The headlines blare building permits are the highest in five years. Housing building permits come from the Census issued Residential construction report and for October building permits increased 6.9%. While that sounds great and good, it is not an indicator the residential real estate sector is red hot again as some in the press proclaim.

Worse, the shutdown didn't allow for accurate data collection, so information on housing starts was scuttled for September and October. That alone should raise some eyebrows on this statistical release. While building permits are valid and from a separate survey from housing starts, the are still subject to two months of revisions.

The lapse in federal funding affected the data collection schedule for the Survey of Construction, the source of data on new housing units started and completed. Accurate data collection for September and October could not be completed in time for this release. Data on housing units started and completed in September, October, and November 2013 will be released on December 18, 2013.

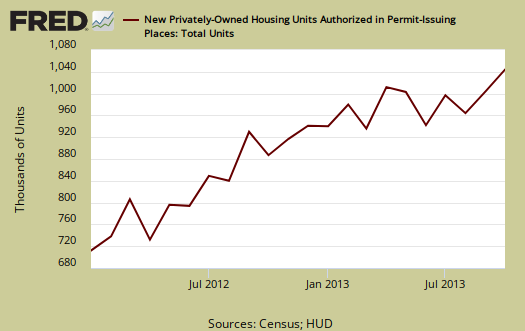

Building permits increased 6.9% for the month to 1,034,000 and are up 13.9% from this time last year. The monthly change for building permits has a ±0.8% margin of error and the yearly change has an error margin of ±1.1%. Low error margins means building permits are much more accurate, yet building permits for housing do vary month to month.

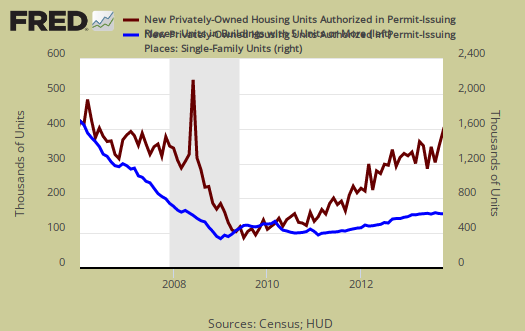

A more accurate story on building permits being at a five year high is apartments. Homeownership rates are at record lows, so it would make sense for rental units to be on the raise due to increased demand. The monthly building permits bear this out. Single family building permits increased 0.8% from last month, but building permits for five or more housing units soared by 16.9%. Moreover while single family building permits have increased 13.9% for the year, permits for five or more units of housing have jumped by 24%. The below graph shows building permits are not always a smooth line from month to month, especially for apartments. The maroon line is apartment building permits, the blue, single family units. As we can see the figures for apartments vary widely on a month to month basis. Also note the funky spike up in building permits for 5+ units during the recession. That is the five year high the press is referring to.

In terms of the annual rate of growth for apartments versus single family homes by building permits, here too we see more activity going on with apartment buildings than single family houses. Below is a graph of the percent change from a year ago in single unit building permits, in blue, versus five or more units, in maroon. We see a leveling off on single family building permits in terms of yearly growth and the more volatile apartment building permits shooting up for this month. The below graph doesn't imply great increased growth for single family new construction in 2014 as some in the press proclaim. Single unit building permits were an annualized 620,000 while apartments were 387,000. In terms of building permits this means there are almost twice issued for single family housing construction than building five or more units. By volume then one should not expect this 2014 new construction blow out some in the press are predicting from this monthly increase in building permits.

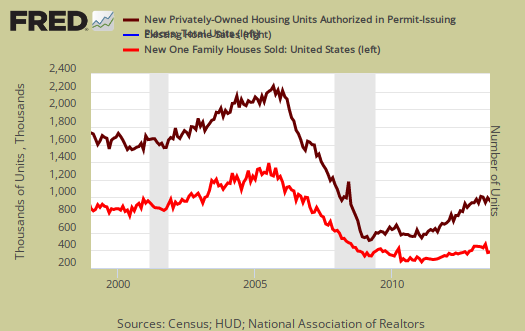

Finally, the below graph compares building permits to existing home sales, in blue, which obviously because they already exist are not new construction and then new home sales, in bright orange-red. While there is some matching trends to building permits, from the flat new home sales trend line, it is not directly correlated to building permits, graphed below in maroon.

Generally speaking, beware of financial press headline buzz. It is often written for stock market traders, focused on fast moving titles and belies the actual statistics underneath. To get a real feel for what is happening in residential real estate, one must look at a host of metrics and not jump on the latest and sometimes misleading headline buzz train.

Here are past overviews of new residential construction.

Recent comments