The key monthly release of the past week was on Personal Income and Outlays for August from the BEA, which gives us the first look at personal consumption expenditures for the month, which as we know has been the critical component of GDP during the recovery. This report also includes data on personal income and disposable income after taxes, total personal savings and the national savings rate, as well as the price index for PCE, which the inflation gauge the Fed targets. A footnote tells us that the income data in this report reflects revisions from January to March due to the inclusion of the recently available first-quarter wage and salary data from the BLS...

Overall, this month's report shows an improvement from recent months, although it's a source of some confused misreporting in the press. The BEA opens by telling us seasonally adjusted personal income for August increased by $57.2 billion, or 0.4 percent over July's level; however, what their news release fails to mention is that the $57.2 billion is an annualized figure, which means that August’s personal income gains, if extrapolated over an entire year, would increase annual personal income by $57.2 billion from $14,131.0 billion to $14,188.2 billion. In a similar manner, annualized disposable personal income (DPI), or income after taxes, increased by $56.2 billion to an annualized $12,522.8 billion, which was a 0.5% increase over July's DPI, making August income increases the largest since February.. And unlike last month, when incomes from wages and salaries reported fell at a $15.3 billion rate, income from private wages and salaries increased at a $28.5 billion rate in August. Even wages and salaries from government jobs increased at a $2.0 billion rate in August, in contrast to a decrease of $7.6 billion in July, despite being reduced by $7.3 billion in August and $7.7 billion in July due to sequester related furloughs. Business proprietors incomes also rose by $5.0 billion in August, compared with an increase of $2.3 billion in July, and farm owners incomes we up at a $7.9 billion rate. In addition, personal rental income increased $7.6 billion in August, while personal income from receipts on assets (interest and dividend income) decreased $4.5 billion, in contrast to an increase at a $13.6 billion rate in July.. Although rental income and dividends account for less than 10% of all income, they have accounted for 25% of the increase in all earnings over the last 4 years...

Personal consumption expenditures (PCE) increased 0.3% in August and were up at an annual rate of $34.5 billion to an annualized $11,528.8 billion; of that, spending for durable goods increased at a $6.7 billion rate to $1,274.4 billion, and spending on non-durables was down by $0.5 billion to an annualized $2,635.1 billion, while spending for services was up at a $28.3 billion rate to a $7,619.3 billion rate. Total personal outlays during August, which includes interest payments, and personal transfer payments in addition to PCE, increased by an annualized $38.4 billion to $11,942.2 billion, which left personal savings, which is disposable personal income less total outlays, at $580.7 billion for the month, which was the largest monthly savings this year. As a result, the personal saving rate, which is personal savings as a percentage of disposable personal income, was at 4.6% in August, up from 4.5% in July and the highest savings rate since May..

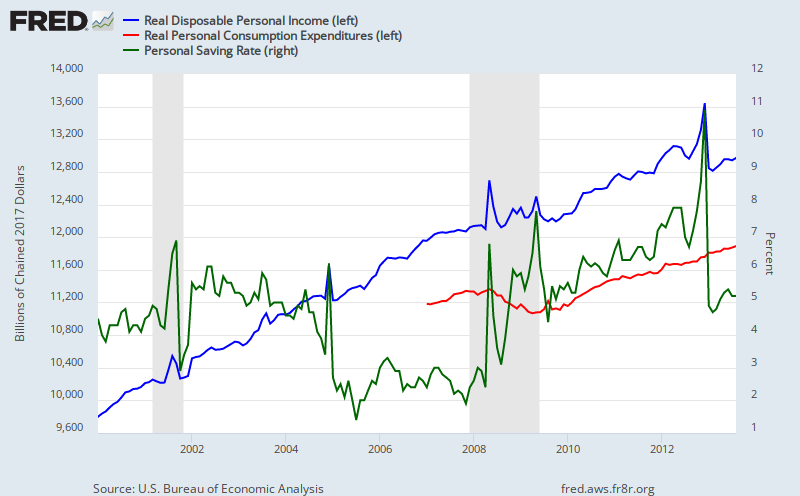

The price index for personal consumption expenditures, based on 2009 = 100, was at 107.423 in August, nominally a 0.1% increase from July's 107.276 reading; the core PCE price index, which removes food and energy, was at 106.131, up 0.2% for the month. The year over year change in the headline PCE price index works out to an increase of 1.15%, and the year over year Core PCE price index, which the Fed has targeted at 2.50%, is at 1.23%, 0.1% higher than last month's 1.13% year over year level.. As a result, real disposable personal income, which is DPI adjusted for PCE inflation, increased 0.3% in August, after being up 0.2% in July. Real PCE, which is personal consumption expenditures adjusted for inflation using the PCE price index, increased 0.2% or $17.5 billion annualized in August, after being up 0.1% or $7.2 billion in July. Thus for the 3rd quarter to date, real PCE has increased at a $24.7 billion rate, or at a 1.4% annual rate, which indicates a weak contribution to 3rd quarter GDP. Our FRED graph below shows monthly real disposable personal income in blue and real personal consumption expenditures in red since January 2000, with the scale in chained 2009 dollars for both on the left; also shown in green is the monthly personal savings rate over the same period, with the scale as a percentage of DPI on the right. Although it may appear from the graph that real disposable income has been accelerating over the past 13 years, real DPI below is not adjusted for increases in the population…On a per capita basis, real DPI is up just 18.3% over the span of this graph. And we already know the lion’s share of that has gone to the rentier class…

(cross posted at MarketWatch 666)

Comments

PCE/GDP

I didn't cover either this month for the 3rd revision to GDP is minor and PCE was the same sluggish spending with the same sluggish income.

I'm getting sick of PCE too for it doesn't show that most of the income gains are to the super rich, not regular people.

2nd quarter PCE deflation

i did a sketchy coverage of the GDP reviision; as you say, not much changed...however, the deflator for personal consumption expenditures, which the Fed has targeted at 2.5%, now actually fell at a annual rate of 0.1% in the 2nd quarter, rather than unchanged as previously reported...

rjs

After seeing unfunded pensions counted as income

Plus the goal to count offshore outsourcers as manufacturing and intellectual property, most likely parked in SPVs in the Caymans as U.S. economic growth, I am completely disgusted in reviewing these economic reports.

See a pattern? We're getting further and further away from the truth of the U.S. economy and what is really going on.

That was the big news of the PCE, the declining inflation figures, good catch and so glad you took up the slack as I stood down just well, disgusted!