops might negate the drop in crude oil. Second, the economy, or global demand seems to be slowing down, as evidenced by dropping prices. Third, it is looking more probable the Federal Reserve will enact another round of quantiative easing.

Here is the BLS website for more details on the Producer Price Index. They list individual items and special indexes.

Recent comments