The WTO appellate court has ruled against China's export taxes on minerals. The case was brought by the U.S., Mexico and the E.U.

The Appellate Body, reviewing an earlier decision by a W.T.O. dispute settlement panel, said the panel had gone too far in defining why more than three dozen Chinese policies violated free trade rules. But the appeals group said on Monday that the overall effect of China’s export restrictions was harming international trade and the policies would have to be scrapped.

China is the largest global producer of bauxite, zinc and yellow phosphorus, fluorspar, magnesium, manganese, silicon carbide and silicon metal, the minerals listed in the WTO case.

The United States, European Union and Mexico accused China of using export taxes and quotas to force international chemical companies and other businesses to move their factories to China to tap these resources.

While people rejoice and believe this ruling implies China will have to remove export restrictions on rare earth minerals, au contraire, it's not so.

Analysts said Beijing's strategy to restrict rare earth supplies and control prices would likely remain unchanged.

"It is still too early to say what the impact will be but I can't see it having a big impact on prices -- the main issue will still be supply and demand," said Vivian Pang, an analyst with the Asian Metal consultancy in Beijing.

Why? Because China has a monopoly on the market. 97% of rare earth minerals come from China. Additionally rare earth minerals are not publicly traded, like gold and silver, they are sold on private markets.

Already the EU is demanding China remove restrictions on rare Earth minerals as are some in Congress.

The EU has demanded that China loosen its policy on sales of rare earth materials after the World Trade Organisation upheld a ruling that Beijing's policies to limit raw material exports violated international trade rules.

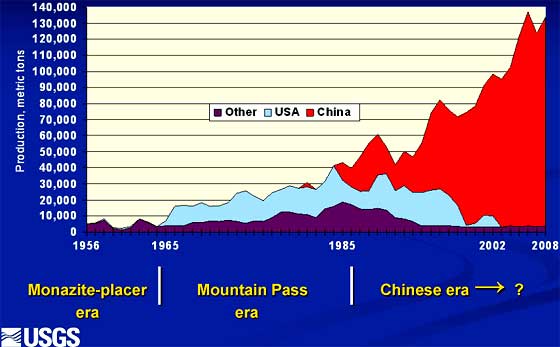

Rare Earth minerals are a big deal. They are the minerals used to make most modern technology. Why does China have a monopoly in these rare elements? Strategy and a very long term one. China actually has only 30% of the globe's rare earth metals sources. One thing is clear, China has been moving up the manufacturing ladder to dominate advanced technology, so why should they export their raw materials supply? After all, they literally have captured the entire supply chain by first undercutting the globe with below cost prices, over production and then limiting exports on many different product specific sectors. Why should rare earth be any different?

From Human Events:

The Chinese have a policy of restricting and driving down the currency of exports while driving up the price of those exports. Since 2005, the Chinese have reduced their allowed exports by 6%, yet in 2010 they reduced their exports quota by 40% and announced they will reduce their exports even further in 2011, according to a 2011 report by the US Geological Survey, citing figures from the China Customs Import and Export Tariff Department. The declines in exports contributed to a surge in prices.

The Chinese have also temporarily shut down production of Batou Steel Rare Earth, their largest rare earth mine, admittedly to drive up prices to levels they believe are appropriate, artificially creating critical shortages of rare earths. This was a wakeup call to Congress.

“China is spending more on the rare earth industry than the U.S. spent during World War II,” said Stephen Leeb, chairman and chief investment officer of Leeb Capital Management and author of The Coming Economic Collapse.

China's stranglehold is so strong, literally they can put the lights out on other nations. China shut down production of rare earth minerals which are used to make fluorescent bulbs.

While we've been pointing out manufacturing begets manufacturing, there is another element to that story, raw materials also spawn manufacturing;

Big companies in the United States, Europe and Japan that use rare earths in their manufacturing have been moving operations to China, drawing down inventories, switching to alternative materials or even curtailing production to avoid paying the extremely high prices that prevailed outside China over the summer, executives said at an annual conference in Hong Kong on Wednesday.

As demand for rare earths wilted outside China, speculators dumped inventories, feeding the downward plunge. Cerium peaked at $170 a kilogram, or $77 a pound, in August but now sells for $45 to $60 a kilogram. Prices are negotiated by buyers and sellers directly with one another and reported by market information companies like Asian Metal, based in Pittsburgh.

That is still far above cerium’s price of $6 a pound three years ago, before China, the world’s dominant producer, sharply cut its export quotas.

“We all learned a hard lesson in July and August, how high these prices can go before customers begin yelling,” said Mark Smith, the chief executive and president of Molycorp, the only American producer of rare earths.

So, while the press claims the WTO appellate ruling is a great victory and soon China will have to stop their manipulation of trade, including supply chains, and raw materials such as the all important rare earth minerals, uh, don't hold your breath.

Recent comments