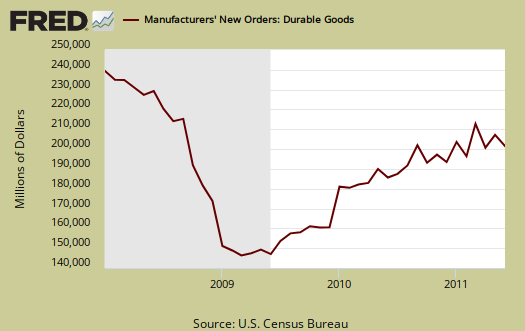

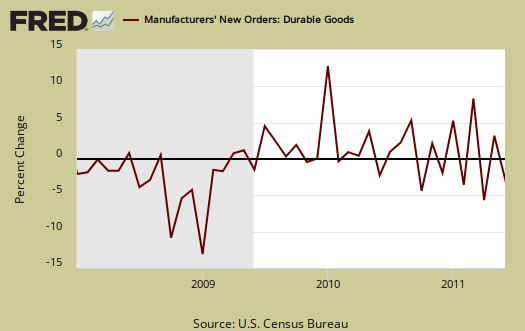

New Orders in Durable Goods decreased -2.1% for June 2011. New Orders has declined the last two months out of three.

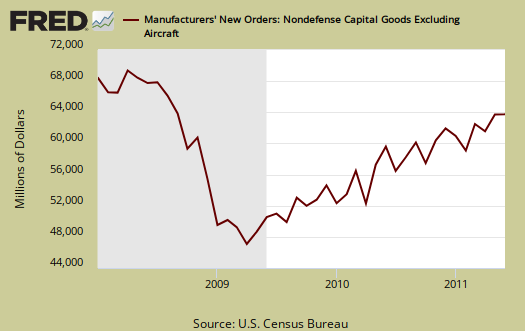

Core capital goods new orders decreased -0.4%, after gaining 1.7% last month. Core capital goods is an investment gauge for the bet the private sector is placing on America's future economic growth.

For all transportation equipment, new orders plunged -8.5%. Our volatile air-o-planes caused the decrease, dropping -28.9%. Defense aircraft decreased also, -20.5% and motor vehicles declined -1.4%.

We now have two decreases in new orders for the last three months, with April being the plunge from hell, -2.5% and a bounce up of +1.9% for May.

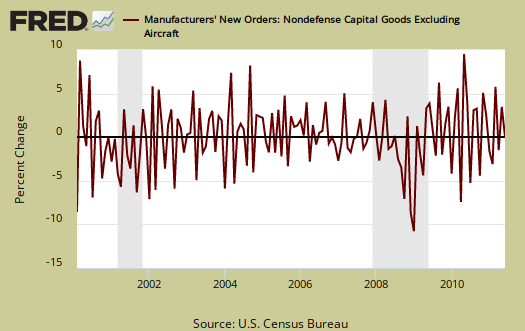

Core capital goods are a leading indicator of future economic growth. It's all of the stuff used to make other stuff, kind of an future investment in the business meter. Core capital goods excludes defense and all aircraft. Shipments in core capital goods increased +1.0%. Machinery is a large part of core capital goods and new orders in machinery dropped -2.3% for June. Note, core capital goods has not recovered to 2007 levels.

To put the monthly percentage change in perspective, below is the graph of core capital goods, monthly percentage change going back to 2000. In January 2009, core capital goods new orders dropped -9.9% and also declined by -9.4% in December 2008.

Inventories, which also contributes to GDP, are at an all time high and up 0.4%. Three months now have hit record highs since inventories have been tracked via the NAICS system. Core Capital Goods inventories increased +0.7%.

Unfilled orders increased +0.2%. Machinery had a another record on unfilled orders, breaking last month's all time high. The NAICS basis has been used since 1992.

Shipments, which contributes to the investment component of GDP, is up 0.5% for June with machinery shipments increasing 2.6% in June. In core capital goods, shipments increased +1.0%, after a -1.7% May increase. This is ok news as an approximation and indicator on Q2 2011 GDP growth, with about a 1.2% increase for the quarter. Although the change in inventories might, once again, be the dominant player in Q2 GDP considering the latest records. Q2 GDP is released on Friday.

Here is last month's overview of Durable Goods, numbers unrevised.

Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor).

Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, used as an approximation.

What is a durable good? It's stuff manufactured that's supposed to last at least 3 years. Yeah, right, laptops and cell phones.

inventories vs. investment

TBD is a post on what all of these inventories really mean since they have consistently been such a large part of quarterly GDP.