In Part I of this series, Bonddad and I looked at the years 1929 - 1933. These years saw a decline of 25% in the chained GDP figures; a failure of 20% of commercial banks, a drop in personal income from $90 billion to $50 billion and a drop in the level of industrial production from 60 to 30. In

part II we looked at the years 1934 - 1940, where we saw that growth returned to 1929 levels in 1937, although this was lowered by the recession of 1938. By 1939 GDP was again increasing. In Part III, we looked at what happened statistically and practically during the years of 1934 - 1938.

In this, our 4th and final installment, we expose and rebut the lies and distortions of the RW noise machine New Deal denialists.

Q. "Do you feel the New Deal saved our society?"

A. "By and large? (Pause) Yes."

- Alf M. Landon, 1936 Republican candidate for President, to Studs Terkel, Hard Times

As we have already seen, the New Deal succeeded in reversing and dramatically improving all of the objective measures of the economy, and most of them had returned to pre-depression levels by 1937. Since the RW noise machine can't rebut those objective facts, their effort to discredit the New Deal relies on 3 arguments:

1. By 1939, unemployment had only fallen to about 10%

2. Business's uncertainty about changing New Deal enactments led them to invest less

3. The economy of the New Deal failed to measure up to theoretical mathematical economic perfection.

We will examine the RW meme via its three usual sources: "The Forgotten Man" of Amity Schlaes, "Regime Uncertainty" by libertarian think-tanker Robert Higgs; and an economics paper by UCLA Profs. Ohanian and Cole.

1. The polemic "The Forgotten Man" by Amity Schlaes (what was being regurgitated by George Will when he was schooled by Prof. Paul Krugman in the videoclip from Part 2 of this series) is the leading example of this effort. Ms. Schlaes is neither an economist nor a historian. She holds holds a a Bachelor's degree in English, first found employment as an Op-ed writer for the Wall Street Journal, and has generally fed at the RW noise machine trough ever since. In other words, her forte is rhetoric and her career is as a RW shill. Now, in terms of credibility, Ms. Schlaes' other sage analyses include the following about Hurricane Katrina:

Still, Iraq has not caused the US to botch Katrina -- either the preparation or response. On the contrary, the fact that the country and President Bush personally were already mobilised for disaster has saved lives.

and this gem from earlier this year:

Gramm said that the country was not in a true recession but a "mental recession." He also said, "We have sort of become a nation of whiners" and "You just hear this constant whining..."

Gramm was right about the recession .... A recession is two consecutive quarters in which the economy shrinks, and last quarter it grew. But no matter. Voters feel they are in a recession, and so they are, at least according to Campaign Econ.

So perhaps we should just say that her analysis of the Great Depression is equally cogent and leave it at that. But as her "analysis" of the Great Depression is obviously the designated meme of the RW echo chamber, a detailed rebuttal is in order. Ms. Schlaes gave an summation of her argument in a speech at the American Enterprize Institute, which serves as a convenient foil to respond with, you know, the truth.

Ms. Schlaes judges the New Deal entirely on two factors, charging that:

[FDR] flunked by two other meters that we today know are critically important: the unemployment rate and the Dow Jones Industrial Average. In his first inaugural address, Roosevelt spoke of a primary goal: "to put people to work." Unemployment stood at 20% in 1937, five years into the New Deal. As for the Dow, it did not come back to its 1929 level until the 1950s. International factors and monetary errors cannot entirely account for these abysmal showings.....

Let's look first of all at Ms. Schlaes metrics. Why has she not chosen GDP? Or median household income? Or the foreclosure rate? Or the rate of bank failures? Or industrial output? All of those are good, valid measures of how well parts or all of the population/economy is doing. But our readers by now know why: because by those measures the New Deal was a brilliant success.

On the contrary, the Dow Jones Industrial Average has never been considered "critically important" to determine how well the economy is doing (The S&P 500 is a leading indicator, but by no means the most important one), especially in an era like the 1920s and 1930s when only about 3% of the populace owned stock; the simple fact of the matter is, under Roosevelt, the S&P 500 did fantastically well! The inflation level rose 20% from March 1933 to 1937 and ended the decade up 11%. By contrast, in March 1933 when Roosevelt took office, the DJIA stood at 60; it rose to 180 in 1937 (a gain of 200%!) before ending the decade at 150 (a gain of merely 150%!). By 1937 in real terms the DJIA had recovered ~60% of its losses from 1929, and considering the obscene disparities in wealth during the 1920s Guilded Age that gave rise to such corporate values, a 60% rebound is certainly impressive. In fact, in real terms the DJIA was higher than at any point except for 1928 and 1929 stock bubble.

More importantly, Ms. Schlaes' odd use of the "DJIA compared with 1929" as a yardstick to measure the New Deal's effectiveness appears deliberately chosen to mislead. Here is a graph of something called Q (or Tobin's) ratio, which measures stock valuations as a percentage of GDP. This is a measure for how manic vs. pessimistic stock investors are. As you can easily see, in 1929 the DJIA was at its most "bubblicious" in 70 years!

In essence, Ms. Schlaes faults FDR for failing to create another stock market bubble! To the contrary, the return of stock prices to their more sober norm of about 80% of GDP by the mid 1930s -- a level equivalent to the booming 1960s -- appears from this vantage-point to be a thorough success.

That leaves Ms. Schlaes with exactly one metric one which her entire thesis that the New Deal "failed" must rely: unemployment never recovered to its 1929 level until the cusp of World War 2. That the banking system was stabilized, that Wall Street was regulated to minimize fraud, that millions were put to work in public infrastructure programs, that the elderly were elevated from poverty by Social Security --none of this matters. The New Deal was a failure, according to Ms. Schlaes, because only 2/3 to 3/4 of the Great 1929-32 Contraction's (depending on how you count) joblessness was remedied as of 1936-37. In other words, because the New Deal did not 100% succeed on each and every front, therefore it was a failure.

Ms. Schlaes has a number of other "doozies" in her book, for example:

* defending her cherry-picking of unemployment data, she refers to the official US Census as "obscurer data" (you know, the very same data relied on by St. Milton Friedman in his "Monetary History of the United States).

* She claims that "the New Deal hurt the economy, and that mattered more. At some points Roosevelt seemed to understand the need to counter deflation. But his method for doing so generated a whole new set of uncertainties....", actually upping the ante from an argument that FDR didn't simply retard recovery, he actually made things worse. As we have discussed at length (ad nauseum?) in this series, by every single measure, including employment, the economy improved dramatically under the New Deal.

* As for the alleged fallacy that "price cutting caused deflation", Ms. Schlaes book, alas, came out only a year before Oil price decreases from $147/barrel to $35/barrel caused the CPI to decline -3.4% over only 4 months!

* that "Herbert Hoover was... an interventionist in spite of himself [who] bullied companies into maintaining high wages and keeping employees on their payrolls when they could ill afford to do so". In addition to bordering on the vile -- if only corporations had cut wages even more, then surely the privations of the American people would have ended -- this charge is also patently false. Despite Hoover's exhortations, the fact is that by the middle of 1930, companies cut wages with wild abandon, contributing to the deflationary death-spiral. Further, as noted by the New York Times' review of her book:

There is very little support for this idea among professional economists. Consult Essays on the Great Depression by Ben S. Bernanke, for example, and you will learn that a majority of macroeconomists have concluded in recent years that prolonged adherence to the gold standard played a dominating role in determining the worldwide monetary contraction of the 1930s. ... In other words, something approaching a consensus exists among economists that poorly-designed institutions and short-sighted policies were at the heart of the Great Depression.... (About this considerable volume of work, Shlaes has very little to say.)

* that "After the 1980s and 1990s we know that markets can do much of the work that Roosevelt believed only government capital could do..... After all, the argument of markets has its own powerful morality. It is immoral to cause unemployment by pretending that a big government policy is morally necessary. When Andrew Mellon and Calvin Coolidge put through their tax cuts in the 1920s, they made the efficiency argument that supply-siders make today: lower rates could yield, they posited, higher revenues." Such supply-side nonsense has been endlessly debunked by nearly every reputable economist there is. Morever, suffice it to say, from the viewpoint of January 2009, a paeon to the deregulatory frenzy that has already ended the investment banking industry and required the commitment of over $1 Trillion of public funds to bail them out, the "argument that markets have their own morality" is ridiculous nonsense.

Ms. Schlaes argues, in support of her conclusion, that

"the intervention, the lack of faith in the marketplace. Government management of the late 1920s and 1930s hurt the economy... Fear froze the economy, but that uncertainty itself might be a cost was something the young experimenters simply did not consider."

because

the cost of uncertainty, as the economic historian Robert Higgs first pointed out[, is] that unknown unknowns are inherently destabilizing. Roosevelt, a man of impulses, changed policies routinely. He moved from supporting big business to attacking it to supporting it again, many times in his presidency.....

..... Policies like this caused the most unnecessary part of the Depression: the Depression within the Depression of the late 1930s.

2. This is the second prong of the argument; that business uncertainty prolonged the Great Depression.

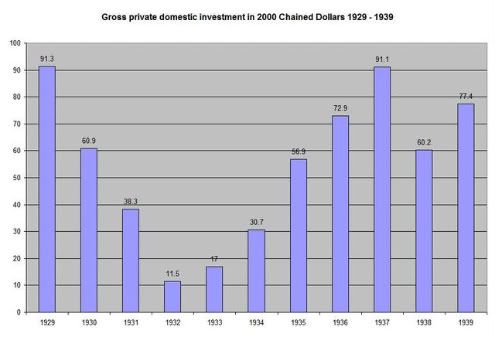

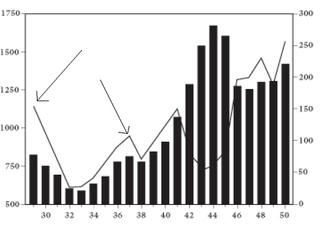

This argument was advanced by Robert Higgs in the paper Regime Uncertainty; Why the Great Depression Lasted so Long and Why Prosperity Resumed After the War. Let's begin this critique with this chart from the third part of the series.

This is a chart of gross private domestic investment in 2000 chained dollars. It shows that in 1929 total investment was $91.3 billion and in 1937 total investment was $91.1. In other words, according to the BEA total private domestic investment rebounded to 1929 levels in 1937 in chained 2000 dollars.

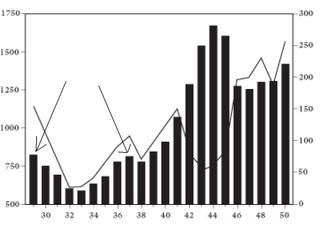

Here is a chart of GDP in 2000 chained dollars:

Also note that my 1937 GDP had rebounded to 1929 levels.

Also remember the graphs of GDP growth for each year from 1934 to 1937 from the third installment. Total private domestic investment was responsible for 25% of growth in 1934, 50% in 1935, 19% in 1936 and 50% in 1937. So, in chained dollars there was investment and in the growth of real (inflation adjusted) GDP there were two years where investment was responsible for half of all GDP growth. So someone was obviously investing.

Higgs presents this information in two graphs. Here is the first one.

The skinny line represents gross private domestic investment in 1987 dollars. So -- according to this graph gross private domestic investment was higher in 1929 than 1937. With me so far? Good.

Also note the following:

According to Higgs, the columns are GDP, again in 1987 dollars.

Anyone notice something funny?

Look again at Higgs first chart. This chart is in 1987 constant dollars. It shows GDP rebounding to 1929 levels by 1937 but private investment not rebounding. The BEA's chained dollar chart directly contradicts Higgs' first chart.

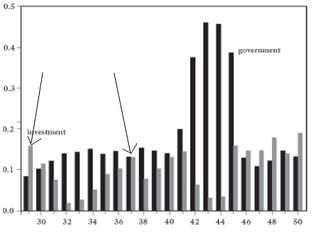

Higgs next shows investment as a percent of GDP in the following chart:

According to him, the second chart has investment at 16% of GDP in 1929 and 13% in 1937 -- much more in line with the official BEA data and hardly the dearth of investment that he claims existed in the Great Depression.

Why did Higgs provide this second chart? The first was in 1987 dollars; in other words it was inflation-adjusted. Higgs admits that the second chart "avoids the distortions potentially effecting data shown in exhibit 1". In other words -- by Higgs' own admission -- the first chart might be misleading. If the second chart was more accurate -- it it avoided "distortions" (again his words) why include it at all? Wouldn't the second chart -- which by his admission is more accurate -- suffice?

So far we have the following:

1.) Higgs' included two charts, the first of which is (in his own words) "misleading"

2.) The BEA's data directly contradicts Higgs' assertion regarding inflation adjusted gross private domestic investment.

3.) Higgs provides a second chart which is much more in line with the information provided by the BEA.

Higgs than argues that "regime uncertainty" created a lack of investment. He argues that literally every major New Deal Program "substantially attenuated or threatened private property rights" (here is the list)

And then uses polling data that shows business was hostile to the New Deal. This is the cause of "regime uncertainty" which lead to the lack of investment.

Higg's list of New Deal programs that threatened private property rights is, well, delusional. What he's really saying is any law is bad. Period.

But more to the point, Higg's spends a great deal of energy avoiding the most logical conclusion. The country was in a deflationary spiral from 1929-1934. There was no reason for there to be any investment over these years -- as evidenced by the BEA's decreasing chained numbers above. Also remember that by 1934 the country had lost 25% of its total GDP. This is not an environment where business opens their wallet and builds mammoth new projects. Also remember the country grew at strong rates from 1934 - 1937 and gross private domestic investment was responsible for a lot of that growth. Total private domestic investment was responsible for 25% of growth in 1934 when the economy grew 10.8%, 50% in 1935 when the economy grew at 8.9%, 19% in 1936 when the economy grew 13% and 50% in 1937 when the economy grew 5.1%. Bottom line -- the economy was growing as fast as it could (given that it was getting out of the worst economic slump in its history) and gross private domestic investment was responsible for a lot of that growth. Higgs is saying "it could have grown faster" -- but can't prove that with any facts save those lovely Chicago school models which we discuss below.

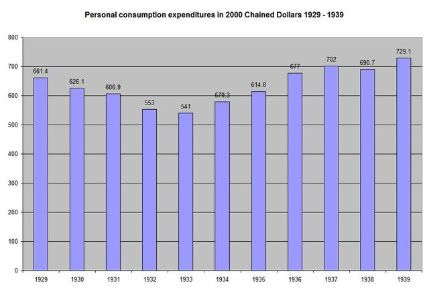

While consumer demand started to return for the years 1934-1937 unemployment was still above 10% in 1937. In addition, GDP has just at 1929 levels by 1937, so arguing investment should have been higher (especially with 10% unemployment) is a stretch -- at best.

3. Ultimately, Amity Schlaes charges that, had the evil New Dealers not intervened,

" the economy would have quickly equilibrated by itself, with wages and share prices quickly 'marked to market.'

Why didn't it? Because

The most useful economic philosophy for understanding what went on is not Keynesianism. It is the public choice theory of James Buchanan and others, which says that government is a competitor that will annihilate what comes in its path.

Here Ms. Schlaes finally gets to the third prong of New Deal denialism: she is a true free market fundamentalist. As before, alas, her book hit the shelves only a year before the 1980s, 1990s, and 200s worshiping of free markets without regulaton came home to roost in the biggest Wall Street financial collapse ever, that has economists worried that the next Depression might be just around the corner. And the reference to "public choice theory" is telling. This is the theory by which, in its hard version preferred by RW ideologues, the Let's-Pretend-as-if Fairyland of Econ 101's "perfect competition" is enshrined in "Pareto optimality" meaning that if 1 million starving people can only be saved by causing heartbreak to Paris Hilton due to her inability to get pedicures, then intervention to save the starving is "sub-optimal" and therefore should not be done.

Thus, when overmatched by a credentialed opponent, such as Prof. Krugman, she like all the other New Deal denialists, goes running back to the other academic sourcewater of the third argument, an economic paper by Profs. Ohanian and Cole of UCLA. These papers purport to demonstrate that New Deal policies actually prolonged the recovery from the Great Depression. So, to refute the RW noise, we need to examine Ohanian and Cole's paper.

To summarize, the authors note that wages and prices increased dramatically beginning with the "First New Deal" of 1933 which featured the National Industrial Recovery Act (NIRA) which encouraged collusion among manufacturers and collective bargaining by workers in those industries. When the Supreme Court struck down the NIRA, in the "Second New Deal" collective bargaining was enshrined by the National Labor Relations Act (NLRA) which explicitly permitted unions and collective bargaining, plus de facto encouragement of collusion in industries by declining to enforce the Antitrust acts. Not surprisingly, this led to inflation in prices and wages. Ohanian and Cole posit that workers and employers would seek to become part of this cartelized economy in which wages and prices were higher. Therefore there would be more employment and effort in these industries than would otherwise be the case.

Again, not surprisingly, when compared with an alternative universe in which these things didn't exist, wages and prices are higher than they would otherwise be. The authors posit that, had the New Deal not happened, lower wages and prices would have led to rapid rise in production and output, and faster growth. This faster growth would have returned the economy to its 1929 growth path in 1936, as opposed to a later parity in 1943 for which they claim the New Deal was responsible.

This argument sounds very powerful, until you recall the axiom that "Assumptions make an ass out of u and me." And in this case, that axiom is spot on. Let's look at the actual critical paragraphs of their paper. In the first place

These data [from the 1930s] contrast sharply with neoclassical theory, which predicts a strong recovery from the Great Depression with low real wages, not a weak recovery with high wages.

Ohanian and Cole tell us up front that the "data" (i.e., "reality") from the Great Depression conflicts with neoclassical economic "theory." Now, if a physicist, neurobilologist, or behavioral psychologist were confronted with such a conflict, there would be a focused effort to determine what might be wrong with the theory. Not so RW neoclassical economists. Ohanian and Cole never give a moment's thought to questioning the theory; instead, their entire endeavor is focused on what went wrong with the reality!

And on page 18 of their paper, they cut to the chase.

Our model abstracts from monetary and financial factors, which substantially simplifies our analysis. This abstraction seems reasonable since, as [we] note, the money supply grew substantially after 1933, and banking panics ended shortly after the introduction of deposit insurance. Both of these developments might be expect to foster a rapid recovery, rather than have impeded the recovery.

In other words, the authors are going to say that the New Deal was bad, by starting out with an assumption that the FDIC, a New Deal enactiment, "foster[ed] a rapid recovery"!

Our analysis also abstracts from explaining the downturn of 1929-33, but rather focuses on what happened after New Deal policies were adopted. By abstracting from the downturn of 1929-33, our analysis proceeds by assuming that either the negative shocks that caused the downturn no longer depressed the economy after 1933 -- as argued [previously] ... -- or that if the effects of these shocks did continue, that they did not significantly affect the impact of New Deal policies.

in more simple, layperson's terms, the two bedrock assumptions of their work are:

1. the New Deal is not compared with other historical panics and recoveries, such as those of 1837 and 1873, but rather with the Fairyland of Let's-pretend-as-if Econ 101 perfect competition!

2. In their alternate "reality", the Let's-pretend-as-if Fairy magically sprinkled pixiedust on the economy and it spontaneously started to recover in Spring 1933 with no effort whatsoever. No need to worry about banking panics, debt deflation, starvation and privation, the Let's-pretend-as-if-onomic Fairy gave everybody a clean slate on FDR's first day in office!

It is only under these two explicit assumptions, which at no point in the paper are relaxed, that their results are valid. Nowhere in their paper is there an attempt to compare the actual reality of the 1930s with a comparable period that did not feature government intervention (such as the 19th Century great Panics). At best they make a theoretical comparison to a 1920s which featured some monopolies, and surprise, surprise, even under that limitation they concede that their results are considerably more tepid.

Despite the fact that their entire reasoning rests on economic fairydust, their conclusion pretends as if it is comparing two realities:

Despite the fact that their entire reasoning rests on economic fairydust, their conclusion pretends as if it is comparing two realities:

Our results suggest that New Deal policies ... reduced consumption and investment about 14 percent relative to their competitive balanced growth path levels. Thus, the model accounts for about half of the continuation of the Great Depression between 1934 and 1939.

New Deal labor and industrial policies did not lift the economy out of the Depression as President Roosevelt and his economic planeers had hoped. Instead, the joint policies of increasing labor's bargaining power, and linking collusion with paying high wages, impeded the recovery by creating an ifefficient insider-outsider friction that raised wages significantly and restricted employment. The recovery would have been stronger if wages in key sectors had been lower.

In fact, all they have proven -- theoretically, not experimentally nor even by real historical comparisons -- is that the New Deal slowed down recovery compared with an imaginary world where there was Econ 101 perfect competition and magical economic pixiedust ended the contraction in spring 1933. Take away the two preposterous assumptions, and Ohanian and Cole have proven nothing except the ability of neoclassical economists to indulge in thoeretical autoeroticism.

(hat tip to Mr. Francesco for the images of the fairygodfriedman)

In short, as Bruce Wilder has said, they "compare and contrast an entirely imaginary, right-wing fantasy economy with the actual economy, and then blame the actual economy for falling short of the imaginary economy," without even bothering to "test the realism of their imaginary economy." To which we can add, under the substantially "lower real wage" rate desired by Ohanian and Cole -- a rate apparently close to 1932-33 wage rates -- there would certainly have been a great deal more privation and death. But no concern to the economist authors. After all, it would have been much more efficient privation and death.

In Conclusion, our series of essays on the Great Depression and the New Deal has shown that:

1. The Republican reaction to the Great Contracition of 1929-32, the first-ever globalized contraction of industrialized economies, was to insist on balanced budgets and to resist virtually all efforts to directly relieve the privation of tens of millions of Americans who suffered even unto starvation.

2. As soon as FDR and the New Deal democrats took office, they immediately passed measures to Relieve the suffering of ordinary people, to promote economic Recovery, and to Reform the system to try to prevent similar meltdowns in the future.

3. The effort was tremendously but not perfectly successful. Faith in the banking system was almost immediately restored, as was confidence in the future. The economy grew in more rapid and sustained fashion through 1937 than in virtually any other period. Millions were relieved of unemployment, and we still are beneficiaries of their legacy of laws and sweat and toil. The most significant shortfall, the Recession of 1938, was in part brought on by Roosevelt's effort to become more conservative, even balancing the budget!

4. The New Deal doubters cannot dispute the numbers and the overwhelming accomplishments, so they focus on the few incomplete successes (persistent unemployment) and compare the New Deal to "let's pretend as if" fairyland economies that never existed.

Comments

Amity Shlaes - The Forgotten Man

Good for you for nailing that book. I watched Lou Dobbs who normally has some book authors on who deserve to be read and are based in some sort of reality and I couldn't believe he didn't challenge her on the spin pouring out of her mouth on that show. It was a "WTF"?

Economic fairies! Read New Deals post!

He has economic fairies! Awesome! Sorry I love the graphs and the data but when someone takes the time to also add economic fairies, well, I'm tickled pink! ;)