In Part I of this series, I examined the 1992 best seller entitled "Bankruptcy 1995", which had predicted that the US would become unable to service its national debt as early as 1995 due to soaring budget deficits. So dire and well-documented was the warning that it affected the outcome of the 1992 presidential election, helping to elect Bill Clinton. In light of new looting of the national treasury by George W. Bush and the Republican Congress, I re-read the book to see if any of its predictions were now coming true. I posted those predictions, and the book's thesis that continued budget deficits would drive up interest rates and lead to "Death by Hyperinflation" or "Death by Panic" in Part I.

But "Bankruptcy 1995" obviously didn't happen, in spite of the fact that deficits have continued to be run nearly every year since then. Only part of the reason was the fiscally responsible Clinton tax and budget plan that began in 1993. In this diary I examine how a long-term, continuous decline in interest rates has actually reduced the carrying costs of the National Debt, and why that means the sky Hasn't fallen -- yet.

[Note: This is an update of a diary originally published at the Big Orange Political Blog about a year ago]

"Bankruptcy 1995" completely misjudged the secular decline in interest rates

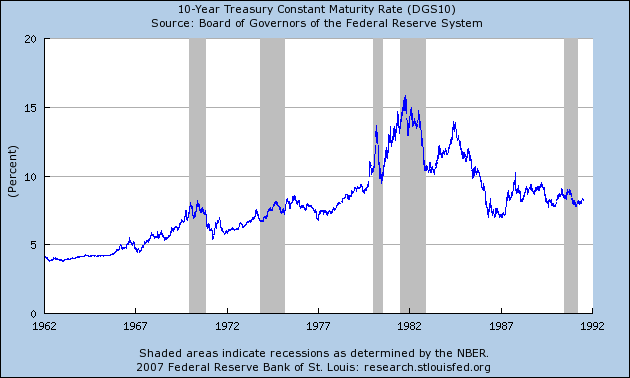

"Bankruptcy 1995" was based on interest rate projections made in 1986. Those projections proved quite accurate through 1991. When the book was published, the most recent data suggested that, despite a decline in the late 1980s, the long term trend was still for interest rates to continue to increase, as shown in the below chart of 10 year bonds through June 1991:

Based on this data, and their debt and deficit projections, the authors expected interest rates on the national debt to rise significantly in the 1990s, hitting 21% in 1993, 30% in 1994 and rising thereafter until the economic system collapsed.

In fact, we now know that interest rates began a long-term, secular decline in 1981, a decline that has lasted until the present day. Here is the same chart of 10 year Treasury bond yields, from 1981 to the present, showing that long-lasting and continuous decline in the interest that must be paid on 10 year government debt :

The result: far from rising in the 1990s, interest rates on long term bonds declined from about 10% to under 5% by the year 2000.

Declining interest rates have reduced tremendously the cost of carrying the National Debt

By completely misjudging the future of interest rates, the authors similarly misjudged the impact of deficits and the national debt upon the economy. Far from presaging gloom and doom, those ever-declining interest rates made it easier and easier to sustain deficits and to service the national debt.

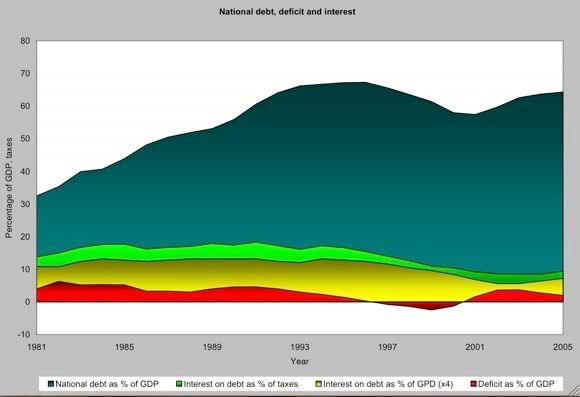

Below is a graph I prepared over a year ago demonstrating the amazingly positive impact lower interest rates have had on carrying costs for the national debt. The blue area is the national debt as a percentage of GDP; the green area represents the amount of interest that has had to be paid each year on the interest on the debt as a percentage of taxes collected; the yellow area is that same interest payment shown as a percent of GDP (enhanced 4x to more easily show the trend); and the red area designates the yearly budget deficit/surplus as a percentage of GDP:

This graph demonstrates that, although the National debt was approximately 65% of GDP as of 2005, close to its 1995 high of 67.2%, due to declining interest rates, the percentage of taxes which must be devoted to interest payments on that debt actually declined from over 18% in 1991 to only 8.5% in 2003! As a percentage of GDP, interest payments went from 3.3% in the early 1990s to a mere 1.4% in 2003.

Deficits as a percentage of GDP in George W. Bush's term, peaking at 3.7% of GDP in 2003, also are not nearly as much as Ronald Reagan's deficits of up to 6.3% of GDP in the early 1980s.

Also, notice the time lag of 2 to 3 years from changes in fiscal policy under Clinton and then under Bush 2 to their appearance as higher or lower percentages of debt and interest on this graph.

UPDATE: In the year since this diary was originally published, the National Debt has grown to 67% of GDP. Since all sorts of bailout funds and stimulus packages are being appropriated, that number looks certain to continue to grow. Even if the next Administration mimics the Clinton tax increases, it will be several years before the growth of the National Debt as a % of GDP peaks, perhaps as high as 70%, a post-WW2 high!

Sadly, far from incurring massive new deficits in a tax giveaway to the wealthy, this decade with its low interest rates was a once-in-a-lifetime opportunity to pay down the National Debt which all but the very young among us are unlikely to ever see again.

Why, in the face of increasing debt, did interest rates decline?

While examining the cause of interest rate declines is somewhat of a diversion from the main thrust of this diary, some explanation is clearly in order. Essentially, there are 2 intertwined causes for the long-term decline in interest rates in the US: (1) the effects of globalization on wages and inflation; and (2) investment in US bonds by America's trade creditors.

Federal Reserve Governor Donald L. Kohn addressed the globalization issue in a speech in 2006:

Although inflation is ultimately a monetary phenomenon, it seems natural to expect, as others have argued, that these developments would have exerted some downward pressure on inflation in the United States.....

.... [T]he existing research does highlight several channels through which globalization might have helped to hold down domestic inflation in recent years. These channels include the direct and indirect effects on domestic inflation of lower import prices, a heightened sensitivity of domestic inflation to foreign demand conditions (and perhaps less sensitivity to domestic demand conditions), downward pressure on domestic wage growth, and upward pressure on domestic productivity growth.

I will start with the import price channel.... In the reduced-form model that I’ve just described, the effects of import prices on inflation show up quite clearly; furthermore, the estimated effects appear to have increased over time, with the increase apparently stemming primarily from the upward trend in the share of imported consumer goods in household spending.... [T]he direct and indirect effects of this decline in the relative price of imports held down core inflation by between 1/2 and 1 percentage point per year over this period, an estimated effect that is substantially larger than it would have been in earlier decades....

A second hypothesis is that increases in global capacity have held down U.S. inflation in recent years by limiting the ability of U.S. producers to raise prices in response to increases in the domestic costs of production.... With regard to the first test, we do find evidence that the coefficient on the unemployment gap has fallen in the United States. In particular, the coefficient from a model estimated over the past twenty years appears to be about one-third lower than when the model is run over a forty-year period.

Similarly, the evidence that globalization has helped to restrain unit labor costs in recent years is mixed. ....[S]ome cross-section studies have found a relationship between industry wage growth and import penetration, while the research on wage inequality tends to relate some of the relative decline in wages of low-skilled workers to trade, although in both types of studies the effects are generally relatively small. Similarly, research from the Federal Reserve Bank of New York shows a modest relationship between exchange rate fluctuations and wage growth, with larger effects evident for the wages of lower-skilled workers.

A second possibility is that globalization has restrained unit labor costs by raising productivity.... [R]esearch at the Board finds that multinational corporations, which may have the greater opportunities to realize efficiencies by shifting production locations, accounted for a disproportionate share of aggregate productivity growth in the late 1990s. And some microeconomic studies have found a relationship between global engagement and productivity at the firm level. Thus, it seems possible that the persistently high growth rates of multifactor productivity in recent years may partly be due to the productivity-enhancing effects of globalization.

Ironically, the second cause of lower interest rates is the other towering deficit which. perversely, ameliorated the effects of chronic budget deficits and caused increase rates to decline: the trade deficit. Since about 1970, not only has the US run budget deficits, but trade deficits as well. The below graph shows just how dramatically those trade deficits have grown:

When we run a trade deficit, we ship dollars overseas (in the old days of the gold standard, actual gold bullion would have to be shipped! Now we just electronically transfer greenbacks.). In essence, the inflation we would have felt in the US got shipped overseas and has been reflected in the increasing wealth of our trading partners, most especially, China. Those foreigners must do something with the dollars we ship them. Since for example, China would rather maintain their own currency's devalued status relative to the dollar, and thus their own economic and employment booms, our trading partners for a long time were willing to invest their ever-increasing surplus of dollars in US Treasury bonds (although in the year since this diary was originally written, many such countries have turned to Sovereign Investment Funds in an effort to buy assets and companies rather than passively invest in their bonds). When more and more dollars sought out investment in US Treasury bonds, the demand for those bond surged, and the interest rates paid on those Treasury bonds plunged. Thus, at least up until recently, our fiscal profligacy not only did not cause an increase in domestic interest rates, but rather an actual decrease in those interest rates.

In short, the fundamental error of the "Bankruptcy 1995" scenario was that, so long as our creditors are willing to re-invest their gains in the IOUs we continue to sell, US insolvency can never happen.

The long-term decline in interest rates may be ending

At some point, even the most credulous of creditors begins to get the feeling that their biggest debtor might possibly never break their spendthrift habits, and may possibly never pay them back in full, or may pay them back with devalued assets. At that point, the creditor begins to demand more stringent terms -- and those translate into higher interest rates.

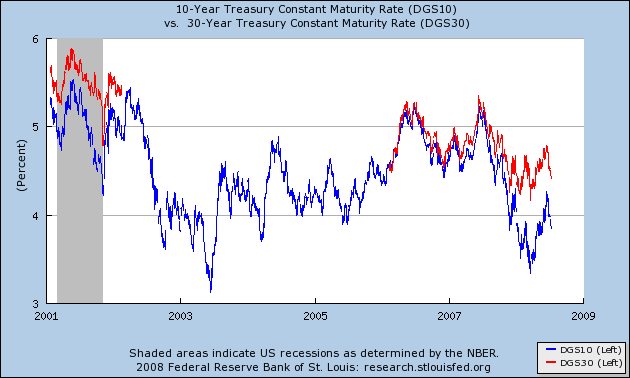

There is some evidence that, ever so slowly, that has begun to happen. After over 20 years of decline, the 10 year Treasury bond has failed to make a new low in yields since June 2003, and the trend since then has actually been if anything towards higher interest rates:

Additionally, the percentage of taxes that must be devoted to interest payments has risen again from its 2003 low of 8.5% to 9.4% in 2005 (and has probably risen more since); as a percentage of GDP they have risen from 1.4% to 1.8% in 2005. And Donald L. Kohn, in his speech quoted above, indicated that in the last several years, as wage rates in places like India have improved, their own inflation is accelerating and may start to become reflected in US inflation via increased import prices. As demonstrated in a graph in MidtownG's most recent diary, that has indeed begun to happen since 2006.

If declining interest rates have been Uncle Sam the debtor's best friend, what happens if interest rates no longer declilne, as seems likely to have already happened, or even worse, begin to rise on a long-term basis? A vicious cycle will ensue, making "Bankruptcy 2015" or a variant thereof a a significant possibility.

Recent comments