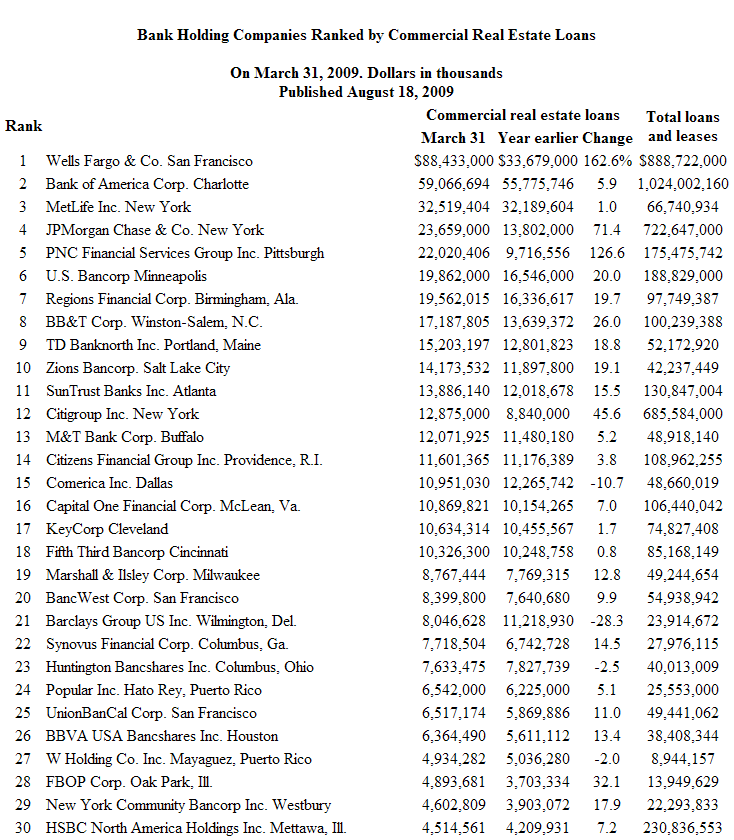

The Big Picture has posted Bank Holding Companies Ranked by Commercial Real Estate Loans.

The entire post lists 150 banks, this was published in August and the raw data was collected from the end of March, 2009.

The top 30 image is reposted below.

Src: The Big Picture, click on the above image to enlarge

Recall we have multiple posts showing Commercial Real Estate is getting worse and about to cliff dive.

Note many of our TARP recipients are on this list. Now what was that about redoin' the stress tests with more stringent conditions?

Thanks to the Big Picture for releasing this (which was obtained from American Banker).

Oh, but everything is OK.

Banks can earn their way out this mess. Sure, and I have ocean front property in Kansas.

At some point, this Administration is going to have to piss off some powerful special interests for a change. Or wind up the next Herbert Hoover.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

How is a system that relies on credit

going to function properly when the credit providers are loaded with all this toxic waste on their books?

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

stress tests

the past stress tests are hitting past the "worse case scenario" which is why so many people are calling for them to be redone.

Serious question of sustainability

If we are going to maintain the status quo then we have to reinflate the bubble. However, how do you re-inflate a bubble when creditors and debtors are already too leveraged?

Would the stress tests be a waste of time? I believe regulators and banks already know the truth - the financial sector is for the most part insolvent.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Look at this SH*T

THE SYSTEM IS FU*KING INSOLVENT. PRESS RESET.

Manufacturers Seek $20 Billion in Loan Guarantees

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

interesting manufacturing story

Most of the layoffs have come from manufacturing and I'm sure this is true and small manufacturing needs credit, help IMMEDIATELY...

but what is suspect are the executives being quoted. General Dynamics for example ain't no small manufacturing business.

Robert, Am I over reacting?

We have an estimated 150 to 500 banks that may be insolvent. We have banks very tight w/ credit DESPITE a boatload of liquidity poured into the system and very low interest rates. We have foreclosures still going up and CRE is still tanking. Oh, yeah, we have housing prices artificially supported by a tax credit that expires in November.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

I don't think so

The key (which is beyond hard and why we have so many different perspectives) is how does all of this affect the big macro economic picture?

But to me, the biggest number that freaks me out is 1 in 9 on Food stamps. I try to always put the Federal poverty levels with that, which is what qualifies someone to get food stamps and frankly you cannot rent a cardboard box on that level of income.

But how all of these facts interact, can they cause anything from people who are projecting we're on the Great Depression path and this is simply 1930, to the "happy feet" projections of all is well, don't worry, be happy, recovery is right around the corner.....that's the baffling thing

and implies it's really good we have a large database to hold all of our writings on it.

World leaders knew about coming global crisis and did nothing

London Standard has the blow by blow details on precisely how the G7 as well as Congress were explicitly warned about derivatives, toxic assets would cause a global economic crisis.

I think we all know here that the claim "no one could have foreseen this calamity" is pure bunk to the point we're really wondering if it was simply used for Shock Doctrine purposes.