"An increase in the supply of money will lead to an exactly proportionate increase in the price level. Thus, money supply expansions only cause price inflation."

- John Locke's Quantitative Theory of Money

You just got a lot poorer this month. Did you notice? You will.

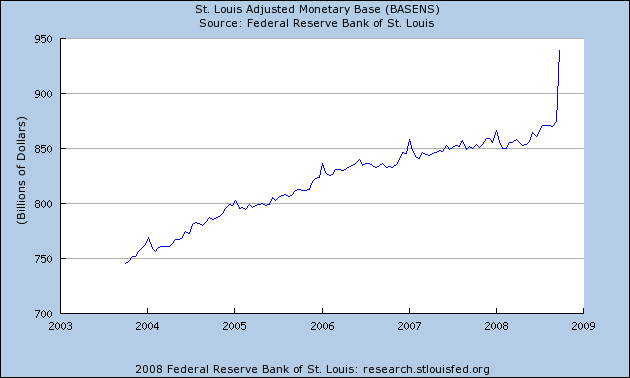

The amount that you got poorer can be shown very simply in this graph.

If you wanted to see what the dollar will look like in about 6 months, all you need to do is to take this chart and flip it upside down.

"Inflation is everywhere a monetary phenomenon"

- Milton Friedman

What does this have to do with class war? The answer to that question depends on where all that new money goes.

Hume and Cantillon pointed out that most monetary injections would involve non-neutral distribution effects. New money would not be distributed among individuals in proportion to their pre-existing share of money holdings. Those who receive more will benefit at the expense of those receiving less than their proportionate share, and they will exert more influence in determining the composition of new output. Initial distribution effects temporarily alter the pattern of expenditure and thus the structure of production and the allocation of resources. This is how inflation causes income disparity.Thus it is understandable that conservatives would be sympathetic to the QTM to maintain the wealth distribution status quo, or if the QTM is skirted, to ensure that the mal-distribution tilts toward those who are more likely to engage in capital formation, namely the rich. This is precisely what happened in the past two decades and caused sharp rises in income disparity.

To put it another way, the creation of new money benefits the people nearest to its creation at the expense of the people furthest from its creation. The money lenders on Wall Street are near to its creation. The working class are the furthest from it.

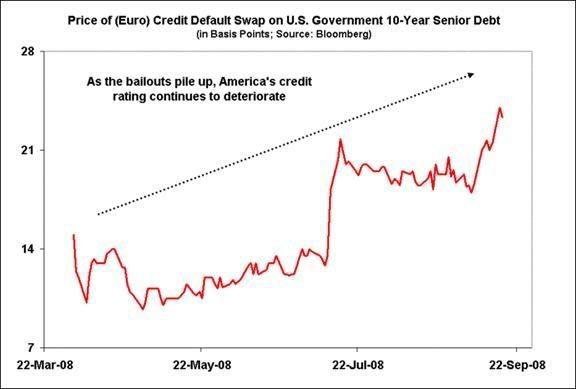

To bring this idea full-circle, the huge and unprecedented amount of money that was created this past month was in the form of bailouts for Wall Street banks by the Federal Reserve. That money is going to dramatically increase the income disparity in this country.

"The Bank was saved, but the people were ruined."

- William M. Gouge, circa 1830

The Dollar's Coup De Grace

The largest holders of American debt in the world will soon meet to try to forestall any panicked selling of dollar-based assets. None of these participants are American.

An agreement is needed so that no nation rushes to sell, "causing a collapse," Yu said.

"Whether some kind of agreement between them to continue to hold Treasury bills is viable, I'm not sure," said James McCormack, head of sovereign ratings at Fitch Ratings Ltd in Hong Kong.

...

The U.S. financial crisis had taught China a lesson and that was: "Why are we piling up these IOUs if they may default?"

Without yuan appreciation, China will continue to accumulate foreign reserves, which means further accumulating "IOUs from the U.S.," said Yu. "This is paper and it may default and it will not increase China's national welfare."

Our Asian creditors are finally coming around to the realization that we can never pay them back what they loaned us - we never intended to - and that's why they are panicking.

Assuming the CBO is correct, the fiscal deficit for 2009 (which begins Oct. 1, 2008) will easily exceed $1T, or more than 2.5 times the 2008 deficit. To put it another way, $700B worth of bonds is just under 5% of US GDP and if this is added to the CBO's earlier projection of a $438B deficit the total comes to 8.1% of GDP.To be perfectly clear- in most media reports I've read, clarity is lacking- the "taxpayer" isn't going to be paying more. That is, taxes are not going to rise, yet. Somebody needs to come up with 5% of US GDP.

That someone will have to be foreigners, because Americans have no savings. Thus we have the problem. Chinese banks have stopped lending to American financial institutions. In fact, just as America is dramatically increasing its borrowing needs, our debt is losing its appeal.

"The image of U.S. Treasuries as a safe haven has been tainted by the ongoing financial debacle," said Kwag Dae Hwan, head of global investment in Seoul with South Korea's $220 billion National Pension Fund, which holds about $14 billion of U.S. government debt. "A big question mark hangs over whether the U.S. can deal with an unprecedented amount of debt. That is unnerving all the investors, including me."

Investors outside the U.S. own 56 percent of the $4.8 trillion in marketable Treasuries outstanding, up from 42 percent of the $3.4 trillion outstanding five years ago, according to data compiled by the government.

The drop in yields combined with the likelihood that the government will sell more debt makes Treasuries ``unbelievably expensive,'' said Theodora Zemek, global head of fixed income at Axa Investment Managers in London, which has about 120 billion euros ($177 billion) invested in debt assets.

"There is little value other than panic value in government bonds," Zemek said. "We've potentially got a big sell-off."

A big sell-off of treasuries would force interest rates in America to jump to levels not seen since the 1970's.

Simply converting your savings to another currency might not be the solution.

Some analysts predict a plunge in the dollar, which will be followed by competitive devaluations in Europe.

"The dollar's crossed the Rubicon. It's the point of no return,'' Hathaway said Monday in an interview in New York, where the fund is based. "It's just loss of confidence in paper currency of whatever brand it is.''

"The world will never be the same again."

The quote above is not mine. It's from Peer Steinbrück, Germany's finance minister. The whole quote is such:

"The US will lose its status as the superpower of the world financial system. This world will become multipolar" with the emergence of stronger, better capitalised centres in Asia and Europe, Mr Steinbrück told the German parliament. "The world will never be the same again."

What Mr. Steinbruck is talking about is the current financial crisis and the End of the American Empire. Almost everyone on this planet has lived their entire lives with America being the dominant economic and military superpower, so a world in which America doesn't call all the shots is not something that most people can readily picture.

With this massive Wall Street bailout passed, despite overwhelmingly negative feedback from the voting public, we have crossed the Rubicon. We've burnt our bridges. There is no longer a way back.

Comments

I've been expecting this

and still do not totally understand the interaction of this financial meltdown in the face of such foreign debt and holdings (except it seems to imply a 3rd world type of cliff)....

but what I don't understand is gold futures are way way down right now. I would assume that gold would be going up through the roof.

The Fed turns on the spigot

This is unprecedented. Maybe I should have waited another day to post this diary. Look at this.

moved to Instapopulist

When you see things like this which are so dramatic, but don't have time to write up a full bore blog post (why does DK have everyone trained to say diary? ;)), you can use the Instapopulist.

If you go to create content->forums and then select the category or if you go to the left (on the green/yellow site, not available on the blue version) and click on forums, those are fly out menus. You just select which category it goes under and then click create new topic.

That will immediately be posted in the Instapopulist, middle column and more importantly, also goes out into the RSS news feed. We have a lot of people subscribing to the news feed and they bop over to read something when something new is added to the RSS feed.

I guess I should change the left title to Instapopulist so it's more clear.

And just when you think the new guy posting a blog post is out of his head, talking about money supply, bam they doubled the money supply. ;)