The July ISM Manufacturing Survey shows PMI had a blow out increase of 4.5 percentage points to 55.4%. Manufacturing has moved into sold growth with new orders increasing by 6.4 percentage points and production roaring in an 11.6 percentage point gain. Even the employment index increased. Let's hope this month isn't a statistical anomaly for the United States sorely needs her manufacturing base to start humming again.

Comments from manufacturing survey responders defied this month's ISM index. Some said said business is stable, improved slightly, while two said business was flat. Computer & Electronic Products said business was slower than last year. Overall comments gave the impression of stable and slowing plodding upward demand in the manufacturing sector.

The comment which stood out, simply because it's so weird, is from the food industry. Are you kidding me, is the average consumer so gullible to spend extra on something they have zero problems with in the first place and thus have no need to avoid? Who says markets cannot be created out of thin air and consumer needs manufactured?

We see gluten-free industry to be strong and it continues to grow

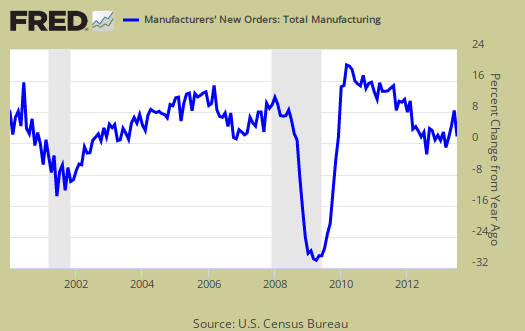

Back to the index, new orders increased a 6.4 percentage point increase to 58.3%. This is the highest the new orders index has been since April 2011. Below is the correlation with the Census Bureau.

A New Orders Index above 52.3 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders.

The Census reported manufactured June durable goods new orders growth was 4.2%, where factory orders, or all of manufacturing data, will be out later this month, but note the one month lag from the ISM survey. The ISM claims the Census and their survey are consistent with each other. Below is a graph of manufacturing new orders percent change from one year ago (blue, scale on right), against ISM's manufacturing new orders index (maroon, scale on left) to the last release data available for the Census manufacturing statistics. Here we do see a consistent pattern between the two.

Below is the ISM table data, reprinted, for a quick view.

| ISM Manufacturing July 2013 | ||||||

|---|---|---|---|---|---|---|

| Index | July 2013 | June 2013 | % Change. | Direction | Rate of Change | Trend Months |

| PMI™ | 55.4 | 50.9 | +4.5 | Growing | Faster | 2 |

| New Orders | 58.3 | 51.9 | +6.4 | Growing | Faster | 2 |

| Production | 65.0 | 53.4 | +11.6 | Growing | Faster | 2 |

| Employment | 54.4 | 48.7 | +5.7 | Growing | From Contracting | 1 |

| Supplier Deliveries | 52.1 | 50.0 | +2.1 | Slowing | From Unchanged | 1 |

| Inventories | 47.0 | 50.5 | -3.5 | Contracting | From Growing | 1 |

| Customers' Inventories | 47.5 | 45.0 | +2.5 | Too Low | Slower | 20 |

| Prices | 49.0 | 52.5 | -3.5 | Decreasing | From Increasing | 1 |

| Backlog of Orders | 45.0 | 46.5 | -1.5 | Contracting | Faster | 3 |

| Exports | 53.5 | 54.5 | -1.0 | Growing | Slower | 8 |

| Imports | 57.5 | 56.0 | +1.5 | Growing | Faster | 6 |

| OVERALL ECONOMY | Growing | Faster | 50 | |||

| Manufacturing Sector | Growing | Faster | 2 | |||

Production, which is the current we're makin' stuff now meter, increased 11.6 percentage points from last month to 65%,and is the highest the index has been since May 2004. Production usually follows incoming orders in the next month, so this is a welcome surprise.

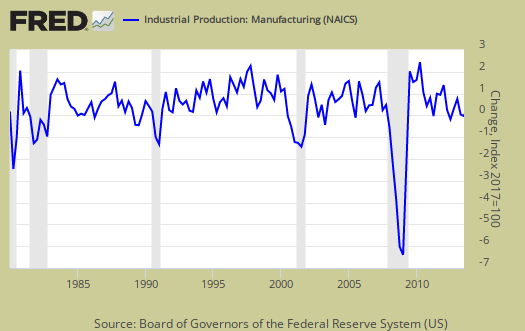

ISM's manufacturing production index loosely correlates to the Federal Reserve's industrial production, but not at 50% as the inflection point, instead 51.2% to indicate growth. Below is a graph of the ISM manufacturing production index (left, maroon), centered around the inflection point, quarterly average, against the Fed's manufacturing industrial production index's quarterly change (scale right, blue). We can see there is a matching pattern to the two different reports on manufacturing production.

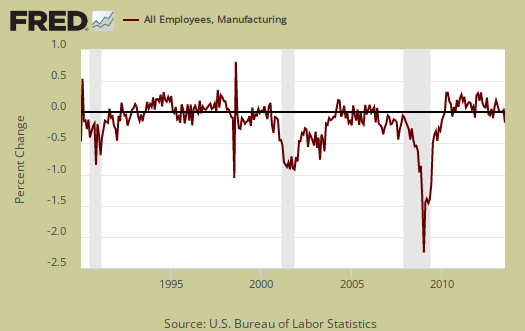

The manufacturing ISM employment index gained 5.7 percentage points to 54.4%, which is growth. The neutral point for hiring vs. firing is 50.1%. Employment lags new orders and production. Below are the BLS manufacturing non-farm payrolls (jobs) for the past decade on the left (maroon), graphed against the ISM manufacturing employment index on the right (blue). The BLS manufacturing payrolls is the monthly percentage change and the ISM manufacturing employment index is centered around it's inflection point of contraction and employment growth. This is just monthly change, manufacturing has lost approximately 6 million jobs over the graphed time period.

Inventories showed contraction. July saw inventories lose -3.5 percentage points to 47.0%. As the economy is stagnant, businesses adjust inventories in response, which in turn impacts GDP. In December 2009 inventories came in at 41.9% for comparison's sake.

An Inventories Index greater than 42.7 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis' (BEA) figures on overall manufacturing inventories.

Supplier deliveries are how fast manufacturers can get their supplies. A value higher than 50 indicates slower delivery times, a value below 50 means the supply chain is speeding up. The index increased 2.1 percentage points to 52.1%, which means slower speed.

Order backlogs dropped another -1.5 percentage points to 45.0% and is in contraction, the 3rd month in a row. Backlogs of orders contraction is not good news. Less order backlogs would imply less production eventually, but the contract might also explain the production blow out.

Imports increased 1.5 percent points to 57.5% and and are in expansion or no change for the 8th month in a row. Imports are materials from other countries manufacturers use to make their products.

New orders destined for export, or for customers outside of the United States dropped by -1.0 percentage point to 53.5% and is in expansion for the 8th month in a row. Previous to that there was half a year of contraction.

Prices decreased -3.5 percentage points to 49% which shows raw materials prices decreased. Only two of the last 7 months have shown a raw materials price decline..

Customer's inventories increased 2.5 percentage points to 47.5%. Below 50 means customer's inventories are considered by manufacturers to be too low. Customer inventories, not to be confused with manufacturer's inventories, are how much customers have on hand, and rates the level of inventories the organization's customers have.

Here is the ISM industrial sector ordered list of growth and contraction. Chemical products finally reported expansion after being in contraction for the last three months.

Of the 18 manufacturing industries, 13 are reporting growth in July in the following order: Furniture & Related Products; Textile Mills; Printing & Related Support Activities; Paper Products; Wood Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Food, Beverage & Tobacco Products; Primary Metals; Transportation Equipment; Chemical Products; and Fabricated Metal Products. The four industries reporting contraction in July are: Plastics & Rubber Products; Apparel, Leather & Allied Products; Machinery; and Miscellaneous Manufacturing.

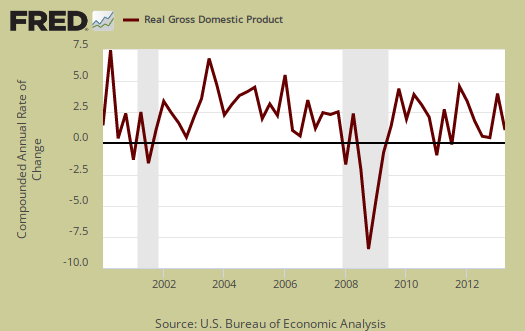

The ISM has a correlation formula to annualized real GDP, but they are now noting the past correlation, but note, PMI only has to be above 42.2% to indicate economic growth (right). Notice also that the PMI went to equal weighting in 2008. July's data, gives a 4.1% 2013 annual real GDP correlation. The below graph plots real GDP, left scale, against PMI, right scale, GDP up to Q2 2013. One needs to look at the pattern of the two lines to get anything out of this by quarters graph. If they match, GDP goes up, PMI goes up, would imply some correlation. Of all of the ISM's correlations, this is the one which consistently is way off.

The ISM neutral point is 50, generally. Above is growth, below is contraction, There is some some variance in the individual indexes and their actual inflection points. For example, A manufacturing PMI above 42, over time, also indicates growth, even while manufacturing is in the dumpster. Here is last month's manufacturing ISM overview, unrevised. The ISM has much more data, tables, graphs and analysis on their website. For more graphs like the above, see St. Louis Federal Reserve Fred database and graphing system. PMI™ stands for purchasing manager's index. On ISM correlations to other indexes, when in dollars they normalized to 2000 values. The above graphs do not do that, so our graphs are much more rough than what the ISM reports these indices track.

Note: The ISM is seasonally adjusting some of these indexes and not others due to the criteria for seasonal adjustment. Those indexes not seasonally adjusted are: Inventories, Customers' Inventories, Prices, Backlog of Orders, New Export Orders and Imports.

Made in America

I just read:

1) Our exports are taxed overseas through value-added taxes in over 150 countries, leaving us at a competitive disadvantage that trade agreements cannot erase. Those nations’ imports to the U.S. are effectively subsidized through VAT rebates.

2) American manufacturers are forced to work around a substandard infrastructure desperately in need of repair, yet public construction expenses as a percentage of GDP are dropping like a rock.

3) We’re under-investing in human capital, although some communities are putting vocational educational opportunities back into place for high school students. Our [real] competitors abroad possess mature, seamless programs to train young people, provide them with apprenticeships, and place them in high-wage jobs in modern factories.

4) Public investment in innovation is strong in the United States, but it focuses entirely too much on ideas that end up in products made overseas [sweatshops in low wage countries].

http://www.tradereform.org/2013/08/made-in-america-the-competitiveness-i...

VAT is manipulated for trade advantage

We're the only industrialized country, or one of the few without a VAT and believe this or not, the left flips out at the idea, not understanding this is a dynamic tax, one that can be made progressive and one that can be changed daily and perfectly legal by the WTO, so no trade complaint.

I also need to check it out more thoroughly but the new Google/Motorola smartphone might be made in America, which is one hell of a plus if true and everyone can thrown their Chinese iPhone into the trash. (Anyone think about the cost of an iPhone vs. the fact it is made with glorified slave labor???) Apple, not so cool afterall!