The Federal Reserve's consumer credit report for August 2013 shows a 5.4% annualized monthly increase in consumer credit, driven by student loans. Once again student loans increased, while credit card debt declined. Revolving credit declined by -1.2%, and non-revolving credit jumped another 8.0%. This is the third month in a row revolving credit has declined. Consumer credit matters due to personal consumption being the driving force in economic growth.

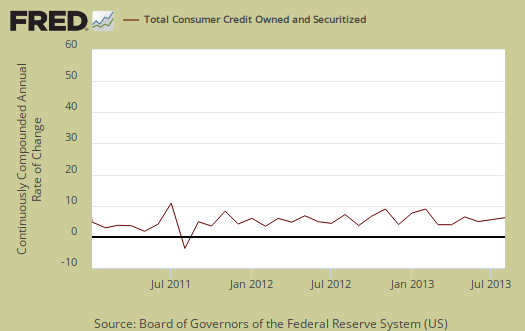

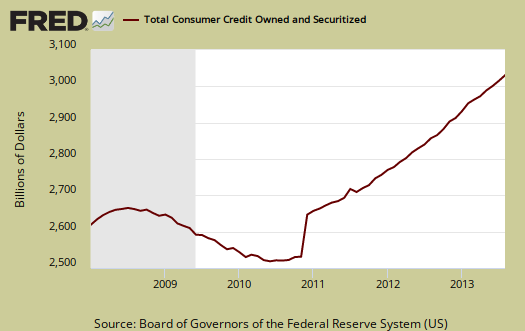

Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages, home equity loans and other loans associated with real estate are not included in this report. Overall consumer credit increased $13.6 billion dollars to $3,036.9 billion, seasonally adjusted. Revolving credit declined by -$0.9 billion, or -$10.6 billion annualized, to $848.9 billion while non-revolving credit is huge, $2,188.0 billion. Seasonally adjusted non-revolving credit increased by $14.5 billion, or $174.1 billion annualized. The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Consumer credit contractions correlate to recessions. The consumer credit report does not include charge offs and delinquencies. Graphed below is total consumer credit.

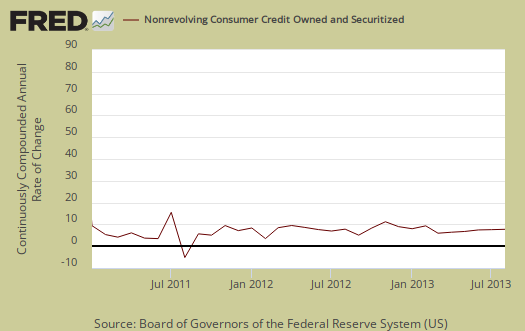

To get a feel for how much of non-revolving credit was student loans, unfortunately we must deal with not seasonally adjusted data for the report does not break down credit reported with seasonal adjustments. Not seasonally adjusted non-revolving credit increased $31.7 billion and has increased every month since August 2011. Subtracting the not seasonally adjusted Federal Government non-revolving credit, which primarily is student loans, we get a $9.8 billion increase in non-revolving loan debt. There was a $21.9 billion increase in Federal Government non-revolving credit, so sans seasonal adjustments, once again consumer credit was driven by student loans. Below is non-revolving credit, seasonally adjusted, annualized percentage change.

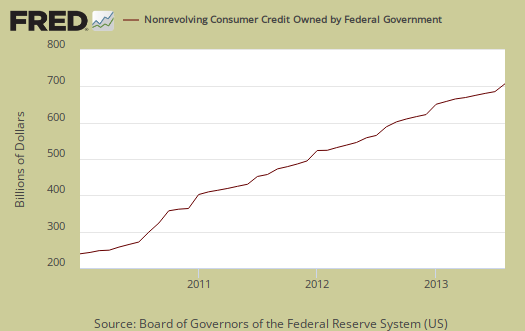

Federal government non-revolving consumer credit includes loans originated by the Department of Education under the Federal Direct Loan Program, as well as Federal Family Education Program loans that the government purchased from depository institutions and finance companies. In other words, Federal government non-resolving credit is student loans. If we take just the Federal government non-revolving credit, not seasonally adjusted we have a 46.3% annualized increase for the month. Taking the rest of non-revolving credit without student loans, we see a 8.2% annualized increase for August, not seasonally adjusted. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. Below is the not seasonally adjusted ballooning non-revolving credit held by the Federal Government, i.e. student loans.

Revolving credit, which is mainly credit cards, continues to decrease. Since the great deleveraging of the Great Recession, revolving credit has been fairly flat line Charge offs are not included in this report. Since most of America doesn't have enough money to make ends meet, when charge it! declines this implies there will be less consumer spending. Clearly there is a limit as to how much debt is offered to people with little to begin with and Wall Street relies on people using their credit cards at high interest rates to pay for basic living expenses.

Graphed below is the monthly revolving consumer credit annualized percentage change. The fact people are not whipping out Visa and Mastercard as much is actually a bad sign for economic growth, sad as that sounds. The reason is wages have not increased or even kept up with inflation, so to increase consumer spending implies an increase in consumer debt and thus credit card use and high balances imply people are buying more groceries and paying their electric bills with their credit card and that increased spending drives the economy. Sad, but true.

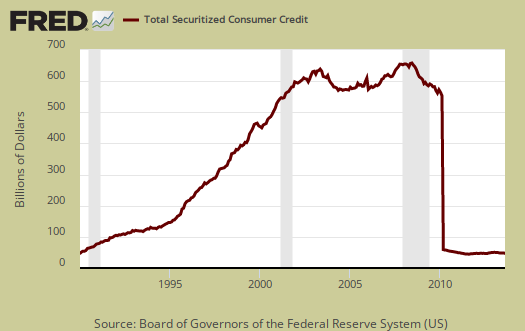

Now below is the pools of securitized assets, which is $48.3 billion. The Fed describes this category as:

Outstanding balances of pools upon which securities have been issued; these balances are no longer carried on the balance sheets of the loan originators. The shift of consumer credit from pools of securitized assets to other categories is largely due to financial institutions' implementation of the FAS 166/167 accounting rules.

They are off-balance-sheet securitized assets originated by all major holders and like much in Federal Reserve reports, not explained well, which is why we include them here for those actually reading the Fed's consumer credit balance sheet.

Below is commercial banks revolving credit.

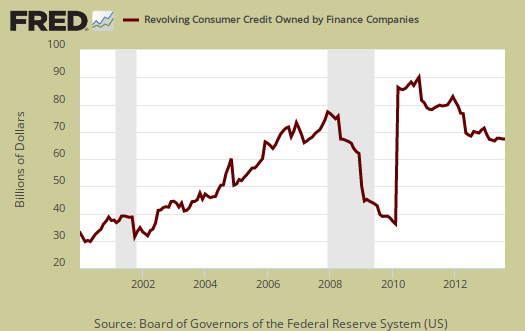

Below is revolving credit by finance companies.

Those 2010 "cliffs" on pools of assets and commercial banks graphs were the off the corporate books derivatives. They were brought back onto the liabilities book, via FSAB accounting rules changes in 2010.

Those in the press like to characterize debt as an increase in consumer spending and thus good for the economy. We somehow doubt crushing student loan debt has a stimulative effect to consumer spending or the economy since those funds go primarily to the schools as profits. It is clear student loans, not auto loans are driving the non-revolving credit increases, although the good news is auto loans are clearly growing as well, just not as much as student loans. Every month we see student loan debt just piling up and this month is no exception, yet a not seasonally adjusted 8.2% annualized increase in non-revolving credit sans student loans implies auto loans are increasing.

Additionally, the Fed loves to truncate as well as not give much detail on seasonally adjusted figures. Note the difference between seasonally adjusted monthly changes and the not seasonally adjusted ones. Student loans would clearly be seasonal with a large increase as the Semesters start, so while it is clear student loans are driving consumer credit increases, the timing and seasonality of this for the month of August is not determinable from what is publicly available from the Fed consumer credit statistical release.

bloomberg says it's auto loans

here's their headline: Consumer Credit in U.S. Rises $13.6 Billion on Car Purchases

and they also say: The boost to household wealth from improved home values and stock-market gains has put consumers in a position to take advantage of cheaper borrowing costs for major purchases such as automobiles.

i hadn't looked at the G-19 till just now...you're right, of course: of the unadjusted $31.7 billion increase in non-revolving credit, 69%, or $21.9 billion of it, was student loans from federal agencies

rjs

well, Bloomberg also said consumer credit was $3 billion

Switch on Bloomberg news and they claimed consumer credit was $3 billion in total. I'm not sure if they pay their reporters enough or they put people with backgrounds in economics on these stories or what goes on, but they all just "say something" and that "something" becomes their "fact" and this happens over and over again. Of any of the MSM who gets it right, probably MarketWatch and then often on the WSJ blog, but I cannot recall which blog at the moment.

There is only one caveat with the claim on student loans here and that's it is not seasonally adjusted, but still we see this figure increase every month so when a statistic consistently increases month to month and it is not seasonally adjusted, it implies new student loans are issued year round, not that cyclical.

It does appear auto loans have increased though, not to imply they are dropping.

Hey, that's why we make the big bucks (sic), but seriously, Bloomberg should hire us to cover economic statistics, they are really weak in this area of financial reporting (great investigative!)

do you know what this was about?

http://alfred.stlouisfed.org/graph/?graph_id=140841&category_id=0

zero hedge had post on it, but all they said was it's "merely the latest entrant in a long series of absolutely made up garbage" that Ben Bernanke slipped in to the data...

i've been looking around & couldnt find anything on it..

rjs

backward revision

I completely forgot about it over the infamous "auto loans" headline buzz. they announced the revision in April, see here. I missed this, my bad, but they added Perkins student loans which seemingly accounted for most of the revision.

I wouldn't call this made up since it's seemingly tabulating student loans more completely.

duh.

pretty dumb on my part for not noticing the revisions tab on the release...(i was using google)

likewise, zero hedge. too often they think unusual data is some kind of conspiracy.

rjs

better to be late than wrong my motto

Often this site is late in the publishing rush but I'd rather be correct than first. I think that's the issue over there, write first analyze later.