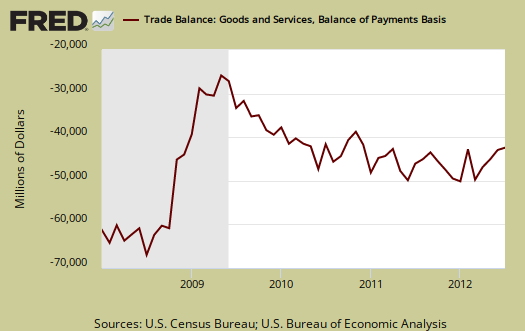

The U.S. July 2012 monthly trade deficit was essentially unchanged, and increased 0.25%, or $103 million, from June to $42.002 billion. Exports decreased $1.81 billion, or -0.98%. Imports declined $1.81 billion, or -0.80%. June's trade deficit was revised from $42.924 billion to $41.899 billion.

The three month moving average gives a trade deficit of $43.832 billion, down from $46.440 billion in June. July is the 1st month of the 3rd quarter, so it's way too early to guesstimate how the decline will affect GDP.

The U.S.-China goods trade deficit alone was, $29.376 billion, or 41.8% of the total goods trade deficit and this ratio includes oil, our largest commodity import. The year to date tally of the goods trade deficit with China is $174.433 billion, or 40.71% of the entire goods trade deficit to date. In July 2011, the China goods trade deficit up to that time was $160.422 billion and 38.9% of the total goods trade deficit. This is a year to date increase of 8.73% in the goods trade deficit with China. China's never ending import barrage is highly cyclical as one can see in the below graph of the not seasonally adjusted trade deficit with China and why we compare to this time last year in order to try to remove seasonality.

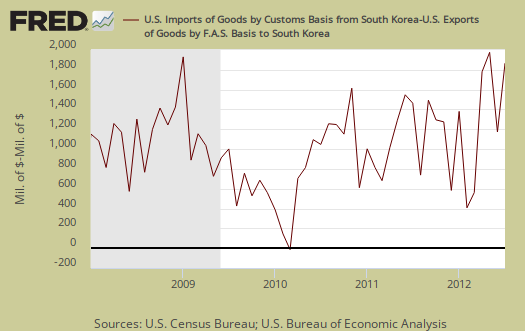

We should also mention the quick to increase South Korea-U.S. trade deficit. From January to July 2012 we have a $9.147 billion trade deficit with Korea. The same time period for 2011 shows a $7.878 Korean trade deficit, a 16.1% increase. March 15, 2012, the South Korean NAFTA style trade deal went into effect. Below is a graph of the Korean goods trade deficit, not seasonally adjusted and also cyclical, in particularly the cyclical high point seems to be December.

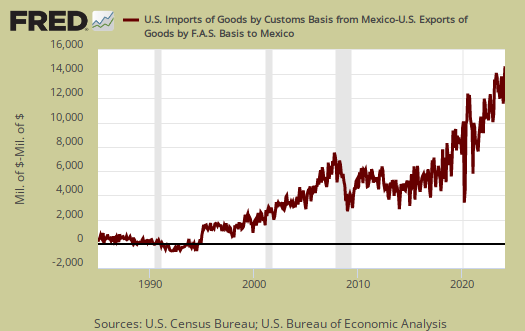

For comparison's sake, NAFTA went into effect January 1, 1994. Below is our goods trade deficit with Mexico, not seasonally adjusted. July's trade deficit with Mexico was $5.039 billion.

Oil or petroleum showed an end use trade deficit of $20.914 billion, for July, a decrease of -$1.076 billion, or -4.78%, from last month, a welcome relief as prices dropped. Petroleum related end use was 36.9% of the goods trade deficit. When adjusted for prices, Petroleum related end use actually increased by 1.85%. Petroleum related imports from China as essentially non-existent.

End use means the final use of the product. For example, plastics are made up of petroleum, yet by their end use category, would be marked often as consumer goods.

The United States basically has two major ongoing problems with the trade deficit, Chinese goods and Oil imports. Below is the not seasonally adjusted import price index for oil fuel. The average price for a barrel of oil in July was $93.83. On September 6th, oil via the WTI, was $95.37/barrel.

Below are imports vs. exports of goods and services. Notice how much larger imports are than exports, but also notice the growth, or rate of change between months of U.S. exports over time. To state the obvious, imports subtract from GDP and exports add. While pundits pontificate over exports, it's the deficit that really matters when it comes to economic growth or lack thereof.

Below is the list of good export changes from June to July, seasonally adjusted, by end use. Exports of goods decreased by -$2.108 billion on a Census accounting basis, whereas the headline buzz is the BOP accounting method, or a -$1.950 billion decrease for goods exports. Exhibit 7 gives Census accounting method breakdown for exports. Soybean exports lead the charge with a +$1.979 billion change. That's a lot of soybeans. Industrial materials and supplies plummeted with a -$0.992 billion drop in nonmonetary gold and a -$575 million decline in fuel oil. Yes, we actually export fuel oil. Capital goods exports were salvaged by a $1.370 billion dollar increase in civilian aircraft exports. Consumer goods exports declined on diamonds, which dropped by -$319 million.

- Automotive vehicles, parts, and engines: -$0.627 billion

- Industrial supplies and materials: -$2.400 billion

- Other goods: -$0.602 billion

- Foods, feeds, and beverages: +$1.838 billion

- Capital goods: +$0.113 billion

- Consumer goods: -$0.430 billion

Below are the goods import monthly changes, seasonally adjusted. Overall imports decreased -$2.054 from last month on a Census accounting basis. The story here is oil, whose monthly change was -$1.407 billion. Fuel oil imports also declined by -$881 million. Price matters.

- Industrial supplies and materials: -$2.134 billion

- Capital goods: -$0.553 billion

- Foods, feeds, and beverages: +$0.115 billion

- Automotive vehicles, parts, and engines: +$0.496 billion

- Consumer goods: -$0.569 billion

- Other goods: -$0.410 billion

Running a trade deficit in advanced technology is not a good sign for those jobs of tomorrow. The below report statistics are not seasonally adjusted.

Advanced technology products exports were $24.8 billion in July and imports were $33.0 billion, resulting in a deficit of $8.1 billion. July exports were $1.7 billion less than the $26.5 billion in June, while July imports were $0.7 billion less than the $33.7 billion in June.

Here is the breakdown with major trading partners, not seasonally adjusted. China is the worst trade deficit, as detailed above.

OPEC can be assumed to be oil and the OPEC nations are: Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, Venezuela.

The April figures show surpluses, in billions of dollars, with Australia $2.1 ($1.9 for June), Hong Kong $1.8 ($2.6), Singapore $0.7 ($1.2), and Egypt $0.2 ($0.1).

Deficits were recorded, in billions of dollars, with China $29.4 ($27.4), European Union $12.0 ($8.4), OPEC $8.4 ($8.5), Japan $6.8 ($6.0), Mexico $5.0 ($5.9), Germany $4.9 ($4.1), Ireland $2.6 ($2.6), Canada $2.1 ($1.5), Korea $1.9 ($1.1), Taiwan $1.5 ($1.2), Venezuela $1.4 ($1.0), and Nigeria $0.8 ($1.4).

Here is the BEA website for additional U.S. trade data, such as it is. May we suggest the Census make publicly available much more data so one can compare Apples to Apples, end use, NAICS and seasonally adjusted series.

You might ask what are these Census Basis versus Balance of Payment mentioned all over the place? The above mentions various accounting methods so we're comparing Apples to Apples and not mixing the fruit. The trade report in particular is difficult due to the mixing of these two accounting methods and additionally some data is seasonally adjusted and others are not. One cannot compare values from different accounting methods and have that comparison be valid.

In a nutshell, the Balance of Payments accounting method is where they make a bunch of adjustments to not count imports and exports twice, the military moving stuff around or miss some additions such as freight charges. The Census basis is more plain raw data the U.S. customs people hand over which is just the stuff crosses the border. The 2005 chain weighted stuff means it was overall modified for a price increase/decrease adjustment in order to remove inflation and deflation time variance stuff.

Bottom line, you want just the raw data of what's coming into the country and going out, it's the Census basis and additionally the details are only reported in that accounting format. Additionally the per country data is not seasonally adjusted so watch out trying to add those numbers into the overall trade deficit. It's a statistical no-no to mix seasonal and non-seasonally adjusted numbers.

Here is last month's trade deficit overview, data unrevised.

Recent comments