The Central Banks went on the move. Within 45 minutes of each other, the ECB lowered interest rates, the Chinese central bank did too and the U.K. just enacted more glorified quantitative easing. BoE increased their asset purchases by £50 billion to a grand total of £350 billion.

The Central Banks went on the move. Within 45 minutes of each other, the ECB lowered interest rates, the Chinese central bank did too and the U.K. just enacted more glorified quantitative easing. BoE increased their asset purchases by £50 billion to a grand total of £350 billion.

While it appears we have a global, coordinated plan of attack by Central banks, one might also notice we have a global coordinated plan to counter an economic slowdown. In other words, by all acting in concert, this gives more confirmation that we have a global economic mini-implosion going on.

We already know a U.S. recession is projected for 2013. The IMF not only scolded the United States but also is warning on a global economic growth downgrade, coming to a press release near you on July 16th.

“The United States remains vulnerable to contagion from an intensification of the euro area debt crisis, which would be transmitted mainly via a generalized increase in risk aversion and lower asset prices, as well as from trade channels” said IMF Managing Director Christine Lagarde during a press conference in Washington, D.C.

On the domestic front, failure to reach an agreement on near-term tax and spending policies would trigger a severe “fiscal cliff” in 2013, threatening the recovery, she added. Lagarde made these remarks after joining the final policy discussions.

The IMF expects U.S. growth to remain modest during the next two years, constrained by housing difficulties, the expiration of fiscal stimulus measures, and continued low global demand, particularly in Europe. Growth is projected at 2 percent in 2012 and about 2¼ percent in 2013.

Seems generally the globe is preparing for yet another economic slowdown. In other words, things are not going to get better, things are going to get worse.

We've already seen a slew of economic reports showing declines not seen for three years. Earlier the FOMC downgraded the economy as well.

Europe is probably already in a recession and China's mercantile trade practices might be hitting a wall:

The big data release of the week will come on Thursday when China unveils its second quarter economic growth numbers, and June data on industrial production and retail sales.

A Reuters poll showed economists expect the data to show China's economy expanded in the second quarter by 7.6 percent from a year earlier, its weakest performance since the 2008-09 financial crisis and the sixth straight quarter of lower growth.

The big worry for Asia's exporting nations, such as China, is a possible slide by the world economy into a repeat of the financial crisis of 2008/2009, when global trade ground to a halt.

Naked Capitalism does a round up on China's not so soft landing by relying on exports for growth. Yet for the United States, our problem is the trade deficit, it has been negatively impacting U.S. economic growth for over 30 years. That said, so much production has been offshore outsourced to China, raw materials and intermediate components for finished products and other interdependencies could negatively impact the U.S. We haven't even started talking about China's U.S. Treasury purchases either.

Of course much of this economic malaise could be averted, but our politicians will do nothing.

None of this should be happening. As in 1931, Western nations have the resources they need to avoid catastrophe, and indeed to restore prosperity — and we have the added advantage of knowing much more than our great-grandparents did about how depressions happen and how to end them. But knowledge and resources do no good if those who possess them refuse to use them.

And that’s what seems to be happening. The fundamentals of the world economy aren’t, in themselves, all that scary; it’s the almost universal abdication of responsibility that fills me, and many other economists, with a growing sense of dread.

The ECRI has already said an economic contraction is imminent. S&P just warned on a European recession.

A recession is defined as two quarters of real GDP contraction. Yet, 2% annualized real GDP growth is assumed to be barely trending water. Generally speaking, most economic indicators point to a stagnant U.S. economy to a slow down, rather than a dramatic recession. U.S. LEI haven't been updated with this month's economic reports, nor have many others. Also, 2013 is six months away. That said, for the average American, U.S. citizen worker, the great recession never ended. We have the never ending jobs crisis and the middle class losing 40% of their wealth.

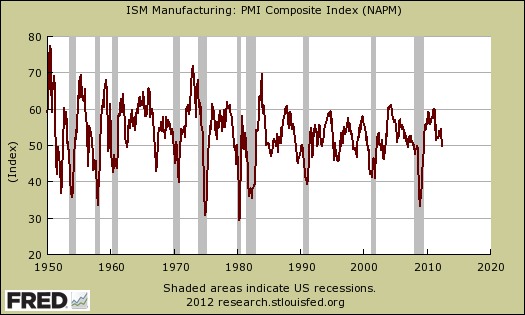

Bottom line, the recent U.S. economic reports give us a bad feeling, never mind what all of the official indicators and business cycle daters have to say. With that, we'll leave you with two graphs. The first is PMI, which contracted to 49.7% for June, against gray U.S. recession bars. Notice how clearly PMI, with a 50 inflection point for expansion and contraction, tracks U.S. recessions, especially when below 40%. Also notice sometimes PMI has contracted without a full bore recession happening as well.

The second is the number of people in part-time jobs due to having their hours cut as a percentage of the total unemployed. This figure has remained highly elevated starting with the great recession. Notice how closely this ratio matches the gray recession bars. Job losses really start happening after a recession is in full bloom.

There are some who insist residential real estate is going to make some amazing recovery and save the day. In fact residential investment did add 0.41 percentage points to Q1's 1.9% GDP. This is an improvement over Q4's 0.25 GDP percentage point contribution, it is not enough to get the U.S. over the hump. Nor do any of the housing indicators imply the deflated housing bubble can magically pop back up. On top of things people never say where Americans are gonna get the money for the mortgage on a long term basis and clearly America is tapped out. Add to that Central banks have already played most of the tricks up their sleeves, numerous governments only act when corporate lobbyists want them to and we've got dark clouds on our economic horizon. Just what we need when we're already decimated by the previous recession storm.

Speaking of which, Dr. Doom Nouriel Roubini says 2013 is the perfect storm and could be worse than 2008.

Comments

nice analysis on housing''s GDP additions

James Hamilton, over at Econbrowser just put up some tables of housing's contribution to GDP in recent recessions and right afterwards. Click here to read his article. Lots of tables, graphs, statistics to amplify his points.

Very nice, he seems also to be pointing to dark clouds and there is no return to the housing bubble to temporarily stimulate economic growth as well.

Housing issue has so many aspect to it with no answers coming

Housing in the US is such an interesting issue, same as China and other nations face too.

1) Even if people wanted to buy houses and enter into 30 year contracts with banksters that they could trust in and never fear banksters would screw them in, how could they ever count on securing a safe, stable job in the same locale for 10+ years when the govt. and American companies are doing everything they can to scare the Hell out of Americans, force them into short-term/low-wage contract jobs (when they offer jobs)? There's such a contradiction there and given the IQ + corruption of banks, companies (even real estate companies), and govt., I'm not sure they even care to address this dichotomy. A mortgage requires faith in multiple systems and organizations and in one's future, I see that honestly destroyed. A rental agreement one can get out of within a month or two and move across the world for work if necessary seems essential nowadays as companies seem to view people more and more as expendable cogs for short-term use with no value to them.

If you don't create community builders through govt. and company actions, then they need to prepare for a Nation of people who will move at the drop of a hat - burdening local services without property taxes or forcing a new way to provide local services people want.

2) Should new housing construction even be sought at this point given the overabundace of homes that aren't moving, are off the lists because of shadow inventory, etc.? Again, the US has entire sections of cities and towns that are uninhabited, so the govt., average citizens, banks, and companies should look into how these sections of the USA can be fixed and people can find good housing in areas that will be utilized effectively with good schools, fire+police, sewage, etc. There's no point building more homes in Detroit or southern Cal. or AZ. or Nevada if the neighborhood around it is completely vacant, banks are sitting on homes next to new construction, the city won't provide sewage service to the house, or no jobs can be found within 50 miles, etc. China has ghost cities, so it's in this same predicament too, but is 100% building a property bubble to give the world the impression it's got no probs.

Again, as long as the average person isn't involved in the govt. + policy making, nothing true or productive will come. Only suckers would look to DC, Wall Street, and the real estate industry for insightful questions and real answers - until honest people and groups are involved, we'll keep discussing BS "fixes" to banksters and less regulation = better times for America, no hiring is a result of "too many taxes for job creators," and housing bottoms called every week and how everyone needs to buy a house (why they should when too much debt is always blamed on the consumers, or how the press keeps telling people to remain mobile cogs, or with what $ is not even discussed).

residential fixed investment definition

Real residential fixed investment is defined as:

So, because existing homes are just changing hands, unless they are owned by the government, in terms of growth, it's just the commissions and business/activity surrounding selling and buying that existing home. FYI, next time you see some brew ha-ha from NAR. It's new construction that's more important, in terms of GDP.

Finding BEA quick definitions is irritating, most often the methods are buried in some large pdf.

Love to hear reply to Bonddad per housing

Today 8/7 Bonddad leads off with:

"Will Housing Save the Economy in the Second Half? Their Stocks Say Yes

Over the last few weeks, both NDD and I have weighed in on the housing market, arguing that we've put in a bottom and that we could see a big improvement in the second half. The stocks of this sector are starting to agree with that assessment.

I would be very interested in hearing your take on the subject. Frankly, I'm confused. Who is going to be buying houses give unemployment, marginal employment, low wages, increased medical expenses...have I missed anything?

So I'd love to know what you think

Best

Tom

"Housing "recovery"

The link above under residential real estate goes to all of the economic statistical overviews. A huge question is how much "shadow" inventory is still around but inventories have dropped overall. I think nationally, housing prices haven't hit bottom, as case-shiller mentioned earlier in the year. But overall, the "cliff dive" has stopped. Beyond institutional and foreign investors and I think I link to the amazing amount of Canadians buying U.S. houses, I don't see some "amazing recovery" for housing. I see housing kind of rolling around where it is, maybe a small uptick but anyone who believes we're returning to the days of 2004 even I think they are smokin' crack. I see nothing in the data to suggest this and let's see....

What was that about "green shoots" in 2009 and "the unemployment rate will drop quickly" and so on? In other words, I can't count how many times Bonddad has been dead wrong on these predictions, but so have many other "financial pundits".

More amazing after so many "predictions" out there which are outright fiction, why are these people still read?

Anyway, I can see residential fixed investment going up to even 0.8 percentage points of GDP, so that's an increase in activity, but hardly this massive "saving of the economy". That said, if Congress doesn't do anything about those draconian budget cuts, I think the CBO is dead on as have the Fed hinted, we will see negative GDP in 2013.

Check out James Hamilton's take, it's in the first comment. Pretty much is close to what this article is about.

thanks on housing

Thanks,

You provide empirical reasons for what I intuitively felt.

Best

Tom

should mention the many who say the "housing bust is over"

You need to read their details. I am also saying "the housing bust is over" but what I'm not saying is some return to 2004. I also think there is slight lowering of prices, mainly some areas are still bursting, such as Atlanta and some are just so out of alignment with wages, income in their areas.

But claiming that residential real estate is going to "save the economy" and bring up GDP to even 2% over other factors, that I do not see happening. Also, in spite of the cliff dive being over, another recession should cause housing contraction for it always has, in spite of residential real estate massive balloon deflate already.

So, except an uptick in new construction, sales, questionable on prices, I still think there is room for prices to decline, but volume on new activities I think should increase, slightly. Not that smokin' crack NAR claims.

90% of Foreclosures "Held off the Market" no housing recovery!

AOL Real Estate Blog says housing shadow inventory is 90%. In other words 90% of foreclosed homes are being held off of the market, sitting empty, not for sale.

RealtyTrak - only 15% of foreclosed homes are for sale, or 85% held off of the market.

Corelogic - only 10% of REOs are for sale, 90% held off of the market.

Aha! I am not surprised by this and in the original discussion I mentioned it was all about inventories, which officially have dropped like a stone.

If this is true, and I believe they are right, there is absolutely no way prices will increase as some claim or there will be this magic housing recovery. Foreclosures are existing homes and the economic activity their sale adds is in broker commissions, banking commissions and so on. It's not "new" or "added growth". They are existing properties changing hands.

I guess I should point out the law of supply and demand. When one has a massive supply with the same level of demand, prices drop. Econ 101.

Next time I overview housing statistics, I will try to add as much information as I can find on shadow inventories.

This is a huge story really. So, if these homes are kept off of the market, we'll see what we've been seeing in terms of volume, new construction, prices and so on, but as they are added and eventually they must be added to the market, no way will residential real estate, housing magically "save the economy", nil to none.

OECD global economic slowdown

OECD just released their economic indicators. The U.S. can be interpreted as "stagnant", which it certainly is.

If the US were moving any slower, we'd be going backwards

To the man on the street in most G-8 countries, life hasn't recovered at all post-2007/2008. And for true improvements in everyday life, I'm sure it's been stagnant for 2-3 decades. When US corps. can simply be HQ'd here, but build and sell products overseas without any interaction with US shores, how relevant is that activitity truly to US indicators. Or $ being made here is remitted to some other country. The rest of the G-8 and G-20 can deal with these issues too, when "Chinese" products are built next door and sold in Vietnam, or "Indian" products are built and sold in Bangladesh.

"Slowdown"? Old rivalries will become physical when Thais see Cambodians stealing their work. Damn, my thinking is getting in the way of feel good, Chamber of Commerce/DC/Wall Street/MSM lies.

I guess once political and business leaders have an agenda that requires acknowledging a slowdown, only then will they do it (e.g., needing QE3-QE99, more visas for "smarter, more talented entrepreneurs + workers").

Roubini "perfect storm" + China imports drop by half

Added Dr. Doom, after all what would a recession prediction be without him, but also, tonight China imports were half of what they were the previous month. The problem is finding out specifics, obviously we do not import oil to China, but do import soybeans, raw materials....so how much that negatively impacts our trade deficit and correspondingly GDP, unknown.

Q2 GDP advance is released July 27th, but investors are focused on China GDP which is out soon. Since our problem is a China problem, too many jobs offshore outsourced and so on, I question the heavy emphasis put on slower Chinese growth to the U.S. economy, beyond all of those Banksters making sure our manufacturing base was moved there.