The ADP national employment report shows 42,000 private sector jobs were created in July. Last month's numbers were revised from 13,000 to 19,000 for private sector jobs created.

July’s ADP Report estimates nonfarm private employment in the service-providing sector rose by 63,000. Employment in the goods-producing sector declined 21,000 during July while employment in the manufacturing sector decreased 6,000, the first decrease in six months.

Probably the worst bit of news from ADP is they see no evidence of acceleration in the number of jobs created each month. For the last six months employment has averaged 37,000 private sector jobs created each month.

This flatness, where unemployment statistics are staying at a local bottom, is also reflected in the initial weekly unemployment claims graph.

Nonfarm private employment in the service-providing sector rose by 63,000. Employment in the goods-producing sector declined 21,000 during July while employment in the manufacturing sector decreased 6,000, the first decrease in six months.

Large businesses, defined as those with 500 or more workers, saw employment remain flat and employment among medium-size businesses, defined as those with between 50 and 499 workers increased by 21,000. Employment among small-size businesses, defined as those with fewer than 50 workers, increased by 21,000 in July.*

In July, construction employment dropped 17,000, the smallest decline since November 2007. Construction employment has declined for over three years, and the total decline in construction jobs since the peak in January 2007 is 2,240,000. Employment in the financial services sector dropped 1,000, the smallest decline since June 2007. Financial Services employment has declined for over 3 years.

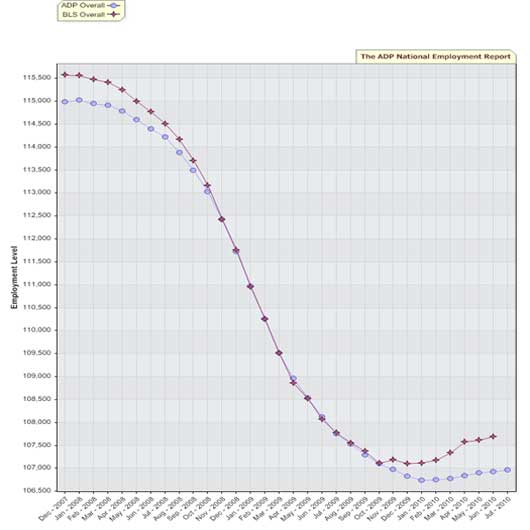

Below is a graph of the BLS private sector job vs. ADP.

Stock Market Happy Buzz Headlines

I think we all know financial "news" sites put up daily happy feel good buzz headlines to explain why the stock market went up.

Now it's this report. There is no good news in this report. The U.S. needs at least 125,000 jobs created each month just to keep up with population growth.

Who else is tired of feel good buzz headlines in the financial press which are completely divorced from economic reality, often even corporate reality on a particular stock.

Somehow off-topic and not ...

I stopped reading financial "news" sites long ago. Either they publish cheerleader stories or apocalyptic doom & gloom. But people seem to like this sort of financial science fiction?

Anyhow some weeks ago I read here a post about the recession won't end until the private sector is finished with the credit cycle. Thus I want to draw your attention to the testimony of Richard Koo to the US Financial Services Committee. He terms it a "balance sheet recession". And the only way out is for the US government to substitute private sector deleveraging with fiscal policies. Very good testimony. He's close to economic enlightenment: MMT ;-)

The link: http://financialservices.house.gov/Media/file/hearings/111/Koo%207_22_10...

Financial Science Fiction

Hi Stephen,

I haven't been able to get to this testimony, just scanning it, but this is important.

Maybe you are of a mind to create an account and write up an overview on this hearing and testimony, along with the consequences of.

One of the reasons EP came into being is economic fiction. It's drives me nuts and let's face it, Cable TV is like a long infomercial. It's bad enough swimming through government stats, making heads and tails out of them, only to later see some "revision" that's as wide as the Mississippi....or major missing data pieces.

Stephan, testimony Japan, House Financial services

I finally got to reading Koo's testimony. He is validating what this Fed Researcher found, that I wrote up in an post here.

Makes perfect sense too, asset deflation on corporate holdings = downsizing further growth projections = more economic job pain.