Friday’s report on our 4th quarter GDP was particularly interesting in that the inflation adjustments for large components of our national output turned negative, which meant that when the inflation adjustment was applied, what appeared to be lower or just modest increases in spending actually represented larger increases in goods and services procured, and hence indicated a larger contribution to our output than the nominal dollar amounts would lead one to believe. The Advance Estimate of 4th Quarter GDP from the Bureau of Economic Analysis indicated that the real output of goods and services produced in the US grew at a 2.6% annual rate over the output of the 3rd quarter of this year, when real output grew at a 5.0% real rate. 4th quarter GDP growth in current dollars was just at a 2.5% rate, the first time current dollar growth fell below real growth since Q2 of 2009, and only the second time that's happened since 1950. That contrasts with current dollar growth at a 6.3% rate in the third quarter and at a 6.7% rate in the 2nd quarter.

Fourth quarter growth was largely driven by an increase in real personal consumption expenditures and increased inventories, while a decrease in fixed investment, lower defense outlays and a large increase in imports were negatives. For the entire year, our real GDP was 2.4% higher than 2013, when the real economy grew by 2.2%. Remember, the change in GDP being reported here is not a measure of the change in the dollar value of our GDP but a measure of the change in our output. To arrive at that, the BEA adjusts the current dollar value of our output for inflation using prices chained from 2009, and calculates all percentage changes in this report from those nonsense numbers.. The inflation adjustment used in the fourth quarter, aka the "GDP deflator" was statistically zero, ie, it would suggest annual inflation at a 0.0% rate, down from the 1.3% deflator applied in the 3rd quarter..

As is always the case with an advance estimate, the BEA cautions that the source data is incomplete and also subject to revisions, which have now averaged +/-0.6% in either direction for nominal GDP, and +/- 0.6% for real (inflation adjusted) GDP before the third estimate is released, which will be two months from now. Also note that December trade and inventory data have yet to be reported, and that the BEA assumed an increase in imports and a decrease in exports, that wholesale and retail inventories had increased and that nondurable manufacturing inventories had decreased in December. While we cover the details below, remember all quarter over quarter percentage changes reported here are given at an annual rate, which means that they're expressed as a change a bit over 4 times of that what actually occurred over the 3 month period...

The press release for this report, from which most news stories and even blog reports are written, reports annual changes as quarterly without noting that they are, and only uses the prefix "real" to indicate the inflation adjustment, so some of the reporting on this release misses that altogether. Although this persists throughout the report, we'll quote just the short paragraph on personal consumption expenditure to illustrate & explain that:

Real personal consumption expenditures increased 4.3 percent in the fourth quarter, compared with an increase of 3.2 percent in the third. Durable goods increased 7.4 percent, compared with an increase of 9.2 percent. Nondurable goods increased 4.4 percent, compared with an increase of 2.5 percent. Services increased 3.7 percent, compared with an increase of 2.5 percent.

Looking at the way the above is written, you'd think it was written about consumer spending, but it really isn't. The BEA is giving us the annualized change in units of goods and services used by consumers over the 4th quarter. The key word is "real"; that means it's spending that has been adjusted for inflation For example, if gasoline prices rise 10% in a given quarter, and dollar value spending for gasoline rises 11%, the BEA will report that as a 1% increase in real personal consumption expenditures for gasoline, meaning the number of gallons of gasoline consumed (and hence produced by the economy) rose by 1% in the quarter. Applying that to what we've quoted above in red, real personal consumption expenditures for durable goods rose at a 7.4% annual rate because actual "spending" for durable goods rose by 0.89% in the quarter, from $1,320.2 billion to $1,332.0 billion, which is an annual growth rate of 3.6%, to which a negative deflator for durable goods of 3.6% annually was applied. Driving that growth in durable goods output was growth in consumption of recreational vehicles and equipment at a 9.8% rate and 6.4% annualized growth in consumption of motor vehicles and parts...

Similarly, although real personal consumption expenditures for non-durable goods rose at a 4.4% rate, the actual dollars spent on non-durable goods declined from $2,691.3 billion to $2,677.4 billion. However, prices for non-durable goods fell at a 6.2% annual rate, meaning more actual goods were consumed, hence increasing GDP. Gasoline was a major factor in this; although gasoline spending fell from $406.3 billion to $369.8 billion, real consumption of gasoline and similar energy goods was actually up at a 12.3% rate...

Meanwhile, real growth in consumption of services followed the pattern we'd normally expect, wherein the inflation adjustment deflated the amount actual spent. In actual dollars, spending for services rose from $7,990.4 billion to $8,102.9, an annualized increase at a 5.7% rate. But prices for service rose at a 2.0% rate, reducing the actual growth in services delivered to 3.7%. Factors contributing to that growth were an 4.5% annualized increase in the amount of health care services delivered and an increase in financial and insurance services at a 6.4% annual rate..

The other components of GDP are computed in the same manner. The actual increase in spending in the quarter is adjusted with an inflation factor for that component, giving the real units of goods or services produced in the quarter, and then it's converted to an annualized figure by compounding it 4 times. Thus, real gross private domestic investment, which had grown at a 7.2% annual rate in the 3rd quarter, grew at a 7.4% annual rate in the 4th quarter. However, most of the investment growth in the 4th quarter came from growth of inventories, as real growth in fixed investment slowed to 2.3% annualized. Of that, real non-residential fixed investment grew at a 1.9% rate as all of its components slowed and investment in equipment decreased at a 1.9% rate, in contrast to 11.0% growth in equipment investment in the 3rd quarter. Investment in nonresidential structures slowed from growth at a 4.8% in the 3rd quarter to a 2.6% growth rate, while investment in intellectual property increased at a 7.1% rate, down from the increase at a 8.8% rate in the 3rd quarter. Residential investment, however, grew at a 4.1% rate in the 4th quarter, a bit better than the 3.2% growth it saw in the 3rd quarter...

In addition, real private inventories grew by an inflation adjusted $113.1 billion in the 4th quarter, after they grew by $82.2 billion in the 3rd quarter, and hence the $30.9 billion greater inventory growth added 0.82% to the 4th quarter's growth rate, in contrast to the $2.6 billion decrease in inventory growth in the 3rd quarter that subtracted 0.03% from that quarter's GDP. Since greater inventories indicate that more of the goods produced goods during the quarter are still sitting on the shelf, their increase by $30.9 billion means real final sales of GDP were lower by that much, hence increasing at a 1.8% annual rate in the 4th quarter, compared to the real final sales increase at a 5.0% rate in the 3rd quarter, when the change in inventories was nearly unchanged…

The trade figures were also boosted by large inflation adjustments, as the price of goods exports fell at 9.4% annual rate while the price of imported goods fell at an 8.8% annual rate. The high percentage of commodities was the major factor in this, as we still import a lot of crude oil & raw materials while we export agricultural commodities and refined fuels, all of which were priced lower. So even though exports fell from $2,366.5 billion to $2,341 in dollars, real exports are recorded growing at a 2.8% rate. Similarly, real imports, which had fallen by 0.9% in the 3rd quarter, grew by 8.9% in the 4th quarter, aided in part by lower prices. Remember that exports add to gross domestic product because they represent that part of our production that was not consumed or added to investment in our country, while imports subtract from GDP because they represent either consumption or investment that was not produced here, and that it's the quarter over quarter change in each that affects the quarterly change in GDP. So the 2.8% increase in our real exports of goods and services resulted in an addition of 0.37% to the fourth quarter's growth rate, while the 8.9% increase in our real imports of goods and services subtracted 1.39% from fourth quarter growth, resulting in a 1.02% subtraction from GDP from net trade in the quarter, a sharp contrast from the 0.78% that the decrease in our trade deficit added to GDP in the 3rd quarter...

Finally, real consumption and investment by governments decreased at a 2.2% annual rate, as federal government consumption and investment fell at a 7.5% rate over the 4th quarter, while state and local consumption and investment grew at a 1.3% rate. Inflation adjusted federal spending for defense fell at a 12.5% rate and subtracted 0.58% from GDP growth, while real non-defense federal consumption and investment grew at a 1.7% rate and added 0.04% to GDP. Note that federal government outlays for social insurance are not included in this GDP component; rather, they are included within personal consumption expenditures only when such funds are spent on goods or services, indicating an increase in the output of goods or services. Meanwhile, state and local government investment and consumption expenditures, which grew at a 1.3% annual rate, added 0.14% to the quarter's growth rate, as state and local consumption government spending rose at a 1.1% rate while state and local government investment grew at a 2.2% rate...

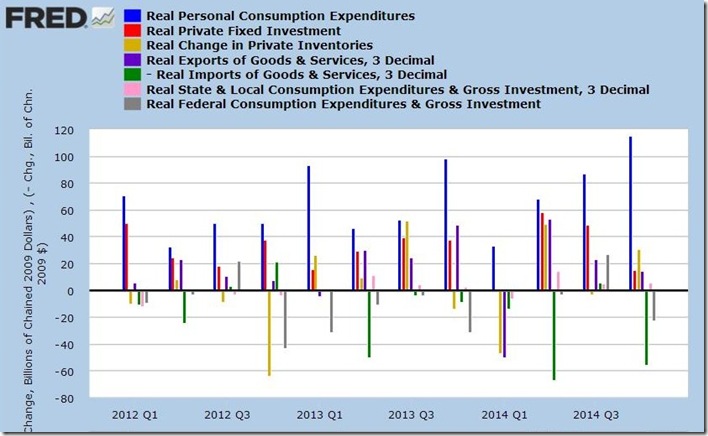

In our FRED bar graph below, each color coded bar shows the change, in billions of chained 2009 dollars in one of the major components of GDP over each quarter since the beginning of 2012. In each quarterly grouping of seven bars on this graph below, the quarterly changes in real personal consumption expenditures are shown in blue, the quarterly changes in real fixed private investment, including structures, equipment and intangibles, are shown in red, the quarterly change in real private inventories is shown in yellow, the real change in exports are shown in purple, while the change in real imports is shown in green. Then the change in state and local government spending and investment is shown in pink, while the change in Federal government spending and investment is shown in grey. Those components of GDP that contracted in a given quarter are shown below the zero line and subtract from GDP, those that are above the line grew during that quarter and added to GDP. The exception to that is imports in green, which subtract from GDP, and which are shown on this chart as a negative, so that when imports shrink, they will appear above the line as an addition to GDP, and when they increase, as they have in the recent quarter, they'll appear below the zero line as a subtraction. It's clear from the graph that even though fixed private investment has been an ongoing contributor to the recovery, it's been the increase in real personal consumption expenditures that have been driving growth..

NB: all the data that we used in reporting the above comes from the pdf for the 1st estimate of 4th quarter GDP, which is linked to on the sidebar of the BEA press release, which also offer links to just the tables on Excel and other technical notes. Specifically, we refer to table 1, which shows the real percentage change in each of the GDP components annually and quarterly since 2012, table 2, which shows the contribution of each of the components to the GDP figure, table 3, which shows both the current dollar value and inflation adjusted value of each of the GDP components, and table 4, which shows the change in the price indexes for each of the components, and which is used to convert current dollar figures into units of output.

(the above has been cross-posted from Marketwatch 666)

Comments

not since 1950

Deflator caused nominal GDP to be higher, that's amazing, think the Fed will raise rates here?

i dont know about the Fed...

the PCE price index for December was out this morning, & it fell 0.2% for the second month in a row...core was down 0.1% for both months...the YoY inflation rate is 0.75%, while the Core PCE index is up just 1.33%...theyre supposed to be targeting 2.5%, and they've even missed the low 2.0% target 25 months in a row..

rjs