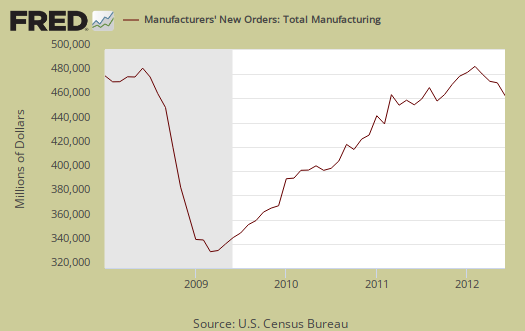

The Manufacturers' Shipments, Inventories, and Orders report shows a -0.5% new orders decrease for June. The last three of four months in manufacturing new orders have shown declines. May revised down, from +0.7% to +0.5%. This Census statistical release is called Factory Orders by the press and covers both durable and non-durable manufacturing orders, shipments and inventories. Manufactured durable goods new orders, increased +1.3% and May durable goods showed a +1.5% increase. Transportation equipment had a blow out, with a +8.0% increase for June. Services, on the other hand, dropped -2.0% and explains why June overall showed a manufacturing new order decline.

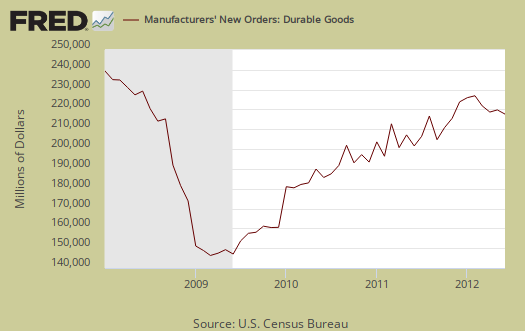

Most of durable goods new orders increase was due to transportation. Computers & electronics new orders declined -4.4%. Machinery dropped -2.1% and electrical equipment declined -2.0%.

Transportation equipment new orders increased 8.0% with non-defense aircraft increasing 14.2%. Defense aircraft new orders increased 22.6%. Ships & boats had an unbelievable new orders increase of 223.5%. This is the 3rd month the ship building industry has come alive, but never like this, which is good news. Motor vehicle body, parts new orders declined, -0.7%. New orders for all manufacturing, minus just transportation, declined -1.8% for June.

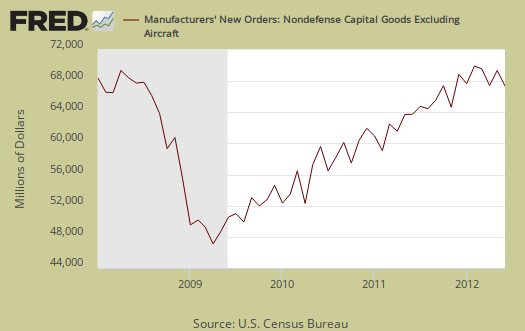

Core capital goods new orders decreased -1.7% for the month. This is bad news for April declined, -1.5%, in essence wiping out May's +2.3% gain. Core capital goods are capital or business investment goods and excludes defense and aircraft.

Graphed below are the revised durable goods news orders. Notice that Durable goods new orders have still not recovered to pre-recession levels.

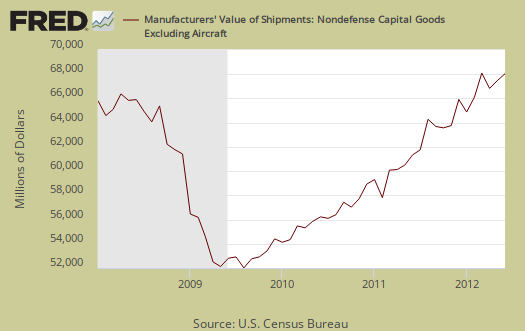

Shipments decreased -1.1% with core capital goods shipments increasing +1.0%. Below is a graph of core capital goods shipments.

Inventories for manufacturing overall barely budged, an increase of +0.1%. Inventories of manufactured durable goods increased +0.4%. Transportation equipment inventories are up 0.8% while nondurable goods inventories declined -0.5% after dropping -1.0% in May. Petroleum and coal inventories, which are part of nondurable goods, dropped -2.3% and one must wonder why considering the price of crude has now dropped. This report is by price, not adjusted for inflation, yet by volume oil & gasoline inventories have dropped. Core capital goods inventories as a whole increased +0.6%. The inventory to shipments ratio is 1.29, a bump up from May's 1.27 implying an increase of inventories to completed sales.

Part of this report goes into GDP. The BEA takes this report, called M3, and uses the shipments values to calculate investment in private equipment, investment in software. Manufacturing inventories also goes into the changes in private inventories GDP calculation. At the bottom of this post is a little more information to estimate part of the GDP investment component.

This report isn't alleviating, despite the increase in durable goods new orders. The ISM manufacturing survey showed contraction.

The St. Louis Federal Reserve FRED graphing system has added individual NAICS data series from this report. If you're looking for a graph of some particular NAICS category, such as light trucks, autos & parts, or machinery, it might be found on FRED.

Here is last month's overview on factory orders, unrevised.

August Durable Goods -13.2% monthly decline

Economists and analysts are aghast at the plunge in durable goods for August. I just wanted to give a heads up that is the advance report number and the next release will be October 4th. We will make a point to really cover durable goods new orders and shipments in great detail, along with graphs against other economic indicators (GDP, payrolls, PCE). Look for it, we don't like covering the advance report because durable goods manufacturing is so often revised in the space of 7 days between the two economic statistical releases.

Just a little advance heads up for those wondering why the overview is missing with such a dramatic plunge.