The Plunder, Pillage and Destruction of the American Tax Base

We don’t pay taxes; only the little people pay taxes. – Leona Helmsley

PREAMBLE:

This brief blog is an attempt at a synthesis of the excellent and exemplary research of superior individuals who have sought out the ways and manner of tax evasion and tax avoidance.

When such avoidance and evasion becomes institutionalized, the impact on any society can be quite severe. Seldom do people understand the connection between massive and institutionalized tax loss and deficit (debt) spending and the existence of debt-financed billionaires (that is, debt-financed wealth).

These activities are extremely antithetical to all forms of progress, as I endeavor to illustrate here.

In the virtual economy, tax shelter design and securitized financial instrument creation rules the day. From the information presented below, one would not be remiss to believe that those with American citizenship who work to evade taxation are truly only citizens of transnationals and multinationals, not citizens of any country.

1913

The sense of responsibility in the financial community for the community is not small. It is nil. – John Kenneth Galbraith, The Great Crash

The year 1913 was fraught with momentous change. That was the year America saw the establishment of the oil depletion allowance, the Federal Reserve System, the federal income tax and the Rockefeller Foundation.

The federal income tax as we know it today was, not unexpectedly, introduced in Congress by a Republican, to be adopted as the Sixteenth Amendment to the Constitution.

While some historians suggest that the original intent of the tax was meant to tax income from capital as opposed to taxing income from wages, it wasn’t long before the first loophole law was passed to alter that. Within that very same year, the Tariff Act of 1913 was enacted.

At that time the federal income tax only affected a minor portion of the population; it wasn’t until after World War II that the tax code was expanded to cover the majority of Americans. Up until 1912, the majority of revenues to the government derived from taxes on liquor and tobacco.

Even so, in 1933 the public was accosted with the revelation that all the partners of the colossal Wall Street banking firm, J.P. Morgan & Company, had paid no income taxes in the previous two years; perhaps a precursor of things to come in the annals of tax history?

The actual codification of the tax laws didn’t occur until 1939, later to be officially named the Internal Revenue Code (of 1939). Federal withholding tax from paychecks was introduced a few years later with the increase in tax rates to finance World War II. [1]

Holding companies originally came into being to hide ownership and concentration of financial power. Banks organized themselves into holding companies and then purchased securities firms to act as the subsidiaries in the securities business.

From Charles R. Geisst’s excellent history work, Wall Street:

…after 1916, the subsidiaries were suspected of being used to avoid paying income tax. The same shroud of mystery that masked true corporate ownership could also be used to hide tax liabilities of individuals.

Immediately after the Great Crash of 1929, the bankers committed millions of dollars in order to stabilize the market. Albert Wiggens of Chase National, one of the bankers involved with the attempt to stabilize the market, secretly began shorting market shares, earning over $4 million and avoided paying taxes on that profit by using his Canadian shell companies to hide it.[2]

TANSTAAFL

(Unless you’re super-rich?)

Corporate welfare has this sinister tone to it. – George W. Bush

When individuals, or corporations, refuse to pay their taxes by utilizing an almost endless variety of tax avoidance and evasion schemes, the burden is shifted on to the rest of us, either in direct or indirect increases in taxes, as well as downgraded government services, etc.

Let us examine a few of the ways and methods which are use to avoid taxes.

Citigroup, as with other global banks, offers specialized private banking for their high-net-worth-individuals (HNWIs), or rich clients.

These services range from finding maids and baby-sitters for them, to estate planning and creative offshore accounts designed for evading taxes.

Again, it is difficult to quantify the amount of wealth (for tax avoidance and evasion purposes) offshore as governments and global financial institutions aren’t predisposed to research this.

The Bank for International Settlements (BIS), the central bank for the world’s central banks (located in Switzerland, of course), tracks bank deposits by country. Looking at their 2004 data, out of $14.4 trillion total bank deposits (that’s US$14.4 trillion), approximately $2.7 trillion could be found offshore; which works out to one-fifth of all deposits – as in cash deposits – were held offshore.

The BIS doesn’t, or can’t, track other financial assets such as stocks, shares (in private companies), bonds, real estate, precious metals, super-sized yachts, etc., held offshore. [3]

These financial assets are usually found at offshore companies (shell companies, holding companies, etc.), foundations and trusts. It is important to note that trusts aren’t usually required to be registered, or required to file statements of accounts so tracking can be problematic.

Ergo, that US$2.7 trillion could easily be US$3 trillion, or higher. And it is safe to assume that scant amount of that figure is ever taxed.

TRANSFER PRICING

More than half of “world trade” takes place within corporations, not between them. This corporate intra-trade takes place at offshore financial centers (OFC), popularly known as tax havens.

There are over seventy of these throughout the world, where secret shell companies, bank accounts, etc., are used for creating paper profits and losses and artificial transactions. There are approximately three million shell companies. The USA itself would be considered an offshore finance center (or tax haven) to foreign companies and thereby serve the same purpose.

These shell companies are structured as offshore subsidiaries and holding companies to cut or remove taxes by relocating – on paper – a company’s logo, intellectual property, trademark, etc., and then the company rents or leases these back.

In many cases money is moved there, then loaned back to the American company with interest payments deducted from their taxes, naturally. [4]

Corporations also “park” their money offshore to avoid paying taxes on it as such taxes on overseas profits can be deferred until they return to the USA, and that could take years.

General Electric, at last count, has $62 billion parked offshore, as well as Pfizer ($60 billion) and ExxonMobil (with $56 billion).[5]

From 1983 to 1999, the value of American corporation assets in Bermuda, the Cayman Islands plus eleven other tax havens increased by 44 percent compared to their assets in tax-relative countries such as Germany and the United Kingdom, etc.[6]

A major tax avoidance – really tax evasion – scheme is transfer pricing. Imports and exports are handled through these offshore shell companies. The US company sells – or transfers – via the shell company – an export at an extremely low price, then it is sold at a normal price offshore (this is all done on paper, that is), thus realizing no official taxable profit.

In the opposite manner, the shell company buys items at a normal market price, then sells (as a paper transaction) to the US corporation at an astronomical price, thereby allowing the US corporation to deduct said cost when it resells at a loss.

There are fellows at Harvard and Stanford who are reputed to be experts on this, but I don’t pay any attention to them as their data are sparse and their extremely low estimates of tax loss ($10 billion) leads one to believe that they only read each others papers and estimate accordingly!

I do, however, pay considerable attention to academics and scholars who do the tedious and laborious work of actually reading and researching the data; in this case Simon Pak (Penn State University) and John Zdanowicz (Florida International University).

These professors examined aggregate customs data to analyze over-invoiced imports and under-invoiced exports for the year 2001 and its impact on US federal tax revenues.

These two stalwart fellows performed a comparison of the going prices and those recorded on the invoices and arrived at the estimated US tax loss of $53.1 billion for that year (2001).[7]

Evidently Vladimir Putin isn’t agreeable to transfer pricing. From the American Foreign Policy Council web site:

Prime Minister Vladimir Putin has again attacked Mechel, one of Russia’s largest coal and steel companies. Putin, who earlier accused Mechel of selling coking coal, a component used in steelmaking, to domestic customers at twice the price it was selling it for abroad, has now accused it of exporting raw material through offshore companies at prices four times lower than those in the domestic market. “It’s a reduction of the tax base inside the country, tax evasion; it’s the creation of a deficit in the domestic market, which means an increase in the price of metallurgical products,…"[8] (Emphasis mine-JW)

So Mr. Putin is disagreeable with over-invoicing and under-invoicing. That Mr. Putin is one smart Russian! And please note the terms he used in his statement of criticism (bolded). He perfectly understands what is going on.

Wish we had more politicians like him in America.

Please bear in mind that $53.1 billion applies only to transfer pricing, and doesn’t include rentals of their own offshore corporate logos, intellectual property, loans, etc., nor a myriad of other tax avoidance schemes.

There was a study at the University of Maryland conducted during the 1990s (I am unable to find the link at this time, but I do recall reading about this in the Sunday edition of the business section in the NY Times back in 2000) which examined the intra-trade among corporate affiliates which took place only offshore, as opposed to the invoice research just mentioned which followed imports and exports to and from America.

Such trade between the affiliates owned by the same corporation involved the shifting back and forth (at least on paper) of various goods and supplies owned by the affiliates, acting in a manner so as to lower profitability of such items.

This study extrapolated a conservative loss of over $200 billion yearly in corporate taxation.

PROFIT SHIFTING

Recently, OMB Director Peter Orszag addressed an audience at New York University on reining in the deficit. During this talk, he made some very interesting remarks.

The cost of the tax cuts will total about $4 trillion over the next decade, including the additional interest on the debt the federal government will have to pay since the tax cuts were deficit financed. The Medicare prescription drug bill will add about another $700 billion to the deficit – bringing us to about $5 trillion total for the cost of just these two policies.[9]

There are several points of data which mystify me about Mr. Orszag’s remarks. First off, Social Security took in $1.7 trillion more than it paid out during the years of 1984 to 2002. And Medicare comes under those taxes collected from Social Security taxation.[10]

Now I’m really confused! But I’m sure Mr. Orszag knows whereof he speaks, after all he did come from Robert Rubin’s prestigious Hamilton Project (situated within the Brookings Institution), where he was involved in the privatization of everything. And we know from the shape Mr. Rubin left Citigroup in that Rubin is a certified financial wizard (CFW).

But wait….what if the pharmaceutical companies are guilty of tax avoidance as well as other corporations, and some of those missing taxes could actually be recovered? Let’s take a brief look at one way, called profit shifting, that the pharmaceutical companies appear to be avoiding payment.

Profit shifting is what takes place when an affiliate of a transnational corporation makes a sale or loan to another affiliate. The transaction is structured so that the corporation’s expenses are recorded in the high-tax country, while greatest profits are recorded to occur in the affiliate in the low-tax country, thus reducing the overall income tax burden on the transnational.

This situation occurs frequently with pharmaceutical corporations, which own considerable patents and similar marketing intangibles which are developed in a limited number of sites, then utilized worldwide.

Estimates of the nine largest drug companies suggest a possible total of $2.9 billion in taxes could be recovered if profit shifting were halted.

This estimate derives from the following: the nine largest drug outfits had total pretax profits in 2005 of $42.6 billion. Assuming 23 percent of $42.6 billion, or $9.8 billion, were shifted back to the USA and taxed at the average rate of 30 percent, $2.9 billion would be the result.

This may actually be a low estimate as the prices of drugs in the USA are usually higher than in other countries. Again, these estimates are based upon detailed analysis of the averages involved in profit shifting over a period of time.[11]

So, that $700 billion might shrink a bit if just profit sharing were halted. Of course, that legislation, voting on by both Republicans and Democrats, allowed for a fixed price (and considerably higher than those companies charge in foreign markets) demanded by the pharmaceutical industry; not particularly competitive pricing.

To the matter of the tax cuts for the wealthiest from the Bush administration dating back to 2001 and 2003; there is only one remedy for such actions.

In Europe there has been frequent mention of the “Irish miracle,” referring to the positive surge in Ireland’s economy prior to the recent meltdown, and corporate flight from there. Studies have indicated a strong likelihood that a considerable amount of those positive numbers on their economy can be attributed to profit shifting there by American corporations (and probably other countries, as well).

It has been estimated, in a report by former Department of the Treasury economist, Martin A. Sullivan that as much as 74 percent of profits listed for American subsidiaries in Ireland resulted from profit shifting.[12]

Some important and factual quotes from a Norwegian government report.

No empirical analysis is needed to establish that multinational corporations manipulate transfer pricing to reduce their total tax burden. Many instances have been uncovered by tax authorities, and have been discussed in newspapers articles both nationally and internationally. Another indicator to the problem is found in the economic literature. Textbooks on international finance will typically discuss transfer pricing in detail, and leave no doubt that problems of taxation are central. However, such sources cannot tell us how much profit is withheld from taxation.

Our best guess is that between 25 and 40 percent of the potential tax take from foreign multinational enterprises in Norway is lost because of profit shifting. For the companies in our selection, this could amount to 15-25 billion NOK. Our selection represents around 90 percent of the turnover of all foreign-owned joint stock companies in Norway outside of oil extraction and mining. As a comparison, the Norwegian Tax Administration last year uncovered about 50 cases of what they believe is juggling with prices and invoices between closely related companies, involving all told 6.6 billion NOK. (NOK=Norwegian kroner)[13]

SECURITIZATION

There is another method of tax avoidance which is both subtle and far reaching, but would require an entire thesis paper to explain its subtleties. This would be what is involved in the securitization process and creation of securitized financial instruments. Therefore, I will only remark briefly on this.

The securitization process, involved with the creation of securitized financial instruments involving pools, acts to move the taxable event from individual positions within a pool (e.g., CDOs, CLOs, CBOs, CMOs, CFOs, etc.) to the collective result of the pool. This alters the taxing or tax collection equation.

Also, securitization conduits can be (and are) re-characterized to lower the overall tax bill.

I mention these tedious tax aspects of securitization due to its heavy involvement with the economic meltdown of 2008 – 2009 period; securitization being the underlying process in credit derivative creation and credit default swaps.

So, tax revenues were lost in the creation of those derivatives, as well as in the aftermath of the meltdown.

MEET MARSHALL LANGER, AMERICAN PIONEER

Oddly enough, Marshall Langer is not a household name in America. And yet, Mr. Langer is a pioneer of enormous stature in certain circles, specifically tax avoidance and tax shelter venues.

Marshall Langer is either the first, or among the first group, of architects of offshore tax shelters. Mr. Langer’s first book, How to Use Foreign Tax Havens, was published in 1975, some years after he created one of the earliest tax shelters in Bermuda. Later, he would expand to the Caymans and elsewhere.

Among his many accomplishments relating to tax avoidance and tax shelters, Mr. Langer assisted the Central Bank of Barbados in developing that country’s offshore legislation and served as an Adjunct Professor on the faculty of the online LLM program of Global Tax and Offshore Financial Centers at St. Thomas University of Law.[14]

If you love tax shelters, you’ll love Marshall Langer.

JOBS OFFSHORING

Inequality produces unemployment. Unemployment produces inequality. – James K. Galbraith, The Predator State

From an Oxford University Centre for Business Taxation report:

WHO ULTIMATELY BEARS CORPORATION TAX?

Ultimately, individuals must bear any tax burden. But it is not clear which individuals bear the ultimate burden of corporation tax. It could fall on the owners of the company, reducing their post-tax income. But it could also fall on suppliers, on consumers or --- by reducing wages or the number of jobs --- on the workforce.

And their findings indeed did find that a substantial portion of corporate tax liability falls on the workforce from the reduction of the tax base by corporate tax avoidance.

The graph below, in my humble opinion represents what occurs when a country reaches the point of critical mass with regard to corporate, and governmental, offshoring of jobs.[15]

Please click to enlarge

And the offshoring of jobs represents a significant reduction in the tax base. First, there is now the absence of tax payment until other (assuming other is a possibility) employment can be found, plus the multiplier effect on others.

Take, for instance, a small company where the employees routinely ate lunch at a nearby sandwich shop. Once everyone has been laid off, the business for that sandwich shop suddenly takes an enormous downturn. So too any public transportation which may have been used by the workers, as well as any nearby cleaners, etc., which had depended on the patronage of that company’s employees.

And multinationals, which is the proper term for companies which have any offshore operations, offshore jobs they are also highly likely to take part in tax avoidance and/or tax evasion activities. (A highly publicized case was Stanley Works, a few years back, but there are numerous examples almost weekly in the business news.)

The senator who is supposed to represent me, among other constituents in my state, has repeatedly argued with me over the years about jobs offshoring, claiming that labor arbitrage is the only way companies can remain competitive. Sounds similar to the very same reason they always promote for lowering corporate taxes.

This is simply the non-argument of the misguided politician. If an American company is unable to function by employing American workers, the American citizenry should be unconcerned about the status of such a company as they are a net loss to the tax base, on so many levels.

HEDGE FUNDS

Deferred taxes comprise the bulk of tax planning, and deferral of taxes is a wonderful thing – to those fortunate enough to have them deferred! There are instances of hedge fund managers, who have made from $1 billion to over $2 billion in income in their offshore hedge fund accounts and can defer taxes on those profits until they retire. Consider how much money those managers can earn from those monies – from numerous investments or simply from compound interest -- now being deferred?

So those offshore-registered hedge funds are tax-exempt and so too are earnings of those fund managers. Yet, they live and work in America. They utilize the same streets, highways, playgrounds and facilities as the rest of us, yet they escape all financial responsibilities.

And naturally, should those managers take a trip to their offshore sites, such as Bermuda, the Caymans, Netherlands-Antilles, Andorra, Lichtenstein or elsewhere, they can deduct these trips as business expenses.

Life is grand for the tax avoider and evader!

Now one might surmise this group at least pays property taxes? Not even that is for certain as frequently their property is listed under corporate ownership, or involved in a structured corporate leaseback arrangement; escaping all but the most minor of taxation.

Recall a former CEO of GE, Jack Welch, and his infamous divorce case years back when the public learned that GE was picking up the tab for Welch’s daily life expenses. (Interesting to note that some Street insiders suggested that had GE not availed themselves of those TARP bailout funds it was highly probable that it might have had to pay a visit to the bankruptcy court.)

DEFERRED INCOME

The money deferred by an executive cannot be deducted on the company’s tax return.

Thousands, perhaps thousands of thousands, of executives defer part of their pay every year. What is the sum total of such deferrals?

Who knows, as such disclosure isn’t required under existing accounting rules.

The total could easily range from many billions, or more, on untaxed funds. This works as an interest-free loan to the executive, and is designed as a structured financial investment, such that the deferred funds, and interest accrued along with any dividends, are continuously rolled over until retirement.

A 1974 tax law only allows this situation for the highest paid; in essence the highest economic stratum of society. These are monies that cannot be amortized or reinvested to grow the company or for innovative research and development activity.[16]

SOCIAL SECURITY TAXATION

Now at the opposite end of the spectrum, and to the extreme detriment of working Americans, the Social Security taxes represent pay-ahead taxation in the extreme future, robbing the lower 90 percent of income which could be used, and controlled, on their own behalf.

The Social Security tax increase (almost doubled), which was designed during the Reagan administration to offset tax cuts for the wealthiest, allowing for the increased social insurance taxation to fund the operation of the government.[17]

So, the ultra-rich are able to defer their taxes, ostensibly to be paid at some point far in the future, while the rest of us pay our taxes years in advance, thus robbing us of savings, investment capital or disposable income.

GOLDMAN SACHS' TAX SCHEMES

The world's most powerful investment bank is a great vampire squid wrapped around the face of humanity,..-Matt Taibbi, Rolling Stone

EXCHANGE FUNDS: Only the rich need apply

When selling stocks, taxes may be deferred for years if one has $5 million of stocks and bonds and is willing to invest at least $1 million of stock in a company’s investment pool made up of similar investors.

Shares of a variety of stocks held by the pool, are returned to each investor when they wish to withdraw (this allows for a more diversified portfolio) --- but unlike normal investors, who would be taxed, no taxes are required on the profits of the contributed pool shares. Should the investor remain in the pool for seven years, stocks withdrawn don’t incur capital gains taxes. (They only come due upon sale.)

Goldman Sachs is one of the largest operators of these tax-avoidance investment pools; known as exchange funds or swap funds. Other operators include Credit Suisse FB, Citigroup, etc., and the occasional mutual fund company.

These are actually federally-mandated secret deals, as investors are required to sign non-disclosure statements; only allowing them to discuss these deals with their financial advisors.

Another investment tax avoidance scheme, originated by Goldman Sachs, is accessible only by people with $10 million or more in a single stock.

Should someone have significant stock in a popular startup, and doesn’t wish to sell it, suggesting to the market that the stock or their company’s valuation is questionable, the stock holder can retain LEGAL ownership while transferring the ECONOMIC ownership to a single investment house. The shares would be deposited with Goldman Sachs; the contract specifying that if the share value rises, Goldman Sachs receives all of the gain up to the new level, and some portion of any further increase.

In return, Goldman Sachs loans more than 90 percent of the shares’ value at a low rate of interest. Next, the recipient purchases a portion of stocks and bonds, placing them in a Goldman Sachs’ account, with the other investors, or would be investors, with this particular startup none would be the wiser. (Those stocks and bonds will be paying dividends and interest to the LEGAL shareholder.)

Goldman Sachs next shorts the market in that startup’s stock; if those shares fall, Goldman Sachs makes money, but if the price rises, GS gets a hefty percentage increase, thus hedging its position.

No taxes are paid on this arrangement.

Neither time nor space allows for a proper recounting of the endless tax avoidance schemes and tax shelter explanations.

THE EXCITING WORLD OF PRIVATE EQUITY

(And its impact on tax base reduction)

Leveraged buyouts have seriously impacted the American tax base, and any foreign tax base where they have preyed on corporate takeovers as the private equity firms, with their LBOs, exploit the interest tax deductibility of debt to the maximum.

By this action they usually tend to reduce corporate-paid taxes, then, to further exacerbate tax recovery, the companies tend to pay the interest offshore to avoid taxation on receipt!

When leveraged buyouts occur, overall statistics indicate a rise in unemployment (although sometimes their numbers are confusing as they will count newly acquired companies under new job creation) and the demise of many a corporation or business.

Josh Kosman, a business reporter for the NY Post, details this nicely in his recently published The Buyout of America. In his book, Mr. Kosman mentions that after the leveraged buyout of the Danish telecom operator, TDC, the corporate taxes for that country were reduced by 3 percent, as estimated by the Danish Ministry for Taxation. (I’ve read later reports estimating it at a much higher tax loss.)

The case of leveraged buyouts is illustrative of the misuse of mathematics in the realm of financial engineering. The justification for the rated increase of the value of the target firm derives from the use of the Modigliani-Miller Theorem.

This theorem posits that the tax shield of the acquisition debt, as income flowing through to equity is taxed, while interest payments to debt are not; thus the greater capitalized value of cash flowing to debt.

I will concede the logic of this as an isolated event, but the situation dramatically changes when multiple private equity firms do multiple major mega-buyouts, incurring major negative impacts on the tax base (as well as negative impacts on real business valuations and employment).

It is akin to a firecracker going off in a rock and dirt-covered landscape. In such a landscape, nothing significant will occur, but should one thousand firecrackers be lighted in a forested area containing dense and dry foliage, the consequences will surely be devastating.

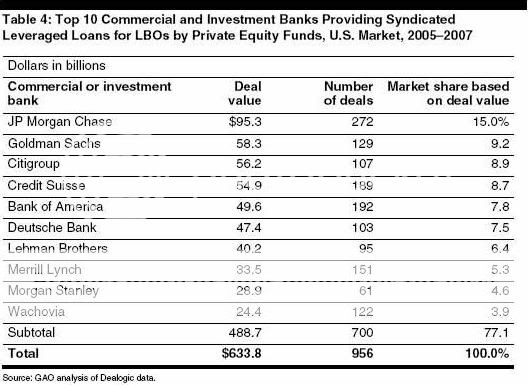

A chart from the GAO report on private equity below illustrates the large amounts invested in buyouts. And please keep in mind that we are discussing only those negative impacts on taxation and tax reduction, not the securitized financial instruments involved (CLOs, CFOs, etc.).

Please click to enlarge

Add to this mix the involvement of offshored funds, and offshore investors, for tax avoidance purposes, and the further use of tranched CLOs and layers of securitization, and taxation appears as almost an arbitrary afterthought.

Debt-financed billionaires, who derive their wealth either from private equity leveraged buyouts or credit derivative markets, or a combination thereof, do so at an enormous cost to the national tax base.

The peddling of debt, especially as the major driving industry in the American economy, does not set the stage or create the framework for a viable future. The end result is simply the creation of a select group of infinitely wealthy individuals, with the concentration of unearned wealth the principal cause of poverty.

Far more telling, is the weight of historical data which strongly suggests that societies and cultures never progress when concentrations of wealth reach epic proportions.

That path leads to the Dark Ages. In the USA, the income growth from 1970 to 2000 tells us that the bottom 99 percent average income grew by $2,710, while the top one-hundredth of 1 percent grew by $20,328,482.[19]

GIFTS, INHERITANCES

A gift can be a large thing or a gift can be a small thing. – African proverb

Previously, gift tax returns were audited on the death of the donor and the filing of his or her estate tax return. The Tax Relief Act of 1997 (TRA1997) changed that to require the IRS to audit gift tax returns within three years or they would be automatically filed, thereby greatly helping the very rich to lower their taxes.

The only real federal taxes on wealth are the gift tax, the estate tax, and a special generation-skipping gift tax on grandchildren and future generations of heirs.

While it is popularly thought that extreme wealth can’t be passed on to heirs due to estate taxes, this is utter nonsense. Simply hire a high-caliber firm such as Milbank, Tweed, Hadley & McCloy or Sullivan and Cromwell, and utilize either the vehicles of life insurance or charitable trusts, and their wealth is most efficiently passed on in concentrated form.[20]

Tax shelter laws apply only to income taxes, not estate and gift taxes. Of course, such laws must be upheld by the courts, which have become something of a rarity. On those few occasions where a judge finds against an obvious tax shelter ploy, the decision is usually overturned at the next higher judicial level, or after appeal.

And we have just witnessed what happens to whistleblowers who attempt to expose tax shelters by the shocking treatment of Bradley Birkenfeld, the UBS banker who tried to interest the Department of Justice in those wealthiest of Americans who had tax shelters in Lichtenstein by way of UBS.

Sadly, Brad is presently serving time, hopefully in a federal penitentiary and not a private or privatized prison, perhaps owned by the very same people he tried to expose![21]

LIMITED LIABILITY PARTNERSHIPS

While discussing the courts, it is important to realize that IRS rules that a professional firm (as in accounting and law firms) can be a Limited Liability Partnership (LLP), thus removing serious liability and effectively removing any real self-policing mechanisms from the equation.

Prior to this, each partner was liable for each and every partner in their firm. Shared liability was a great enforcer when anyone and everyone could go to jail, as did occur in the S&L meltdown during the ‘80s.

THE INCREDIBLY SHRINKING TAX BASE

Please click to enlarge

Tax base breakdown:

The personal income tax, the federal government’s single largest source of revenue, comprised 41.3 percent of the total 2005 revenues. Corporate income taxes were a smaller slice at 14.5 percent of the total revenues for that year.

Added together, these two tax categories were 56 percent of the 2005 tax revenues. Social insurance taxes account for 38 percent of all revenues, with social security taxes comprising 89 percent of that 38 percent number (unemployment insurance taxes along with some minor programs constitute the remaining 11 percent).

Since the total tax revenues make up 27.5 percent of 2005’s GDP, this represents a significant figure.

But the corporate income tax number of 14.5 percent seems rather insignificant, and that percentage has been shrinking as well (as will be demonstrated later).[22]

In response to the horrible events which transpired on 9/11/01, the Bush administration acted quickly. They put in place tax cuts for the wealthiest Americans, began multiple wars, and staunchly supported American multinationals in their move to re-register their companies offshore to avoid American taxes. (This is referred to as corporate inversion.)

Now, I don’t mean to be partisan with the previous description; many Democrats routinely supported predatory tax legislation as well as voting in favor of legislation In support of offshore finance centers and tax havens, but let us examine the consequences.

These tax cuts act to reduce the national tax base as well as increasing the federal deficit. While corporate pretax profits increased 26 percent between 2001 and 2003, federal corporate income tax payments shrank during the very same period.

Amazingly, during this same period individual paid taxes increased. Now isn’t that peculiar?[23]

Other pertinent points:

1995: Federal data for the nation’s largest corporations (assets of $250 million plus), indicates that 1,279 out of 7,537 --- 17 percent --- paid no taxes due to reporting no net income.

1996 – 2000: According to examination of IRS data by the Government Accountability Office (GAO), over 60 percent of American companies paid no federal taxes.[24]

1998 – 2005: According to the GAO’s further examination of IRS data, two out of every three corporations paid no federal taxes (over 66 percent).[25]

Now this may appear confusing to some who routinely browse those SEC filings and corporate prospectuses, so please keep in mind that it has long been legal for corporations to keep two sets of books; one for the shareholders (book income) and a different set for the IRS.

Also, there has been an obvious trend away from auditing the corporations to auditing lower-income individuals over the past twenty-six years. This isn’t a reflection on the IRS so much as it is due to direction and funding from the US Congress, and the occasional presidential administration pressure.

This trend was dramatically enhanced by the dissolving of the “high roller” division within the IRS during the (George W.) Bush administration. This division, the most profitable in tax revenue recovery, was responsible for auditing the wealthiest individuals and corporations.

Please click to enlarge

STATE LEVEL

Now at the state level, corporate taxes have likewise been plummeting, most likely from both a combination of tax evasion by way of loopholes, as well as tax breaks enacted by the state and local governments in response to corporate promises (frequently empty promises) of future jobs and employment opportunities.

Arizona: 1980-1981 --- corporations accounted for 26 percent of all income taxes. In 2002 – 2003 --- down to 15 percent.

Arkansas: 1970s --- corporations accounted for 33 percent of state income taxes. In 2002 --- down to 10 percent (source: Arkansas Advocates for Children and Families)

California: 2001 --- 73 percent of all companies involved in business in the state paid just $800 minimum franchise tax (regardless of whether they were profitable or not --- source: California Budget Project)

Florida: 2002 --- 98 percent of corporations paid no income tax. (source: St. Petersburg times investigative reporter, Sydney Freedberg, examination of data from a Florida Senate Report)

Idaho: 1980-81 --- corporations paid 19 percent of all income taxes. In 2002 – 2003 --- declined to 10 percent.

Ohio: Mid-1970s --- corporations paying state franchise tax contributed 16 percent. In 2002 --- declined to 4.6 percent (source: Policy Matters Ohio)

Oklahoma: 1979 --- corporations paid over 6 percent of state tax revenues. In 2003 --- declined to 1.8 percent. Personal income taxes rose during same period from 22 percent to 36 percent of state revenues. (source: Community Action Project

Pennsylvania: 1999 --- 66 percent of all companies subject to corporate net income tax paid $0.00. (Source: Keystone Research Center)

Utah: 1980 – 81 --- corporations paid 12 percent. In 2002 – 2003 --- declined to 9 percent.[26]

While tax breaks serve to increase corporate profits, they also increase the federal deficit and then we observe the decrease in corporate-paid income taxes.

Note a repeating pattern here?

1950s – corporate tax revenues comprised 28% of federal revenues

1970s – then it falls to 15.5%

1990s – and now it’s 10.8%

2000s – so far it’s slightly over 9% (although not all data is in yet for this decade)

A major force for tax base reduction at the state level has been the creation of the Single Sales Factor (SSF), a major tax break category law for manufacturers.

The problem, of course, was that it was used to motivate individual states to compete for their relocating, or remaining, within that state, but there was never the necessary accountability and transparency requirements.

Therefore, state tax recovery has subsequently dropped, while the tax burden was shifted onto smaller business, with probable negative outcomes.

There’s no correlation between tax breaks and profits reinvested in a corporation. In fact, there’s a concrete trend to reinvest less amounts from profits after the tax breaks are legislated.

In research undertaken by Citizens for Tax Justice (2003-2004) it was found that America is the third lowest corporate-tax nation; only Germany and Iceland taxed at lower rates.[27]

Since then, Germany has altered some of their corporate taxation laws, including those which now act to restrain leveraged buyouts by private equity firms (now taxing interest payments to corporate-held debt).

Iceland did not make any similar changes to their corporate tax laws.

How’s that working out for Iceland? Perhaps a harbinger for America?

TAX RATE DESCRIPTIONS

In David Cay Johnston’s book, Perfectly Legal, he makes an excellent case that, while ostensibly America is thought to have a progressive tax system, in reality it breaks down to a flat rate system when all types of taxes are analyzed and the percentage paid by all levels of society is considered.

Also, the frequently overlooked alternative minimum tax (AMT), magnified by the tax cuts during the Bush Administration, acts as a subsidy for the rich, while placing a heavier tax burden on the middle-class and upper-middle-class.

Regressive taxes – sales taxes, excise taxes on consumer goods, high property tax rates in poor and lower-income communities, and the way Social Security taxes are structured --- absorb taxes from the lower strata in equal or greater proportion to the highest stratum.[28]

And the lower strata simply don’t have, and in most cases are legally barred, access to those high-end tax dodges of hedge funds and private equity leveraged buyout “pump-and-dump” schemes.

The “little people,” as in the bottom 90 percent, seldom have the time, money and most of all, the anti-American wherewithal, to establish a multitude of tax shelters, shell companies, tax evasion schemes and other nefarious methods of avoiding taxation.

So, all things and data considered, the assumed graduated tax system appears more and more to in actuality be a flat tax system.

SUMMATION

Taxes are what we pay for civilized society. – Oliver Wendell Holmes, Jr., former justice of the Supreme Court

The manner in which the tax system has been, and continues to be, structured to redistribute income upwards to the upper half of the top 1 percent has dire consequences for the majority of Americans.

Pundits frequently try to obscure deficit spending and the federal debt in the American economy, proclaiming that debt should be spent down (which normally anyone would agree with), but allowing for deficit spending as it greatly profits them.

Unlike their diatribes, deficit spending and the federal debt are interconnected and connected to the national tax base. A reduction in the tax base almost surely means an increase in both areas.

The federal debt is the amount the government owes other countries, while the deficit is the yearly amount the federal government goes over the budget, which again must be borrowed each year.

The formula for the deficit,

deficit = (spending + service of debt) – tax

and also,

primary deficit = spending – tax

clearly demonstrates that a reduction in the debt servicing reduces the actual deficit, and the consistent reduction in the American tax base actively works to drive up the federal debt and the deficit.

The deficit and the federal debt correlate to the reduction of the American tax base. It is really that simple.

While quantifying the actual number of taxes avoided and evaded is extraordinarily difficult; extrapolating such a figure, based upon various studies and international reports isn’t. We can be certain the actual number is in the high hundreds of billions, perhaps trillions.

And these are taxes whose burden has been shifted onto the rest of us.

RECAP

Factors in the reduction of the tax base:

- Tax avoidance (legal) reduces the tax base.

- Tax evasion (illegal) reduces the tax base.

- Offshoring jobs reduces the tax base.

- Deficit spending reduces the tax base.

- Tax cuts for the wealthy reduces the tax base.

- Pharmaceutical industry giveaways reduces the tax base.

- Leveraged buyouts (even when they don’t lead to destroyed companies) reduces the tax base.

- Securitizations, and multiple layers of securitizations of credit derivatives, reduces the tax base (both from the securitization process itself, and after the super-leveraging has created the fortunes of debt-financed billionaires, then the de-leveraging takes place).

- Profit laundering through offshore finance centers reduces the tax base (transfer pricing and profit shifting).

- Hedge funds (American-operated), registered offshore, reduces the tax base.

- Taxes deferred by hedge fund managers reduces the tax base.

- Deferred income to highly paid executives, and others in their bracket, reduces the tax base.

- Intracompany loans originating offshore reduces the tax base.

- Foreign tax credit capture schemes reduces the tax base.

- Corporate inversion dramatically reduces the tax base.

- Tax shelters reduces the tax base.

NOTES

- Lewis, Charles and Allison, Bill (2001). The Cheating of America, pp. 7-10.

- Geisst, Charles R. (1997). Wall Street, pp. 127-128; 191-192.

- Komisar, Lucy. Citigroup: A culture and history of tax evasion, p. 2.

- Komisar, Lucy. Profit Laundering and Tax Evasion. Spring: 2005. Dissent Magazine.

- Lynch, David A.(3/28/08). Corporate Tax Offshoring. USA Today Online

- Johnston, David Cay (2003). Perfectly Legal, pp. 255-256.

- Komisar, Lucy. Profit Laundering and Tax Evasion. Spring: 2005. Dissent Magazine

- American Foreign Policy Council, Edited by Jonas Bernstein, July 31, 2008

- Halperin, Mark (11/03/09). Peter Orszag's remarks at NYU. The Page

- Johnston, David Cay (2003). Perfectly Legal, p. 118.

- Sullivan, Martin A. (2008).Multinational Corporations Individual Tax Evasion & Offshore Tax Havens, pp. 20-21.

- Sullivan, Martin A. (2008).Multinational Corporations Individual Tax Evasion & Offshore Tax Havens, pp. 20-12.

- From Tax Havens and Development – Preliminary Report (June 18, 2009). Report from the Government Commission on Capital Flight from Poor Countries. Appointed by Royal Decree of 27 June 2008, pp. 206, 212.

- Reference two seminars - Marshall Langer's bio provided: http://www.rpifs.com/2009otbc-seminar.html; http://www.asiaoffshore.org/MarshallJLanger

- Devereux, Prof. Michael P. and staff (2007/08). Oxford University Centre for Business Taxation, Annual Report 2007/08, p. 6.

- Johnston, David Cay (2003). Perfectly Legal, pp. 48-51.

- Johnston, David Cay (2003). Perfectly Legal, p. 147.

- Johnston, David Cay (2003). Perfectly Legal, pp. 266-271.

- Johnston, David Cay (2003). Perfectly Legal, p. 37.

- Johnston, David Cay (2003). Perfectly Legal, pp, 165, 263.

- Gonzalez, Juan (01/06/10). NY Daily News Online, UBS whistleblower Bradley Birkenfeld deserves statue on Wall Street, not prison sentence

- Slemrod, Joel and Bakija, Jon (2008). Taxing Ourselves, pp. 13-15. U.S. Bureau of Economic Analysis data published 2007

- LeRoy, Greg (2005). The Great American Jobs Scam, p. 179.

- GAO-04-358, pp. 7, 11.

- GAO-08-957, p. 23.

- LeRoy, Greg (2005). The Great American Jobs Scam, pp. 168-171.

- LeRoy, Greg (2005). The Great American Jobs Scam, pp. 178-181.

- Johnston, David Cay (2003). Perfectly Legal, pp. 94-98.

REFERENCES

Barabasi, Albert-Laszlo (2002). Linked: The New Science of Networks. Massachusetts: Perseus Publishing. ISBN 0-7382-0667-9 (Excellent reference for link analyses-JW)

Chorafas, Dimitris N. (2005). The Management of Bond Investments and Trading of Debt. Massachusetts: Elsevier Butterworth-Heinemann. ISBN 0-7506-6726-5

GAO-04-358. Tax Administration Comparison of the Reported Tax Liabilities of Foreign- and U.S.-Controlled Corporations, 1996-2000 (February 2004)

http://www.gao.gov/cgi-bin/getrpt?GAO-04-358

GAO-08-885. PRIVATE EQUITY: Recent Growth in Leveraged Buyouts Exposed Risks That Warrant Continued Attention.

http://www.gao.gov/new.items/d08885.pdf

GAO-08-957. Tax Administration Comparison of the Reported Tax Liabilities of Foreign- and U.S.-Controlled Corporations, 1998-2005 (July 2008)

http://www.gao.gov/new.items/d08957.pdf

Geisst, Charles R. (1997). Wall Street. New York: Oxford University Press. ISBN 0-19-5115120

Johnston, David Cay (2003). Perfectly Legal. New York: Penquin Group. ISBM 1-59184-019-8

Komisar, Lucy (Dissent Magazine: Spring 2005). Profit Laundering and Tax Evasion.

http://www.dissentmagazine.org/article/?article=246

Komisar, Lucy (Tax Justice Network: 01/2006). Citigroup: A culture and history of tax evasion

http://www.taxjustice.net/cms/upload/pdf/Citigroup_-_a_culture_and_histo...

Kosman, Josh (2009). The Buyout of America. New York: Portfolio. ISBN 978-1-591-84285-9

LeRoy, Greg (2005). The Great American Jobs Scam. San Francisco: Berrett-Koehler Publishers, Inc. ISBN 10:1-57675-315-8

Lewis, Charles and Allison, Bill (2001). The Cheating of America. New York: HarpersCollins Publishers, Inc. ISBN 0-380-97682-X

Lynch, David J. (USA Today Online, 3/28/08). Corporate Tax Offshoring.

http://www.usatoday.com/money/perfi/taxes/2008-03-20-corporate-tax-offsh...

Slemrod, Joel and Bakija, Jon (2008). Taxing Ourselves. USA: Massachusetts Institute of Technology. ISBN 978-0-262-19573-7

Sullivan, Martin A. (2008). Multinational Corporations Individual Tax Evasion & Offshore Tax Havens - Tax Analyst’s Briefing Book/2008 Presidential Election, Martin A. Sullivan, 2008

Taleb, Nassim Nicholas (2007). The Black Swan. USA: Random House. ISBN 978-1-4000-6351-2

Villamil, Anne P. The Modigliani-Miller Theorem (2008). The New Palgrave Dictionary of Economics.

Comments

WOw!

This isn't a blog post more of a overview research article.

I'm so glad you're mentioning the "O" word. Ya know, even our trade data refuses to break down "services" so figuring out exactly how many jobs were directly outsourced and then the probably much larger number, how many jobs were created offshore instead of the U.S. is pretty much impossible to determine.

Nice huh? So glad we can look the statistics in the eye and deal with economic reality.

I have to digest this and write another comment.

transfer pricing

oh something that is NEVER mentioned.

Folks, this is a classic post, I'm submitting it to reddit and I suggest you rate it up so others can find it.

Taxes, esp. corporate taxes are so not understood it's the best way for thievery.

Thanks

I've done quite a bit of volunteer political-type stuff over the years (which has all been rendered useless by the present and previous administrations, BTW), so I should be used to this garbage by now, but it truly reaches colossal levls of nauseation when reading about endless types of "legal" and "legitimate" tax evasion by the ultra-rich bandits who are simply not paying their fair share, and certainly don't "earn" their money by doing anything constructive, simply peddling debt on top of debt on top of debt, then proclaiming themselves "doing God's work."

Truly stomach-turning.

this whole thing is disgusting

Obama administration is now working on "deficit reduction"?

The real reasons the U.S. economy is going down (this is the long slow decline to 3rd world status, not the Economic Armageddon cliff from Q4 2008/Q1 2009) are completely ignored or enabled further...

and we literally have complete economic fiction bullshit out there trying to claim the obvious that is destroying the U.S. middle class somehow "helps the economy".

Yeah, I'm sure Rat poison cures cancer too.

Not American

There must be a way to prevent the global bandits of Wall Street from destroying Main Street. This article turns the stomach and it is not new. We all knew this just like we knew much of what was happening was a ponzi scheme. Bush and SCOTUS allied with the GOP see these tax schemes as the real America. The "fix" needs to come from our sliver of democracy and probably not through traditional channels like Congress and the White House.

An almost insurmountable question

I've given my reply to you much thought over the past 24 hours.

Over the past 35 years I, and a number of others, have begged, pleaded and cajoled people to take a more activist stance in their citizenship duties. Over this time, we've been insulted, yelled at, spat upon, and much, much worse. But the quasi-citizens have been too busy looking out for number one, or attending those ever important sports games, or some other type of games, or their favorite TV shows, etc.

Therefore, we have ended up today in the situation we had been fighting against for these many years --- namely a place where we essentially have no economy, simply the world ruled by the masters of fantasy finance.

A lady at the bus stop approached me a week ago, importuning me with a frequently heard phrase that Obama has been in office "only a year" so people should cut him some slack.

I asked her if she was aware of all those anti-worker, anti-union, and fundamentally, anti-American citizen cretins Obama had appointed to his administration.

Of course, she couldn't name a one. As long as people choose to absolve themselves of any citizenship duties and functions, they will easily fall prey to the common stupor-induced state by the corporate media, the foundation-sponsored propanda, those "experts" from those "think tanks" who always have the well-being of their ultra-rich patrons in mind.

As long as nobody notices that the various individuals making up the presidential administrations, from at least Nixon (and probably Johnson, as well) to the present administration, have an interesting similarity of names, people will continue in a normal state of obliviousness, never comprehending that those position papers from whatever political party is in power always seem to be written by the same people.

Anyone paying attention will notice that the position papers for this health insurance program and the cap-and-trade legislation appear to originate from the same groups, the Markle Foundation and the Center for a New American Security. Check out the names on those organizations; notice some similarities? Some were in the Clinton and Bush adminstrations (both Bushes, also). Several of those names were connected with the NY Fed, Goldman Sachs, and intelligence advisory boards of both Republican and Democratic administrations, and a number of intelligence community-related organizations.

And to those who read the 9/11 Commission report, will notice at least one of those organizations, the Markle Foundation (a member of the Rockefeller Foundations network), appearing. How very peculiar, what did that have to do with health "care," after all?

With over 50,000 foundations, possessing enormous resources, does anyone not understand that their stated purposes are seldom truthful? Otherwise, we'd be living in paradise or some form of utopian existence.

Does anyone really believe Zemurray, after leaving United Fruit, suddenly became a saint and therefore had to open a foundation? Ditto the Rockefellers? And Milken, has his foundation really been a charitable event, or up to nefarious profit-making activities? Puuuhhhlease!!!!!

The dems voted just as heavily as the cons against the Dorgan Amendment -- the closest thing to the public option over the past year of this fiasco.

Had Cheney been elected, he couldn't have chosen any worse appointments in the anti-worker category than Obama.

One of the best "conspiracy" books I've read, although I've never seen it mentioned under that label, was Jane Jacobs' Dark Age Ahead, where she very subtly points the reader in the proper direction. (She was heralded as a city design and urbitecture critic.)

If you have any idea of what has been transpiring, if you are familiar with Narus boxes, and IXP physical mapping (that's IXP, not ISP) and MASINT, and satellite remote sensing technology, then you realize that we are way, way beyond Will Smith's Enemy of the State movie. Ideally you realize my response because you are aware that the Obama administration has continued in law the USA PATRIOT Act, and other anti-privacy, anti-rights contrivances.

Which is why I will point you to the latest issue of 2600, and Annalee Newitz's column on p. 26 in the Hacker Perspective, especially to her final paragraph.

The question you posed rather late and akin to asking someone, after they have been imprisoned: "Now how do we break out?"

If anyone had bothered to listen to us over the preceding decades, we wouldn't be here, now would we?

We had our chance to vote for Ross Perot (whom I had little use for as he shirked his military obligation after graduating from the Naval Academy, obtaining a well-connected and extremely early discharge -- and obtained sweetheart government contracts via his brother-in-law, Ramsey Clark, then, after Clark was out of a position of power, abused and exploited the judicial system to bring baseless lawsuits to interdict the recipients of other government contracts he lusted after), and I did; we had a chance to vote for Ralph Nader, and I did, and I voted for the best candidate in the last election (as futile as it was) -- and it certainly was neither Obama nor that clown who bombed his own aircraft carrier, lost five planes while piloting while drunk, and couldn't even last 24 hours in combat prior to being captured!

Nope, I've tried and I've tried, it is for the others who been existing in a chronic state of obliviousness and idiocy to explain themselves.

Corporate Taxation

I must be missing something. Why should corps pay taxes anyway?

GE & me

So, this past year while I was unemployed, I actually managed to pay more taxes than GE.

What a country......

Hey, you're back!

Did you really ex-pat?

I also got hit with a major whammy on taxes to the point I am panicked! I thought I would supposed to get a bunch of tax breaks (cough, cough) and I ended up getting an extension because something was so amiss.

@&*)$!@

Welcome back!