Michael Collins

The Associated Press ran an article Sunday that focused on the wasted funds during the US reconstruction efforts in Iraq. There were stories of an unused children's hospital, a prison for 3,600 that will never open, and the diversion of reconstruction funds to pay off Sunni fighters to turn on al Qaeda.

AP failed to mention that the main reason that we have to rebuild Iraq is that the United States government invaded it and destroyed everything it could in a display of shock and awe. Also unmentioned were the unique post invasion strategies of no security for sites like power plants that keep the country running and the dissolution of the 400,000 man army, the main institution that kept order in the country before the invasion. But I digress.

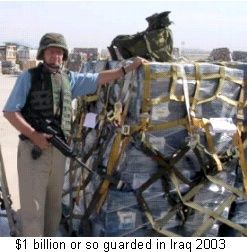

Anyone paying attention should know that financial controls and accountability went out the window from the very first days following the defeat of Saddam Hussein's military.

Recent comments