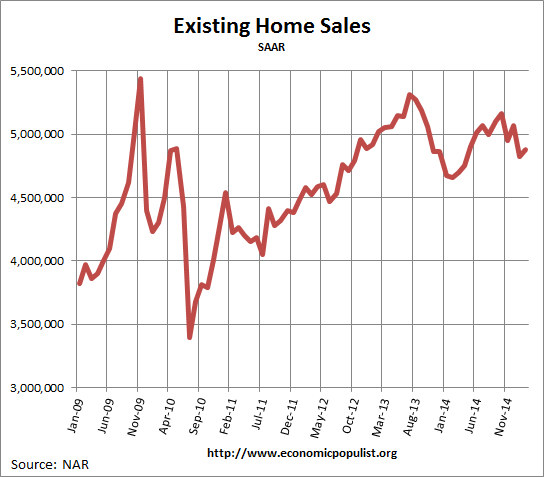

NAR's existing home sales bounced up slightly for February with a 1.2% sales increase. This is surprising sales increased at all, even with seasonality adjustments, considering America's East was stuck in either a snow bank or an ice cube for the month.. This makes sales 4.7% higher than February of last year. Sales by volume was 4.88 million in February. Existing home sales have been above their year previous amounts for five months now. Prices are soaring in unaffordable territory as the median home price has increased for 36 months in a row.

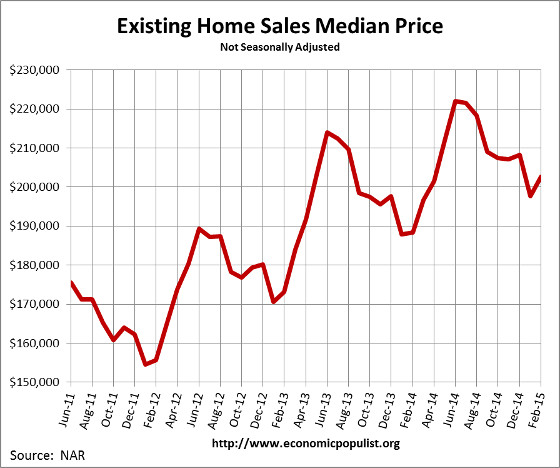

The national median existing home sales price, all types, is $202,600, a 7.5% increase from a year ago. The average existing sales price for homes in February was 248,400, a 5.0% increase from a year ago. Below is a graph of the median price.

NAR Economist Yun finally observed what we have for some times, wages are much too low to support these types of home prices. We often wonder how anyone is getting by with rents and homes being so expensive. People must be sacrificing food in order to make rent and mortgage payments.

With all indications pointing to a rate increase from the Federal Reserve this year – perhaps as early as this summer – affordability concerns could heighten as home prices and rents both continue to exceed wages.

Distressed home sales are now only 11% of all sales. Distressed sales have declined -16% from a year ago. Foreclosures were 8% while short sales were 3% of all sales. The discount breakdown was 15% for foreclosures and short sales were a 15% price break.

So called investors were 14% of all sales and 67% of these investors paid cash. A year ago investors were 21% of all sales. All cash buyers were 26% of all sales. A year ago all cash buyers were 35% of all existing home sales. First time home buyers were 29% of the sales, the first increase since November 2014.

The median time for a home to be on the market was 62 days. Short sales by themselves took 120 days. Housing inventory from a year ago has decreased -0.5% but is up 1.6% from the previous month. Current the 1.89 million homes available for sale are a 4.6 months supply.

On a separate note, RealtyTrac reported February foreclosures decreased by 4% for the month and are down 9% for the year. RealtyTrac reports 918,565 properties are in the foreclosure process or already bank owned. It's fairly obvious the great bargain hunt from the housing bubble collapse is over as cheap properties have simply dried up. Now the issue is the very tight lending standards so new home buyers cannot get into a home, plus the over inflated prices. The never ending middle class squeeze crush continues.

Below is NAR's breakdown by existing home sales type and regions. The west has the most unaffordable housing consistently. NAR does seasonally adjust but the weather overall was the 19th warmest while the Northeast had some of the coldest temperatures and largest snowfalls on record.

February existing-home sales in the Northeast dropped 6.5 percent to an annual rate of 580,000, but are still 3.6 percent above a year ago. The median price in the Northeast was $241,800, which is 3.3 percent above a year ago.

In the Midwest, existing-home sales were at an annual level of 1.08 million in February, unchanged from January and 4.9 percent above February 2014. The median price in the Midwest was $152,900, up 8.8 percent from a year ago.

Existing-home sales in the South increased 1.9 percent to an annual rate of 2.11 million in February, and are now 6.0 percent above February 2014. The median price in the South was $177,900, up 8.5 percent from a year ago.

Existing-home sales in the West climbed 5.7 percent to an annual rate of 1.11 million in February, and are now 2.8 percent above a year ago. The median price in the West was $290,100, which is 4.2 percent above February 2014..

Here are our past overviews of existing home sales not revised.

America's Richest Slumlord

(* This is from a joint investigation of The Center for Public Integrity and The Seattle Times)

Clayton-owned mobile home dealerships with different names and similar banners offer to “BEAT OR MATCH ANY DEAL.” Customers say they thought they were comparison shopping, when they were really visiting multiple Clayton-owned dealerships — all owned by one company.

The U.S. second richest man, Warren Buffett, owns Berkshire Hathaway, which owns Clayton, the mobile home industry’s biggest manufacturer and lender. Clayton is a many-headed hydra with companies operating under at least 18 names. It also sells property insurance on their mobile homes — and repossesses them when borrowers fail to pay.

Berkshire Hathaway extracts value at every stage of the process. Clayton even builds the homes with materials supplied by other Berkshire subsidiaries. And Clayton borrows from Berkshire to make mobile home loans, paying up to an extra percentage point on top of Berkshire’s own borrowing costs.

Clayton customers described a consistent array of deceptive practices that locked them into ruinous deals: loan terms that changed abruptly after they paid deposits or prepared land for their new homes; surprise fees tacked on to loans; and pressure to take on excessive payments based on false promises that they could later refinance. Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders. Those loans averaged 7 percentage points higher than the typical home loan in 2013.

Buyers told of Clayton collection agents urging them to cut back on food and medical care or seek handouts in order to make house payments. If they don't, their mobile homes are repossessed.

Berkshire Hathaway’s Omaha headquarters sent a statement on behalf of Clayton Homes to the Omaha World-Herald (which is also owned by Berkshire Hathaway) to dispute the allegations.

(* Read more in the links below about Warren Buffett's sleazy company to see why we need more government regulation, not less, as the Republicans always want.)

http://www.publicintegrity.org/2015/04/03/17024/warren-buffetts-mobile-h...

http://www.publicintegrity.org/2015/04/06/17081/look-berkshire-hathaways...

story on it's own, conglomerates

Conglomerates control so much that is under different brand names to make it seem like choice, when there is little choice. Food is an example where just a few own all of the brand names, ConAgra Foods as an example. Yum Foods for fast food as another.