Europe is imploding. Today S&P cut Belgium's credit rating to AA:

S&P projects Belgium will end 2011 with general government debt at around 93% of gross domestic product in net terms, and at around 97% of GDP in gross terms.

Italian bond yields hit 7.8% and that's a 14 year high for borrowing costs and a doubling in a matter of days. Unlike the Fed, Italy cannot print up more Euros either to take care of their problem.

The Italian Treasury paid 6.504 percent to auction 8 billion euros ($10.6 billion) of the debt, almost twice the 3.535 percent a month ago and the highest since August 1997. Italy’s two-year bonds yielded a euro-era record 7.83 percent, almost 50 basis points more than 10-year notes.

Yesterday Moody's cut Hungary to junk status. Junk means not ready for prime time, or investment.

The foreign- and local-currency bond ratings were cut one step to Ba1, the highest junk-level score, from Baa3, the company said today in a statement. Moody’s, which awarded Hungary its investment grade in 1996, assigned a negative outlook. The country is rated the lowest investment grade at Standard & Poor’s and Fitch Ratings.

We see titles like Germany Buys a First Class Ticket on the Titanic, after Germany Chancellor Merkel reaffirmed there will be no Euro area bonds issued jointly for all member countries:

Germany’s 10-year borrowing cost dropped to a record 1.64 percent on Sept. 23 as bunds offered a refuge from the debt crisis. The rate now exceeds 2 percent, driving the gap with U.S. Treasuries to a 30-month high, after bids at the sale of securities repayable in January 2022 fell 35 percent short of the 6 billion euros ($8 billion) offered yesterday.

It's so bad, Paul Krugman got up from his Turkey to write about the apocalyptic German trade:

I really wasn’t planning on blogging on Thanksgiving Day. But what’s going on in Europe deserves a mention.

So, the big story: German bonds are now being priced as a risky asset — what the FT calls the “apocalypse trade“. The interest rate on bunds, at 2.21% as I write this, is still very low by historical standards. But it’s above the rate on UK bonds (2.17%) and way above the rate on US bonds (1.88%).

The way to see this is that the market is in effect pricing in a real possibility of eurozone collapse.

Right before Thanksgiving, there were more events pointing to a tsunami from the Eurozone.

Bunds are losing the haven status they share with Treasuries as Germany rules out common bond sales to solve the debt crisis.

The canaries in the coal mine are dying in mass. Earlier Lativa and other smaller European countries cancel their bond auctions:

Latvia cancelled an auction of ten-year bonds on Tuesday after regulators suspended operations at Latvijas Krajbanka, a small bank owned by the troubled Snoras Bank of Lithuania, taken over by authorities last week.

So that’s two failed banks and a bond strike, soon after yields on Slovenia’s ten year bonds hit new highs. The smaller countries of peripheral Europe are beginning to look like canaries in coal mines.

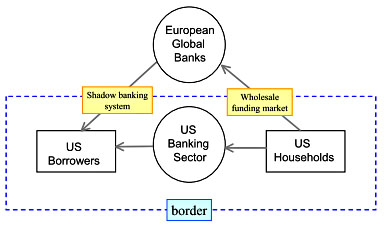

Instead of economic stability, we now see analyses of an Italian default if the ECB doesn't cut that bail out check. A new research paper, Global Banking Glut and Loan Risk Premium, by Hyun Song Shin, shows the inter-dependencies of the European banking system to the United States and it ain't good news. We'll let Kevin Drum sum it up for you:

The European segment of the shadow banking system was indirectly providing about $5 trillion in credit to U.S. borrowers. This was about as much as U.S. banks provided directly.

The European banking sector provides about as much credit to the U.S. as the American banking sector does. So when the European banking sector deleverages, as it must, it will have a very substantial effect on credit conditions in the U.S.

Europe's problem is our problem and to make matters worse, none of us regular folk had anything to do with this. It's all the shadow banking system, where intermediaries issued derivatives, securitization of claims. Even conservatives are calling the global financial securitzation system a giant scam.

All of this points to contagion, or a spreading of the Euro zone crisis to the globe.

Today Canada's finance minister screamed Uncle and demanded the crisis being stopped before it brings down the entire global economy:

Ongoing uncertainty stemming from the European sovereign and banking crisis is leading to broader contagion outside Europe and global credit markets,” Flaherty, 61, said today. “If European authorities move aggressively and with decisiveness to address the crisis and restore financial market stability and confidence, the situation can be stabilized.”

Citizens in many countries face “dire consequences” without a quick solution, including more social unrest and major tax increases, Flaherty said.

Let's stop this before we're all staring at the abyss. Problem is, don't ya know, it's only the abyss, a crisis of apocalyptic proportions, which allows special interests and lobbyists to push their their latest agendas through governments' parliamentary procedures. Austerity is just another word for bringing back the proletariat. Societies be damned, come hell or high water, that's the real agenda, beyond the great derivative, shadow banking, financial sector gambling casino, Russian roulette wheel going off it's hinges, collapse.

Comments

Solution to Germany's dilemma?

Brilliant headline by Bloomberg! I love it. "Germany Buys Itself First-Class Ticket on the Titanic". That's the dilemma alright. And every dilemma has a solution .... or not.

It's a lot like war, isn't it? Albeit a cold war, a war where everyone works around the nuclear option.

The question is: "What exactly is the agenda that will be pushed to resolve Germany's dilemma?"

One factor here that is often overlooked is the importance to Germany of gas imports from Russia. See, news report on opening of Nord Stream gas pipeline by Merkel and Medvedev (8 November 2011).

It's obvious what Germany gets out of the pipeline, but what does Russia get out of it? The answer is Euros, which Russia desperately wants and/or needs. How will it look to Russia if the Euro begins a precipitous decline just when gas deliveries are cranking up? Many people are still thinking in terms of German-Russian animosity, but the reality is very different. Let's face it. The potential for Germany of trade relations to their east is of far more importance to them than relations to their south.

It's like the Eastern front and the Western front that together presented huge problems to Germany in two world wars. (Germany is in the middle of Europe.) On the Western front, Germany needs to allow the ECB to create massively more Euros, but that would negatively impact German interests on the Eastern front -- again massively.

A solution has been proposed, namely that Greece, Italy, Spain, Portugal and others (Ireland? Hungary? Austria?) be allowed to stay in the Euro zone but also "print" their own national currencies. These countries would each then do business in two currencies, although their national currencies (floating against the Euro) would become the denomination for all debts and credits (for example, public employment and retirement paychecks). On some day soon to-be-announced, all accounts would be entered in two columns -- one for Euros, one for lire, drachma, etc..

Another factor that is regularly overlooked, in the news about Europe's prospective demise, is that Italy's central bank (Banca d'Itaglia) is still functional (as a part of the European system of central banks) and is said to retain very large holdings of gold bullion. If these reports are true, it's possible that Italy at least may remain (along with Germany, France and Benelux) as a country with the single currency of the Euro. Of course, many will say that it just doesn't pencil out, it's impossible .... but these nay-sayers forget that all EU nation-states remain sovereign countries, so if Germany says okay and waives Euro zone rules, there's nothing that is impossible. At some level or another, paper is the only way out.

The Euro -- which is thought to be backed to some extent by gold bullion -- actually may continue to function throughout the EU function as the 'gold' of the EU. The Euro zone is but a part of the EU, and British sterling, Swiss franc, etc., are all functioning within the system just fine. It's a win-win situation, because Greece and the others absolutely need to be able to paper their way out of the corners they have painted themselves into (or been painted into, if you prefer).

Finally, the solution to Germany's dilemma will probably be presented as a transitional plan. Even if the plan works very imperfectly and must be revisited constantly for the next few years, it still can work to calm the troubled waters as we go into 2012.

Inflation will be contained, although hardly conquered. The Titanic continues to float, although not everyone will have First Class tickets. Some of the passengers will be down below with the proletariat, shoveling coal ... but all the paychecks will keep coming, nothing will bounce, nobody will default. And, last but not least, gas will keep flowing in the Nord Stream pipeline.

thanks the official line, Euro is D.O.A.

I'm not so sure that's a good idea. While it's been pointed out the Greek 50% CDS haircut caused a run on sovereign bonds, I still think plain cleaning out the banking casino hall is the way to go. Honestly I'm not so sure anymore beyond this is beyond to cause us pain.

Ending casino-style finance system

I agree. "Cleaning out the banking casino hall is the way to go"!

For the USA, I favor the American Monetary Reform Act (incorporated into Rep. Kucinich's NEEDS Act), per recommendations of American Monetary Institute. So, I would tend to favor something similar for Europe.

The thing is that the EU is an unprecedented experiment, and who knows how it's going to evolve or even if it's going to survive?

I just put up a couple of lectures in the FMN

Finding objective documentaries on what's really going on, the history of the EU/ECB is near impossible, that's the closest I could come. Basically due to their system, there aren't a lot of easy answers. One common currency yet sovereign debt/bonds and sovereign economic management.

I think they still, in concert, should "pull a Sweden", nationalize the banks, cancel the debt. One big painful swallow.

This is a side note, but one of the things the EU shows is what happens when strong national economies are mixed with weaker ones. The weaker one pulls down the stronger one. Case in point was the reunification of Germany, took them this long to integrate.

I mention this because people "believe" unlimited migration is just fine and we should more integrate with Mexico. That, would be an/is a labor/economic disaster.