Michael Collins

Gretchen Morgenson of the New York Times just published one of the few feel good stories in months following the 2008 financial crisis. She describes a possible day of reckoning for the perpetrators of the 2008 crisis and much of the pain that has followed.

The newly elected New York attorney general, Eric Schneiderman (D), wants information from Goldman Sachs, Bank of America, and Morgan Stanley. Among other things, the information concerns mortgage pooling and bundling. This may well include information on collateralized debt obligations (CDO's) and mortgage backed securities (MBS). New York state officials told Morgenson:

"The New York attorney general has requested information and documents in recent weeks from three major Wall Street banks about their mortgage securities operations during the credit boom, indicating the existence of a new investigation into practices that contributed to billions in mortgage losses." New York Investigates Banks’ Role in Financial Crisis New York Times, May 16

Morgenson indicated where the attorney general might be heading - securitization fraud:

"Some litigants have contended, for example, that the banks dumped loans they knew to be troubled into securities and then misled investors about the quality of those underlying mortgages when selling the investments."

"The possibility has also been raised that the banks did not disclose to mortgage insurers the risks in the instruments they were agreeing to insure against default." New York Times, May 16

In addition to the leaked investigation, Morgenson makes a critical point about ongoing federal and state attorneys general efforts for settlement order on mortgage fraud, fictional mortgage agreements, and matters related to ForeclosureGate.

"By opening a new inquiry into bank practices, Mr. Schneiderman has indicated his unwillingness to accept one of the settlement’s terms proposed by financial institutions …" New York Times, May 16

Matt Tiabbi explained what this means:

"If the AGs were to sign off on a friendly global settlement for mortgage abuses prematurely, it would be like a DA offering a millionaire murderer a 2-year plea bargain before the cops even had a chance to interview all the eyewitnesses. It would be a blatantly political arrangement." Matt Tiabbi, May 17

The settlements (consent orders that avoid a trial) by the Obama Department of Justice and the state attorneys general would cost the big banks and Wall Street a few billion dollars in legal fees but free them from civil suits that could stretch into the trillions and jail time for criminal fraud.

The New York AG's actions stop any settlement in its tracks since, according to Tiabbi; it takes all 50 states to generate a consent order. Should it become official, Schneiderman's investigation would also set a high bar for any other settlements. It could also simulate demands for serious prosecutions around the country.

Serious charges by Schneiderman would also make a federal settlement like the one leaked to American Banker look simply awful to the public.

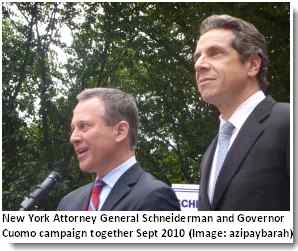

Nexus between Cuomo 2009 Charges against Bank of America, Schneiderman's Investigation, and the Senate Report on "Wall Street and the Financial Crisis"

On February 4, 2009, then New York Attorney General Andrew Cuomo filed a complaint against the Bank of America, Kenneth D. Lewis, and Joseph L. Price.

"The bank and the two named executives are charged with failing to inform the bank's board of directors and shareholders of the major red ink on Merrill Lynch's books prior to the merger. CEO Lewis, CFO Price, and other BofA officers and professionals chose to hide $16 billion of Merrill Lynch known pre tax losses prior to board approval. That's fraud, plain and simple." Michael Collins, Economic Populist, February 8, 2009

The complaint also, "charges that the same parties with strong arming the federal government for $20 billion to cover Merrill's debt by threatening to back out of the merger if the money wasn't forthcoming." Economic Populist

We don't know the exact direction that Schneiderman's investigation and charges will take (if they are any). However, Morgenson notes that Schneiderman may be looking at current civil charges claiming, "that the banks dumped loans they knew to be troubled into securities and then misled investors about the quality of those underlying mortgages when selling the investments." New York Times, May 16

There is a tight fit between the illegal acts and the subject matter of those acts in both Cuomo's case and the attorney general's direction, according to the Morgenson article.

Selling troubled securities without disclosure is precisely the type of fraud that Cuomo charged against Bank of America - defrauding investors on a deal by withholding vital information.

The information withheld in the Bank of America case concerned the huge losses Merrill had incurred in the collateralized debt obligation (CDO) and mortgage backed securities (MBS) market.

The Permanent Subcommittee on Investigations April hearings and report dealt with a broad range of appalling Wall Street behavior leading to the financial crisis. In a memo from Chairman Carl Levin (D-MI) and ranking member Tom Coburn (R-OK), the behavior that Schneiderman is reportedly investigating is described in clear terms:

Steering Borrowers to High Risk Loans. WaMu and Long Beach [as examples] too often steered borrowers into home loans they could not afford…

Polluting the Financial system. WaMu and Long Beach securitized $77 billion in subprime loans…, used Wall Street firms to sell … worldwide, and polluted the financial system with mortgage backed securities. Sen. Carl Levin (D-MI), Sen. Tom Coburn (R-OK), Permanent Subcommittee on Investigations, April 13, 2010

Schneiderman's focus benefits from the groundwork laid by Cuomo's 2009 action. That's a considerable benefit given the depth of interviews and analysis in Cuomo's New York complaint.

The attorney general can also call on the contributions of former Special Inspector General for TARP, Niel Barofsky. The former SIGTARP collaborated wiht Cuomo in the Bank of America complaint. Schneiderman also has the benefit of exhaustive evidence developed by the Senate's Permanent Subcommittee on Investigations.

Should he file a complaint, the attorney general of New Your will have a solid foundation preceding his efforts. Using these resources provides the opportunity for broad based civil and criminal actions .

The Martin Act

Cuomo's charge against Bank of America, Lewis and Price were brought using the Martin Act, a 1921 New York law designed to promote investigations of fraudulent stock market schemes. The law has some unique provisions:

"The purpose of the Martin Act is to arm the New York attorney general to combat financial fraud. It empowers him to subpoena any document he wants from anyone doing business in the state; to keep an investigation totally secret or to make it totally public; and to choose between filing civil or criminal charges whenever he wants. People called in for questioning during Martin Act investigations do not have a right to counsel or a right against self-incrimination. Combined, the act's powers exceed those given any regulator in any other state." Nicholas Thompson, Legal Affairs, May/June 2004

The infrequently used law was the centerpiece of Elliot Spitzer's investigations into Wall Street fraud as New York AG, prior to his election as governor. Had Spitzer survived, it would have produced an array of fraud cases prior to the financial crisis.

If wishes were horses …

If wishes were horses, we'd all take a ride. Spitzer's investigations blew up after a personal scandal. Cuomo's gubernatorial campaign interrupted his Bank of America case of 2009.

We now have the new attorney general, Schneiderman, and the leaked investigation. Robert Scheer praised the effort but expressed this jaded (and probably accurate) caution:

"Eric Schneiderman will probably fail, as did his predecessors in that job; the honest sheriff doesn't last long in a town that houses the Wall Street casino. But decent folks should be cheering him on. Despite a mountain of evidence of robo-signed mortgage contracts, deceitful mortgage-based securities and fraudulent foreclosures, the banks were going to be able to cut their potential losses to what was, for them, a minuscule amount [by the state and federal consent order proposals]." Robert Sheer, Truth Dig, May 17

Sheer has been around long enough to know the odds against the good guys winning, at least for long enough to make a difference. But you never know. Success is often a matter of timing. This attorney general is certainly attacking Wall Street and the big banks at the right time.

The support for serious legal action would be overwhelming. There isn't be a venue in the country that would miss the opportunity to sock it to these and other institutions and put a some of their officials behind bars. Of note, the Martin Act can be used for civil and criminal prosecutions. But let's not get carried away. Trillions lost, a nation in economic distress, 150,000 foreclosures a month…and how many prosecutions have we seen? The only time these guys will do is in a Timex commercial.

END

This article may be reproduced entirely with attribution of authorship and a link to this article.

Comments

Matt Taibbi on a roll, video

Taibbi is one of the few journalists still pounding on Goldman Sachs pointing out they lied to Congress and their customers. Good video interview below.

Great report

Thanks for keeping the bankster issue alive. There are many a crook and criminal within those Wall Street rooms and many need to visit Bernie Madoff. I was surprised that Schneiderman was willing and able to fight the banksters on their own turf. Cuomo knows the score as well, so it's good that the two of them are on the same page. I am looking forward to the details of the investigation.

Thanks. A bright light is needed

They've got the whole game rigged but now their time may come. I was impressed that Cuomo went after BofA in a big way. He also got settlements out of a number of financial institutions. But Schneiderman doing the Martin Act interviews with Goldman, BofA and Morgan is another story. The act allows intensive questioning and requires those interviewed to keep quiet. If they don't, then they're up for violating that part of the act.

I'm sure Schneiderman and Cuomo have good motives. This is a politically charged investigation and prosecution, if they move forward. I'm also sure that they can both count. There are a far more New Yorkers hurting than banksters hustling. In this case, I'll actually "hope" for a while.

BTW, Cuomo's popularity rating was above 70% after his budget cuts. Interesting.

Michael Collins