The 3rd estimate of 4th quarter GDP indicated that our output of goods and services in the last three months of the year grew at a 2.2% annual rate from the 3rd quarter, which was unchanged from the 2nd GDP estimate.

That means that for the whole of 2014, our economic output grew by 2.4%, a bit better than the 2.2% growth we saw in 2013 or the 2.3% growth we saw in 2012. Our growth rate in current dollars in the 4th quarter was revised up from 2.3% in the 2nd estimate to 2.4% in this estimate as the inflation adjustment, aka the GDP deflator, which had initially been reported negative, was revised from 0.1% to 0.2% with this estimate. Even while overall growth was unrevised for the quarter, our exports, imports, and all of the components of personal consumption expenditures were revised higher, while inventories and several components of fixed private investment were revised lower. Since the press release for this report isn't very useful in understanding what transpired, we'll refer you to the Full Release & Tables (pdf), and specifically the first 4 tables therein, in explaining what changed.

In the GDP pdf, Table 1 shows the real (inflation adjusted) percentage change in output for each component of GDP year over year and quarter over quarter since 2011. Table 2 shows how much the real change in each of those components of GDP added to or subtracted from the final GDP reading for each of those quarterly and annual periods going back to 2011. Table 3 is in 3 sections; the left body of that table, headed "billions of dollars" is the current dollar value of each of the GDP components listed; the remaining two sections are in chained 2009 dollars, from which all the annual change figures reported here are computed. The 4th quarter of 2013 and each quarter of 2014 are shown, seasonally adjusted and at an annual rate. Then the last 3 columns show the change from the preceding period in fictional 2009 dollars for each item. Note those are not real dollar amounts; they're used for computational purposes only. Finally, Table 4 shows the percentage change from the preceding period in the price index for each of those components. This percentage change is applied to the change in current dollars to give the real, inflation adjusted change in output for each component shown.

Real personal consumption expenditures (PCE), the largest component of GDP, were revised to show growth at a 4.4% annual rate, rather than the 4.2% growth rate reported last month, making it the greatest quarterly growth in real PCE since the first quarter of 2006 and the largest chained dollar increase in PCE since the 3rd quarter of 2003. Consumption of durable goods rose at a 6.2% annual rate, revised from the 6.0% rate reported last month, and added 0.45% to GDP. Consumption of nondurable goods rose at a 4.1% annual rate, revised from the 3.8% growth rate reported in the second estimate, and added 0.61% to 4th quarter growth. Consumption of services rose at a 4.3% annual rate, revised from the 4.1% rate reported last month, and added 1.98% to the final GDP tally. All types of consumer services made a positive contribution, with an increase in the amount of health care delivered accounting for more than 40% of the growth in services. Increases in consumption of all types of consumer durable goods also added to 4th quarter growth, with outlays for recreational goods and vehicles accounting for over 40% of the durable goods growth, and only a 0.3% decrease in consumption of food subtracted from the overall non-durables increase.

Seasonally adjusted real gross private domestic investment grew at a 3.7% annual rate in the 4th quarter, revised from the 5.1% estimate of last month, while the growth rate of private fixed investment was unchanged at 4.5% and added .72% to the 4th quarter's growth rate. Real non-residential fixed investment grew at a 4.7% rate, rather than the 4.8% previously estimated, as investment in non-residential structures was revised up from a growth rate of 5.0% to a 5.9% growth rate, investment in equipment grew at a 0.6% rate, not the 0.9% rate previously reported, and the quarter's investment in intellectual property products was revised down, from growth at a 10.9% rate to growth at a 10.3% rate. In addition, growth in residential investment was revised from 3.4% to 3.8%. After these revisions, investment in non-residential structures added 0.17% to the GDP's growth rate, investment in equipment added 0.04%, investment in intellectual property added 0.39%, while growth in residential investment added 0.12% to 4th quarter GDP.

Meanwhile, a decrease in the quarter over quarter change in the growth of inventories subtracted from investment and hence from GDP, as the increase in real private inventories was revised from the $88.4 billion growth reported last month to show real inventory growth at an inflation adjusted $80.0 billion in the 4th quarter. This was after inventories grew by $82.2 billion in the 3rd quarter, and hence the $2.2 billion smaller inventory growth subtracted 0.10% from the 4th quarter's growth rate, in contrast to the 0.12% addition from inventory growth that was reported in the second estimate. Since inventories indicate that some of the goods produced goods during the quarter are still 'sitting on the shelf', their decrease by $2.2 billion means real final sales of GDP must have been higher by that much, hence increasing at a 2.3% annual rate, revised up from the real final sales of GDP increase of 2.1% reported last month.

Both the increase in real exports and the increase in real imports were revised higher with this release, where increasing exports add to gross domestic product because they represent that part of our production that was not consumed or added to investment in our country, while increased imports subtract from GDP because they represent either consumption or investment that was not produced here. Our real exports grew at a 4.5% rate rather than the 3.2% rate reported in the second estimate, and as a result added 0.59% to GDP. However, our real growth of imports was revised to 10.4% from the previously reported 10.1% growth, and hence subtracted 1.62% from the 4th quarter's growth rate. Thus, the increase in our imports in the 4th quarter was greater than the 4th quarter increase of our consumption of durable goods, non-durable goods and equipment investment combined, and was largely responsible for the weak showing in 4th quarter growth..

Finally, there were also minor revisions to real government consumption and investment in this 3rd estimate. Real federal government consumption and investment contracted at a 7.3% rate, which was revised from the 7.5% contraction reported in the 2nd estimate, and subtracted 0.53% from 4th quarter GDP. Real federal spending for defense was revised to show contraction at a 12.2% rate rather than the 12.4% contraction previously reported, while all other federal consumption and investment grew at a 1.5% rate, revised from the 1.4% growth rate reported last month. Real state and local outlays, on the other hand, were revised lower, from the 2.0% growth rate previously reported to growth at a 1.6% rate, which only added 0.18% to GDP.

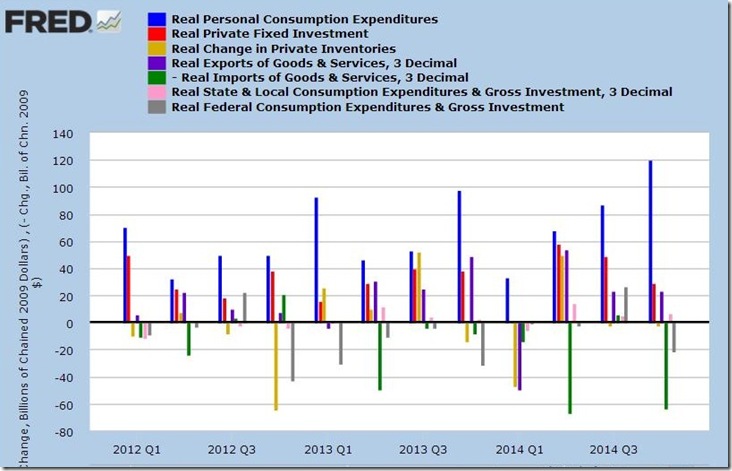

Our FRED bar graph below, which can also be viewed as an interactive, has been updated with these latest GDP revisions. Each color coded bar shows the change, in billions of chained 2009 dollars, in one of the major components of GDP over each quarter since the beginning of 2012. In each quarterly grouping of seven bars on this graph below, the quarterly changes in real personal consumption expenditures are shown in blue, the quarterly changes in real fixed private investment, including structures, equipment and intangibles, are shown in red, the quarterly change in real private inventories is shown in yellow, the real change in exports are shown in purple, while the change in real imports is shown in green. Then the change in state and local government spending and investment is shown in pink, while the change in Federal government spending and investment is shown in grey. Those components of GDP that contracted in a given quarter are shown below the zero line and subtract from GDP, those that are above the zero line grew during that quarter and added to GDP. The exception to that is imports in green, which subtract from GDP, and which we have shown on this chart as a negative, so that when imports shrink, they will appear above the line as an addition to GDP, and when they increase, as they did in the 2nd quarter, they'll appear below the zero line. You can see from the graph that it was our personal consumption expenditures that drove 4th quarter growth, and our imports that limited it to a 2.2% rate..

(cross-posted from MarketWatch 666)

nice call out on PCE

Without the details wouldn't have known that. I do have an issue, you are using % instead of percentage points on GDP. Big difference.

mea culpa

yeah, i should have phrased that correctly...there is a lot in reporting on NIPA that is difficult to express accurately in a smooth sentence...

to discover the PCE aberration, i just used the interactive version of that graph to see a longer view...although it wouldn't make a clear image with all that data, that the 4th quarter PCE bar was the highest in a decade was obivious...

rjs