What would less government mean for you? Will you earn higher wages, be more safe, live a healthier life, have more financial security and be more free? The Republican mantra is: Less Taxes + Less Regulation = Less Government and more Freedom

The GOP likes to say they are for getting the government jack boots off our throats, as though most typical American citizens are being constantly oppressed by a tyrannical government in their daily lives. But yet, for over 200 years, people from all over the world continue to immigrate here — and by any means possible, sometimes risking their lives. Why?

When most Americans first wake up in the morning, are they dreading government oppression? Or are they dreading having to go to work for an over-demanding and unreasonable boss who barely pays them enough for food and rent? If so, then one example of "better" government (not "less" government) might be a government law to raise the federal minimum wage if their boss is too cheap and greedy to pay them a fair and living wage.

Would a good example of less government oppression and tyranny be to eliminate all speed limits, stop signs, school zones, crosswalks and traffic lights as they're driving to their crummy job?

Capitalism Requires Government: One of the most common and misleading economic myths in the United States is the idea that the free market is “natural” – that it exists in some natural world, separate from government. In this view, government rules and regulations only “interfere” with the natural beneficial workings of the market. Even the term “free market” implies that it can exist free from government and that it prospers best when government leaves it alone. Nothing could be further from the truth. In reality, a market economy does not exist separate from government – it is very much a product of government rules and regulations. The dirty little secret of our “free” market system is that it would simply not exist as we know it without the presence of an active government that creates and maintains the rules and conditions that allow it to operate efficiently.

If Americans really gave this some serious thought and asked themselves: "How is government [laws and regulations] bad for me and how is government good for me?" — many people might be surprised at how much better off they are WITH "government" — and that "better" government (not "less" government) is really what we need. After all, there's always room for improvement.

Yes, we are jealous and angry about smug government workers making more than us and getting much better benefits (pensions, etc.); but that's because they belong to labor unions — and most private sector workers no longer belong to a labor union to demand higher wages (to keep up with inflation) and to negotiate for better benefits (like retirement plans, vacations and paid sick days.)

And yes, there is fraud in government (just like there is in the private sector). And yes, we resent it when government workers take their jobs for granted, especially when so many of us are suffering with low wages, no benefits at all, and sometimes forced to work in part-time or temporary jobs.

The worse offenders would be, not typical government workers, but our politicians who go to work for corporate lobbyists after we vote them out of office — many times, the very people who work for the government and also berate "government". When you hear people saying, "Government is not the solution, government is the problem" — you usually hear it from a politician, who is part of the government and part of the problem.

So yes, we do need "better" government (and more honest politicians) — but not necessarily "less" government, people who actually do the people's work.

But at the same time, we shouldn't begrudge and envy government workers if they are better off than the rest of us; but instead, we should try to make our own working conditions, benefits and wages better by ALSO joining a union (Read my post: What Anti-Union Workers Should Know)

Since we need tax revenues to fund government and hire government workers (whether it's a good government or a bad government), here's a brief mention about the current tax code:

Even though the very wealthy pay much more in taxes than anyone else (because they make so much more than anyone else), as a "percentage" of their income, they pay less than the poor. One reason is because of the low tax rate on capital gains (where the very wealthy generate most of their income), and because capital gains isn't taxed at all for Social Security.

Most of the GOP tax plans want to lower the capital gains tax rate (even lower than it already is), or not tax capital gains at all. Also, most members of Congress refuse to eliminate (or even raise) "the cap" on Social Security taxes.

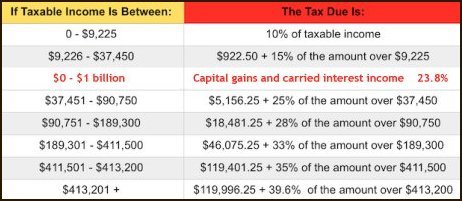

Below is the 2015 tax rates for individuals on wages (per Forbes). I added the capital gains tax rate for comparison. If you look at wage data from Social Security, and then compare it to the tax brackets above, it shows:

- About 64% of wage earners make less than $40,000 a year (most falling into the two lowest federal tax brackets.)

- About 95% of wage earners make less than $120,000 a year. I mention this because after the first $118,500 an employee earns ("the cap"), they no longer have to pay the 7.65% Social Security tax.

Now note that the 3rd lowest tax rate is for capital gains income (at 23.8%) — and capital gains income is not taxed at all for Social Security. But a neurosurgeon is taxed at 39.6% on income over $413,201 and pays tax for Social Security up to the first $118,500 — but a CEO, hedge fund manger, or investor making several million dollars a year with stock options or carried interest is only paying a 23.8% tax rate and pays no Social Security taxes at all on this income. If a CEO has a "base salary" of $0, they also pay no Social Security tax if their income is only derived from stock option grants and hidden in other benefits.

Now consider this: Because wages have been stagnant or declining for the past 35 years, most workers haven't also been able to contribute more in tax revenues to fund government and the Social Security trust funds. Stocks are UP, corporate profits are UP, but more and more workers are leaving the labor force due to a lack of jobs, and many of the new jobs are part-time, temp and on-call in our new "gig" economy. Meanwhile, the CEOs are raking in huge salaries, but paying less as a percent of their incomes to tax revenues.

Besides more tax cuts (meaning less tax revenues to fund any government, "good" or "bad"), the GOP also wants less regulation and less government workers. Soldiers in the military and police officers are the only government workers the GOP wants to increase. But this is what less tax revenues, less regulation and less government workers would mean:

Less auto and safety recalls; less people to clean up oil spills; less people to oversee food and drug safety; less people in inspect containers at ports and airports; less people to audit tax dodgers; less people to monitor safety conditions at work places; less people to inspect bridges, roads and railways; less first-responders at FEMA; less regulators at the SEC; less people overseeing medical and old-age facilities; less building inspectors; less people fighting wildfires in the northwest; less air traffic controllers; less inspectors investigating plane crashes; less government research; less people at the EPA testing the air and water (etc.) — and probably less speed limits, stop signs, school zones, crosswalks and traffic lights while driving to work — and probably less government workers at the DMV processing driver license renewals.

The GOP wants less regulation and less government, but just much less law and order when it comes to big business, but more soldiers and police to protect the interests of the rich from the heathen (everybody else.)

With a growing population (up 33% over the last 40 years), we don't need LESS government workers, we need MORE government workers to do the people's work. But there is also lot a fraud in government (like bank regulators being captured by the banks). So we also need BETTER government. Which means, we'll also need more oversight of government workers — which means, we need to hire more government workers to watch the government workers ;)

And to do this is, we need more tax revenues, which means we'll need to reform the tax code so that capital gains income (investment income) is taxed at the same rate as regular income (income from wages). But the GOP also wants to completely eliminate the tax on capital gains income too. So what does that tell you? Less taxes, less regulation, less government (and more "freedom") — but a lot more income inequality as well.

Meanwhile, our infrastructure is crumbling, government institutions and major corporations are being hacked, the Social Security trust funds are in danger, sequester has cut our military, (etc, etc, etc), — all because the GOP wants "less" government.

The next time a hurricane or tornado hits a Red State, where will they get the money for federal disaster relief? The next time one of their corporations wants to file bankruptcy or one of their banks needs a bail out, where will the money come from — the Social Security trust fund?

Now the GOP wants to build a wall on the Mexican border. Where will they get the money without either raising taxes on the rich or cutting government services for everyone else?

Pope Francis denounced "trickle-down" economic theories in sharp criticism of inequality. In his most authoritative writings as pontiff, Francis decried an “idolatry of money” in secular culture and warned that it would lead to “a new tyranny.” He strongly criticized an economic theory — often affiliated with conservatives — that discourages taxation and regulation:

“Some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naive trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting.”

Comments

Capital gains are double taxed and tax non-existent gains

Capital gains taxes apply to gains that aren't real. You pay tax on the inflated value of assets as the gain is not indexed for inflation. Income on the other hand is an absolute gain of dollars and the bands are indexed for inflation.

Companies can deduct wages from their taxes to avoid wages being subject to both the corporate tax rate and the personal income tax rate. Both dividends and retained earning that lead to capital gains are taxed at both the corporate level and the individual level.

This two things alone mean the rate has to be lower.

The next thing to consider is that taxing capital in the long term reduces the capital stock. The capital stock lets employees increase their productivity and hence their standard of living. Currently America is seeing no real standard of living improvement.

The capital gains rates has been put up twice in the last few years. Each time progressives conveniently forget the last raise. If things aren't good now then maybe it's because you raise the capital gains rate twice already? Federal reserve is saying the country still needs emergency rates at 0%?!?1

If you want capital gains to be taxed as income then allow inflation adjustment and get rid of corporate taxation.

Then you can have the joy of progressives in a REIT like structure. Heer you get to tax them at 39.6% + 3.8% which is higher than income tax rates.

Finally each Apr the government boot is on my neck as I submit at 50+ page tax return to the IRS. Takes months to prepare. No longer a problem for me though as I just quit working.

I'm not sure what you mean

I'm not sure what you mean when you say: "The capital gains rates has been put up twice in the last few years. Each time progressives conveniently forget the last raise."

The capital gains tax used to be near 40% before Jimmy Carter lowered it 28%. Reagan lowered it again to 20%, but then back to 28%. Clinton lowered it back to 20%. Then Bush lowered it to 15%. Obama extended those Bush tax cuts for 2 more years in 2010, until the capital gains tax rate went back to 20% starting in 2013 — but with the 3.8% surtax added under Obamacare (to expand Medicaid for poor single people without kids).

What do you mean when you say: "If you want capital gains to be taxed as income then allow inflation adjustment and get rid of corporate taxation."

If a CEO and his hand-picked members on the board all agree to pay each of themselves with stock option grants worth $1 million in 2015, and then a year later (after buying back $1 billion of their own company stock to increase the stock value of the remaining outstanding shares), and the stock shares for each company exec become worth $2 million, you're saying they should only owe tax on the first million that was given to them as "compensation" or "pay for performance" — and that they should not be taxed on the increase in value of the shares over one year before their gains are realized?

One more question: If we don't tax capital gains at all (as some have suggested), how will the government make up for the lost revenue? Or should we cut the federal budget more to compensate for the loss in tax revenues? And if you want to cut the budget, where do you suggest the cuts come from?

>I'm not sure what you mean

>I'm not sure what you mean when you say: "The capital gains rates has been put up twice in the last few years.

>Each time progressives conveniently forget the last raise."

I mean that there is an call to increase the taxes we just raise twice in the last few years.

>What do you mean when you say: "If you want capital gains to be taxed as income then allow inflation adjustment and get

>rid of corporate taxation."

I mean don't tax the corporation on money you will tax the person on later. I mean don't tax nominal gains only real gains.

>you're saying they should only owe tax on the first million that was given to them as "compensation" or "pay for performance"

You don't understand how stock options work. First stock options are earned income. So no capital tax treatment without filling to get that treatment. Second you don't tax the first million. Only option value over strike price is income at the time of exercise

What I am actualy saying on inflation is if I buy a stock for $100 and later sell it for $200 then I get a capital gain of $100. In the time I held the stock though. The present value of that $100 in the past was $130 because the government inflated the dollar then I should only be taxed on $200 - $130 = $70. India for example uses this much fairer mechanism.

Of course taxing capital is a mistake anyway but that's secondary to the calculations being theft.

>If we don't tax capital gains at all (as some have suggested), how will the government make up for the lost revenue?

The government already taxed it at the corporate level. The stock in a company is a share of the assets. So somebodies office is owned by the shareholder. That worker occupying that office generates income the government taxes as well.

>And if you want to cut the budget, where do you suggest the cuts come from?

All the places people get stuff for free. I have no love for the military either. There is never a plan to cut stuff only a plan to get cleaver about taxing.

You are confused

You are confused. You're information is just wrong. You also don't understand what a corporate tax, which, is officially 30% but an actual 17% and is 49th out of the top 50 wealthiest nations when it comes to tax revenue from corporations. We have that tax so we can have a much much lower payroll tax and still maintain income because we have one of the lowest payroll tax in the world because it makes it easier for small businesses to grow because we want free market competition...or capitalism does but republicans no longer do. Republicans now fight to merge banks they call to big to fail into even bigger banks so that...if the one bank was too big to fail, what the heck do you call this now? Its a laugh. Republicans are now CREATING monopolies. They want to protect monopolies in the state too when it comes to health insurance. Of course republicans think that when it comes to the health of the citizens of this nation that they should have to worry about the costs of that healthcare and the costs of health insurance as well. There are just some things that should be above profit in an advanced and enlightened society.

Also, we have no national sales tax, no luxury tax and the lowest tax rate on any import/export that isn't with a free-trade nation. Corporations also are provided services by the nation that they don't directly pay for. WHy should we help your corporation that just got hacked? Why should we help your corporation that just was defrauded? Why should we build roads so people can have better access to your facility...or why should we repave those roads? Your factory is on fire? Ok. Well, you are a corporation and not an individual by definition and law. Of course, we have some republican supreme court justices who could care less about the fact that a corporation by definition for legal protection is not a person but then when it comes time to give money to politicians, then they are individual people somehow. Don't you love your conservative supreme court justices? They really know what they are doing. Anyway, best of both worlds again for corporations. Do individuals pay taxes for themselves or for corporations that have factories in Vietnam? The truth is, without the government, corporations would fail. The people in your party not only want to get rid of the IRS but also the EPA, FEMA and the craziest of all, the FDA.

"So, you say this is pill is an antibiotic? Ok. I trust you. Wish there was a group that tested this stuff to make sure it is what the seller says and that if it isn't, I have some legal recourse. OH well, too bad there isn't an agency that does that with our drugs and food to make sure its safe."

And the fact that you are bringing inflation and deflation into this is just a joke. You wanted to be compensated for inflation? So why can we not all be? What about your house? Should you be able to sell that house for more than you bought it because of inflation? Oh geez...I bet you flipped out the first time you tried to sell your car. "What do you mean its value depreciated??!!"

You are a joke and so are your attempted arguments. Capital gains is how rich people stay rich off of the labor of others and when they may stock gains they pay a lower tax than everyone else but when they lose money on stocks they get to write it off on their taxes. No-lose situation.

And why? If you don't like this nation, go somewhere else. You will have less of a deal in India than you do here. So why don't you go to India? If you want to stay here, you should think about giving back. If you have enough money that you are worrying about the capital gains tax rate, you should shut up and give back to this nation that has afforded you the lifestyle you have.

I don't think so

I do not think you know what you are talking about. Capital gains is not double taxation and cannot even be manipulated to view it that way unless you are somewhat mentally impaired. When a person takes their money and purchases a portion of a corporation (That is what buying stock actually is) and then getting money from that corporation's profits with the amount of the dividends being based on how much of the corporation they own. Then, when they sell a stock that rose, say, 40% over the last 6 months, when they sell that stock for a profit, please tell me why paying taxes on new income is double taxation? Seriously, as someone who makes 100% of their money from capital gains, I'd love to hear you tell me why its double taxation. Thanks.

capital gains

Back in the day when capital gains taxes were much higher, the way companies and investors avoided or reduced their tax burden was to reinvest the money back into capital equipment, physical plant or R&D - basically investing in the future and creating jobs in the process.

by lowering the rate it only encourages profit taking, stock buy backs and asset bubble inflation

$7.6 trillion Hidden in Tax Havens

Research by Gabriel Zucman (a Tom Piketty protege) shows tax havens hide $7.6 trillion -- about 8 percent of the world’s net financial wealth. For individuals, he estimates at least $2 trillion held in Swiss banks is still undeclared by account holders to their home countries. Zucman’s calculations are conservative because he can’t count assets like art, jewelry or real estate. Those trillions were missing because they were showing up as shares of mutual funds incorporated in tax havens, primarily in Luxembourg, Grand Cayman and Ireland. His theory: wealthy investors around the world have used the investments, often made through Swiss bank accounts, to hide their wealth.

http://www.bloomberg.com/news/articles/2015-09-21/if-you-see-a-little-pi...

* Maybe the richer someone becomes, the greedier and cheaper they become.

Half says government is immediate threat

A recent Gallup poll shows almost half of Americans (49%) say the federal government poses "an immediate threat to the rights and freedoms of ordinary citizens".

This was similar to what was found in previous surveys conducted over the last five years. When this question was first asked in 2003, less than a third of Americans held this attitude.

The finding about these attitudes is how much they reflect apparent antipathy toward the party controlling the White House, rather than being a purely fundamental or fixed philosophical attitude about government.

http://www.gallup.com/poll/185720/half-continue-say-gov-immediate-threat...

The problem is not in our stars, but in our selves

The unfortunate part of this situation is that the people who fear and mistrust the government are generally speaking not all that different from the people in government who they loathe.

This is the reason most revolutions fail to improve the lot of those who live where they occur. At the end of the fighting, you get a new government which is peopled by those with the same world view as those they overthrew.

(The theme of the book "Animal Farm")...

I think in this case, it is true that people fear and distrust the current administration, to a greater extent than in the past. Perhaps this is due to the administrations aggressiveness is supporting the narrative of certain minority groups.

It is also true that we have an abundance of laws, and we regulate the lives of people in ways clearly contrary to what was intended when our constitution was accepted. I would like, like Dr. Paul, to be a strict constitutionalist. However, it seems to me that as a people we are in need of more limits than the constitution would allow.

When my father was a young man, he could go to Dodd's lumber yard and buy dynamite. As much as he wanted, provided he had the money. When I was a young man, we mixed ammonium nitrate fertilizer with diesel fuel to make explosives, which were useful (and rather fun). My mothers brothers took their guns to school, and leaned them up against the wall behind the teacher. Perhaps they could shoot a rabbit on the way home for dinner. None of these things caused much difficulty for anyone.

My son was going to make a potato gun for his science class, but due to recent legislation, was advised not to, as IEDs are not tolerated.

So while I wish (In my libertarian, constitutionalist fantasy) for a country where peoples wickedness was restrained, and few laws were needed, I must agree with John Adams, who observed "Our Constitution was made only for a moral and religious people. It is wholly inadequate to the government of any other." John Adams is a signer of the Declaration of Independence, the Bill of Rights and our second President.

So I think the Republicans are wrong, in that we need laws to restrain their greed, and insatiable desire for control over others. But we also need laws to restrain the immorality of their Democrat opponents, and their insatiable desire for control over others.

Poll shows voters want to FIX gov't, not CUT gov't

Global Strategy Group ran a national survey to rebut GOP calls for cutting the size of the federal bureaucracy. The results are interesting because they suggest voters care more about the power of special interests and mismanagement, rather than the size or scope of government. The poll shows that we need to make government work again for average Americans by reducing the corrupting influence of special interests and big money in politics. The Republican argument for smaller government is effective because it is simple and easy to understand, but it doesn’t deal with the root cause of frustration. Voters are in a "let’s-fix-it" mode, not a "slash-and-burn, cut-the-thing down" mentality.

http://globalstrategygroup.com/wp-content/uploads/2015/09/GSG-Compass_Se...

Where did all the teachers go?

The number of teachers and education staff fell dramatically during the recession, and has failed to get anywhere near its pre-recession level, let alone the level that would be required to keep up with an expanding student population.

Public education jobs are 236,000 less than they were seven years ago. For the number of public education jobs that should have been created just to keep up with enrollment, we are currently experiencing a 410,000 job shortfall in public education.

* Check out tier inter-active chart:

http://www.epi.org/blog/disappointing-jobs-numbers-and-not-enough-teachers/

LOOKS LIKE HILLARY DIDN'T BRING ENOUGH APPLES TO SCHOOL

Some teachers are resisting union endorsement of Hillary Clinton for president. Many are saying no — or at least, not yet — and calling upon their state leaders to resist a move by the president of the union representing 3 million teachers to endorse Clinton. The pressure has been intense enough to prompt some notable defections in the National Education Assn.

http://www.latimes.com/nation/politics/la-na-clinton-teachers-20151001-s...

Government Rules

This argument is not for the critical thinker. You have intentionally conflated the concept of "less government intrusion" with "no government at all" - such as " no traffic laws". It is also a mistake to suggest that only government can make rules, and enforce them. There are infinite rules in our society that are not enforced by goverment, including contracts, sports, neighborly behavior, etc.

Your emotional argument for minimum wage reads like " I don't want to go to work unless you agree to pay me more than the value I can produce. Therefore, I propose to use the guys with the guns and money (government) to force you to raise my wage."

Of course none of this matters. Once the Republicrats get in, they will protect their own interests by growing government empire.