The Durable Goods advance report for March 2010 was released yesterday and showed a -1.3% decrease for new orders. Just like last month, the report (original on Census.gov), was driven by non-defense commercial aircraft & parts, which plunged in new orders, -67.1% in a month. As mentioned previously, air-o-planes and such are huge, big ticket items and also something not ordered every day, so the below will look at the overall report, trying to remove this volatile metric.

Below is new orders minus the volatile aircraft. New orders, excluding transportation (nondefense air-o-planes), was up 2.8% overall. Yet, remove Uncle Sam and new orders are still down, -1.2%.

New orders for manufactured durable goods in March decreased $2.2 billion or 1.3 percent to $176.7 billion, the U.S. Census Bureau announced today. This decrease followed three consecutive monthly increases, including a 1.1 percent February increase. Excluding transportation, new orders increased 2.8 percent. Excluding defense, new orders decreased 1.2 percent.

Transportation equipment, down two consecutive months, had the largest decrease, $5.9 billion or 12.9 percent to $40.2 billion. This was due to nondefense aircraft and parts which decreased $6.5 billion.

Shipments increased 1.2%, unfilled orders decreased -0.3%, with our friendly air-o-planes causing a -1.1% decrease in unfilled orders.

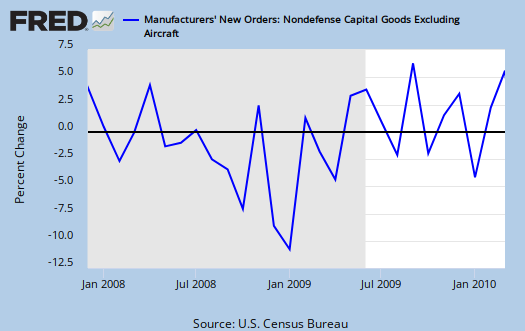

Ok, what part of lukewarm report don't people understand? Contrary to CBS MarketWatch claiming capital goods is roaring, in the private sector, we have a decrease of -7.5%. Even in defense capital goods, there is a drop of -4.0%. With defense counted in, new orders in capital goods dropped -7.0% from February 2010. It's only in the private sector, discounting transportation (air-o-planes again), is there a 4.0% increase in nondefense capital goods new orders. I wouldn't call 4.0% that roaring, even with the aircraft plunge factored in. Below is manufacturing new orders, capital goods, minus defense and aircraft (transportation), which is the monthly percent change during this recession. As we can see the monthly change in this metric is one of the highest but even in this recession, not the highest swing! The second graph, at the top of this post, which gives absolute new order totals, also shows how off private manufacturing capital goods new orders, minus aircraft, is from pre-recession levels. So, while it is important to try to smooth out durable goods and remove the volatility of defense and aircraft, come on, give me a break, this isn't implying the kind of blockbuster growth the U.S. needs to create 5.1 million jobs or anything.

Nondefense new orders for capital goods in March decreased $4.6 billion or 7.5 percent to $56.1 billion. Shipments increased $1.4 billion or 2.4 percent to $59.0 billion. Unfilled orders decreased $2.9 billion or 0.7 percent to $409.1 billion. Inventories decreased $0.5 billion or 0.4 percent to $132.1 billion.

Capital goods is the stuff businesses buy to make more stuff. In the case of Defense, it's stuff to make more war (sorry, but it's a business!)

Here is the definition of capital goods, straight from the report.

The Capital Goods Industries include Nondefense : small arms and ordnance; farm machinery and equipment; construction machinery; mining, oil, and gas field machinery; industrial machinery; vending, laundry, and other machinery; photographic equipment; metalworking machinery; turbines and generators; other power transmission equipment; pumps and compressors; material handling equipment; all other machinery; electronic computers; computer storage devices; other computer peripheral equipment; communications equipment; search and navigation equipment; electromedical, measuring, and control instruments; electrical equipment; other electrical equipment, appliances, and components; heavy duty trucks; aircraft; railroad rolling stock; ships and boats; office and institutional furniture; and medical equipment and supplies.

Defense Capital Goods include : small arms and ordnance, communications equipment, aircraft; missiles, space vehicles, and parts, ships and boats, and search and navigation equipment.

Manufacturing new orders dropped -2.0%, while machinery new orders is up 8.6% and computers a whopping 12.6%. (Moore's law, ain't it swell?) Autos were ok, new orders up 2.5%, yet semiconductors shipments were down -20.6%.

I am fairly certain that the metric new orders excluding defense includes non-defense transportation. (but removes the defense department orders).

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 66.38 KB |

Capital Goods Numbers Just Get Strange

"Manufacturing new orders dropped -2.0%, while machinery new orders is up 8.6% and computers a whopping 12.6%. (Moore's law, ain't it swell?) Autos were ok, new orders up 2.5%, yet semiconductors shipments were down -20.6%."

There is more to this if you factor in $12 billion in non oil trade deficit.

The shipments of computers are all servers not going for export, and not PCs which show up as imports. Machinery new orders is every kind of business machine. Perversely, domestic cap goods purchases are negative to trade - so we do not export them. Autos should only be cap goods if business related. But hey, everybody is writing off their car and truck these days.

Moore's law is MIPS not dollars. If the dollars of servers shipped grows,

the MIPS shipped is spectacular and that is a 10 year trend.

Burton Leed

durable goods is domestic

It's doesn't count imports, exports. I'm cracking a side joke on Moore's law in that because of transistor die size yield, computational speed increases and people's computer's quickly become out of date. They have to buy new.

That total manufacturing new orders drop includes aircraft.