Anyone find these economic stimulus packages put out by the government and the Federal Reserve ridiculous at this point? The reality is a direct jobs program would be much cheaper and much more effective to get the economy moving. Yet, magically that idea has been dismissed and worse since 2008.

Anyone find these economic stimulus packages put out by the government and the Federal Reserve ridiculous at this point? The reality is a direct jobs program would be much cheaper and much more effective to get the economy moving. Yet, magically that idea has been dismissed and worse since 2008.

Fire in the Jackson Hole - Bombastic Stimulus Claims

Federal Reserve Chair Ben Bernanke will do more quantitative easing. That's the consensus from his Jackson Hole speech. As usual, the utterances on labor are ignored by Wall Street or in this case, used to justify Wall Street's crack addict quantitative easing fix.

The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years.

Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.

Bernanke is justifying this action through various studies claiming quantitative easing generated jobs.

A study using the Board's FRB/US model of the economy found that, as of 2012, the first two rounds of LSAPs may have raised the level of output by almost 3 percent and increased private payroll employment by more than 2 million jobs, relative to what otherwise would have occurred

Two million jobs, really? Are those CEO jobs because each one cost $1.3 million!

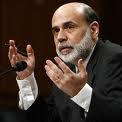

The astronomical sums from FOMC quantitative easing and operation twist actions are off the charts. Below is quantitative easing vs. the unemployment rate.

In 2007, the Federal Reserve held $790 billion in T-bills, agency debt and MBSes. Then, the quantitative easing bomb started to go off. Below is a summary time line of the Fed's bombastic easing activities.

QE1 - December 2008 to March 2010

"On November 25, 2008, the Federal Reserve announced that it would purchase up to $600 billion in agency mortgage-backed securities (MBS) and agency debt. On December 1, Chairman Bernanke provided further details in a speech. On December 16, the program was formally launched by the FOMC. On March 18, 2009, the FOMC announced that the program would be expanded by an additional $850 billion in purchases of agency MBS and agency debt and $300 billion in purchases of Treasury securities.

QE2 - November 2010 to June 2011

In November 2010, the Fed announced that it would purchase $600bn of longer dated treasuries, at a rate of $75bn per month. That program, popularly known as "QE2", concluded in June 2011.

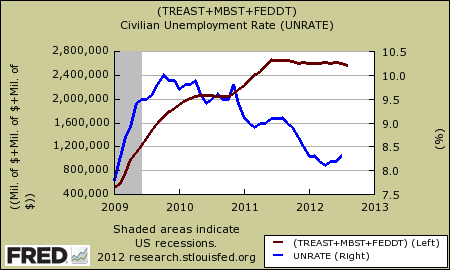

Operation Twist was all about increasing the Federal Reserve holdings more subtly. They bought first $400 billion, then in June 2012 purchased $267 billion more in long term bonds, those with maturities of six to 30 years. The Fed then sold that amount in short term Treasuries or those with maturities of less than three years.

Now the claim is quantitative easing creates jobs. Below is the breakdown of quantitative easing up which this claim is based.

To accomplish such a reduction, the Federal Reserve purchased about $1.25 trillion in agency MBS, $170 billion in agency debt, and $300 billion in longer-term Treasury securities over the course of 2009 and early 2010, with the purchases reflected in an increase in banks’ reserve balances held at the Federal Reserve Banks.

More recently, the FOMC announced at its November 2010 meeting that it intends to purchase another $600 billion in longer-term Treasury securities by the middle of 2011; in addition, the FOMC stated its intention to continue reinvesting principal payments on its asset holdings in Treasury notes and bonds, a policy first announced at the August 2010 meeting. Because of these actions, and taking account of earlier redemptions and MBS principal payments, security holdings in the Federal Reserve’s System Open Market Account (SOMA) are expected to climb to $2.6 trillion by the middle of 2011, with essentially all of these assets having an original maturity of greater than one year.

We haven't even gotten to other Federal Reserve Holdings, but suffice it to say the amounts are so massive, every U.S. citizen could have been won the Federal Reserve's mega millions jackpot and not come close to the tally spent by the Fed. The problem is, U.S. labor did not win the jackpot.

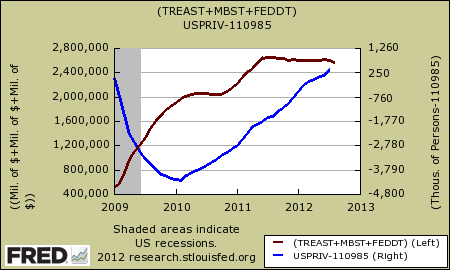

Since January 2009, the private sector only has a net gain of 332,000 payroll jobs. That's right, it's not 3 million, or 2 million, it's 332,000. If one takes the start of the recession, December 2007, the United States is still down 4.3 million private sector jobs. We're leaving out the government here because the claim is quantitative easing affects the private sector. Below is quantitative easing vs. the net change in private employer payrolls since January 2009.

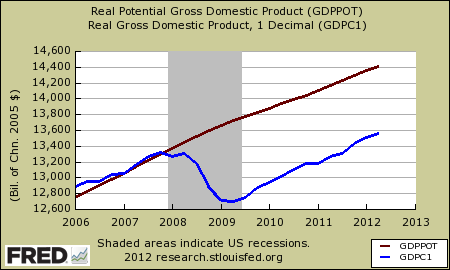

Bernanke quotes various research studies which claim quantitative easing increased national economic output by 3%, generated 3 million private sector jobs and lowered the unemployment rate by 1.5 percentage points. Below is the real output gap, as it currently stands, or the difference between potential and actual GDP. This is what kind of economic output we are getting instead of what we should be getting.

Quantitative easing also kept the U.S. from falling into deflation. This part of the effects of quantitative easing effects we can say are true, the rest, uh, not so much. The paper most cited by Bernanke is Have we underestimated the likelihood and severity of zero lower bound events? (pdf), published by, surprise, surprise the San Francisco Federal Reserve Bank with the analysis done by various Federal Reserve Governors. Here's what their models show and we'll skip the mathematics:

Phase 1 of the program by itself is estimated to boost the level of real GDP almost 2 percent above baseline by early 2012, while the full program raises the level of real GDP almost 3 percent by the second half of 2012. This boost to real output in turn helps to keep labor market conditions noticeably better than they would have been without large-scale asset purchases. In particular, the model simulations suggest that private payroll employment is currently 1.8 million higher, and the unemployment rate ¾ percentage point lower, than would otherwise be the case.

These benefits are predicted to grow further over time; by 2012, the incremental contribution of the full program is estimated to be 3 million jobs, with an additional 700,000 jobs provided by the most recent phase of the program alone.

Remember quantitative easing came about because the Federal Funds Rate was already effectively zero and FOMC had nowhere else to go in terms of stimulus tools.

Based on other simulations of the FRB/US model (not shown), providing an equivalent amount of support to real activity through conventional monetary policy—had it been possible—would have required cutting the federal funds rate approximately 300 basis points relative tobaseline from early2009 through 2012.

Now, here's the thing, we have esoteric modeling using Bayesian formulas, Taylor rules and all sorts of fancy advanced statistical methods. That said, there are many other elements affecting employment and GDP, including the trade deficit. Ignoring potential spurious conclusions from the Fed's econometric modeling, there is something seriously wrong with this picture. Where is labor as a demand generator, an economic output generator, and as a multiplier effect?

Never on the table is the simple stimulus idea of creating a direct jobs program. Simply hire U.S. citizens for jobs. A direct jobs program does the same stimulative thing, assuming the Federal Reserve models are correct and gee wiz, it's way cheaper. If you spend money to give people jobs and income, that increases economic output, increases consumption, stops deflation, increases payrolls, increases production and lowers the unemployment rate.

Hello! The problem is labor, yet U.S. citizens hires are considered a by product of economic activity, instead of the top focal point, the most important element of economic activity. In other words, what is an economy good for if the top priority isn't to provide work and income for the people who live in that economy? Really, let's get down to basics here.

Honestly, you can read through these various economic models, if you have the time and the advanced mathematics in some cases and nowhere is labor a primary variable. Uh huh. Stocks are, equities are, even GDP is, but people? Hell no, especially the American people, ya know, the citizens who make up this country. We are an after thought an effect, a consequence in most of these macro economic models. Nice huh?

We can spend $2.6 trillion bucks in U.S. treasuries and toxic derivatives known as mortgage backed securities, but use taxpayer funds or hell, print money to actually pay the people to work? Ain't gonna happen. Not on their radar. To be honest, the Federal Reserve cannot hire millions, cannot create a direct jobs program. Even quantitative easing isn't exactly the same as government spending, since the Federal Reserve controls the money supply.

The real culprit is Congress. Magically, they could give a $8,000 tax credit to buy a home, as well as cash for clunkers to buy a car. Yet a tax credit, or more importantly a refund, for private employers to hire additional workers and keep the ones they have? Nah, not on the Congressional radar.

Bernanke also played the blame game in his Jackson Hole speech. For example, here's the blame on the housing market:

I see growth being held back currently by a number of headwinds. First, although the housing sector has shown signs of improvement, housing activity remains at low levels and is contributing much less to the recovery than would normally be expected at this stage of the cycle.

Dear Ben, shouldn't that be wages? Shouldn't the Federal Reserve be blaming the housing market on wages and income? People earning a median wage of $26,000 a year cannot afford a $200,000 mortgage!

States have cut back and are on tight budgets and this is effecting the recovery. This is true generally ignoring crazy states like California, which spends approximately $11 billion a year on illegal immigrants. Laying off teachers, police, and fire fighters is not helping the U.S. economy and it sure doesn't help States' tax base later down the road, for these same laid off people pay state taxes.

Of course what would be a good speech without mentioning the fiscal cliff.

It is critical that fiscal policymakers put in place a credible plan that sets the federal budget on a sustainable trajectory in the medium and longer runs. However, policymakers should take care to avoid a sharp near-term fiscal contraction that could endanger the recovery.

Tight credit is also blamed by Bernanke. Yet who is gonna lend to people who do not have stable income? America has now suffers from disposable worker syndrome, which having your paycheck rug pulled from under you at any moment is not a good sign one will be able to payback debt long term.

Tight borrowing conditions for some potential homebuyers and small businesses remain a problem today

Hmmm, well, how effective has quantitative easing been for regular people? The of two minds site spells out the other effects on regular people in no uncertain terms.

1. What is the nominal yield on your savings account, thanks to the Fed's zero-interest rate policy (ZIRP)? (Answer: 0.25%)

2. What is the inflation-adjusted yield on your savings account? (Answer: - 2.25%)

3. What is the rate of interest the Fed charges banks for "free money"? (Answer: 0%)

4. What is the average interest rate for bank-issued credit cards? (Answer: 14.52%)

5. What is the interest rate for student loans? (Answer: 6.8%, and 7.9% or 8.5% for PLUS loans)

6. Does the Fed pay interest on the funds banks have borrowed from the Fed for 0% and then deposited with the Fed? (Answer: yes)

7. Exactly how has the average American worker benefited from the Fed's policies? (Answer: interest on credit cards has declined from 19.9% to 14.52%, if the worker has outstanding credit, which few of the bottom 90% do.) Theoretically, workers could re-finance their homes at lower interest rates, but the vast majority are either underwater or no longer qualify. Ben and the Merry Thieves love pulling Catch 22.

Bernanke said quantitative easing, or non-traditional Federal Reserve policies have a high bar:

The bar for the use of nontraditional policies is higher than for traditional policies.

We think not. The round about costs of round about policies which have round about effects to get people jobs are obscene. Obama's stimulus also did not enact a direct jobs program or have funds hire those with U.S. citizenship and keep the money in the country. In other words, Obama's stimulus was spending money, but was not true Keynesian economics, not by a long shot.

It is high time for a direct jobs program. We have a real unemployment rate of 17% with almost 28 million people needing a good job. This is the crisis! It is not GDP, banks, finance, regulation, Obamacare and any other faux pas issue. Unemployment is crisis of our time. Nobody is bothering to model Keynesian economic stimulus as the conditions of the theory require. In order to really stimulate a domestic economy, the money must be kept within that domestic economy and go directly into the pockets of workers. Yup, the additional spending by the government must go to the citizens that live in the nation. That's not Wall Street, investors, the banks, not the corporations, not the foreign interests, the special interests, but to us, the Populace. Direct employment programs work, just ask anyone who was involved with the WPA or CCC during the Great Depression.

This is the fundamental problem, the blind spot. U.S. labor is the economy. The economy is not Wall Street, hedge funds, the financial sector and even politicians. The economy is for the people and when you don't share the wealth, put U.S. labor first and foremost, not only in consideration, but also labor's effect in macroeconomic models, this is the kind of crap we get. Round about astronomical spending which might help hire some people as an afterthought. Come on Economists, here's the variable you are missing, it's called L for labor. We're not an expense, we are the economic creation engine.

Comments

QE is a tax

QE removes interest income from the economy. Randy Wray claims QE sucks about $400 billion a year out of the economy, in reduced interest payments.

http://www.economonitor.com/lrwray/2012/08/01/more-qe-libor-bond-vigilan...

So QE not only fails to create jobs, it may be killing jobs.

Agree that direct job creation would be better.

models

I purposely did not go into the various simulations and models used to support these Fed QE claims, they ain't a "10 minute read". That said, it appears the inputs ignore savings, interest, dividends as input variables. Aggregate hours worked is there but unless my quick study missed something, seems to be more of a correlation versus a final result output variable.

I have a direct link to the main quoted paper for this reason. I'm none too thrilled either at measuring real GDP by the change in the price index, which appears to be what's happening. They also seem to be using the correlation of QE to a negative Federal Funds Rate.

So, there are a lot of scalar fudge constants I see and ratios, correlations to other macro economic elements.

For example, labor arbitrage, i.e. offshore outsourcing and bringing over foreign workers to displace U.S. workers won't even be recognized by the BLS so those effects won't be considered under Okun's law as a ratio, just as an example.

I haven't studied the Fed tools and models enough to be an expert, but I sure can see $1.3 million per job is obscene and we keep seeing this over and over. If the government just literally handed people even $40k a year, free and clear, it would have been cheaper and that's not even requiring work for the money exchange.

QE helps the banksters' drug habits - so those are some jobs

Come on, without the Fed loaning our money out to banksters at 0%, how else could banksters get their coke and women? Be fair! Do you really expect these banksters to pull their kids out of Harvard, or Dalton, or Choate, or cancel a Labor Day weekend in Paris? What are you, a Communist or Socialist or even an educated American? Praise the oligarchy in all its wealth. Rupert Murdoch just told me during a private phone call he was hacking that I should stop my criticism otherwise he would pay the police to stalk me, and now I know he was right, banksters rule.

Trust the banksters, they keep telling us they are the best and brightest, and given their track record (besides their repeated failures in the billions-trillions of dollars and endless criminal activity) who are we to doubt them?

If you don't give Dimon free money and other primary dealers through QE 1-99, they won't be able to bet $2+ billion dollars on a coin flip aka swap trades. Why, even Jon "I like to commingle and steal $1.2 billion from farmers" Corzine enjoyed primary dealer status at MF Global. Without free Fed money, who's going to cover bankster severance packages when Barclays' employees get fired for fixing LIBOR? Sure, Barclays is British, but only the Fed can make secret international loans with taxpayer money to foreign banks. What, you thought America's Third Estate mattered? Nope. Banksters need that money, it's been proven that TARP and QE help create jobs for drug couriers and professional women (yeah, exactly). And besides, don't some of those very banksters do business with Iran and Cuba and drug cartels? Do you think it would be fair if banksters couldn't buy coke from the same cartels they are laundering money for with Fed money? Come on, that wouldn't be very friendly of them. And Romney and all the others are beating the war drums against Iran. So, the more we help out banks that help arm Iran, the more jobs Romney and others will create when we take on our enemy. Kind of like Rumsfeld. See Iraq needs our help - 10 years on, see Iraq is our enemy and now we can try to beat the same military we helped arm! Fantastic! Just make sure your memory is very, very short. Otherwise that might seem quite puzzling. Jobs when we arm them, jobs when we fight them.

The Fed is looking out for us, I'm sure of it. Why just the other day Bernanke and Congress and the President themselves left their bubbles and elite retreats and sat down with America's long-term unemployed and talked to them for weeks and weeks to find out how to help the Third Estate (America's 99%). Just kidding, Jackson Hole and Davos are secure and remote for good reason - who wants to meet the people you supposedly represent - I mean why would Louis XVI ever want to meet the peasants, the French monarchy could never fall and those starving, dirty peasants that happened to feed the entire country were just a nuisance to Versailles, right?

Obsession with the Fed shows how false "free market" is

In what true capitalist system with free market economics and the "invisible hand" would so many people scrutinize everything the Fed does or doesn't say? Adam Smith didn't envision this scenerio no matter how many times someone reads him. Bad economic stats are good because it means more QE? Madness. Good economic stats are bad? or good? because no QE? I think it started with "Mr. Kermit the Bubble Creator" Greenspan and politicians reading brilliance into his idiocy/"musings." Anyone that cared saw the Emperor had no clothes. Politicians wanted to believe he was some sort of genius when everyone knew he was busy helping build massive bubbles through housing, derivatives, and the complete deregulation of the financial markets. And it continues with Bernanke. With algos running the market and hedge funds and other banksters piling into the same stocks, of course Bernanke must do whatever it takes to keep those who feed at the Fed trough happy. If that means QE3, so be it. If it means ZIRP until 2018, so be it. Look at all the fake "free marketers" on CNBC and Bloomberg. They sure do love that central planning and banking when it suits their paydays and stocks at the expense of savers, inflation, and the unemployed labor force, don't they? Again, the Fed is supposed to have an average citizen on the Board to make sure we are represented, but where is he/she? Bernanke is looking forward to leaving and joining Goldman or JP Morgan in the near future, you can't do that if you piss off potential employers when they demand more free money from the Fed.

They turn to the Fed because Government is corrupt, incompetent

We were all over the Stimulus and boy were hopes dashed quickly. Politicians just gave more favors to big business, enabled offshore outsourcing with taxpayer funds, did an absurd amount of tax cuts, when the multipliers just do not add up for the expense, and plain refused to give the most "bang for the buck".

All of this basically reduced the "multiplier effect" and why it turn into "spending money" instead of true Keynesian.

Right, no doubt about it the affect of further expanding the monetary base is Wall Street's crack and clearly they don't need more stock market profits. I'm positive we do not need commodities, esp. oil and food to increase in asset price.

This article basically says "wrong prescription" for the problem is the lack of regulations on the financial sector and #1 the lack of good jobs, stable jobs.

My issue is this fundamentally isn't the Fed's job, it's this government and Congress. Ignoring our corrupt Democrats who blew it and thus their power, we have the crazy GOP trying to claim up is down and left is right in their agenda.

Those automatic budget cuts coming, i.e. the fiscal cliff will probably throw the U.S. into another recession, two quarters of negative growth.

That entire "free market" bogus crap has been proven time and time again. Hey, "free markets" generate extreme poverty and there is no such beast as well.

Easy Money for Wall Streeters, No real Job Stimulus

It's not going to take much longer before what is happening becomes so obvious that real people take to the streets for action.

Your summation here is so well written it needs to be showcased.

"This is the fundamental problem, the blind spot. U.S. labor is the economy. The economy is not Wall Street, hedge funds, the financial sector and even politicians. The economy is for the people and when you don't share the wealth, put U.S. labor first and foremost, not only in consideration, but also labor's effect in macroeconomic models, this is the kind of crap we get. Round about astronomical spending which might help hire some people as an afterthought. Come on Economists, here's the variable you are missing, it's called L for labor. We're not an expense, we are the economic creation engine."