In Part I of this series, Bonddad and I looked at the years 1929 - 1933. These years saw a decline of 25% in the chained GDP figures; a failure of 20% of commercial banks, a drop in personal income from $90 billion to $50 billion and a drop in the level of industrial production from 60 to 30. In

part II we looked at the years 1934 - 1940, where we saw that growth returned to 1929 levels in 1937, although this was lowered by the recession of 1938. By 1939 GDP was again increasing. In this article, we will look at what happened statistically and practically during the years of 1934 - 1938.

"I was laid off in '31. I was out of work for over two years. I'd get up at six o'clock every morning and make the rounds. I'd go around looking for work until about eight thirty. The library would open at nine. I'd spend maybe five hours in the library." ....

"I can remember the first week of the CWA checks. It was on a Friday. That night everybody had gotten his check. The first check a lot of them had in three years. Everybody was out celebrating.... Everybody was so happy, you'd think they got a big dividend from Xerox."

"I never saw such a change of attitude. Instead of walking around feeling dreary and looking sorrowful, everybody was joyous. Like a feast day. They were toasting each other. They had money in their pockets for the first time. If Roosevelt had run for President the next day, he'd have gone in by a hundred percent."

- Hank Oettinger, as told to Studs Terkel, "Hard Times"

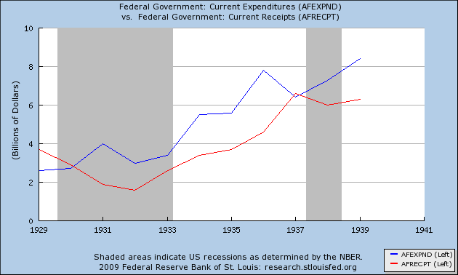

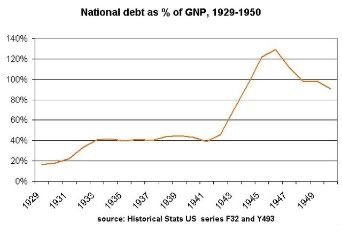

Let's start with government spending. The government ran a deficit for these years. Here is a chart from the St. Louis Federal Reserve.

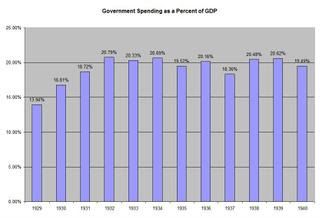

The blue line represents government expenditures and the red line represents government receipts. In addition, the amount of national debt tripled. However, remember that in the second installment of this series we learned the economy grew at strong rates from 1934 - 1937, returning to 1929 levels by 1937. As a result,

in 2000 chained dollars, government spending as a percent of GDP fluctuated between 18% and 21% for the years 1929 - 1933. In addition,

Federal debt as a percentage of GDP remained around 40% for the entire decade. By modern standards this hardly shocking. By standards of he 1930s it was very controversial.

Whether or not the increase in government spending as a percent of GDP is good or bad is a judgment call and is an issue that is still hotly debated today. In my opinion it was warranted. The country was in the middle of a deflationary spiral. Older school economic ideas were not working. In addition, with unemployment over 20% by 1932 something had to be done to prevent civil unrest.

So -- what did happen? Let's answer that with this explanation about what makes a country tick. GDP is composed of four categories: consumer spending, net private investment, exports and government spending. What we see of the decade of 1929 - 1939 is a decline and the return of both private investment and consumer spending:

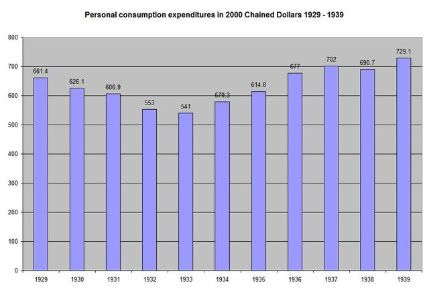

First, here is a graph of personal consumption expenditures in 2000 chained dollars for the years 1929 - 1939:

Notice that by 1936, PCEs total $677 billion in chained 2000 dollars, which is slightly higher than the $661 billion total from 1929. In other words, people started spending again.

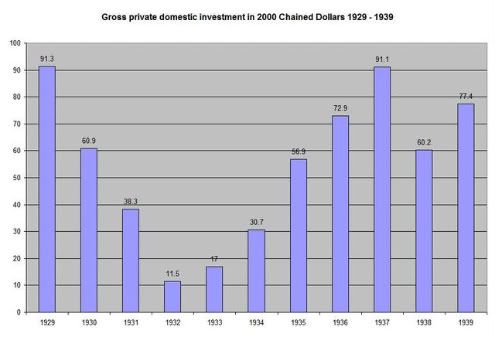

Secondly, here is a chart of total private investment in 2000 chained dollars from 1929 - 1939:

Notice that gross private domestic investment dropped from the years 1929 - 1933, but returned to 1929 levels by 1937. The levels dropped again in 1938 (due to an increase in banking reserves, see below), but rebounded in 1939. The reason for the 1929 - 1933 drop is the deflationary spiral that gripped the country in 1929 - 1933 (see part I). (see also page 6 from Regime Uncertainty: Why the Great Depression Lasted So Long and Why Prosperity Returned After the War," which shows investment as a percent of GDP at 16% in 1929 and 14% in 1937. This graph uses current dollar numbers and is close to the BEA's information).

As Paul Krugman explained in the video clip of part II, there is no reason to invest when unemployment is at 20% and there is a ton of idle capacity around the country. But as demand picked-up in the 1933-1937 years, private investment did as well.

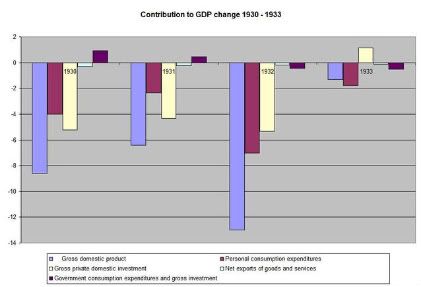

Let's look at this information from another angle. Below are charts composed with information from the Bureau of Economic Analysis. The chart is for the years 1930-1934. Remember the GDP categories from above -- consumer spending, net investment, exports and government spending. Each "cluster" of bars shows several things. The bar on the far left (in blue) is the total GDP gain or loss for the year. The bar next to it (in purple) shows the increase or decrease in personal consumption expenditures. The white bar shows total private domestic investment. These bars show how much of the GDP gain or loss was caused by a particular sub-category. For example, in the cluster farthest left GDP dropped 8.6%. The bar next to it shows that personal consumption expenditures were responsible for about 4% of that 8.6%, or about 46% of the drop in total GDP for 1930.

The point to the above chart is to demonstrate large drops in personal consumption expenditures and investment were responsible for most of the drop in GDP for the years 1930 - 1934.

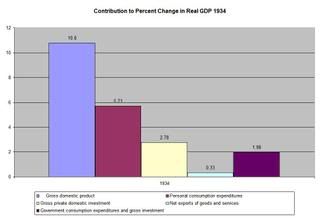

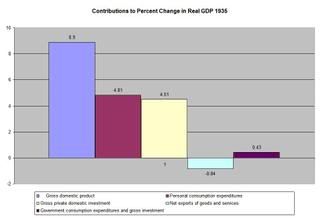

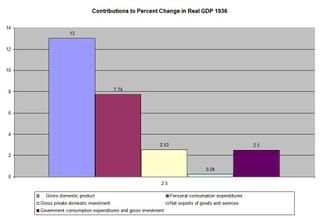

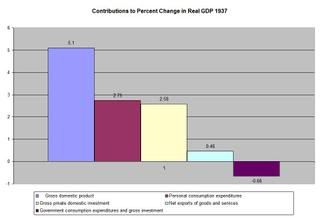

Let's look at each year of the 1934 - 1937 to see what they say:

In 1934 the economy grew at a 10.8% (that is inflation adjusted). Of that figure, 5.71% came from PCEs and 2.78% came from private investment. In other words, 52% of growth came from consumer spending and 25% came from investment. 18% of growth came from government spending.

In 1935 the economy grew at an 8.9% (that is inflation adjusted). Of that figure, 4.81% came from PCEs and 4.51% came from private investment. In other words, 54% of growth came from consumer spending and 50% came from investment. 4.83% of growth came from government spending.

In 1936 the economy grew at a 13% (that is inflation adjusted). Of that figure, 7.74% came from PCEs and 2.53% came from private investment. In other words, 59% of growth came from consumer spending and 19% came from investment. 19% of growth came from government spending.

In 1937 the economy grew at a 5.1% (that is inflation adjusted). Of that figure, 2.75% came from PCEs and 2.58% came from private investment. In other words, 54% of growth came from consumer spending and 50% came from investment. Note the government spending provided a negative stimulus that year.

Then came 1937-1938 recession. Why did this happen when things were going so well? There are several contributing factors:

1.) Beginning mid-way through 1936 and continuing through 1937 the Federal Reserve raised the reserve requirements for central reserve city banks from below 15% to 25% (see Friedman's Monetary History of the US, page 513. See page 526 "Our conclusion, expressed above, is that the increase in reserve requirements did have important current effects.")

2.) As Krugman pointed out in the clip from the second part of this series, the government balanced the budget in 1938. The government raised taxes at an inappropriate time.

3.) An inventory build-up caused "by a general impression, among business men, that "inflation" might be coming and that one had better buy before it was too late....When the purchasing power came to sell these goods at retail to the public, the purchasing power to absorb them just wasn't there." (From Since Yesterday, by Frederick Lewis Allen).

Increased bank reserve requirements along with a change in the fiscal situation combined to create a recession.

As with the Great Contraction of 1929-33, while the graphs may tell the technical story, underlying them is the story of a government trying just about everything it can think of to steady and then expand the economy to the benefit of the vast majorit of its citizens. There were a blizzard of New Deal programs and agencies focused on immediate Relief of the afflicted, Recovery of the economy, and Reform to attempt to ensure that the Great Depression could not happen again. To try to fully appreciate the broad scope of that effort, here is a partial list and explanation of important New Deal programs. Remember that many of these are what the RW noise machine wants to claim actually delayed recovery from the depths of the Depression:

RELIEF

The Federal Emergency Relief Act (1933) established the Federal Emergency Relief Administration (FERA) and gave it half a billion dollars to distribute to the states for any relief they felt necessary. Half was for matching grants, with the states contributing three dollars for every dollar of federal funds. The remainder could be given in direct grants. At one point, as many as 6 million families were on direct relief.

The Emergency Banking Relief Act (1933) established a system to close down insolvent banks and reorganize and reopen those banks strong enough to survive, after a mandatory four-day bank holiday that took place immediately after Roosevelt took office. Within 300 days of the act's passage, 5,000 banks had passed inspection and were reopened. Roughly two-thirds of U.S. banks quickly reopened under this act, and faith in banking institutions was restored, with money flowing out from under mattresses and back into financial institutionas as deposits. The act also allowed the confiscation of the gold of private citizens. The US dollar was then devalued by approximately 40%, ending the deflationary spiral of the Depression.

The Unemployment Relief Act (1933) established the Civilian Conservation Corps, a work relief program for young men ages 18-25 from unemployed families. The CCC became one of the most popular New Deal programs among the general public and operated in every U.S. state and several territories in 2600 work camps. The young men were paid wages, but were expected to share their wages with their families. They built such things as fire trails, camp sites in parks, and also cleared swamps and planted trees. Here are some CCC recruits about to leave for Montana:

The Public Works Administration (1933) allowed $3.3 billion to be spent on the construction of public works to provide employment in the construction and building industries, and to stabilize purchasing power,

The Home Owners Refinancing Act (1933) helpeds those in danger of losing their homes, by providing mortgage assistance to homeowners or would-be homeowners by providing them money or refinancing mortages. It also created the Home Owners' Loan Corporation (HOLC), which lent low-interest money to families in danger of losing their homes to foreclosure. By the mid 1930s, the HOLC had refinanced nearly 20% of urban homes in the country.

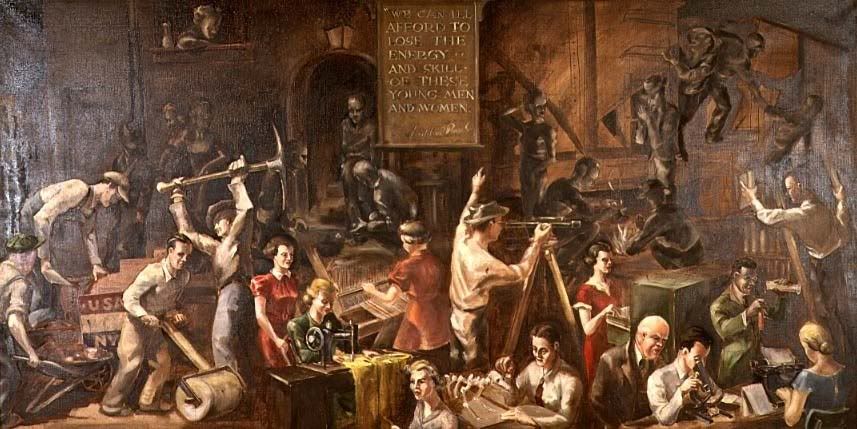

The Civil Works Emergency Relief Act (1934) allotted new funds for Federal Emergency Relief Administration to run new programs of civil works and direct relief. In 1935 it became the Works Progress Administration (1935) and was the largest New Deal agency, employing millions of people and affecting most every locality in the United States, especially rural and western mountain populations. Between 1935 and 1943 the WPA provided almost 8 million jobs and income to the unemployed. The program built many public buildings, projects and roads and operated large arts, drama, media and literacy projects, employing actors, artists, musicians, and writer (nearly 4 million in 1936 alone). It fed children and redistributed food, clothing and housing. Almost every community in America has a park, bridge or school constructed by the agency, and most public buildings of a certain age will feature architecture or a mural created by one of its artisans:

RECOVERY

The National Industrial Recovery Act (1933) legalized cartels and funded massive government spending on public works through the PWA. The NIRA operated under codes for each industry, all of which were written by committees of businessmen from the specific industry involved. Including all sorts of subcodes, rules, and regulations, the Act's proscriptions were enormously complex. The entire purpose was to eliminate unemployment and raise wages. In general - NRA codes limited production, had common control of prices and sales practices, outlawed child labor, and established a 40 hour work week and minimum wage.

The Agricultural Adjustment Act (1933) restricted production by paying farmers to reduce crop area. Its purpose was to reduce crop surplus so as to effectively raise the value of crops, thereby giving farmers relative stability again (in the past, wild swings in prices, particularly precipitous drops due to overproduction, could bankrupt a family farm during a single year). The farmers were paid subsidies by the federal government for leaving some of their fields unused.

The Tennessee Valley Authority (TVA) (1933) provided and still provides navigation, flood control, electricity generation, fertilizer manufacturing, and economic development in the Tennessee Valley, a region particularly impacted by the Great Depression, with a goal of rapidly modernizing the region's economy and society.

The Rural Electrification Act (1936) provided federal funding for installation of electrical distribution systems to serve rural areas of the United States. In the 1930s, the provision of power to remote areas was not thought to be economically feasible and so was largely unavailable in rural areas of farms and ranches. A 2300 volt distribution system was then used in cities. This relatively low voltage could only be carried about 4 miles before the voltage drop became unacceptable. REA cooperatives used a 6900 volt distribution network, distributed over their own network of transmission and distribution lines. which could support much longer runs (up to about 40 miles). Despite requiring more expensive transformers at each home, the overall system cost was manageable.

REFORM

The Glass-Stegall Banking Act (1933) introduced the separation of bank types according to their business (commercial and investment banking), and it founded the Federal Deposit Insurance Company for insuring bank deposits. It also increased the power of the Federal Reserve Board to regulate interest rates.

The National Housing Act (1934) made housing and home mortgages more affordable. It created the Federal Housing Administration (FHA) and the Federal Savings and Loan Insurance Corporation. It was designed to stop the tide of bank foreclosures on family homes. Both the FHA and the Federal Savings and Loan Insurance Corporation worked to create the backbone of the mortgage and home-building industries.

The Securities Acts (1933 and 1934) governs the offer or sale of securities using the means and instrumentalities of interstate commerce, and requires that they be registered; and also governs the secondary trading of securities (stocks, bonds, and debentures). Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer.

The National Labor Relations Act (1935) protects the rights of most workers in the private sector to organize labor unions, to engage in collective bargaining, and to take part in strikes and other forms of concerted activity in support of their demands.

The Social Security Act (1935) established a system whereby payroll taxes, first collected in 1937, that paid for lump-sum death benefits and also, beginning on January 31, 1940, monthly retirement benefits.

==========

ALTOGETHER THESE ENACTMENTS guaranteed two important things to the economy and to society: first, as shown in the graphs above, that the deflationary spiral of wages and prices had stopped, meaning that future income and the ability to pay off new loans could be reasonably assured, and spending could begin again; and secondly and just as importantly, despair was replaced with hope and confidence for the future.

Even now, facing a not dissimilar meltdown in global finance, the surviving reforms of unemployment insurance, collective bargaining, securities law and Social Security are the strongest bulwarks separating us from a similar abyss.

Here is part of a video history of the CCC as remembered by some of the workers themselves:

Recent comments