We've noticed a hell of a lot of political B.S. baffle going on, in particular on business taxes. What happens is politicians conflate small business taxes with the individual income tax and that is due in part to the actual tax code.

We've noticed a hell of a lot of political B.S. baffle going on, in particular on business taxes. What happens is politicians conflate small business taxes with the individual income tax and that is due in part to the actual tax code.

The GOP typical claim is a lower top personal income tax rate will allow businesses to hire more people. That is really a lie. Business profits can enable more hiring, tax refunds for hiring and retaining employees can incentivize new jobs, but the personal income tax rates for those who own businesses has negligible effect.

One thing that gets lost in the rancor are business tax deductions. An employee's salary and most benefits are a business deduction. The business owner would not pay taxes on the costs of hiring a new employee beyond the payroll taxes associated with hiring, about 6.2% of salary. The most important element to hiring is demand for goods and services provided by the business, not taxes.

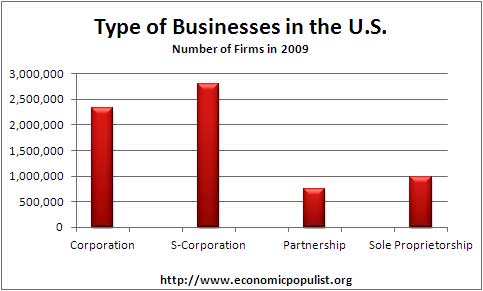

There are four most common business entities in the United States. Corporations, partnerships, S-corporations and sole proprietorships. Partnerships are primarily two types, a limited liability partnership (LLP) or a limited liability company (LLC). There are also other types of businesses, such as RICs, which are glorified investment vehicles with capital gains tax pass through. S-corporations also allow pass through taxes, although not as lenient as partnerships. Below is a graph of number of these firms by type, who had at least one paid employee during part of 2009.

The term pass through refers to how business profits are not taxed at the business level, instead are transferred to the individuals owning the business. Those business profits will then be taxed via the individual income tax code.

First thing to realize when politicians talk about lowering the highest tax rate, they are referring to individual income taxes. The excuse is these same wealthy individuals are small business owners in the form of sole proprietorships and pass through tax structure business entities. These political spinners are referring to the business profits which then pass through to individual income taxes. C corporations do not have pass through business profits. These corporations are taxed via the corporate tax code. Sole proprietorships are taxed as individuals, those business taxes and personal taxes are one and the same. S-corporations, LLCs and LLPs also have pass through tax treatment. The Census, from where our data comes from, gives their business definitions based on the tax code:

- Corporation - An incorporated business that is granted a charter recognizing it as a separate legal entity having its own privileges, and liabilities distinct from those of its members.

- S-Corporation - A form of Corporation where the entity does not pay any federal income taxes. The corporation's income or losses are divided among and passed to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

- Partnership - An unicorporated business where two or more persons join to carry on a trade or business with each having a shared financial interest in the business.

- Sole Proprietorships - An unincorporated business with a sole owner.

The statistics show the self-employed are not paying a large amount of tax. From the SBA we see the median tax rate is only 10%.

Of the 15.5 million individuals whose primary occupation was self-employment (incorporated and unincorporated), the median personal marginal federal tax rate was 10 percent in 2008. Only 4.1 percent of the self-employed were in the marginal tax bracket of 33 percent or more.

Is there a claim sole proprietorships creates jobs? The Census statistics on business latest data is from 2009. These statistics require a business had at least one paid employee during part of the year.

In 2009, a total of 947,088 sole proprietorships employed 4,802,391 people. 752,826 of these sole proprietorships employed zero to four employees for the year, or 1,231,454 people, with an average of 1.63 persons employed for these 752,826 sole proprietorships. In other words, 79.5% of sole proprietorships who had an employee during the year are not generating any real jobs.

Sole proprietorships which at some point in the year had at least one employee represent 16.4% of all businesses with employees in this country, which in 2009 tallied 5,767,306.

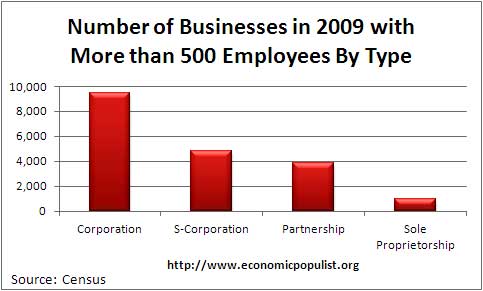

Typically, large business entities are C corporations and are not subject to the type of taxes conflated with individual taxes that we hear so much political spin about. C corporations are 1,246,517 or 21.6% of all firms and within C corporations, 99.2% of them had less than 500 employees.

Small Business

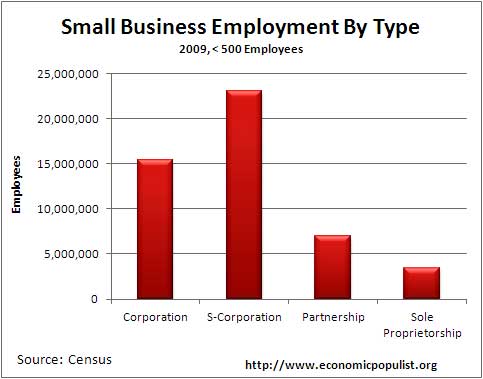

According to the SBA, a small business is defined as companies with 500 or less workers. Of the total number of firms in 2009, 5,749,797, or 99.7% of them, employ less than 500 people each. Yet these same small businesses employ less than half, 49.2%, of the total private employees in the United States. Below are small businesses type and the number of employees they have.

Additionally from the SBA we see many businesses simply have no employees.

There were 6.0 million firms with employees in 2007 and 21.4 million without employees in 2008.

While it's true that small business does generate the majority of jobs, it's actually a tiny percentage of small firms that are the job growth engine so touted by pundits and politicians.

Small firms accounted for 65 percent (or 9.8 million) of the 15 million net new jobs created between 1993 and 2009.

Much of the job growth is from fast-growing high-impact firms, which represents about 5-6 percent of all firms and are on average 25 years old.

S-Corporation

Now one might wonder how S-corporations have so many employees. After all, they are tax pass through vehicles. Here's the thing, S-corporations allow owners to not pay as much in payroll taxes. That's contributions to social security and Medicare. One has to pay employees a reasonable salary in a S-corp, yet income from the business is passed through and taxed as individual income. That income from the S-corporation isn't subject to FICA, or social security and Medicare taxes, unlike sole proprietorships because they pay self-employment tax. Democrats tried to close this loophole, but the bill failed earlier this year.

So, watch out on S-corporations in terms of really generating jobs, many of those employees are also owners of the business, playing games with the tax code and classifying themselves as employees with low salaries in order to reduce their tax bill.

Businesses with No Employees

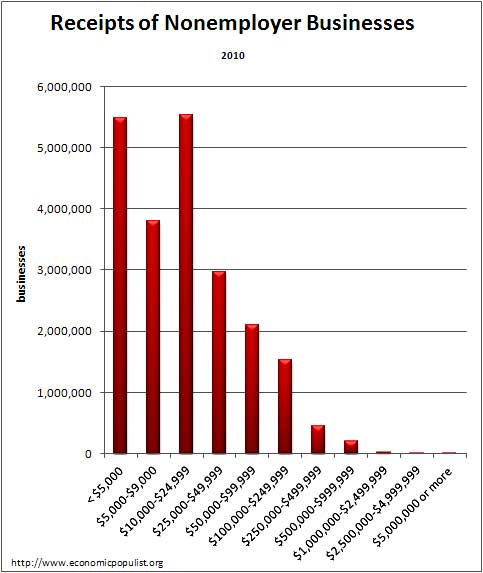

The Census also gives us statistics on businesses, all types, which do not have any employees, yet received $1,000 in gross receipts or more (Construction receipts requirements are only greater than a buck). According to the Census the majority of all business establishments in the United States are nonemployers. These same firms average less than 4% of all sales and receipts nationally.

In 2010, there were 22,110,628 firms which had no employees and 96.9% of 'em had less than $250,000 in gross receipts for their business. That's not income, that's what came into the business. It is not even profits. One has to deduct the costs of operating a business to find that number. Below is the graph of these nonemployer firms and their gross receipts by bracket. As you can see, most people who are self-employed are really broke. They aren't earning enough for themselves, never mind being able to generate jobs.

The point of this exercise is to show politicians and pundits are baffling the people with bullshit. Business taxes are not individual taxes and those which have tax pass through, most of the owners are barely getting by, or hiring themselves....to not pay taxes.

It's clear the claim reducing the top individual income tax bracket has little to do with actual jobs. The statistics from the Bush tax cuts also show lower taxes for the rich do not generate jobs as did a more recent study. If policy makers and politicians really wanted to change the tax code to generate jobs, they would be creating a tax rebate tied to hiring and retaining U.S. citizens as employees, not simply giving even more money to the wealthy.

Comments

small business taxes and personal income taxes, this post

Hi everyone. Maybe I didn't amplify enough in the first paragraphs that this post drills down deeply into small businesses, the size of their employment and their revenues....and the personal tax code.

I dug around so deeply to show we have a major, major lie going on from the GOP generally on small business, the personal tax code and jobs.

I hope you all share this one, I honestly do not believe anyone has graphed up or really dug into these particular statistics.

Jobs and Demand

Re:

"One thing that gets lost in the rancor are business tax deductions. An employee's salary and most benefits are a business deduction. The business owner would not pay taxes on the costs of hiring a new employee beyond the payroll taxes associated with hiring, about 6.2% of salary. The most important element to hiring is demand for goods and services provided by the business, not taxes."

A 6.2 % payroll tax would also be a business deduction, no?

Anyway, I used to work for people who said that expenses that were tax deductible were "a wash," in that they lowered their tax burden the same amount as the expense. Perhaps this was more true under the old graduated income tax, but even now it would mean you could hire people at a discount, i.e., salaries will actually cost the business less than what it pays the employee.

Also, demand should be considered the only element that affects hiring, because taxes is one burden that is the same for everyone. To blame anything on taxes is like a cab driver saying he shouldn't have to buy a cab just to go into the cab business. Everyone in the cab business has to buy a cab, and pay taxes, so those kinds of things are "a wash."

We also forget, sole

We also forget, sole proprietors pay their own payroll taxes and get to deduct half of SS from income, so its a net sum gain from tax of law changes of almost zero.

Greetings, Lie is too strong

Greetings,

Lie is too strong a word here please. This is economic theory. This GOP theory may be dubious or a fallacy, but not a lie.

And, I think you are wrong wyas two different ways.

First, Economics 101, a business or individual considers various projects by their ROI. Two factors among others involved are the cost of labor and the AFTER-TAXES profit. It does the projects that are most profitable until it reaches the break even level (including a discount quantifying risk). So regardless of the expensing if employees, if the tax rate on profits is 25% instead of 40%, that is a major influence on which projects get done (and thus how many people are hired). According to this hypothetical, 60% more projects and for the sake of argument presuming a proportionate labor/project ratio 60% more people will be hired with the lower taxes (40-25/25). I included the cost of labor here because that's realy the problem today I think. This is a jobless recovery because in so many ways, Obama and the Democrats since 01-2007 have raised the cost of labor, both the actual cost and the opportunity cost. First, there is the 35% increase in the national minimum wage. Then there are the legal costs associated with potential lawsuits. Then there are the administrative, etc. costs of this medical bureaucratic maze. Then there is the competition with civil service unions - private employers must compete with what NYC pays its civil service employees, for example, and that is sykrocketing each year. Then there is the opportunity cost of leisure. If one can kind of make $25,000/year sitting at home through food stamps, welfare, disability, savings, whatever else, even illegal activity, why work for IBM, for example.

Second, is kind of that last point from a labor perspective. Obama is doing what cities did in the 70s and 80s, i.e., paying people not to work. Look at labor participation. So if it pays to not work, why be employeed? And that totally affects aggregate demand and productivity. Why work if you can live well not working?

Reaganomics was masterful and proves you are wrong. He cut taxes overall 25% (he never really raised taxes - while lowering rates he "raised" some taxes via ending tax deductions) and captial expenditures boomed. Those crazy schemes like Microsoft and Dell became profitable on the drawing board whereas when tax rates were 70% (they were with Carter) they might not have been for either initial venture capital investors or later merely stock purchasers.

Thoughts?

Lie is fine

We just went through the reasons why personal income taxes have nothing to do with hiring and here you are touting the GOP pundits ramblings where history and statistics show nothing of the kind.

It's like automatons just spewing nonsense and neither a statistic of fact shall enter thy brain and not one line of this post was understood.

There is no "cost of labor after taxes" because labor is a TAX DEDUCTION. You will not pay taxes on employees. Profits are net, that is after taxes, which means that employee deduction just significantly lowered the the net amount that is subject to taxes.

Taxes, whether corporate or on personal income, are net profits from a business, not gross receipts.

Additionally, you completely ignore the point of this post, personal income taxes have nothing to do with running a business and business taxes.

Then, speaking of lies, Obama is not paying people not to work, that's ridiculous. If you think $200 dollars for food stamps to keep from starving is paying someone not to work, you're not in the real world here.

Reaganomics or supply side has been routinely shown to not be effective and again, that is confusing business taxes with personal taxes. A quick look at even wikipedia shows there was inflation which bumped up more income levels to be taxed, a huge social security tax increase and finally deficits, which under Reagan were large, do have a stimulative effect on the economy. Tax collections were actually higher than previously.

More relevant, the Bush tax cuts were not effective.

Again, the personal income tax code is not the business tax code and that is the lie that is spun, including your comment.

"There is no "cost of labor

"There is no "cost of labor after taxes" because labor is a TAX DEDUCTION." -- Robert Oak

While I agree with pretty much everything you said, and even after this do not agree with "Masked Defender"'s comment, I'm not sure what you above said is an accurate reflection of what Masked Defender said.

Masked Defender didn't say "cost of labor after taxes", but instead used two separate categories, (a) cost of labor and (b) after-tax profit. The line of thought Masked Defender and the GOP is using is that if after-tax profit is reduced, business will be less likely to engage in new business ventures and therefore less hiring. Again, just different from saying "cost of labor after taxes". Unless I missed something about Marked Defender's post that caused you to use that wording.

"Why work if you can live well not working?" -- Masked Defender

Total disconnect from reality right there.

It's kind of frightening to

It's kind of frightening to think about what this comment means. Although this sounds like someone who spends his days watching business programs on Fox News and listening to Rush Limbaugh and Sean Hannity, entertainment programs where upward redistributive campaign slogans are assembled and thought of as an economic theory, there are actually economists, academics, who are paid big bucks to come up with economic theories to support the Neoliberal political project, and this is what is being taught in our business schools.

I know a woman who has a degree in Economics from a major US university and I asked her how much time they had spent on Marx. "None," she said.

gradual school

I often wonder how many solid graduate students are denied a PhD or even a Masters due to them not "touting the party line" per their adviser's "agenda". I've seen many a white paper with unbelievable "bad math", ridiculous assumptions, all to basically "make work" whatever they want to believe or their agenda.

I find this despicable and a real violation of scientific methods, objectivity. Seriously I've seen so called "Academic research" that I have to wonder how in God's name it was allowed, it wouldn't past mustard in econ 101.

Frank, consider getting an account on this site. You won't go into the moderation queue and can then use full HTML.

You just can't learn

You go right back to spouting all the failed right wing economic cliches that got us in this mess.

If you couldn't learn after the disastrous Bush years YOU CAN'T LEARN. We were losing 800 thousand jobs a month as the boy king was finishing up his failed presidency. Two weeks after Bush left office the IMF declared america to be in a depression

Learning is beyond your capability. All you can do is parrot the same old same old.

premise of article is flawed

Lots of data but your premise is flawed.

Business exists to create profits for their owners/shareholders, not to create jobs, but ...

Lower taxes leave more for businesses/owners to profit and re-invest.

Profits (and the attraction of more potential profits) and investment create activity.

Increased business activity and personal consumption creates the need for more workers ("jobs").

You can spin graphs and stats but profitable business activity, not higher taxes, leads to jobs.

uh no, the premise is not flawed

What we are showing is that taxes make little difference. An employee is a tax deduction and also would increase profits due to an increase in output through that employee. It is gross receipts that matter in hiring and that has everything to do with demand for that businesses' goods and services.

Stop watching Fox and look at the statistics.

You're article is a bootstrap

You're article is a bootstrap argument. You surmise that because there are deductions for labor expenses, then taxes have no impact on business growth. While I am not sure I accept your premise about labor expense decuction, even if I do, your boot strap is flawed because you can't just saw off labor expenses and then extrapolate that taxes have no impact. Labor expenses do not exist in a vaccum. As a a commercial building owner and employer, my property taxes contiue to go up, cutting into my profit and, ultimately, my incentive and ability to reinvest. The reality of the situation is that taxes do affect investment no matter how much you try to cherry pick your evidence to support your conclusion. Even our founding fathers recognized that the power to tax by the government is the power to destroy.

I doubt your claim

For unless you are oblivious to your CPA and bookkeeper you would know these basic business deductions and pass through. This is personal income tax, it has nothing to do with property taxes, state and local taxes, sales taxes and briefly touches upon payroll taxes.

That is the claim, that lowering the upper personal income tax brackets will create jobs and statistically it has not and the above are the reasons. One would have to have a 90% personal income tax rate to affect hiring and that's not anywhere near the percentages proposed or historically what they have been.

In What Part of China do You Live ?

This is sophomoric bs. The real world is

that that business activity gets put in a crate with the rest of the factory in Ohio, etc, and shipped to China.

Burton Leed

The Long View on Tax Rates and Growth since WW2

Tax rates have declined on both individual and corporate returns since 1954 Tax Reform Act. Yet every measure of employment in industrial activity has also declined during the same period. Just for a moment, freeze frame the early 50s when top individual rates were 70 percent and corporate rates were up to 90 percent if the Excess Profits taxes were included.

The U.S. economy was growing in 1950 at 12 percent by each GDP measure, Consumer, Trade, Government, Investment. How was this possible? Not because of the Korean War, not big enough. Because businesses then concentrated on top-line growth, expanding the enterprise and doing the rate race thing of paying for all expenses with phenomenal growth.

Financing this period of growth, internationally,the U.S. repatriated $50bn of Third Reich gold in the 5 years following WWII. That same gold would be worth $1,750 today. Wisely, the money was recycled dollar for dollar in the Marchall Plan. Germany needed fixed investment, not gold in vaults.

The $1.75 Trillion is almost the same as the corporate money locked up abroad today. There have been many passionate posts on these pages about getting that money back. It's an idea whose time has come. The MNCs if they thought the way the business leaders immediately post WWII, could come up with a second Marshall Plan benefiting both the U.S. and the weak periphery of Europe. MNCs can borrow at 1% on 10 year money and

could start projects in their adopted countries, using the cash balances in the US

Burton Leed

Clarifications?

Hi Robert,

I'm having a bit of trouble understanding a couple of points and explaining them to others.

I'd appreciate it if you could help clarify. I think it would help you make your point to a more general audience as well.

These two arguments are pretty straightforward I think:

1. C corporations' income is not taxed under individual income tax and they only pay payroll taxes (6.2%) on employees' salaries. Therefore, individual income tax rates, especially the top rates, don't really affect hiring at all.

2. Sole proprietorships employ an average of 5 people and only make up about 4.8 million jobs. So even though their business income is affected by individual income taxes, they are not really the primary drivers of hiring.

The income from S-corporations, LLPs, and LLCs pass-through to the shareholders, which includes the owners. They will then pay individual income tax on in. It seems like lower top bracket income tax rates actually WOULD increase the business profits, which as you said can affect hiring.

The comparative effect of this and business demand is still arguable of course, but am I missing something here?

I mean I can still make the moral and social arguments that business owners don't necessarily reinvest in hiring and just hoard the wealth, that society has a responsibility to provide for all its citizens, that the wealthy benefit disproportionately from externalities, etc., but I'd like to make this argument as well.

Thanks for your time,

Charlotte

Charlotte, clarifications

For this discussion, there are two types of taxes, taxes on a business and personal income taxes. C corporations have their own tax code and profits on that corporation are taxed by business or corporate tax code.

Whatever the shareholders own in that corporation are then also taxed on their personal income tax.

Other business entities have what is called tax pass through, that means the profits are not taxed at the business level but when the individuals who own those businesses report those distributed profits on their personal income tax, that's where they are taxed.

All businesses, whether they are C corps, S corps, LLC, LLPs or sole proprietorships, if they hired an employee, that salary and benefits would be part of costs of operating a business and thus a deduction from gross receipts.

Here is the key where I think people are getting confused:

A business has "gross receipts" or what they took in total and then that business has expenses of operating that business. All of those costs are deducted from gross receipts to come up with net profit.

Employees are a cost of doing business.

So, let's say someone owns a hot dog cart. What people pay for the hot dogs, the customers, those are gross receipts of that business. The person hired to sell the hot dogs, unless the owner, is an employee, a cost of doing business and the costs associated with that employee are deducted from gross receipts. The cost of the hot dogs, whole sale, the cart, licenses, fees, advertising, the condiments, maintenance on the cart, legal fees, health insurance, life insurance, long term disability insurance, a website,....

these are costs of operating a business and are deducted from gross receipts to come up with the total profit.

So, then, that net profit, if it is a C corporation is taxed via corporate taxes, but if a sole proprietorship, LLC, LLP, would "pass through" to the business owner who would report that net profit on their personal income taxes. That net profit is what determines their personal income tax as well as some other taxes, depending on the type of business entity it is (LLC, S Corp, LLP, sole prop).

So, as you can see, the driver of hiring someone is demand for goods and services, i.e. gross receipts. Because an employee is a business expense, something deducted before taxes, it has little impact on actual taxes paid.

It's demand for good and services which drives hiring.

Let's say a business's gross receipts are $130,000. Their costs of doing business are $30,000 to give a net profit of $100,000.

Taxes will be calculated on that $100,000.

So let's say that business needs to hire another employee to keep up with the business. Let's put the total costs of that employee, including salary, health insurance, payroll taxes, etc. at $50,000.

Then, the business still has $130,000 in gross receipts but still $30,000 in other costs beyond the new employee, then their new net profit would be $50,000.

That business owner would then pay way less taxes than previously because their net profit was only $50,000 now.

Now let's say something more realistic. That new employee allowed the business to sell way more hot dogs, instead of throwing away ones which expired, and now their gross receipts are $180,000. But now they have $80,000 in costs of operating a business so their net profits are now $100,000.

They would pay taxes on that $100,000, which is the same as previously but they have also provided someone with employment and benefits and expanded their overall business, it's growing, which implies increased profits eventually.

Hope that helps.

Thanks for the detailed

Thanks for the detailed explanation!

I'm with you on the demand-driven hiring; I saw exactly that at the small company I've worked at over the past 4 years. We expanded rapidly in a recession because the demand for our product was there.

I don't think anyone can make a good-faith argument that business demand is not the main driver for hiring.

But you are also making the argument that the individual income tax rate is negligible in terms of hiring decisions, right?

Playing devil's advocate, you could reasonably make the argument that a lower tax rate would put them in a better position to hire.

In your example, if the individual income tax rate were 30% for the hot dog business owner, the S-corporations, partnerships, and sole proprietorships would pay 30K in taxes on the 100K, correct? (I mean obviously ignoring deductions and any tax-code abuse)

Then if the tax rate dropped to 10%, that's 20K more they can invest in hiring.

Another example: R&D jobs are a long-term investment that don't pay off immediately. A small company cannot necessarily eat that expense without borrowing, even if they are cash-flow positive. A bit of extra money could be the difference between hiring now and deferring to the next year.

Again, playing devil's advocate, the effect of the individual income tax rate on hiring doesn't seem to be exactly negligible.

you miss the entire point

It's more there is an incentive to hire in order to reduce one's tax bill. But more personal income tax profits has nothing to do with hiring because the person choose not to hire which would have reduced their potential tax bill.

Lower taxes actually reduce the incentive to hire for one would obtain less savings on taxes by doing so. With taxes owed, higher taxes gives an incentive to hire, lower taxes are less.

R&D is also a deduction. You do not would not pay taxes on R&D. There is a separate R&D tax credit, in addition to the normal deductions for the expenses of having employees. There are some conditions tests but any size business can claim it. It is currently lapsed but large corporations use this credit extensively and odds are it will once again be extended. So, one should assume in 2012 it will be there if not extended in the lame duck session.

But bottom line, if anything higher taxes would be an incentive to hire, not the other way around.

What is it about deduction of the costs of an employee that lowers the potential amount subject to tax that is so hard to understand here?

Look, anyone who has filled out a 1040, schedule C, knows the main points in this article are true. Me thinks we have yet another brainwashed person here when frankly anyone who has ever filled out a IRS 1040 form, especially a schedule C, knows these fundamentals on business taxes and deductions.

Either that or many in America are truly basic math deficient. I just calculated out some very simple examples, it's clear, lowing the personal income tax rate will do absolutely nothing to increase hiring and we link to many statistics which show this is also the case on the personal income tax code.

Lowering the employer side payroll taxes is another story, but the incentive to hire is too small in my opinion.

Congressional Research Service forced to pull tax analysis

The GOP forced the very non-partisan CRS to pull it's analysis on how personal tax cuts don't create jobs, the main theme of this article.

Fortunately those savvy internets people salvaged the report and it's also overviewed here.