Last week the Bureau of Economic Analysis released their report on Personal Income and Outlays for November, which in addition to the important personal income data, also reports the monthly data on our personal consumption expenditures (PCE), which as you all know is the major component of GDP. From that data, the BEA also computes personal savings and the national savings rate, as well as a price index for PCE, the inflation gauge the Fed targets, and which is used in this report to adjust both personal income and consumption expenditures for inflation to arrive at 'real' change figures.. Like the GDP reports, all the dollar amounts referenced by this report are seasonally adjusted and at an annual rate; so the nominal monthly dollar changes, which are not reported, are actually on the order of one twelfth of the reported amounts. However, the percentage changes are expressed as a month over month change and are confusingly used within the report as if they refer to the annualized amounts, making for a difficult report to unpack and report on correctly...

In November, total personal income increased at a seasonally adjusted $54.4 billion annual rate, to what would be a gross national personal income of $14,930.0 billion annually, which was 0.4% higher than in October, when personal income increased by 0.3% over September. Disposable personal income (DPI), which is total income after taxes, increased at an annualized rate of $42.4 billion to $13,155.9 billion annually, which was a 0.3% increase over October, while October's DPI was revised up to 0.3% over September. Increases in private wages and salaries, which account for half of gross personal income, accounted for $38.7 billion of the annualized November personal income gains, up from $24.9 billion in October, as service industry payrolls increased at a $31.5 billion annual rate and goods producing industry payrolls rose at a $7.3 billion clip. Increases in supplements to wages and salaries, such as employer contributions to pension plans, accounted for another $5.4 billion of November's annualized increase, while employee contributions for government social insurance, which are subtracted from the personal income figure, increased at a $5.3 billion rate. Meanwhile, proprietors' income increased at a $7.6 billion rate in November, as farm owner's incomes rose at a $3.2 billion rate while incomes of individual proprietors of other types of business were up at a $4.4 billion rate. Other sources of the November personal income changes included rental income of individuals, which increased at a $0.5 billion rate, personal interest and dividend income, which grew at a $5.6 billion rate, and personal transfer payments from government programs, which fell at a $0.1 billion rate..

Meanwhile, November's seasonally adjusted personal consumption expenditures (PCE), which will be included in the change in real PCE in 4th quarter GDP, rose at a $67.9 billion annual rate to a level of $12,143.8 billion in consumer spending annually, 0.6% higher than in October, which itself was revised up 0.1% to 0.3% higher than September. The current dollar increase in November spending was driven by a $45.4 billion annualized increase to an annualized $8,112.5 billion in spending for services and a $21.7 billion increase to $1,347.5 billion annualized in spending for durable goods, while outlays for non durable goods rose at a $0.8 billion rate to an annualized $2,683.8 billion. Total personal outlays for November, which includes interest payments and personal transfer payments in addition to PCE, rose by an annualized $67.7 billion to $12,579.4 billion, which left total personal savings, which is disposable personal income less total outlays, at $576.5 billion in November, down from the revised $601.7 billion in personal savings in October, which was originally reported at $651.2 billion. As a result, the personal saving rate, which is personal savings as a percentage of disposable personal income, fell to 4.4% from October's revised savings rate of 4.6%, which was originally reported at 5.0%..

While our personal consumption expenditures accounted for 68.2% of our third quarter GDP, before they were included in the measurement of the change in our output they were first adjusted for inflation, to give us the real change in consumption, and hence the real change in goods and services that were produced for that consumption. That's done with the price index for personal consumption expenditures, which is included in this report, which is a chained price index based on 2009 prices = 100. That index fell to 109.015 in November from 109.203 in October, giving us a negative month over month inflation rate of 0.017%, which BEA reports as -0.2%, and a year over year PCE price index increase of 1.17%, with YoY core prices up 1.41%, well below the Fed's target of 2.5% inflation articulated in their December 2012 FOMC meeting. Because of the decrease in prices, the inflation adjusted or real personal consumption expenditures actually increased 0.7% in November, after rising 0.2% in October, when the PCE price index was reported as unchanged by was actually up fractionally. Together, these October and November adjustments imply an annualized increase of approximately 4.2% in 4th quarter PCE, even if December PCE is unchanged. Using the same PCE price index, disposable personal income was inflated to show that real disposable personal income, or the purchasing power of disposable income, rose by 0.5% in November, after increasing by 0.3% in October...

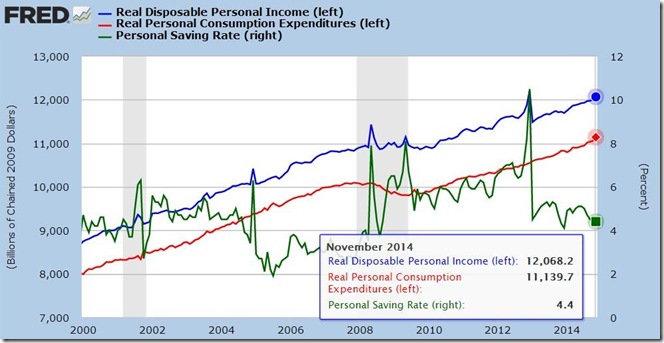

Our FRED graph below shows monthly real disposable personal income in blue and real personal consumption expenditures in red since January 2000, with the annualized scale in chained 2009 dollars for both shown in the current data box and on the lower left. Also shown on this same graph in green is the monthly personal savings rate over the same period, with the scale of savings as a percentage of disposable income on the right. The spike in income and savings at the end of 2012 was mostly the result of income manipulation before the year end fiscal cliff; the earlier spikes were as a result of the tax rebates enacted as a fiscal stimulus under George Bush.

(excerpted from my summary at MarketWatch 666)

Comments

yeah, saw that PCE implies Q4 strong growth

The hits just keep on coming, except.....for workers, wages and middle class, although things have improved, just not in line with Wall Street and now GDP.