On April 23, the Fed released audited financial statements which included financial statements from a few of the super “structured investment vehicles” that it created in 2008. The Fed called them “Special Purpose Vehicles”. Yeah, right, we know what “Special Purpose” means. Here’s a hint: giveaway. AIG and third-party counterparties to AIG's CDS received the largesse with Maiden Lane II & III. Just like Maiden Lane I, with a stroke of the pen tens of billions of dollars of “toxic assets” were lifted from AIG’s and other financial conglomerates’ balance sheets and transferred to the Fed’s balance sheet.

Background

Please note, that I am having trouble locating detailed financial statements for Maiden Lane II, LLC. The financial results have been consolidated onto the Federal Reserve Bank of New York’s financials but the details were lacking.

One November 10, 2008, the Federal Reserve Bank of New York (FRBNY) announced the creation of Maiden Lane II and III as part of the restructuring of its financial support for AIG. FRBNY is the managing member of Maiden Lane II and III. FRBNY is the sole member of Maiden Lane II. FRBNY and AIG are the sole members of Maiden Lane III.

Maiden Lane III

Maiden Lane III was actually funded first. On November 25, 2008, Maiden Lane III borrowed $15.1 billion from FRBNY and AIG kicked in $5 billion. Again, cash is going out of style. The $20.1 billion in capitalization was considered liabilities on the books of Maiden Lane III - nothing like more leverage/debt. Then again, on December 18, 2008, Maiden Lane III borrowed an additional $9.2 billion from FRBNY. FRBNY has $29.3 billion of skin in this game.

The purpose of Maiden III was to acquire Asset-Backed Security Collateralized Debt Obligations (“ABS CDOs”) from certain third-party counterparties of AIG Financial Products Corp. (“AIGFP”). In connection with the acquisitions, the third-party counterparties agreed to terminate their related credit derivative contracts with AIGFP. But interestingly, AIGFP for all their screw-ups got a little taste of the action:

The LLC also made a payment to AIGFP of $2.5 billion representing the over collateralization previously posted by AIGFP and retained by counterparties in respect of terminated credit default swaps (“CDS”) as compared to the LLC’s fair value acquisition prices calculated as of October 31, 2008.

Amazing, with all the pain that AIGFP caused they still got a cool $2.5 billion. Who says crime doesn’t pay?

Maiden Lane III purchased from third-party counterparties ABS CDOs with a total fair value, as of October 31, 2008, of $29.6 billion. What is not clear from the financial statements is whether that was “market price” for the CDOs. The financial statements also do not disclosure who the third-party counterparties were.

All of the ABS CDOs that Maiden Lane III now owns were classified in Level 3 of the valuation hierarchy stated in SFAS 157 – basically what ever your model says they are worth.

In certain cases where there is limited activity or less transparency around inputs to the valuation, securities are classified within level 3 of the valuation hierarchy. For instance, in valuing certain ABS CDOs the determination of fair value is based on projected collateral performance scenarios. These valuations also incorporate pricing metrics derived from the reported performance of the universe of bonds as well as observations and estimates of market data. Because external price information is not available, market based models are used to value these securities. Key inputs to the model may include market spread data for each credit rating, collateral type, and other relevant contractual features.

Nothing changes.

What is scary is the amount of losses incurred within just little over a month of owning these “toxic assets”:

Maiden Lane III Unrealized losses (click to enlarge)

In just little over a month, Maiden Lane III lost $2.6 billion on its investments. Ouch! Again, the issue is whether with credit quality decreasing will these investments incur more losses. My guess is yes. Here is the risk profile of Maiden Lane III’s assets as of December 31, 2008:

Maiden Lane III Ratings Profile (click to enlarge)

The two things that should be highlighted and causes for concern are: 1) the concentration of “High-Grade ABS CDOs” with ratings of BB+ and lower and 2) the level of Commercial Real Estate CDOs.

Maiden Lane II

On December 12, 2008, FRBNY and AIG funded Maiden Lane II. FRBNY provided a senior loan to Maiden Lane II in the amount of $19.5 billion. AIG provided some bogus “fixed deferred purchase price”. FRBNY is the sole and managing member of Maiden Lane II. But AIG is not totally shut out from any potential profits, assuming it is still around and Maiden Lane II’s investments make any money.

As part of the agreement, the AIG subsidiaries also became entitled to receive from ML II a fixed deferred purchase price of up to $1.0 billion, plus interest on any such fixed deferred purchase price outstanding at a rate of one-month LIBOR plus 300 basis points, payable from net proceeds received by ML II and only to the extent that the Bank’s senior loan has been paid in full. After ML II has paid the Bank’s senior loan and the fixed deferred purchase price in full, including accrued and unpaid interest, the Bank will be entitled to receive five-sixths of any additional net proceeds received by ML II as contingent interest on the senior loan and the AIG subsidiaries will be entitled to receive one-sixth of any net proceeds received by ML II as variable deferred purchase price.

Side note, I noticed with all three Maiden Lanes, the financial conglomerate-beneficiaries (AIG and JP Morgan Chase) were receiving a higher return on their money than the Fed: “a rate of one-month LIBOR plus 300 basis points.” What’s up with that?

The purpose of Maiden Lane II was to purchase Residential Mortgage Backed Securities (RMBS) from the reinvestment pool of the securities lending portfolio of several regulated U.S. insurance subsidiaries of AIG. Basically, to clean up the portfolios of AIG subsidiaries so that AIG could possibly sell them. This strategy has been very successful – assuming that was the strategy. But it could have been a way to make AIG more profitable and help shareholders and bondholders.

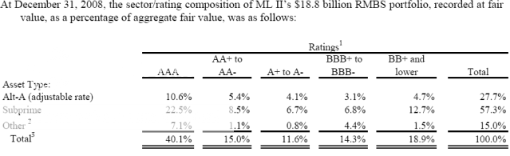

Maiden Lane II’s purchases of the RMBS had a total fair value of $20.8 billion as of October 31, 2008. Surprise, surprise as of December 31, 2008 these same RMBS investments had a total fair value $18.8 billion. Here is Maiden Lane II’s risk profile:

Maiden Lane II Ratings Profile (click to enlarge)

Wow, check out the concentration of subprime RMBS. That is not very attractive to potential buyers. Actually, this whole portfolio can be considered “subprime” now.

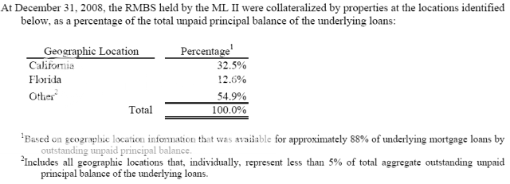

Here is the geographic profile of the RMBS portfolio:

Maiden Lane II Geographic Profile (click to enlarge)

With California and Florida leading the Nation in foreclosures this probably didn’t look too attractive either. Bottom line this RMBS portfolio looked bad in October 2008 and probably is even worse now it is on FRBNY balance sheet.

What have we learned? Well, it pays to screw up and underestimate risk and if we are a financial conglomerate that is “too big to fail” – don’t worry the Fed will provide a bailout. Also, if you want to get even bigger than “too big to fail”, like in the case of JP Morgan Chase, the Fed will help you with that too. Worst of all is that the Fed has assumed a lot of risk with these purchases.

In the end the FRBNY uploaded $74.57 billion on to its balance sheet. That is quite a heavy load.

VIE Investments (click to enlarge)

I would like to close with a quote from a Bloomberg article addressing this huge transfer of assets (h/t to Robert):

“The numbers basically confirm that Treasury is going to have to take some TARP money and reimburse the Fed,” said [Chris] Whalen [of Institutional Risk Analytics], whose financial-services research company analyzes banks for investors. “It is essentially up to the Treasury to get the Fed out of this.”

Comments

what a financial cess pool!

It looks like a dumping ground and a lot of gamesmanship to transfer taxpayer funds to our favorite Zombies to me.

Good work on trying to trace through the various transfers.

I'm not sure I totally get what's going on except isn't it wonderful that the Federal Reserve can now "choose to disclose" in "consolidated financial statements" what would be (my interpretation) Enron level fraud if this was a private sector publicly traded company?

"Fair market value"?

What is "fair market value" on a ABS CDO, which as i understand it is evaluated with daily "evaluations" of CDS rates? Which are also not based in reality at this point.

None of this is based on reality.

Reality is that Fed over paid for all these assets - just look at the losses within months of closing. It is amazing the amount of risk the Fed assumed but I guess that doesn't matter because they got the printing press to back them up.

The Fed is doing all of this with no oversight. I just read that they are prepared to bailout all the banks that are "stressed" and need capital. They know that any "stressed" bank will be hard pressed to obtain private capital.

RebelCapitalist.com - Financial Information for the Rest of Us.

Maybe we should get all of those Ron Paul fans over here

;) I so often ignored all those focused on the Fed because so much of it is CT, but that said, I note Sen. Bernie Sanders is getting on the Federal reserve now as well for transparency and oversight and this is just scary as hell.

They are just doing whatever the hell they want and it's like a black hole in checks and balances.

I thought we were already here

Ron Paul fans, that is....

I don't know though, I'm a social conservative, government liberal. I want the government doing all of this stuff- I just want *NONE* of it to be secret. Governments shouldn't be involved in secrecy, and that goes for intelligence and military segments as well as financial.

In fact, neither should business.

The more I think about it, the more I think certain parts of freedom and privacy are just there to cover up unethical behavior.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

And now for those "stress tests"

Outstanding column, and to anyone who's yet to study the bank "stress tests" protocol, it is interesting to note that the captioned items are EXEMPT from said stress testing!!!

Hmmmmm......????? No further discussion needed on this subject.