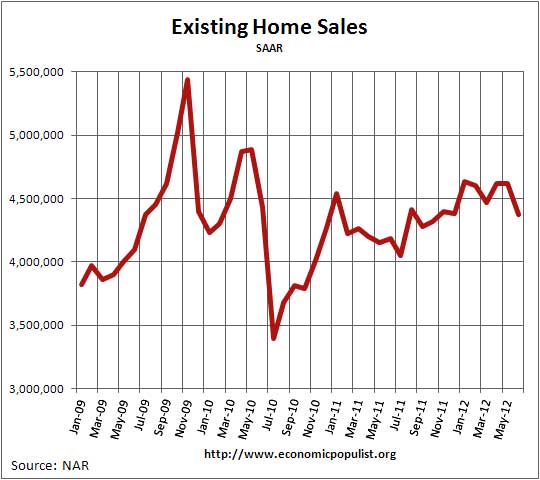

The NAR released their June 2012 Existing Home Sales. Existing home sales plunged -5.4% and inventories ticked up to 6.6 months of supply. May existing home sales were revised to no change from April. Existing homes sales have increased 4.5% from June of last year.

The NAR claims the reason for June's decline is constrained supply.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 5.4 percent to a seasonally adjusted annual rate of 4.37 million in June from an upwardly revised 4.62 million in May, but are 4.5 percent higher than the 4.18 million-unit level in June 2011.

This is a never ending drumbeat from NAR, to claim the problem is supply vs. demand. Yet in the report are the quoted inventory statistics:

Total housing inventory at the end June fell another 3.2 percent to 2.39 million existing homes available for sale, which represents a 6.6-month supply at the current sales pace, up from a 6.4-month supply in May. Listed inventory is 24.4 percent below a year ago when there was a 9.1-month supply.

Here we can see it is possible there were less foreclosures for sale, or is it simply a lack of buyers? NAR claims buyer traffic is up two fold from last fall, yet hello, their sales decreased ....again.

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 25 percent of June sales (13 percent were foreclosures and 12 percent were short sales), unchanged from May but down from 30 percent in June 2011. Foreclosures sold for an average discount of 18 percent below market value in June, while short sales were discounted 15 percent.

Yet here is the money shot and why we find NAR press releases almost laughable.

"The distressed portion of the market will further diminish because the number of seriously delinquent mortgages has been falling," said Yun.

Both Corelogic and RealtyTrak say 90% of REOs are being kept off the market.

As of April 2012, 390,000 repossessed homes sat in limbo, while about 39,000 were actually listed for sale, said Sam Khater, senior economist at CoreLogic.

Online foreclosure marketplace RealtyTrac recently found that just 15 percent of REOs in the Washington, D.C., area were for sale, a statistic that is representative of nationwide numbers, the company said.

Notice in the below paragraph the high percentages of all cash buyers and investor buyers.

All-cash sales edged up to 29 percent of transactions in June from 28 percent in May; they were 29 percent in June 2011. Investors, who account for the bulk of cash sales, purchased 19 percent of homes in June, up from 17 percent in May; they were 19 percent in June 2011.

The median sales price for existing homes is now $189,400 and up 7.9% from a year ago. The median price can also be pushed up by less low end foreclose sales. Again NAR is ridiculous. They claim this is the highest increase since February 2006 when the median price rose 8.7% from a year prior. NAR fails to quote the average price, which was $238,800 and up 5.8% from a year ago, or that prices overall fell further in 2011 and earlier this year.

If 90% of foreclosed homes are being kept off of the market, plus such a large percentage of cash buyers and investors are purchasing homes, assuredly prices will fall further if that REO inventory comes out of the shadows. NAR claims:

Listed inventory is 24.4 percent below a year ago when there was a 9.1-month supply.

Yet even with REOs being held off of the market, expecting tight inventories to continue is questionable. The massive foreclosure fraud and robo signing scandal only temporarily halted the foreclosure process. Recall the unjust national settlement for robo-signing and foreclosure fraud enabled the great foreclosure machine to start up again. May saw a 9% increase in bank foreclosure filings.

Finally, June was hot, blazing hot. Normally that should accelerate the buying season, although it was so damn hot one has to wonder why anyone with AC would venture outside.

Last month's existing home sales overview is here, unrevised.

Recent comments