Update 4:

This week we got a partial answer to the query posed by the title to this series: one of my two possible outcomes was a deflationary recession (an old fashioned "bust"), featuring (-1.5%) or greater deflation on an annual or shorter basis. This week we learned that in the August-October period CPI already declined (-1.5%). Since November and December have a seasonal bias towards slightly negative (-.1 and -.2 respectively) monthly CPI readings, this deflationary recession will almost certainly last into 2009.

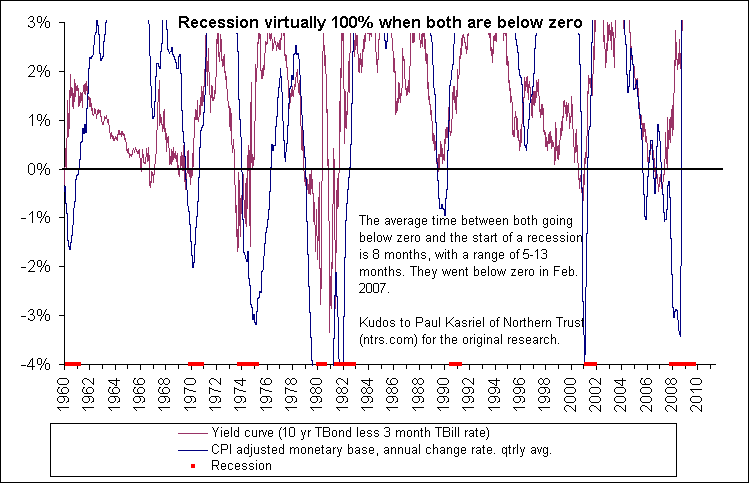

The question remains: could we pull out into at least an anemic economic recovery later in 2009? This second scenario is based on the Kasriel indicator which consists of positive real M1 money supply on a quarterly basis, plus a positively sloping yield curve 12 months previously, which perfectly coincides (sometimes with a slight lag or lead) with recoveries for the period of the last 50 years, and also appears to work for the Great Depression period as well.

I have located an updated graph of the Kasriel indicator, which clearly shows the indicator predicting recovery vs. recession:

Indeed, back in August, Kasriel himself wrote:

Our base case economic scenario is that the U.S. economy entered a recession in early 2008, will remain in a mild recession throughout 2008 and will begin to experience an anemic recovery in the first half of 2009.... In the second half of 2009, when economic growth picks up enough to stop the upward trend in the unemployment rate, the Fed will start raising the funds rate.

This month he has become more negative, and made no mention of whether or not his indicator coincided with his new, gloomier view:

Given our forecast of contracting real GDP for the five consecutive quarters ended the third quarter of 2009, real aggregate demand will be falling short of real aggregate supply, hence, our forecast of decelerating CPI inflation. .... [W]e doubt that labor will be in a position to negotiate significant wage increases.

The principal reason we are expecting a long recession and a muted recovery is because of the evaporation of capital in the financial system due to credit losses.

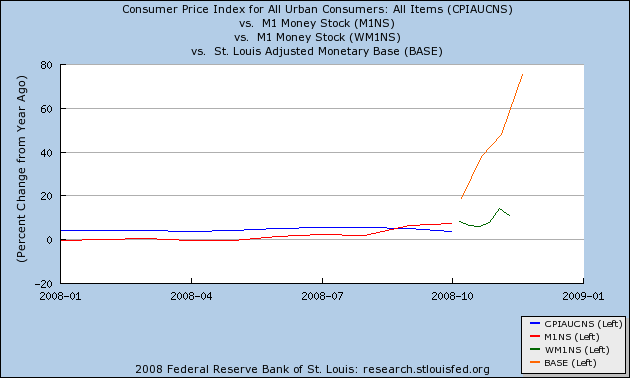

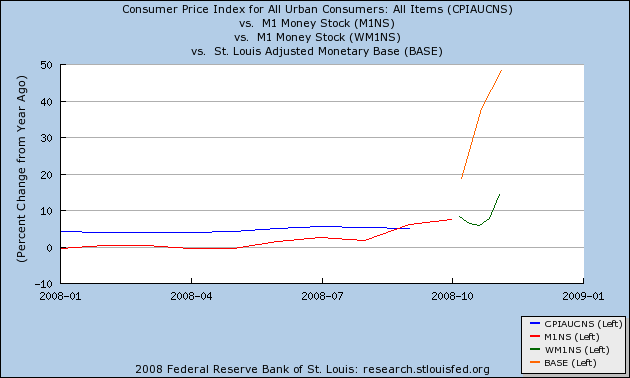

Regardless, this week's data, including October CPI declining to 3.7% on a year over year basis, and weekly updates to monetary base and M1 showing continued robust expansion to say the least, continue to suggest that the indicator is on the verge of forecasting recovery:

_________________

Update 3:

On Friday we got October M1 money supply and import prices. Both of these add substantially to the emerging picture of deflationary recession vs. tepid recovery in the months ahead. To recap, there are two opposing forces at work in the economy: there is a strong deflationary pull based on imploding credit and bad debt, revealed in collapsing commodity prices in particular; and the Fed and Treasury's attempt to reinflate the economy by pumping vast sums of money into the banking system. The 1000 point weekly (daily?) swings in the Dow Jones Industrial Average of the stock market are tantamount to just how different the two outcomes of deflationary collapse vs. tepid advance might be.

The deflationary summary is that any time in the past 85 years there has been a decline in CPI of -1.5% or more in less than a year, it has coincided with a deflationary recession. The recovery scenario is that any time there has been a positive yield curve in the bond market (long rates higher than short rates) at the same time as narrow money supply (M1) is expanding at a rate greater than the inflation rate for 3 months, an economic recovery has occurred within 6 months thereafter. My original post discussing both indicators, along with the first two updates, can be found here.

To the data:

First, here is the October update for M1 (red), and the weekly advance M1 through Nov. 3(green) along with the monetary base (orange) compared with inflation (blue):

It seems clear from this graph that October M1 will easily exceed the inflation rate for the 2nd month, and the first week of November continued that trend.

Meanwhile, the collapse in import prices, which ran at an annual rate of 21.4% in July, but have collapsed to 6.7% in October (mainly due to the collapse in Oil as well as other commodities):

strongly indicates that we will see another deflationary CPI reading when the October number is released on Wednesday of this coming week. This will be the third deflationary reading in a row, heading into the two months (November and December) which have a historical seasonal bias towards deflation to begin with!

At the moment, the best reading seems to be: deflationary consumer recession now, possible tepid recovery by some time in the first half of next year. The second part of that reading is a minority opinion to say the least, but I am glad to note that my contrarian caution about the scope of the consumer collapse is shared by Russ Winter.

Comments

retail sales

I noted in the instapopulist that one of the big reasons retail sales dropped was the price in gas. The other was no one is buying a new car.

correct!

Take out cars and gas, and retail sales are flat. All of the sales incentives that lasted through September stole from future consumption.

I am anticipating a seriously negative PPI and CPI this week. We'll see soon enough....

you couldn't prove it where I am

8 bucks for a damn cooked chicken. 4 bucks for a jar of tomato based pasta sauce. 3 dollars for 6 oz. of cookies.

We'll see but what is the lag with slow demand when supply finally drops it's price on things like perishable or not so perishable goods like food?

Food inflation

The interesting thing is, in the past inflation in the price of food has tended to peak early, sometimes even before the recession begins. This time around, it has continued to increase even after Oil declined (P.S. Gas is as low as $1.83/gallon now where I am).

I just read today or yesterday (there's senility setting in!) that some foodstuffs have just declined substantially in price.

Needless to say, I'll give the food CPI some special attention this week, to see if its rate of inflation is finally declining YoY.

Have a Lobster while doing it

;) I just read that Lobster at least the price has dropped like a commodity bomb. white Truffles too, I'm sure all on these boards eat those regularly!

Who knows but I imagine the foods, esp. preped of any kind are using raw food stuffs bought a few months ago. Although I sure hope a cooked Chicken was not bought months ago! ;)

same price as hamburger here

in chicago a week or so ago. I couldn't believe it. So yeah....you bet your ass I baught some....invited some friends over. mmmm...mmmm!

Lobster index

I think we have found a new index!

In my area

As well as many other places in the United States, Gleaning and Community Supported Agriculture are the deflationary leaders destroying the food supply business model.

-------------------------------------

Maximum jobs, not maximum profits.

I know it's heracy but...

I'm still calling it stagflation because the drop in the cost of goods, especially for production (minus energy) hasn't dropped at the same rate as the price for final goods. The

Producer Price Index

is still advancing versus the

Consumer Price Index

, and you have to figure the difference is what companies are making. OK, that's a stretch but you see where I'm coming from. Secondly, the drop in imports (and what have you of our phony inflation figures) has mainly (though not entirely) been from the drop in oil. Also, have you noticed they stopped reporting the M3?

PPI vs. CPI

Johnny, on a YoY basis, both the PPI and CPI are advancing at a declining rate. According to my edition of Barron's today, this week's CPI is expected to decline (-.8%), PPI at double that rate! This is a classic nearing-the-end-of-recession pattern. For another good example, go to the St. Louis FRED and compare PPI and CPI during the 1973-74 oil shock recession vs. now.

Spelling please....

....heresy.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Recession seems to be making

Recession seems to be making unemploment for many. Its really inceasing worries of good professional's with gerat decrees and making them pray to be employeed. But in all this, happiest people looking little or absolutly nil worried about this huge word "Recession" are small business people with small decrees. They seemed to be not worried and even not at all affected by this slow down. Sometime i think that better to be self employed or having a small business than to work with large orgainsation and facing recession and threat of unemployment. It better to be live than to worring about living.

Recession

I think there are several causes for the extended recession. And it's not the technocratic excuse offered by many.

One is that corporations insist on continued double-digit increase in profit. If one doesn't have a 20% increase in profit, it's a horroshow.

What that means is that corporations are always looking to reduce costs by reducing jobs and/or pay. It also means that prices are continually pushed upward. This creates an increasing gap between folks being gainfully employed and a steady increase in family costs due to increased prices. How does this affect the recession? Well, it becomes harder and harder to pay a mortgage that was already too high for many people.

Obviously, loosened regulations on the banking industry is also an important reason we're in a mess. Congress still hasn't done what's needed - regulate the banking industry.

And giving mortgages to people who really couldn't afford them - that was a load of baloney too.