Economist Dean Baker does a great call out on more fear tactics to convince your average American they must give up their health and retirement to save America:

Steven Pearlstein did his part for the Wall Street crusade to get people to surrender their Social Security and Medicare. He warned readers that if we don't follow the Wall Street deficit reduction agenda, the dollar could enter a free fall. I would say that this is one of the silliest things the paper has ever published, but this is the Washington Post that we are talking about.

Anyhow, let's put on our thinking caps and try to envision what Pearlstein's scare story would look like. Currently, the euro is equal to around 1.45 dollars, there are approximately 6.5 yuan to a dollar and around 80 yen. Suppose we don't follow the Wall Streeters' wishes. Will the dollar fall to 3 to a euro, will it only be worth 3.5 yuan and 40 yen?

Does anyone think this story is plausible? We supposedly have been begging China to raise the value of its currency by 20 percent, is China's leadership suddenly going to sit back and let the yuan rise by 100 percent? What happens to China's export market in this story? The same is case for our other trading partners. Europe will lose its export market in the U.S. and suddenly U.S. made goods would be hyper-competitive in Europe's domestic market. Japan, Canada and everyone else would face the same situation.

These countries will not allow their economies to be destroyed by the loss of the U.S. export market and a surge of imports from the United States. They will undoubtedly take steps to stop and reverse any free fall of the dollar, if we did begin to see one.

What's worse is these fear mongers with their nonsensical claims have changed the dialog. We cannot get policy, legislation to recover the economy and reform Wall Street or even confront China's obvious currency manipulation. Instead, we have this demand all must jump into the volcano as sacrificial virgins or the world will explode.

We also have debt ceiling games with more fear mongering, this time the title is What Happens if the U.S. Defaults on It's Debt:

The United States has never defaulted on its debt and Democrats and Republicans say they don't want it to happen now. But with partisan acrimony running at fever pitch, and Democrats and Republicans so far apart on how to tame the deficit, the unthinkable is suddenly being pondered.

The government now borrows about 42 cents of every dollar it spends. Imagine that one day soon, the borrowing slams up against the current debt limit ceiling of $14.3 trillion and Congress fails to raise it. The damage would ripple across the entire economy, eventually affecting nearly every American, and rocking global markets in the process.

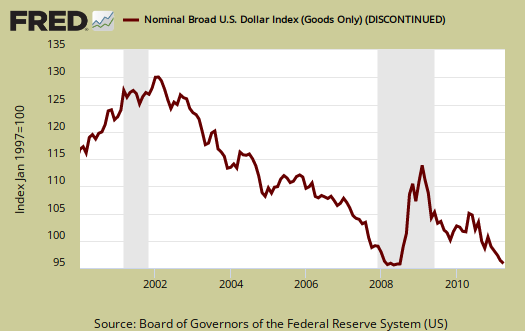

Krugman calls this money madness and notes QE2 is really no big deal. Even Barry Ritholtz notices the obvious, the dollar declined right in line with more globalization, 2001-2008, as the above graph shows.

The hand-wringing about the US dollar is rather late to the party.

Where were all you concerned dollar bulls earlier in the decade? It strikes me that like the late-to-discover inflation, you folks cannot spot a trend until it bites you in your collective asses.

While the WSJ is upset that the dollar has been range bound between 72-87 the past 3 years, I strongly urge them to look at the 7 years before that.

Yup, magically all roads lead to your pocketbook and taking money out of it. Some people will do anything to get you to give up your retirement and health, anything. Right now even the credit ratings agencies are after you, all under the guise of austerity, codespeak to pick what's left in the pockets of the middle class (lint).

If anything that can cause the sky to fall, it's oil, not your retirement. No doubt another exercise in political puppet theater, Obama is putting together a task force to investigate oil speculators.

Crude oil futures have increased 22 percent and gasoline surged 34 percent this year as Middle East unrest reduced supply and the global economic rebound bolstered fuel demand. Both futures contracts touched the highest levels this month since the records reached in 2008.

$6 dollar oil will crush the economy.

Comments

WTO trade system

Another great article by Robert Oak.

Of course, the global neo-mercantilist system is sucking the life-blood out of America! Of course, that life-blood is measured in dollars $US. Of course, not one member of the so-called 'Tea Party' in Congress fails to line up in support of 'free trade' and 'fast track' and in opposition to protectionism that is desired by their constituency out there beyond the Beltway.

But, having read both the Baker and the Pearlstein sources, I can't really make Pearlstein in the line-up or rogue's gallery. Anyway, I can't make him as a major player or kingpin, just another minor bagman.

Pearlstein's article just reviews the same old history, like Bretton Woods and 'emerging markets', which anyone who might possibly read his column already knows about anyway.

Sure, Pearlstein fails to get to heart of any real issues, but do we expect anything else from mass media pundits in this day and age?

(BTW: somebody opined here at Econ Pop the other day that 'rank and file' journalists are paid about $30k to $50k per year: sadly, I suggest Pearlstein gets a lot more than that, especially with benefits figured in.)

Taking him literally, Pearlstein is just saying "Hey, there has to be some kind of budget deal in the Congress before long." Ya Sure Ya Betcha. That's so true it's a truism - a consequence of the Constitution and our expectation that when federal office-holders accept their office, they intend to honor it.

HERE'S SOMETHING TO PONDER: We are at war. Everybody says that. Everybody knows that. Nobody really objects, at least not as to the necessity of it, anywhere throughout mass media punditry.

BUT SINCE WHEN DOES CONGRESS, IN A TIME OF WAR, REFUSE TO RAISE THE DEBT CEILING?

AND SINCE WHEN DOES CONGRESS, AS A MATTER OF 'PRINCIPLE', INSIST ON LOWERING TAXES ON HIGH INCOMES - IN A TIME OF WAR?

Cognitive dissonance, anyone?

Or is it just me, being old enough to remember a different country than we live in now? There was a time when people competed to show their willingness to make personal sacrifices in support of the nation at war.

$6 GAS

Robert Oak:

I think you intended $6 (per gallon) GASOLINE (at the pump) not $6 (per barrel) OIL.