The May 2012 ISM Manufacturing Survey PMI declined -1.3 percentage points to 53.5% and indicates U.S. Manufacturing grew at slower pace in May, yet new orders hit a high not seen since April 2011. Prices paid for raw materials absolutely plunged and is the lowest since December 2011. Survey comment responses were a mixed bag, but generally positive overall. Chemical Products appears to have had a bad month.

New Orders increased +1.9 percentage points, to 60.1% with 13 industries reporting an increase in new orders and 3 industries reporting a decline. This and prices are the best news of this month's report.

A New Orders Index above 52.1%, over time, is generally consistent with an increase in the Census Bureau's real series on manufacturing orders.

PMI is a composite index on manufacturing. Here's how the ISM defines PMI:

The PMI is a composite index based on the seasonally adjusted diffusion indexes for five of the indicators with equal weights: New Orders, Production, Employment, Supplier Deliveries and Inventories.

Below is the ISM table data, reprinted, for a quick view.

| Manufacturing at a Glance May 2012 | ||||||

|---|---|---|---|---|---|---|

| Index | May | April | % Point Chg. | Direction | Rate | Trend |

| PMI | 53.5 | 54.8 | -1.3 | Growing | Slower | 34 |

| New Orders | 60.1 | 58.2 | +1.9 | Growing | Faster | 37 |

| Production | 55.6 | 61.0 | -5.4 | Growing | Slower | 36 |

| Employment | 56.9 | 57.3 | -0.4 | Growing | Slower | 32 |

| Supplier Deliveries | 48.7 | 49.2 | -0.5 | Faster | Faster | 4 |

| Inventories | 46.0 | 48.5 | -2.5 | Contracting | Faster | 2 |

| Customers' Inventories | 43.5 | 45.5 | -2.0 | Too Low | Faster | 6 |

| Prices | 47.5 | 61.0 | -13.5 | Decreasing | From Increasing | 1 |

| Backlog of Orders | 47.0 | 49.5 | -2.5 | Contracting | Faster | 2 |

| Exports | 53.5 | 59.0 | -5.5 | Growing | Slower | 7 |

| Imports | 53.5 | 53.5 | 0.0 | Growing | Same | 6 |

| OVERALL ECONOMY | Growing | Slower | 36 | |||

| Manufacturing Sector | Growing | Slower | 34 | |||

Production, which is the current we're makin' stuff now meter, nose dived -5.4 percentage points from last month to 55.6%. Only two industries reported a decline out of the 18, Food, Beverage & Tobacco Products; and Chemical Products, so they must have almost shut down to pull the overall index this much lower. Production loosely correlates to the Federal Reserve's industrial production, where the May statistics will be out mid-month.

Now we come to employment, otherwise known as where are the damn jobs? The manufacturing ISM employment index decreased -0.4 percentage points to 56.9%. The neutral point for hiring vs. firing is 50.1%. Only 13 industries reported an increase in hiring. Two showed a decrease in employment, Wood Products; and Food, Beverage & Tobacco Products.

Below are the BLS manufacturing non-farm payrolls (jobs) for the past decade on the left, in red, graphed against the ISM manufacturing employment index on the right, in blue. The BLS number is simply raw manufacturing jobs tally, from the CES, not taking into account population growth or overall sector shrinkage as well as time lag. One can eyeball a slight correlation in the middle of the decade, yet note the divergence this recovery, starting late 2008.

Inventories slightly declined -2.5 percentage points to 46%. Inventories are contracting, for the 2nd month in a row. The ISM claims inventories are correlated to manufacturing inputs, that are part of GDP. Changes in inventories have made up a large part of GDP over the last two quarters.

An Inventories Index greater than 42.7 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis' (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

Durable goods April inventories were still at an all time high.

Supplier deliveries are how fast manufacturers can get their supplies. A value higher than 50 indicates slower delivery times, a value below 50 means the supply chain is speeding up. The index decreased -0.5 percentage points to 48.7% and the ISM reports this it the 4th month supplier deliveries have been faster.

Backlog of orders dropped -2.5 percentage points to 47.0% and are in contraction. Order backlogs are exactly what they sound like and only 84% of survey respondents reported on order backlogs.

Imports had no change from again, same as last month and is at 53.5%. Imports are materials from other countries manufacturers use to make their products.

New orders destined for export, or for customers outside of the United States, plunged -5.5 percentage points to 53.5%, literally reversing last month's pop...again. Chemical Products is the only industry reporting a decline in new orders which will be exported, so they must have simply jumped the rails in order for new export order to plunge so significantly.

Prices absolutely plunged, -13.5 percentage points to 47.5%. Prices are what manufacturers pay to make their products. That's an astounding one month drop and here is the ISM's industry specifics for prices paid for raw materials:

Of the 18 manufacturing industries, six reported paying increased prices during the month of May in the following order: Nonmetallic Mineral Products; Furniture & Related Products; Printing & Related Support Activities; Apparel, Leather & Allied Products; Paper Products; and Primary Metals. The nine industries reporting paying lower prices during May — listed in order — are: Wood Products; Fabricated Metal Products; Chemical Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; Machinery; and Transportation Equipment.

Customer's inventories decreased -2.0 percentage points to 43.5%. Below 50 means customer's inventories are considered by manufacturers to be too low. Customer inventories, not to be confused with manufacturer's inventories, is how much customers have on hand, or rates the level of inventories the organization's customers have.

Here is the ISM industrial sector ordered list of growth and contraction:

Of the 18 manufacturing industries, 13 are reporting growth in May, in the following order: Nonmetallic Mineral Products; Furniture & Related Products; Apparel, Leather & Allied Products; Miscellaneous Manufacturing; Primary Metals; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Machinery; Textile Mills; Paper Products; Computer & Electronic Products; Printing & Related Support Activities; and Chemical Products. The four industries reporting contraction in May are: Plastics & Rubber Products; Petroleum & Coal Products; Food, Beverage & Tobacco Products; and Transportation Equipment.

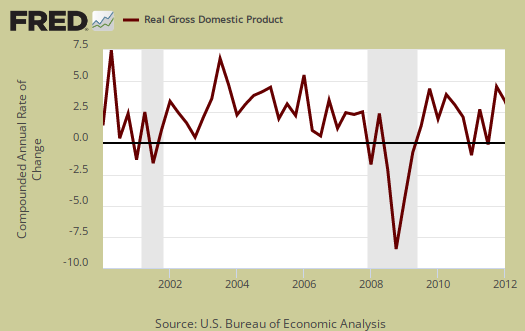

The ISM has a correlation formula to annualized real GDP, but they are now noting the past correlation. Notice also that the PMI went to equal weighting in 2008. Annualizing Mays's data, the ISM get a 3.7% 2012 annual real GDP. The below graph plots real GDP, left scale, against PMI, right scale. One needs to look at the pattern of the two lines to get anything out of this graph. If they match, GDP goes up, PMI goes up, would imply some correlation.

The ISM neutral point is 50, generally. Above is growth, below is contraction, There is some some variance in the individual indexes and their actual inflection points. For example, A PMI above 42, over time, also indicates growth.

Here is last month's manufacturing ISM overview, unrevised.

The ISM has much more data, tables and analysis on their website. For more graphs, see St. Louis Federal Reserve Fred database and graphing system.

PMI stands for purchasing manager's index.

Recent comments