Prices for both oil and natural gas reached 2016 highs on Wednesday of last week before sliding lower, in trading volume that was about one-third of normal. After closing the prior week at $53.02 a barrel, prices for US oil rose steadily after the markets opened on Tuesday, closing 1.7% higher at $53.90 a barrel, as traders focused on the OPEC and non-OPEC production cuts that are set to begin next week. The OPEC inspired rally continued into Wednesday, with prices hitting $54.33 a barrel before getting knocked back when the American Petroleum Institute’s weekly report showed a 4.2 million barrel increase in commercial crude oil inventories, instead of the expected 1.5 million-barrel drawdown, but oil still closed at an 18-month high of $54.06 a barrel. Prices continued to slide on Thursday, even though the EIA reported a much smaller 614,000 barrel increase in oil supplies, and ended the day down 29 cents at $53.77 a barrel. Oil prices then slipped again on Friday, amid profit taking before the long weekend, closing at $53.72 a barrel, and thus ended the year up 45%, in the largest annual increase since 2009...

Prices for natural gas, meanwhile, rose from the pre-Christmas close of $3.662 per mmBTU (million British thermal units) to $3.761 per mmBTU on Tuesday, as cold weather consumption continued to eat into inventories, with heating degree days running 11 percent above average and seasonal natural gas consumption up 21 percent from last year's levels. Gas prices rose sharply again Wednesday, as forecasts called for even colder weather, with the expiring contract for January gas delivery increasing 16.9 cents, or 4.49%, to settle at a two year high of $3.93 per mm-BTU, while the more actively traded February contract rose 13.2 cents, or 3.51%, to close at $3.898 a mm-BTU. Now trading contracts for February delivery, natural gas prices wobbled on Thursday, even though the EIA's Weekly Natural Gas Storage Report showed that natural-gas stockpiles shrank by 237 billion cubic feet to 3360 billion cubic feet last week, which left our natural gas supplies 10.9% below the level of a year earlier, and 2.3% below the 5 year average for this time of year. Prices then went on to close down 9.6 cents, or 2.5% lower, at $3.802 per mmBTU, as moderating weather forecasts had traders pulling back from prior price highs. Natural gas prices then extended their decline on Friday, closing down roughly 1.4% at $3.743 per mmBTU, but were still up 59% for the year, in their largest annual increase since 2005..

The Latest Oil Stats from the EIA

This week's reports on oil for the week ending December 23rd from the US Energy Information Administration indicated a modest drop in our imports of crude from last week's elevated levels, while refining also slipped back to below seasonal levels, which still left us with a small surplus of crude at the end of the week. Our imports of crude oil fell by an average of 304,000 barrels per day to an average of 8,167,000 barrels per day during the week, after rising by 1,111,000 barrels per day the prior week. At the same time, our exports of crude oil rose by an average of 70,000 barrels per day to an average of 627,000 barrels per day, which meant that our effective imports netted out to 7,540,000 barrels per day for the week. Meanwhile, our crude oil production fell by 20,000 barrels per day to an average of 8,766,000 barrels per day, which means that our daily supply of oil, from net imports and from wells, totaled 16,306,000 barrels per day for the week...

Refineries reportedly used 16,557,000 barrels of crude per day during the week, a decrease of 101,000 barrels per day from the week ending the 16th, while at the same time, 88,000 barrels of oil per day were being added to oil storage facilities in the US. Thus, this week's EIA figures seem to indicate that we ended up with 339,000 more barrels of oil per day than were accounted for by our oil imports and production, and therefore the EIA inserted that 339,000 barrels per day number into the weekly U.S. Petroleum Balance Sheet (line 13) to make it balance out. The EIA footnote to that line 13 calls it "unaccounted for crude oil", which is further described on page 61 in the glossary of the EIA's weekly Petroleum Status Report as "the arithmetic difference between the calculated supply and the calculated disposition of crude oil." As you know, we've been calling that number the EIA's weekly fudge factor.

That same weekly Petroleum Status Report tells us that the 4 week average of our oil imports rose to an average of 8.075 million barrels per day, now 2.4% higher than the same four-week period last year. Our crude oil production for the week of December 23rd was 4.7% lower than the 9,202,000 barrels of crude we produced during the week ending December 25th of last year, and 8.8% below our record oil production of 9,610,000 barrels per day that we saw during the week ending June 5th 2015.

US refineries operated at 91.0% of capacity in using those 16,557,000 barrels of crude per day, down from 91.5% of capacity the prior week and down from 92.6% of capacity during the same week a year ago, as they also refined 125,000 less barrels of crude per day than they did during the same week last year. Nonetheless, gasoline production from those refineries rose by 387,000 barrels per day to a record high of 10,537,000 barrels per day during the week ending December 23rd, which was 6.2% more than the 9,921,000 barrels per day of gasoline produced during the week ending December 25th a year ago, and 3.4% more than the 10,195,000 barrels per day of gasoline produced during the week ending December 26th, 2014, which was also an all time record for gasoline output at that time. At the same time, refineries' output of distillate fuels (diesel fuel and heat oil) fell by 165,000 barrels per day to 4,957,000 barrels per day during the week ending December 23rd, which was still up a bit from the 4,927,000 barrels per day that was being produced during the week ending December 25th last year, but 6.6% lower than the 5,307,000 barrels per day of distillates produced during the same week of 2014...

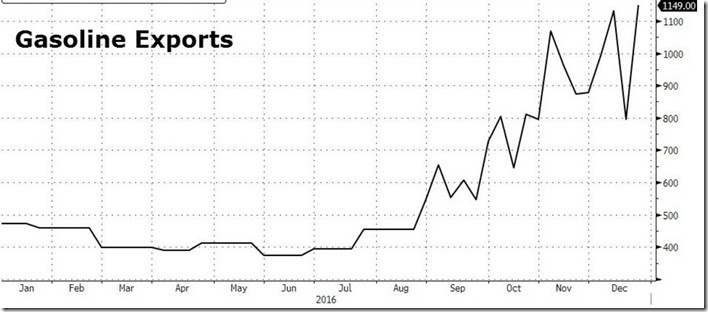

However, even with the record high in our gasoline production, the EIA reported that our gasoline supplies fell by 1,593,000 barrels to 227,143,000 barrels as of December 23rd, even as our domestic consumption of gasoline was little changed at 9,278,000 barrels per day. While our gasoline imports fell by 13,000 barrels per day to 434,000 barrels per day, our gasoline exports rose by 354,000 barrels per day to a record high of 1,149,000 barrels per day, which was only the 3rd time in history that our gasoline exports topped 1 million barrels per day. Nonetheless, our gasoline inventories as of December 23rd were still 2.6% higher than the 221,420,000 barrels of gasoline that we had stored on December 25th of last year, but 0.8% lower than the 229,048,000 barrels of gasoline we had stored on December 26th of 2014. Since our gasoline exports have suddenly jumped to heretofore unheard of levels, we'll include a graph of what that looks like below...

The above graph was taken from an article on this week's EIA report at Zero Hedge, and it shows weekly gasoline exports since late August and a staggered monthly estimate of our gasoline exports before that time, as the EIA itself only reported monthly estimates before then. You can see that for most of this year, our gasoline exports were in the 400,000 barrel per day range, never exceeding 500,000 barrels per day. However, since September, our gasoline exports having been rising in a volatile pattern, ultimately topping and remaining above 800,000 barrels per day since November. Now our gasoline exports have topped 1,100,000 barrels per day in two out of the last three weeks, and as a result our domestic supplies of gasoline continue to be drawn down, even as our refineries are producing gasoline at record levels.

Moreover, at the same time as our gasoline supplies were being drawn down for export, so too were our supplies of distillate fuels, which fell by 1,881,000 barrels to 155,935,000 barrels by December 23rd, as our exports of distillates rose by 284,000 barrels per day to a record high of 1,416,000 barrels per day. Now, unlike gasoline, exports of distillates over 1 million per day is not uncommon, as we've typically exported large quantities of distillates to Europe, where they use diesel powered automobiles, while importing gasoline from them, which European refineries have always produced in excess of their needs. But still, we are now exporting distillates at record levels, and as a result what was once our large surplus of distillates has fallen 1.0% below the distillate inventories of 153,110,000 barrels of December 25th last year, while they still remain 20.6% above the distillate inventories of 125,721,000 barrels of December 26th, 2014.

Finally, even though our oil imports fell from the prior week's elevated level, with the pullback in refining they were still enough to boost our inventories of crude oil by 614,000 barrels to 486,063,000 barrels by December 23rd,which was still 5.1% below the April 29th record of 512,095,000 barrels. But we still ended the week with 6.8% more crude oil in storage than the 455,106,000 barrels we had stored as of the same weekend a year earlier, and 37.7% more crude than the 352,979,000 barrels of oil we had in storage on December 26th of 2014.

(Note: the above was excerpted from my weekly synopsis at Focus on Fracking)

Comments

production cuts

This is so bad, the price of gas can really harm the overall economy, as seen in 2008 and other crises.