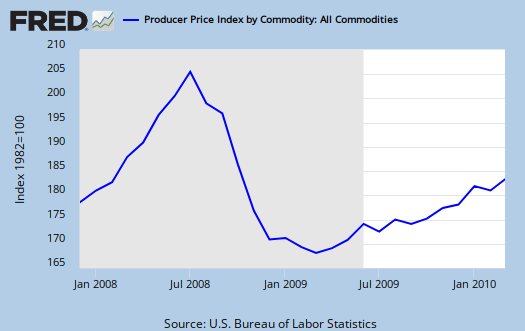

March Producer Price Index, or PPI for March 2010 came in at +0.7%. The original press release is on the BLS website. Eat your veggies just became a right of the privileged. Vegetable prices surged 49.3% in one month.

At the earlier stages of processing, prices received by manufacturers of intermediate goods climbed 0.6 percent in March and the crude goods index rose 3.2 percent.

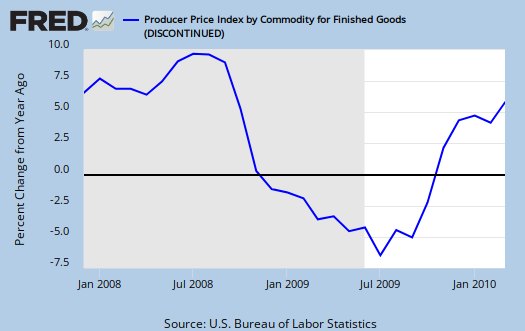

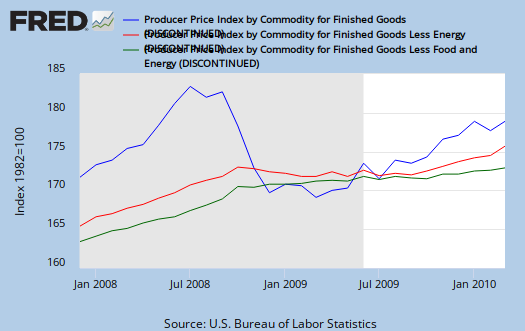

Check out the change in Finished Goods from one year ago. I do believe deflation is quite over.

In Finished goods, 70% of the price increases is due to a 2.4% increase in consumer foods. Finished energy goods increased 0.7%.

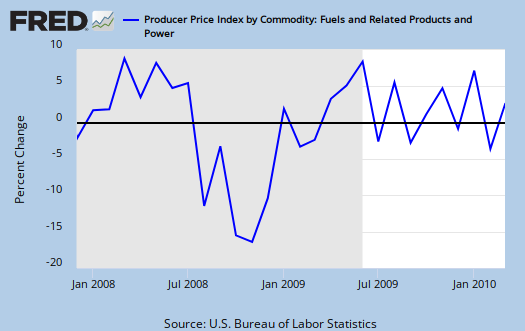

Onto Oil. Cruel oil increased, seasonally adjusted, 12.2% from last month. Check out in the graph below, the change in Finished energy from one year ago, a whopping 23%. Here comes gas prices!

Below is the month to month percent change in Fuels:

Here is last month's report (from this site). The attached report has detailed tables, with specific products and their price changes, at the bottom.

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 243.39 KB |

Defllation / Infration - Predicted by Money Aggregates of 9/2008

In September of 2008 when the M2/M3 spiked, we could forsee

deflation followed by inflation due to the liquidity trap

and the reserve spike at the same time. EP asked the question

"whenever there is a spike like this in reserves, something something is happening, big time. "

I do not believe the inflation is over.

Burton Leed

CPI

We'll have to wait on CPI. Then part of the blow out in vegetables is Chile Earthquake. Gee, lovely what happens when you force food into a global supply chain for cheap prices.

My concern is oil/energy. I haven't looked at the M1, money supply for some time, last i looked at it, velocity was way down so it wasn't a problem, but yeah, they have to pull that in and it's going to be painful I will assume.