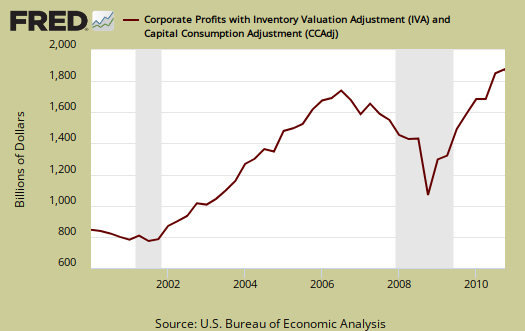

Corporate profits for 2010 were at an all-time high according to the BEA.

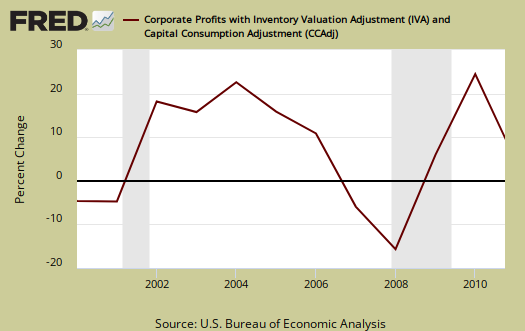

Profits from current production increased 29.2% in 2010, in contrast to a decrease of 0.4% in 2009. Domestic profits increased 37.0%, compared with an increase of 6.4%. The rest-of-the-world component of profits increased 8.9%, in contrast to a decrease of 14.3%.

Taxes on corporate income increased 63.4% in 2010, in contrast to a decrease of 17.3% in 2009. Profits after tax with inventory valuation and capital consumption adjustments increased 20.4%, compared with an increase of 5.1%. Dividends increased 1.9%, in contrast to a decrease of 9.9%; current-production undistributed profits increased 67.3%, compared with an increase of 81.3%.

For just Q4 2010, which is reported in annualized figures, we also have a record of $1.678 trillion dollars with an after tax profit of $1.250 trillion.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $38.2 billion in the fourth quarter, compared with an increase of $26.0 billion in the third quarter. Current-production cash flow (net cash flow with inventory valuation adjustment) -- the internal funds available to corporations for investment -- increased $36.9 billion in the fourth quarter, in contrast to a decrease of $68.4 billion in the third.

Notice how taxes decreased, yet profits increased.

Taxes on corporate income decreased $1.3 billion in the fourth quarter, in contrast to an increase of $23.8 billion in the third. Profits after tax with inventory valuation and capital consumption adjustments increased $39.5 billion in the fourth quarter, compared with an increase of $2.2 billion in the third.

Look who got the money, yup, the Banksters:

Domestic profits of financial corporations increased $57.7 billion in the fourth quarter, compared with an increase of $34.6 billion in the third. Domestic profits of nonfinancial corporations decreased $10.1 billion in the fourth quarter, in contrast to an increase of $0.3 billion in the third.

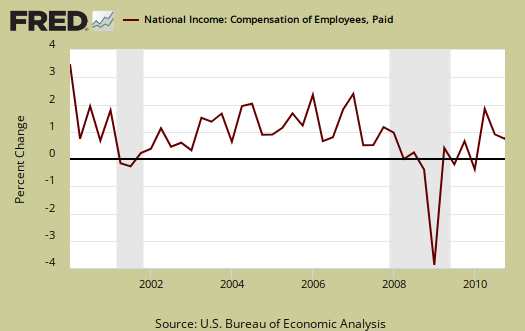

Let's look at the compensation to employees annualized quarterly percent change. See any soaring numbers corresponding to profits? Nope.

In the fourth quarter, real gross value added of nonfinancial corporations increased, and profits per unit of real gross value added decreased. The decrease in unit profits reflected a decrease in unit prices that more than offset a slight decrease in unit labor costs. Unit nonlabor costs were unchanged.

Note the decrease in unit labor costs. In other words, while we have a jobs crisis, corporations are pulling in record dough, much by stealing the change left in worker's pockets and squeezing what's left of the American workforce.

Check out who is raking it in again on domestic profits. Ya got it, our lovely bailed out Banksters or the financial sector:

Profits before tax with inventory valuation adjustment is the best available measure of industry profits because estimates of the capital consumption adjustment by industry do not exist. This measure reflects depreciation-accounting practices used for federal income tax returns and is affected by the bonus depreciation provisions of the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010.

According to this measure, domestic profits of financial corporations increased and profits of nonfinancial corporations decreased. The decrease in nonfinancial corporations reflected decreases in all industries shown, except for small increases in some detailed manufacturing industries. The largest decrease was in wholesale trade.

In other words, Too Big To Fail didn't just get bigger, it's turned into Godzilla, eating the rest of the economy.

Yet in spite of record profits and about $1 trillion more in profits parked offshore, corporations are demanding a offshore outsourcing profit tax holiday, in spite of the existing trickery they use to not pay taxes on pretty much anything.

At the White House on Dec. 15, business executives asked President Obama for a tax holiday that would help them tap more than $1 trillion of offshore earnings, much of it sitting in island tax havens.

The money -- including hundreds of billions in profits that U.S. companies attribute to overseas subsidiaries to avoid taxes -- is supposed to be taxed at up to 35 percent when it’s brought home, or “repatriated.” Executives including John T. Chambers of Cisco Systems Inc. say a tax break would return a flood of cash and boost the economy.

What nobody’s saying publicly is that U.S. multinationals are already finding legal ways to avoid that tax. Over the years, they’ve brought cash home, tax-free, employing strategies with nicknames worthy of 1970s conspiracy thrillers -- including “the Killer B” and “the Deadly D.”

Merck & Co Inc., the second-largest drugmaker in the U.S., last year brought more than $9 billion from abroad without paying any U.S. tax to help finance its acquisition of Schering-Plough Corp., securities filings show. Merck is also appealing a federal judge’s 2009 finding that Schering-Plough owed taxes on $690 million it had earlier brought home from overseas tax-free.

Don't buy into that tax holiday. U.S. multinationals will continue to offshore outsource and park profits abroad (as payments), never to create jobs in the United States.

A rare moment, the U.S. Treasury has called cash on these lobbyists, on their blog no less. This latest U.S. Chamber of offshore outsourcing Commerce is nothing more than a crook of greed. U.S. multinationals have no intention of hiring U.S. workers.

A narrow group of businesses has suggested that instead, our primary focus should be a temporary repatriation tax holiday – an idea tried a few years ago that gave a select group of U.S. multinational corporations a temporary, substantial tax break on their overseas profits. However, letting our eye off the ball of comprehensive tax reform in favor of a temporary measure of this kind would be a mistake.

In 2004, when the U.S. enacted a repatriation tax holiday, the goal was to encourage U.S. multinationals to pay bigger cash dividends from their overseas subsidiaries and use the cash to make investments in the United States. Unfortunately, there is no evidence that it increased U.S. investment or jobs, and it cost taxpayers billions.

Although advocates argue that a repatriation holiday could be costless or even raise tax revenue, the official Congressional scorekeeper, the Joint Committee on Taxation, estimated before enactment that the 2004 repatriation holiday would actually cost billions of dollars. In 2009, when this idea was being pushed once again, Senator Baucus indicated during Floor debates that the cost of a new holiday had increased to $30 billion, presumably because a second holiday would encourage further erosion of the U.S. tax base through shifting of profits overseas. Moreover, according to outside estimates, just five firms got over one-quarter of the tax benefits of the repatriation holiday, and just 15 firms got more than 50 percent of the benefits. To pay for giving this large tax cut once again to a small group of U.S. companies without increasing the deficit, we would have to raise taxes on other U.S. businesses.

In assessing the 2004 tax holiday, the nonpartisan Congressional Research Service reports that most of the largest beneficiaries of the holiday actually cut jobs in 2005-06 – despite overall economy-wide job growth in those years – and many used the repatriated funds simply to repurchase stock or pay dividends. Today, when U.S. corporations have ready access to cash they have accumulated and are holding here in the United States, it is even harder to make the case that a repatriation holiday will unlock new investment and job creation.

Get that? Just 15 multinational corporations, who are offshore outsourcing jobs in droves, are demanding to pay no taxes on their ill gotten gains in order to bring those profits back to the U.S., simply to distribute among shareholders and increase dividends, not to invest in America or hire Americans.

Recent comments