It's almost embarrassing what they will try to spin as "good" economic news these days.

(Bloomberg) -- Home prices saw a “striking improvement in the rate of decline” in April and trading in funds launched today indicates investors believe the U.S. housing slump is nearing a bottom, said Yale University economist Robert Shiller.“At this point, people are thinking the fall is over,” Shiller, co-founder of the home price index that bears his name, said in a Bloomberg Radio interview today. “The market is predicting the declines are over.”

“My guess would be that home prices are going to level off -- they’re not going to keep falling,” Shiller said in a separate interview with Bloomberg Television.

Wow! That sounds wonderful!

So what is this incredible news about housing that has caused such a stir?

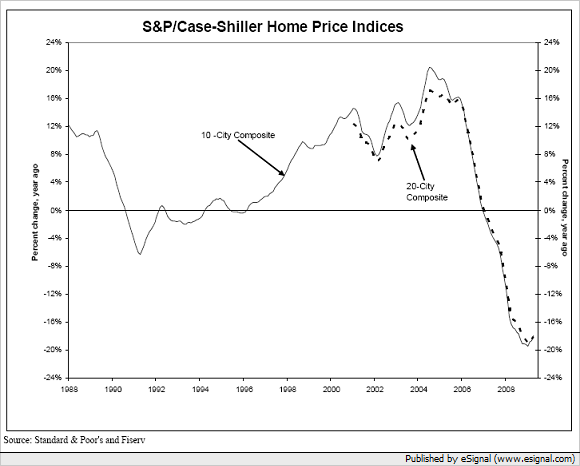

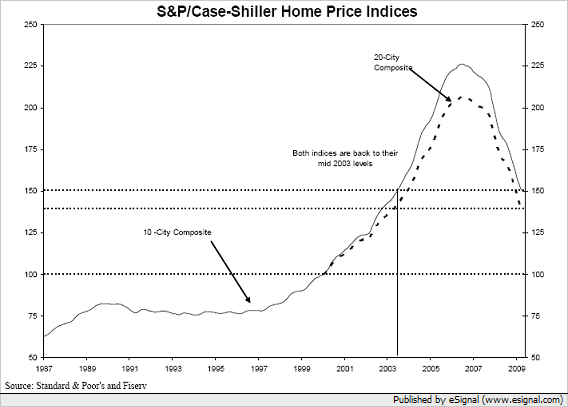

While the Standard & Poor's/Case-Shiller index of 20 major cities tumbled by 18.1 percent, it marked the third straight month the decline was not a record.

Uh...so the fact that the losses are no longer historical records is supposed to be "wonderful" news?

Now a punch in the mouth may be better than a poke in the eye with a sharp stick, but I don't consider either to be a sign of good things to come.

The index decreased 18.1 percent from a year earlier following an 18.7 percent drop in March. Economists predicted the index would drop 18.6 percent, according to the median of 33 responses in a survey conducted by Bloomberg. The measure fell 19 percent in January, the most since the data began in 2001.

If you really wanted to get back to reality, a change of less than 1% is really nothing more than statistical noise in the margins. In an election, which has more reliable results than a housing survey, 1% will draw a call for a recount.

These efforts by the financial media amount to nothing more than putting lipstick on a pig.

Defaults from borrowers with good credit contributed to much of the increase in seriously delinquent loans, echoing data last month from the Mortgage Bankers Association. As the recession claims more jobs, borrowers in good standing are more likely to miss their mortgage payments.Efforts to modify home loans have been slow and easily outpaced by the number of new delinquencies. In the first quarter, loan companies modified 185,156 mortgages, up 55 percent from the previous quarter. But the number of foreclosures in process increased to 844,389, up 22 percent.

And nearly one in four borrows who received a mortgage payment reduction fell behind again within six months, the report found.

might edit and link

I noticed that too, some serious spin. Also note that Schiller is trying to peddle a new ETF style of index to bet for/against the housing bubble.

You might edit your post and link over to this Instapopulist, OTC, OCC report to also justify your reality check.

It's some damning stats on delinquencies, foreclosures.

The increases are astounding but to figure out the absolutes, it's unclear how that is calculated. But the percent change is truly astounding with all of that crap about helping homeowners and so on.

No recession is ever over

Until the lagging indicator of unemployment goes down and the lagging indicator of average wages adjusted for inflation starts rising.

I don't care what the official "economic indicators" say, these are the two statistics that most affect the Personally Screwed indicator.

If you have a job, you might not be able to afford mortgage, but you will likely be able to afford rent, assuming that you're willing to accept a 2-4 hour/day commute- you can always find places to rent outside the UGB and in smaller poorer towns in rural counties.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

They are trying their best to spin the info

so that they can inflate that bubble. I just keep thinking the avg. citizen has to soon catch on to this game. Maybe...don't you think?

The Sheeple remain asleep

I just did a quick search and found this.

Since unemployment is almost sure to be higher next year at this time, I'm not certain what these people are thinking.

They are not thinking and it drives me crazy

Is "ignorance is bliss" a new found way of life or have the schools failed us. Have a been breeding a large mass that can not think without being told what to think?

We are doomed.

welcome reddit users

ya all, reddit (which is one of the sharing buttons) is liking this post. You might hit that reddit share button and rate it up! (it deserves it, today was spin city in the MSM!)