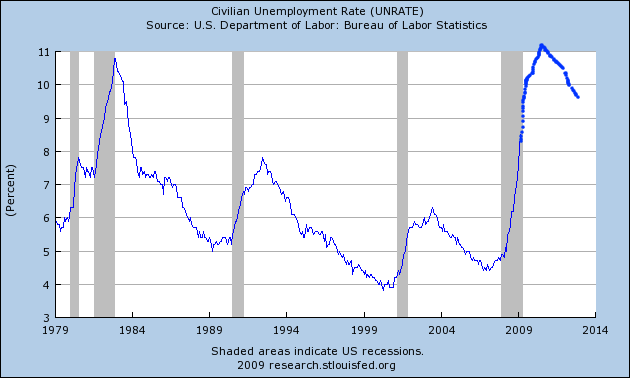

It is almost universally received wisdom that when the turn comes, we will have a "jobless recovery" where GDP turns up anemically, but unemployment stubbornly rises. Indeed the most controversial notion in some parts of the econoblogosphere is that of the "jobless recovery." as in, can it truly be a "recovery" if the number of jobless Americans continues to increase? Much moreso than dry GDP figures, wages and employment are what matter to the average American. I too have generally accepted the idea that any GDP recovery would be jobless, such that in April I made a graph showing what an unemployment spike will look like if the recession bottoms this summer, but a "jobless recovery" similar to 1991 and 2001 ensues:

Recent comments