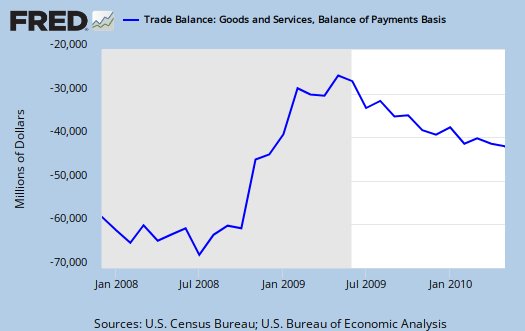

The May 2010 U.S. trade deficit increased from last month's $40.3 billion (revised) to $42.3 billion. Imports increased $5.5 billion from last month, more than exports, which increased $3.5 billion in May. That's a 4.73% jump in the trade deficit in one month. Trade deficits subtract from GDP.

The raw totals of exports are $152.3 billion with imports of $194.5 billion. Percent change from last month for imports was 2.91% and exports 2.35%.

For the year:

The goods and services deficit increased $17.4 billion from May 2009 to May 2010. Exports were up $26.4 billion, or 21.0%, and imports were up $43.8 billion, or 29.1%.

Goods make up the majority of trade and both exports and imports decreased in volume from the previous month.

In May, the goods deficit increased $1.9 billion from April to $54.5 billion, and the services surplus was virtually unchanged at $12.2 billion. Exports of goods increased $3.0 billion to $107.2 billion, and imports of goods increased $4.9 billion to $161.7 billion. Exports of services increased $0.6 billion to $45.0 billion, and imports of services increased $0.6 billion to $32.9 billion.

Below are imports vs. exports of goods from the official start of this recession. Notice the increase in volume on both exports and imports in May.

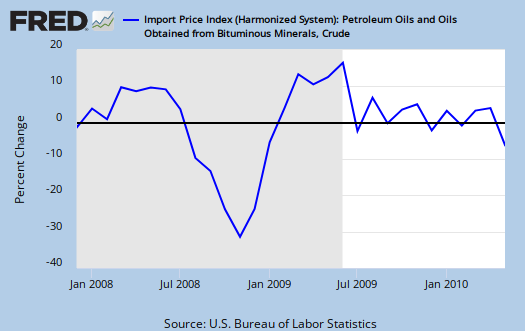

A barrel of crude oil average costs were $76.93, resulting in a Cruel oil imports 5% decrease from last month in terms of real dollars.

The biggest percentage increase in imports was was automotive, a whopping 11.3% increase. Consumer goods, also had a 6.6% increase from last month. Capital goods imports increased +5.2%. Consumer goods exports were a +2.6% decrease from last month. The biggest increase in exports was capital goods, 5.23% from last month. industrial materials and supplies, a 1.7% increase. Below is the breakdown from the report:

The April to May increase in exports of goods reflected increases in capital goods ($2.0 billion); industrial supplies and materials ($0.6 billion); consumer goods ($0.3 billion); and automotive vehicles, parts, and engines ($0.1 billion).

A decrease occurred in other goods ($0.1 billion).The April to May increase in imports of goods reflected increases in consumer goods ($2.6 billion); automotive vehicles, parts, and engines ($2.2 billion); capital goods ($2.0 billion); and foods, feeds, and beverages ($0.2 billion). A decrease occurred in industrial supplies and materials ($2.2 billion). Other goods were virtually unchanged.

The May 2009 to May 2010 increase in exports of goods reflected increases in industrial supplies and materials ($9.6 billion); capital goods ($6.7 billion); automotive vehicles, parts, and engines ($3.7 billion); consumer goods ($1.3 billion); other goods ($1.0 billion); and foods, feeds, and beverages ($0.1 billion).

U.S. advanced technology deficit (yes the jobs of tomorrow are now imports), remained the same as last month, $5.8 billion.

Advanced technology products exports were $21.1 billion in April and imports were $26.9 billion, resulting in a deficit of $5.8 billion.

Advanced technology products exports were $21.8 billion in May and imports were $27.6 billion, resulting in a deficit of $5.8 billion. May exports were $0.7 billion more than the $21.1 billion in April, while May imports were $0.7 billion more than the $26.9 billion in April.

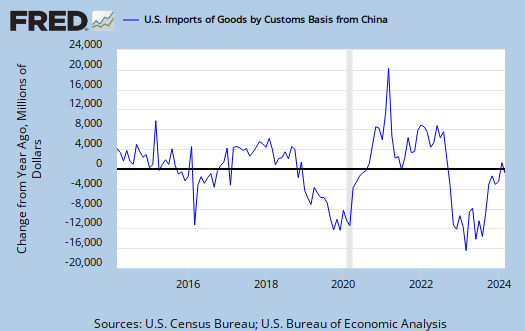

Below is the annual percent change of Chinese imports into the United States. The deficit with China was -$22.284 billion or 44% of the total trade deficit, including oil and has increased 22% from a year ago. This percentage and raw China trade deficit total is not seasonally adjusted. OPEC (read oil) is our next worse trade deficit, at 15.4%, but dropped, again unadjusted -16% from last month. The trade deficit with China jumped 13.5% from last month.

With all of the talk on Europe's implosion, are you aware we run a trade deficit of -$7.6 billion, this month, with them? It is the 3rd highest trade deficit by country. So much for high wages and social safety nets needing to be dismantled in order to remain competitive.

Here is the Government website on Foreign Trade. Here is last month's report (unrevised).

Recent comments