A rebuttal to "Why Are Corporations Hoarding all that Cash?" (posted at Uneasy Money on October 31, 2014)

* Editor's Note: "Hint...the author says one reason is because "cash now held overseas would be subject to the 35% corporate tax rate on either dividends or stock repurchases, imposing a huge penalty on returning idle cash to stockholders."

The author is making the old argument of "double taxation" — such as why some people believe that a CEO's stock-option grants (paid as "performance pay" in executive compensation packages) should not be taxed for capital gains — because their corporation was already taxed. But taxes are usually imposed whenever their is a financial transfer from one entity (or person) to another (the exception being, a financial transaction tax on Wall Street brokers.)

The author might also believe that after an employer deducts taxes from its workers for federal, state, county and city taxes — and for Social Security and Medicare — that those same people should be exempt from ever having to pay any other taxes again (whether from a capital gain earned on the sell of a house, or when they purchase something).

Below are some excerpts from that article at Uneasy Money with a few of my notes:

A disproportionate share of the newly accumulated cash is in the hands of large companies, especially in the telecommunications sector, the most notorious case being Apple, whose hoard is reportedly close to 200 billion dollars.

What can a profitable company do with all that cash gushing into its coffers? Well, 1) it can just hold on to the cash, 2) it could invest in new plant and equipment, (we’ll come back to this in a moment), 3) it could go out and buy other companies, 4) it could pay bonuses to some or all of the employees (guess which ones) of the company, or 5) it could return the cash to the owners of the company by paying dividends or by repurchasing stock.

The most obvious explanation seems to be that firms don’t expect future demand at current prices to increase enough to justify such investments. A surge in corporate cash holding is an indication that corporate expectations about future demand are not very optimistic. Mildly pessimistic expectations about future demand are not inconsistent with high current profitability and rising stock prices.

I will not comment about why companies are not using their cash to buy other companies or to pay more and bigger bonuses to employees, but I do want to say something about why companies aren’t paying higher dividends to stockholders or buying back stock.

* Editor's Note: Is this author crazy? There have been a slew of multi-billion-dollar mergers and acquisitions. And these companies have been paying huge bonuses to their executive employees (and also in the form of stock options). And stock buy-backs are also at historic levels. Apple just bought back $17 billion in stock.

One reason that they are not increasing dividend payments is that dividends are not tax-deductible. The non-deductibility of dividends is a terrible flaw in our corporate tax code. (See this post about Hyman Minsky’s opinion of the corporate income tax.) It penalizes giving the owners of companies the ability to decide how to allocate their capital, locking up capital in existing corporations because capital gains are taxed at a lower rate than dividends.

Now it would still be possible for corporations with excess cash to repurchase stock, allowing stockholders to be taxed at the lower rate on capital gains instead of the higher rate on dividends. But for multinational corporations, there is another obstacle to returning cash to stockholders either by paying dividends or by stock repurchase: cash now held overseas would be subject to the 35% corporate tax rate on either dividends or stock repurchases, imposing a huge penalty on returning idle cash to stockholders.

* Editor's Note: But they do use excess cash to repurchase stock to pay the lower capital gains tax rate! And there's a huge difference between a "statutory" tax rate and an "effective" tax rate. Many of these multinationals have an effective ZERO tax rate!

So, instead of the cash being made available to millions of stockholders to spend or invest as they wish, creating new demand for output or providing capital to firms seeking new financing, the money is now effectively embargoed in corporate treasuries. What a waste.

* Editor's Note: A total lie...or the author is crazy. The money saved on untaxed dividends may or may not be reinvested — for lack of consumer demand — and why corporations have no need to reinvest. And so the extra cash from untaxed dividends might also be hoarded.

The entire post at Uneasy Money seemed like nothing more than an argument to lower taxes for the very corporations who have been paying record low taxes as a percentage of GDP since the 1950s — all while raking in record profits (with the DOW and S&P 500 closing at another record high yesterday.)

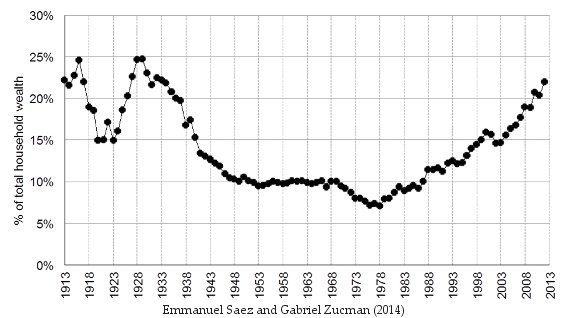

And income and wealth inequality has been increasing since 1979 (see the chart below), in part, due to the offshoring of manufacturing and the decline of labor unions. If anything, the business execs should be paying Social Security taxes on all their capital gains — and/or their capital gains and companies should be taxed to provide a Basic Income for all the people they're putting out of work (with offshoring, computers, automation and robotics) — when human labor becomes obsolete.

As it is now, these "job creators" have been over-working their employees for the past 40 or 50 years — literally killing many with increased worker productivity — but without sharing those gains with equally comparable wages. So if these businesses won't pay a living wage (creating more demand), then I say, "Tax the damn bastards!"

* Editor's Note: Read this new working paper by Emmanuel Saez and Gabriel Zucman (65 pages in PDF) titled "Wealth Inequality in the United States since 1913".

Recent comments