ABC News reported an interview with with Paul Krugman last week his opinions that:

"I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer," he said June 8 during a lecture in London.

However, Krugman argues people didn't listen to his entire speech, which included dire predictions about lingering unemployment. "There's a big difference between the end of a recession, which is really only when some things start to turn up, and the return to prosperity," Krugman told ABC News. "I think what people don't get is the difference between the end of a recession in a technical sense and actual recovery, which matters to people."

In my opinion, Krugman is exactly correct. In this four-part "Big Picture" look at the economy as of Independence Day 2009, I will argue that:

1. Right now, production and consumption in the economy are stabilizing, but job losses and unemployment continue to accumulate at an alarming level, with wages perilously poised to enter deflation soon if matters don't turn around quickly.

2. Three out of the five long term imbalances in the economy have made great strides toward an improved equilibrium, completing most of the necessary adjustment. On of the other two is improving temporarily, but probably not in the long term yet. The final one is as bad or worse than before the Recession began.

3. Despite much bad current news, and in particular the poor jobs report on Friday, Leading Economic Indicators will most likely have their third month in a row of substantial gains for June when reported later this month, suggesting that the Recession will bottom around Labor Day, give or take 2 months. A second long-established and highly-regarded private source suggests recovery is imminent, while a Third suggests renewed weakness.

4. The biggest threat to the beginning of a Recovery is the "Fifty Little Hoovers" of balanced state budgets, and in particular the disaster that is California. There is one specific policy that I believe the Obama Administration should enact and implement immediately.

I. The Recession right now: some stabilization, some continued severe contraction:

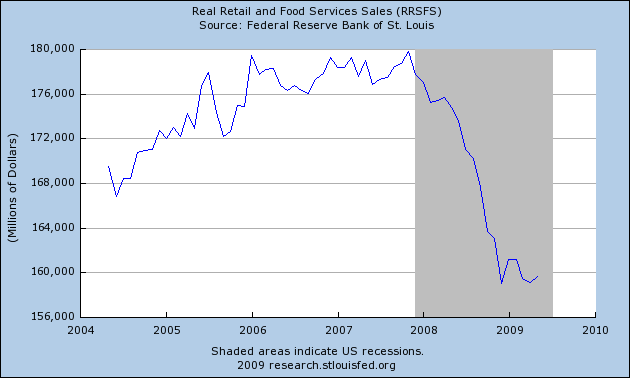

Nouriel Roubini, most famously, declared some time ago that this would be an "L" shaped recession, by which he meant there would be a precipitous decline after which there would be no improvement, but continued low activity. There are a host of graphs that demonstrate that the we are currently in an "L" of a recession. For example, on the consumer side, here is a graph of real (i.e., adjusted for inflation) retail sales, showing that the downturn ended at the end of last year, but there has been no meaningful improvement since:

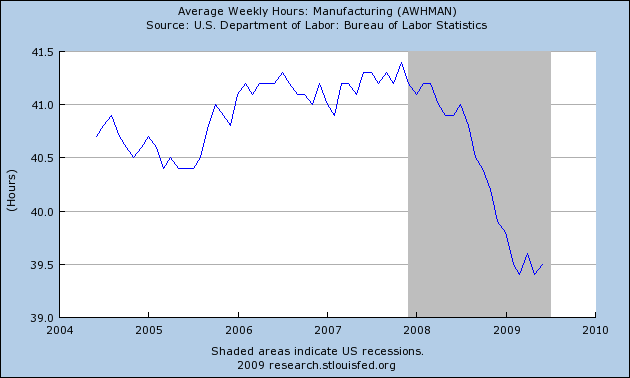

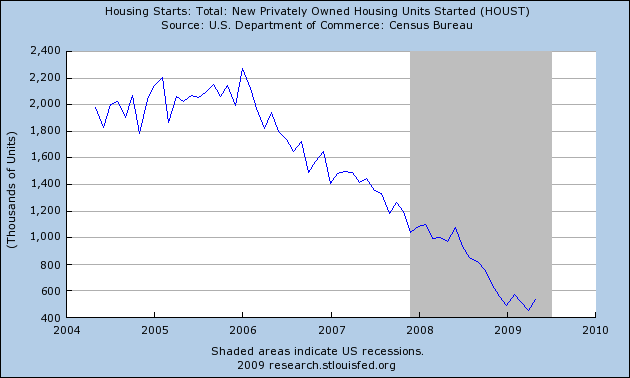

Notice that the steep decline of late last year, plus the recent stabilization, form an "L" in the graph. Here are some more "L"'s:

It looks like car sales have found a bottom too, but again no meaningful improvement:

So have 5 of the 10 statistics that make up the index of Leading Economic Indicators:

Average hours worked in manufacturing is the most important, making up 25% of the weight of the index:

Housing starts and permits have stabilized at least for the last few months also:

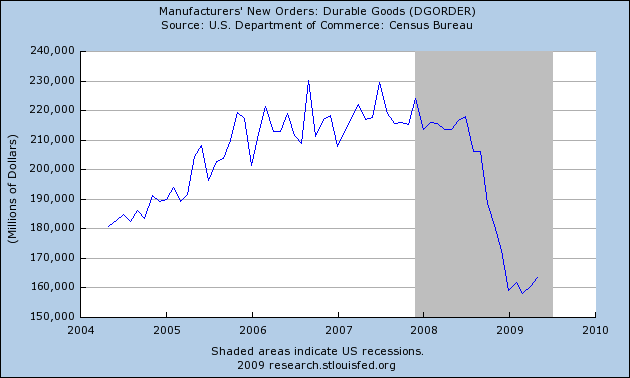

So have manufacturers' new orders for durable goods:

So have manufacturers' new orders for nondurable consumer goods:

So has the ISM's index of manufacturing supplies:

(note: the ISM is a "diffusion" index, meaning readings below 50 are declines. Note the steep declines last year, with readings right at 50 in the last couple of months).

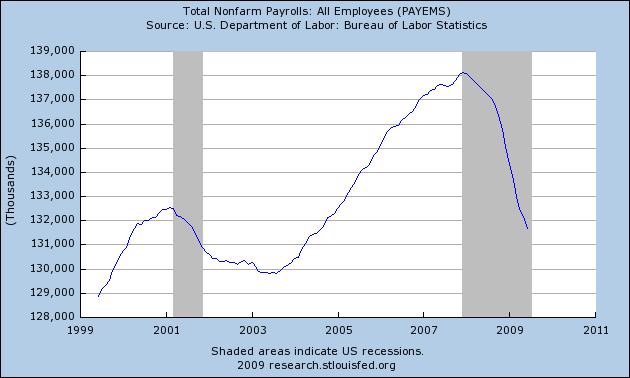

If manufacturing and consumer consumption appear to have stabilized in the last few months, employment and wages continue to terrify:

Almost an entire decade of job growth has already been destroyed by this recession:

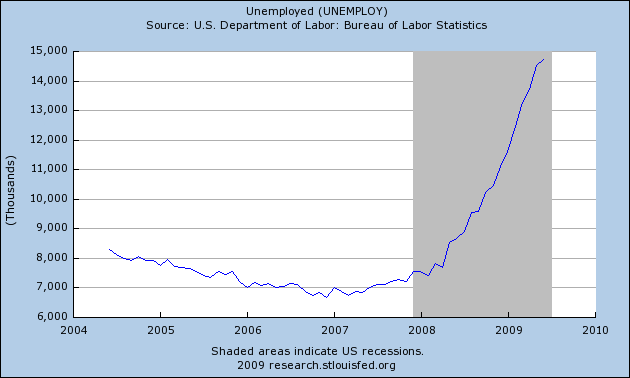

The number of unemployed workers continues to rise:

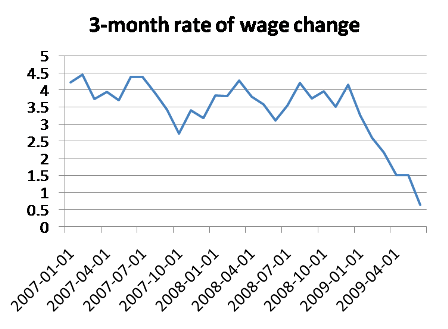

Wages have grown at the paltry rate of about 2.5% in the last year. Worse, wages have totally stagnated in the last few months. Continuing at this trend will mean actual wage deflation within a year:

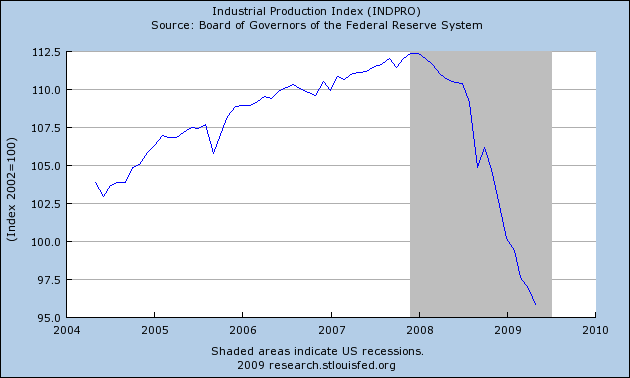

And industrial production, a classic marker of expansions and recessions, continues to decline:

In summary, the free fall has completely stopped for part of the economy, but not at all for the part that is crucial to the well-being of average Americans.

Parts II and III of this analysis can be read at The Bonddad Blog

Recent comments