The DOL reported Initial weekly unemployment claims for the week ending on November 17th, 2012 were 410,000, a 41,000 drop from the previous week of 451,000. Superstorm Sandy's devastating effects can be seen in state not seasonally adjusted claims for the week of November 10th.

Individual states initial claims for unemployment for the previous week ending in November 10th, or two weeks ago, show the blast Sandy gave to workers. Last week's 41,000 decline implies some of the people who filed for unemployment from two weeks ago are now back at work. How many is yet to be seen. In spite of the 41,000 decline last week, initial claims are still above 400,000 and this level implies no growth in payrolls for November.

The largest increases in initial claims for the week ending November 10 were in New York (+43,956), New Jersey (+31,094), California (+24,693), Pennsylvania (+7,037), and Connecticut (+1,808), while the largest decreases were in Ohio (-4,996), Indiana (-877), Arkansas (-665), Massachusetts (-607), and Maryland (-576).

One needs to be careful in looking at state not seasonally adjusted initial claims figures. California is the most populous state with New York ranking third. New Jersey is 11th by population, so keep these facts in mind when looking at the number of people filing for unemployment benefits.

New York rarely has exceeded 40,000 claims per week, so in essence an increase of 43,956 jumped up New York's initial claims to 63,292 a raw level not seen even during the recession.

New Jersey by size is even worse. Their 31,094 weekly increase gives a raw total of 46,129 initial filings for the week ending November 10th. They do didn't even come close to this level of initial claims the entire recession.

New York reports initial claims for unemployment benefits were from the construction, food service, and transportation industries. New Jersey reports increased claims almost across the board, in accommodation and food services, manufacturing, transportation and warehousing, administrative service, health care and social assistance, construction, retail, professional, trade, educational service, and public administration industries.

This is what happens when storms hit, businesses shut down, the roads are closed so commerce is stopped. New Jersey's loss of jobs in health care and public services is strange for this seems the time when those services would be most needed.

That said, no power, no electricity and what happens is soon there is also no job. The delays in restoring electricity assuredly hurt businesses as we saw in the industrial production figures.

California's not seasonally adjusted increase is not unprecedented and one needs to think about state population size. They reported initial unemployment claim increases in the service industry. California has become increasingly volatile in their week to week reporting of initial claims raw tallies, which are now at 73,016.

Connecticut, Pennsylvania also report their unemployment claims increase was due to Sandy. Ohio reported few layoffs in manufacturing. During bad storms, plants can close and this can lead to temporary layoffs. The lights come back on and people go back to work.

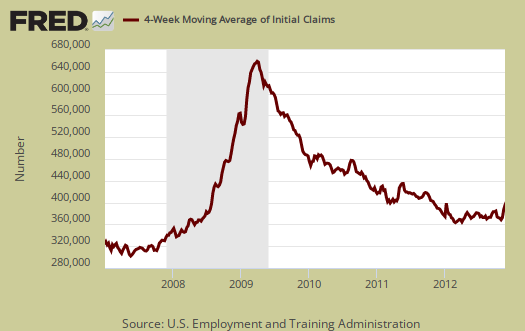

Normally the statistic to pay attention to generally is the four week moving average on initial unemployment claims. Due to the storm, now we need to watch the weekly number to see if Sandy's job loss effect is temporary or more permanent. Let's hope these initial filings for unemployment benefits are temporary, but odds are they are not, at least for a couple of months.

The four week moving average increased 9,500 to 396,250. In the below graph we can see we still are not at pre-recession initial weekly unemployment claims levels. If anyone recalls, even before the Great Recession the job market was not so hot. Below is the four week moving average, set to a log scale, from January 1st, 2007.

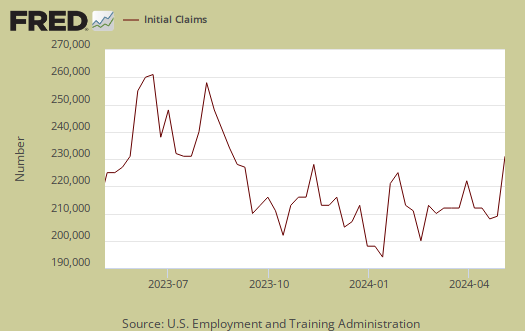

Below is the mathematical logorithm of initial weekly unemployment claims. A log helps remove some statistical noise, it's kind of an averaging and gives a better sense of a pattern. As we can see, we have a step rise during the height of the recession, but then a leveling, then a very slow decline, or fat tail. That fat tail is our never ending labor market, stuck in the mud, malignant malaise. Now here comes Sandy, which is about the last thing American labor needed. Look at the rise appearing, even when applying a logarithm to initial claims statistics.

Continuing unemployment claims didn't budge, and we have large long term unemployed. The below figure doesn't include those receiving extended and emergency unemployment benefits.

The advance seasonally adjusted insured unemployment rate was 2.6 percent for the week ending November 10, unchanged from the prior week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending November 10 was 3,337,000, a decrease of 30,000 from the preceding week's revised level of 3,367,000. The 4-week moving average was 3,285,000, an increase of 19,500 from the preceding week's revised average of 3,265,500.

In the week ending November 3rd, not seasonally adjusted, the official number of people obtaining some sort of unemployment insurance benefit was 5,241,296 with 2,156,363 people receiving EUC, which is scheduled to run out in January 2013.

There were 12.3 million unemployed in October.

.

Last week's initial claims were reported as an increase of 439,000, so we had an upward revision of 12,000 in November 10th week's figures. The reported jump for the week of November 10th was 78,000. For November 3rd, initial claims were at 361,000 with a four week moving average of 372,000.

Don't expect a return to 370,000 levels for some time, at least a month, we believe two. Some are comparing Superstorm Sandy to Hurricane Irene. The damage from Sandy is much more severe, in highly populated areas with high concentrations of industry. Hurricane Irene was $16.6 billion in damages. Sandy is currently estimated at $52.4 billion and climbing. Those who claim we will return to pre-storm initial claims levels by comparing Hurricane Irene's temporary rise in initial claims are sorely mistaken.

New York recovers in Sandy claims, New Jersey does not

For the week of November 17th, New York's initial unemployment claims dropped by -30,603. That's almost a halving of their claims, raw numbers not seasonally adjusted for that week were 32,689. New Jersey did not recover, their claims, same week were 45,631 and before the storm, October 27th's, NJ's initial claims were 9,360.

So, assuming we have about 35k initial claims due to New Jersey and Sandy, that puts this week's figure 393,000 to bout 360k or so. That said, Sandy counts and the number of businesses wiped out by Sandy is huge so those initial claims implying jobs were lost probably isn't temporary for many of those businesses. Not good.